My Personal Portfolio

Letting My Readers Know What I Own And Why I Own It

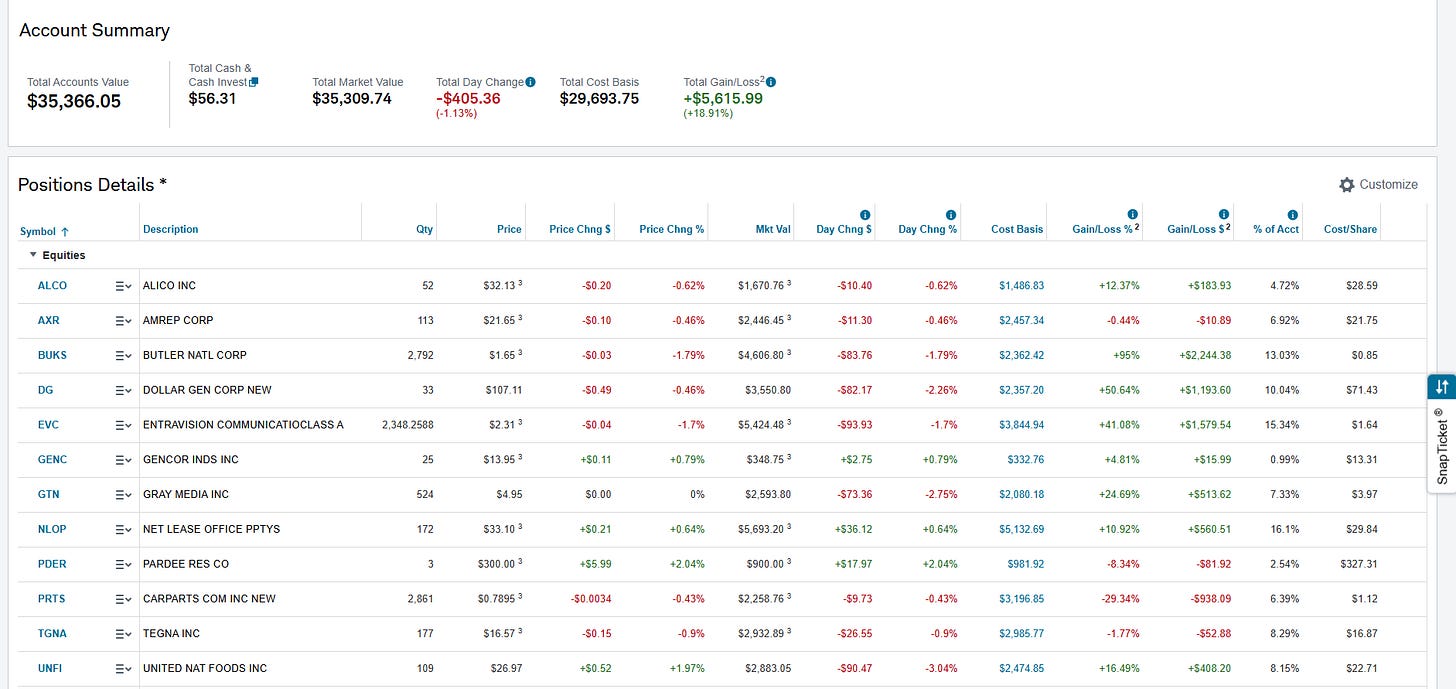

I wanted to take a break from doing paid articles to let my readers in on what stocks I own and why I own them. Every couple of months or so I do post screen shots of my brokerage account from Charles Schwab but I’ve never accompanied that with an in depth look at why I’m invested in each of these positions. Keep in mind, I could buy into a new position or sell off any of these positions at any time in the future but right now I’m feeling pretty good about these 12 stocks that I currently hold.

Alico ($ALCO)

Alico ($ALCO) is finishing out the last of its days as a citrus grower. The citrus industry has seen some catastrophic declines in fruit yield since the early 2000’s. This is due to a disease called citrus greening which came to the U.S. from Asia and has been wreaking havoc on U.S. citrus farmers ever since. While citrus greening is bad, Alico has also seen their operations severely hampered by increasingly devastating hurricanes as well as a large frost event that damaged the company’s trees and created a large amount of fruit to prematurely drop leaving the company unable to harvest it.

It was because of this large string of unfortunate business events that Alico decided to find alternative uses for their properties. In January the company announced that it would develop 10% of their property to housing over the course of the next five years and then develop another 15% of this land thereafter keeping 75% of their property for non-citrus agriculture or mineral rights usage.

Alico’s market cap is only $247 million. The company plans to rake in $335 - $380 million in land sales over the next five years and another $140 - $170 million off of the remaining 15% of their property that the company plans to develop. The stock has already seen a 24% increase since this news was announced. With a land development project underway that could rake in $133 million more than the company’s current market cap over the course of the next five years, I think this stock still has a lot of upside to it.

Click here to read my most recent write up on Alico ($ALCO).

