My Best and Worst Investments Ideas and What I Learned From Each of Them: Part 2

When Opportunity Comes Knocking

My last article “My Best and Worst Investments Ideas and What I Learned From Each of Them: Part 1” was centered around the worst investment decision I had thus far made since I had begun to write articles. RCI Hospitality Holdings, Inc. (NASDAQ: RICK) looked like it was about to substantially increase its cash flow once a couple of casinos were to open up. RCI failed to stick the landing however and the company failed to obtain permits for these casinos. This meant that RCI had sunk a huge pile of money into these properties without any real prospects of being able to re coup these costs.

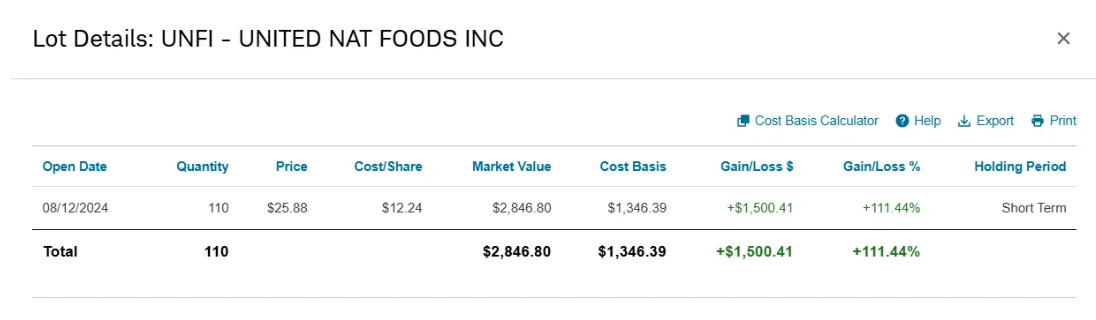

Once the outlook for RCI’s casinos opening began to sour, I sold off my stock in RCI and swallowed a roughly 20% loss on my investment. While I did think that long term, I would probably at least break even on RCI, I had found an opportunity that had a real prospect of not just recouping my losses from RCI but blowing straight past the gains I thought I would probably receive through RCI even if they were to get approval to open up their casinos. This company was United Natural Foods, Inc. (NYSE: UNFI).

How I Stumbled Onto UNFI

UNFI had seen its stock price fall considerably in 2023. In march of 2023 it had sat between $41.00 and $43.00 before falling all the way down to $9.24 per share by April of 2024.

I had stumbled upon the stock when it was priced around $12.00 a share. At the time there was actually a bit of gossip going around LinkedIn concerning UNFI implementing a substantially increased service fee for products that pass through their distribution centers. This had given me the bit of curiosity that I needed to dive further into UNFI and see whether it was indeed a good investment or not. The company had substantial asset values and had clearly fallen on some hard times. The business had failed to successfully navigate pricing their services during the last several years of inflation and saw their profits plummet accordingly.

Over the past year or so UNFI has moved around some of its management as well as implemented a large service fee increase that has been drastically improving UNFI’s margins. On top of these two very crucial factors being implemented, UNFI has been selling off some of its warehouses in areas where they feel their shipping centers are located too close to each other. This has helped them generate cash from these sales as well as slim down the company’s future operating costs, further expanding UNFI’s potential profitability.

Simplified Supplier Agreement (SSA)

The service fees that UNFI has implemented are known as its Simplified Supplier Agreement or SSA. Suppliers will pay a flat rate of 2.5% on all purchases barring some exclusions. These exclusions include UNFI's military purchase program, products intended for sale in Canada, as well as private-label products.

This fee also covers the cost of giving suppliers access to analytical data to support their business relationship with UNFI. This data is suppose to help UNFI's suppliers view insights on how fast products are moving through distribution, how fast products have historically moved through the supply chain, and what estimated future demand may look like among other features.

By forcing the majority of UNFI's suppliers over to this agreement and essentially making sure everyone is making decisions using the same pieces of data, UNFI hopes it can foster a smoother and more efficient product flow from supplier to end customer. By doing so, UNFI should be able to free up warehouse space enabling the company to move more products through them. While some of UNFI's suppliers had previously had access to these pieces of information from either “Supplier in Site” or for a 1.5% fee via a contract with ClearVue, steering almost all of UNFI's suppliers on to both of these data platforms should work wonders to help streamlines UNFI's distribution business.

UNFI began charging this fee May 1st of 2024. Suppliers will be billed quarterly and can not opt out of the agreement. While there is no doubt that some of UNFI's suppliers are unhappy, they are bound by contract to accept this condition. Breaking a contract with one of the country's largest food distributors is not a realistic option for most of UNFI's suppliers as this might entail legal action against them or make other distribution companies wary about entering into a new contract with a supplier that had previously dishonored other agreements. Furthermore, UNFI's largest competitor KeHE charges similar fees. These fees do not add a lot to UNFI’s accounting and management costs and these fees are helping UNFI to raise their EBIT margins substantially while adding some predictability to the timing of when UNFI receives its revenues.

New Roles in Management

Sandy Douglas

Sandy Douglas is the CEO of UNFI and has held this position as well as a board member position since August of 2021. In October of 2023 Sandy assumed the role of President and CEO of UNFI. Sandy spent 30 years at The Coca-Cola Company (KO) eventually working his way up to President of Coca-Cola North America before leaving the company in 2018 to become a CEO at Staples where he worked until coming to UNFI.