AMREP Corporation ($AXR)

The AMREP Corporation ($AXR) owns 17,000 acres of lands in the Rio Rancho area of Sandoval County, New Mexico. The company develops housing on this property on its own and also sells off parcels of its properties to home builders for development. Rio Rancho is located right next to Albuquerque which has run out of room to expand. This has given AXR a tight hold on the area’s housing market. Albuquerque is a tech hot-spot that has grow rapidly over the past 30 years with companies like Intel, Tesla, Torc Robotics, RS21, BayoTech, Spaceport America, and Los Alamos National Laboratory calling it home. This means that the the city has to expand and AXR has the property needed to do so. With America scrambling for greater independence in the production of its semiconductors and other products of modern technology and with global military threats ramping up, owning property for housing developments next to a growing city that specializes in producing semiconductors, defense contracting, and aerospace products seems like a good idea to me. I think this stock could be worth as much as $40 a share.

Click here to read my most recent write up on the AMREP Corporation ($AXR).

Butler National Corporation ($BUKS)

This company caught my eye because of just how strange their operations seemed to me the first time I had laid eyes on them. The Butler National Corporation ($BUKS) operates two distinct segments, one is in the aerospace industry and another oddly enough is in the Casino industry. A long time ago BUKS used to operate a much more diversified business but has since slimmed down its operations to focus mainly on aerospace products. The company has elected to keep their casino running because it produces a healthy income in an area that’s secluded from competition in Dodge City, Kansas. While the company’s casino revenues decreased 1% YOY from 2024 to 2025, their casino operating income increased 5%. The company’s aerospace revenues saw a 15% increase while the segment’s operating income shot up 70% YOY. When I originally bought into BUKS I did so at a discount to the company’s NAV. I’ve held onto the company currently however because they are a cash generating machine and think this company could easily be worth $2.00 a share or more.

Click here to read my most recent write up on the Butler National Corporation ($BUKS)

Dollar General Corporation ($DG)

My Dollar General Corporation ($DG) thesis was very simple. DG was a growth stock darling during the COVID Pandemic and the company was opening up new locations at break neck speeds. Opening up new locations while we were experiencing a lot of national supply chain disruptions proved to be difficult and DG’s margins began to slip. This began a multi-year price tumble for the company. DG had enjoyed share price highs of around $250 per share but by January of 2025 the company’s share price was sitting at just $68. As good news regarding sustainable developments concerning DG’s operations began to trickle in, investors gained a little more confidence in the company. I’m currently considering whether I should sell DG myself or hold onto the stock. I think there’s still upside to the stock but DG is definitely not my typical kind of investment candidate.

Click here to read my most recent write up on the Dollar General Corporation ($DG).

Entravision Communications Corporation ($EVC), Gray Media, Inc. ($GTN), and TEGNA Inc. ($TGNA)

In one of my first posts here on The Value Road called “A Hidden Industry That Will Benefit From Trump Winning” I wrote about how the Trump administration and more specifically Brendan Carr was going to usher in a new era of profitability for legacy media companies by deregulating several aspects of the industry in order to make it more competitive with the modern tech companies.

Station Caps and M&As

One of these deregulatory proposals has been to get rid of station caps. If you own and operate a television broadcasting business you can not broadcast to more than 39% of U.S. households. This station cap limit has effectively created an oligopoly in the Television broadcasting space. The big three players are Nexstar ($NXST), TEGNA, Inc. ($TGNA) and Gray Media, Inc. ($GTN). All three of these players are at their station cap limits. If this cap were to get removed it would trigger a series of M&A events. In fact some of these stations have been M&A candidates in the past but were blocked by the FCC. Soo Kim of Standard General tried to buy out TEGNA before he was blocked by the FCC for $24 a share.

Valuable Spectrum

The most valuable asset that these legacy media companies have however is their spectrum. Spectrum is simply the bandwidth through which these companies send out their digital signal through. As more and more technology become wireless, the band widths available to transmit these signals becomes increasingly cramped. Under Brendan Carr, the FCC has talked repeatedly about how urgent it is to free up more spectrum for the growing needs of the wireless technologies of today. Legacy media possesses this valuable spectrum but investors have been putting valuations on these companies like they’re practically worthless. This is largely because spectrum isn’t worth anything if you can’t sell it. Once the FCC begins to allow spectrum to be sold off Entravision Communications Corporation ($EVC), GTN, and TGNA should get re rated, although it looks like EVC’s and GTN’s re rating have already begun. I believe these positions to be multi-baggers if spectrum sales and or M&A activities begin to take place.

Click here to read my most recent write up on the Entravision Communications Corporation ($EVC).

Click here to read my most recent write up on Gray Media, Inc. ($GTN).

Click here to read my most recent write up on TEGNA Inc. ($TGNA).

Gencor Industries, Inc. ($GENC)

Gencor Industries, Inc. ($GENC) is a special situation. Shortly after their long-term auditor, MSL, P.A. was acquired by Forvis Mazars, LLP on December 17th, 2024, the company issued a notification of an inability to timely file their 10-K. This was due to Forvis Mazars finding a material weakness in the Company’s internal controls over their financial reporting related to the company’s information technology general controls, controls over key third-party service provider Systems and Organizational reports, controls over the period-end close process, and the monitoring of the Company’s internal control framework. Since then the company filed their annual report late and they have missed filing their Q1 2025 quarterly report.

GENC’s share price dropped from $22 a share to $11 because of this. I’m still waiting on GENC to file their 10Q for Q1 of 2025. Once the company has caught up on filing their financials and proves that they can stay current on their filings, their stock price should recover. That’s just the short term catalyst. GENC is an industrial company that designs, manufactures, and sells heavy machinery used in the production of highway construction materials. This company is trading extremely cheap and provides an important service that will be needed for decades to come.

Click here to read my most recent write up on Gencor Industries, Inc. ($GENC).

Net Lease Office Properties ($NLOP)

Net Lease Office Properties ($NLOP) was a REIT that was spun off from W. P. Carey Inc. ($WPC) and was laden with debt. The assets that it owned however had real value and NLOP began to sell off some of these assets to pay down this debt. YOY from 2024 to 2025 the company paid down their mortgage and mezzanine loan debt from $542 million to $169 million, a 69% decrease. As of NLOP’s last 10Q, that debt figure has been reduced another 12% to $148 million. NLOP is chopping away at their debt fast and just posted a small profit their last quarter. The company could begin actively returning capital to shareholders after this debt is gone. With this giant debt burden easing, the company should also begin posting profitable operations consistently too. Both of these events are catalyst for the stock to rerate.

Click here to read my most recent write up on Net Lease Office Properties ($NLOP)

Pardee Resources Company ($PDER)

The Pardee Resources Company ($PDER) has been in operation since the 1840’s as a coal mining and lumber company but now the company also operates oil and gas, alternative energy, and agricultural segments as well. PDER’s revenues for Met Coal, Agriculture, and Timber, the company’s three highest revenue generators could each experience catalysts that have a real potential to move the company’s stock price upward.

Met Coal

PDER has implemented several projects and has signed agreements with lessees that should increase the company’s met coal outputs all the way through 2026. If steel manufacturing picks back up due to increased pricing for foreign metals, PDER could experience enough leverage to increase their pricing on their contracts as met coal is needed in the production of steel.

Almond Farm

PDER has a stake in an Almond farm that’s located in Portugal. These trees are just now reaching maturity and should produce substantially higher yields over the next decade.

Timber

While PDER has experienced price increases for their hardwoods which comprise the majority of their timber revenues, a slowdown in home building has slowed the demand for timber. If housing picks back up so will demand for wood products and PDER’s timber segment could really take off. Tariffs on foreign wood imports might also be a positive catalyst for PDER as would be buyers of international wood products would likely look to domestic suppliers to potentially save money.

Click here to read my most recent write up on the Pardee Resources Company ($PDER)

CarParts.com, Inc. ($PRTS)

CarParts.com, Inc.’s ($PRTS) stock has gotten absolutely obliterated over the past couple of years but I believe that there’s still at least a few more good puffs off of this cigar left. Carparts.com was a COVID beneficiary. The stock hit above $20 per share in 2021 but since, the valuation has crashed due to poor financial results. The company is trading dirt cheap, has a website that generates over 100 million views, they have the number one eBay store in the world, and $94 million in inventories. I think PRTS gets bought out at their cheap valuation.

Click here to read my most recent write up on CarParts.com, Inc. ($PRTS).

United Natural Foods, Inc. ($UNFI)

United Natural Foods, Inc. ($UNFI) has multiple catalysts that should see the company’s stock price continue to rise. The company had a management shakeup, which led to a roll out of a Simplified Supplier Agreement which added to the company’s bottom while. This happened while UNFI simultaneously and diligently cut costs by closing down and selling off their distribution centers that overlapped the paths of other company owned distribution centers. UNFI then would use these proceeds to pay down debt. This was going well and I saw a very large gain on my UNFI investment.

I sold off my UNFI stock because the company was the victim of a rather viscous cyber attack. This attack disrupted how the company processed orders, which left many of the company’s customers left with empty shelves. All of this negative press plunged UNFI’s share price down from $31 or so a share to $21 a share. I bought back in as UNFI was looking like it was bottoming out from the news and fully expect the company to at the very least, pop back up into the low $30 per share range once again. My long-term multi-year price target for UNFI is more like $40 a share if they can get their operating margins to hit 1.7% all the way to $60 a share if their operating margins can hit north of 2%. I believe this to be achievable as the company expects to see $425 million in lost business from this cyber attack yet still expects to see a total revenue increase YOY of $600-$800 million from $31 billion to $31.6 - $31.8 billion.

Click here to read my most recent write up on United Natural Foods, Inc. ($UNFI).

That’s that, all 12 of my current holding in my portfolio. If you want to keep up to date on what stocks I’m looking at consider becoming a paid subscriber.

Disclosure: At the time this article was published I was long on all of these positions but may buy or sell my shares at any time following this article. This is not financial advice. I am not a financial advisor. Do your own research.

They sure don't make round lots like they used to.

Awesome stuff and love the transparency!