Since Sandy has taken over as CEO for UNFI his attention has been keenly focused on lowering UNFI’s working capital and capital expenditures. He plans to accomplish these tasks primarily through properly integrating the company’s Supervalu brand in better with the rest of the company. This will help UNFI to be able to reduce their distribution centers, adding efficiency to the company by reducing overhead costs. Sandy was also instrumental in instituting UNFI’s new supplier fees as these fees are very similar to fees that Coca-Cola had instituted within their company.

Giorgio Matteo Tarditi

Matteo has served as UNFI's CFO and President since April of 2024. Before joining UNFI Matteo spent 26 years at the General Electric Company (GE) serving the company in an assortment of capacities. Matteo served as CFO for seven of GE's business units including Renewable Energy and Energy Connections and for large divisions of the Power, Oil & Gas, Aerospace, and Healthcare businesses. He is a Lean Six Sigma Black Belt and has helped implement various programs to help improve forecast accuracy, accountability, and continuous improvement during his time at GE.

Activist Investor James C. Pappas

James joined UNFI in September of 2023. Before that, he worked in the Investment Banking and Leveraged Finance Division of The Goldman Sachs Group, Inc. (GS) from 2005 to 2007. While at Goldman Sachs, James advised private equity groups and corporations on appropriate leveraged buyout, recapitalization, and refinancing alternatives. From 2007 to 2009 Pappas spent his time private investing as well as being a consultant for several businesses.

Since 2009 James has owned his own investing firm called JCP Investment Management. James is also currently a board member of Tandy Leather Factory, Inc. (NASDAQ: TLF) and Innovative Food Holdings, Inc. (OTCQB: IVFH). He has held a seat at Tandy Leather since 2016 and at Innovative Food Holdings since 2020. Pappas had previously held board seats at various other food companies including Jamba, Inc., The Pantry, Inc., and Morgan's Foods, Inc. all of which should give him a lot of insight into running a variety of complex businesses in the food industry.

How Have These Changes Panned Out So Far?

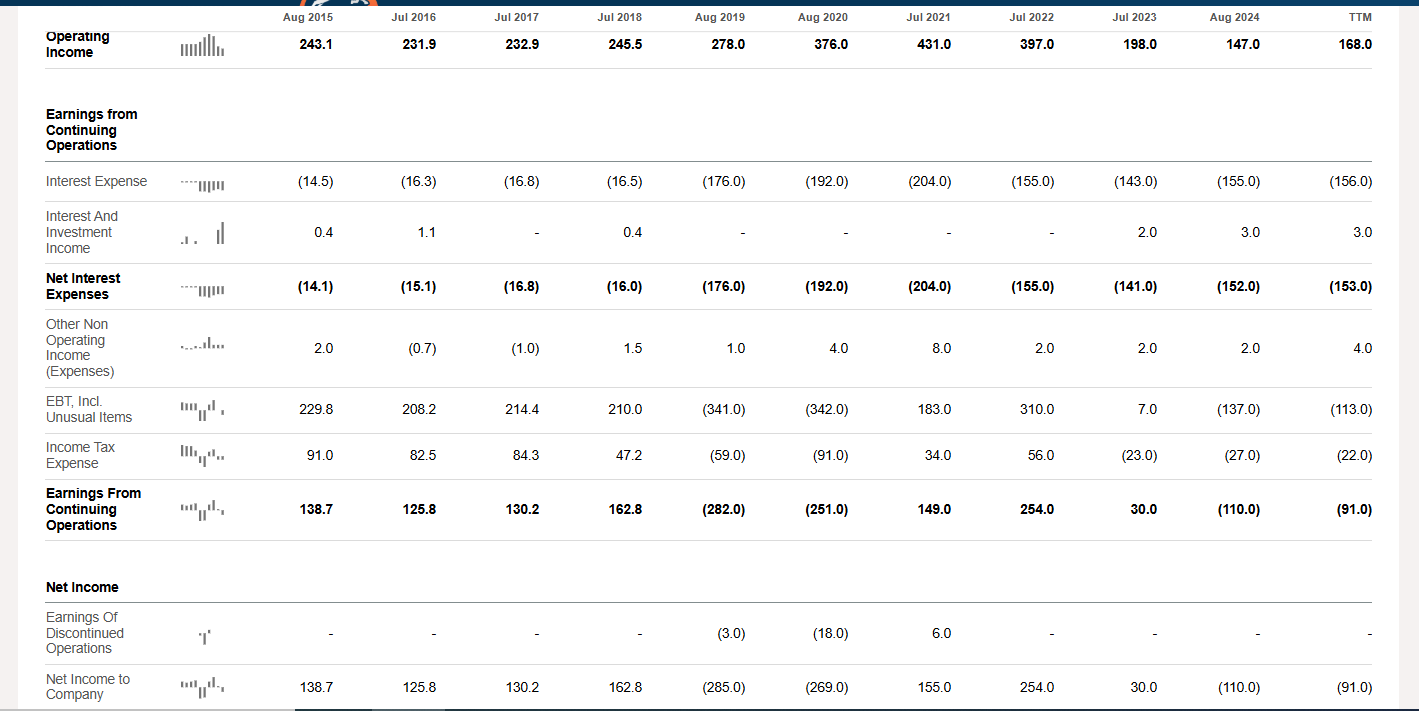

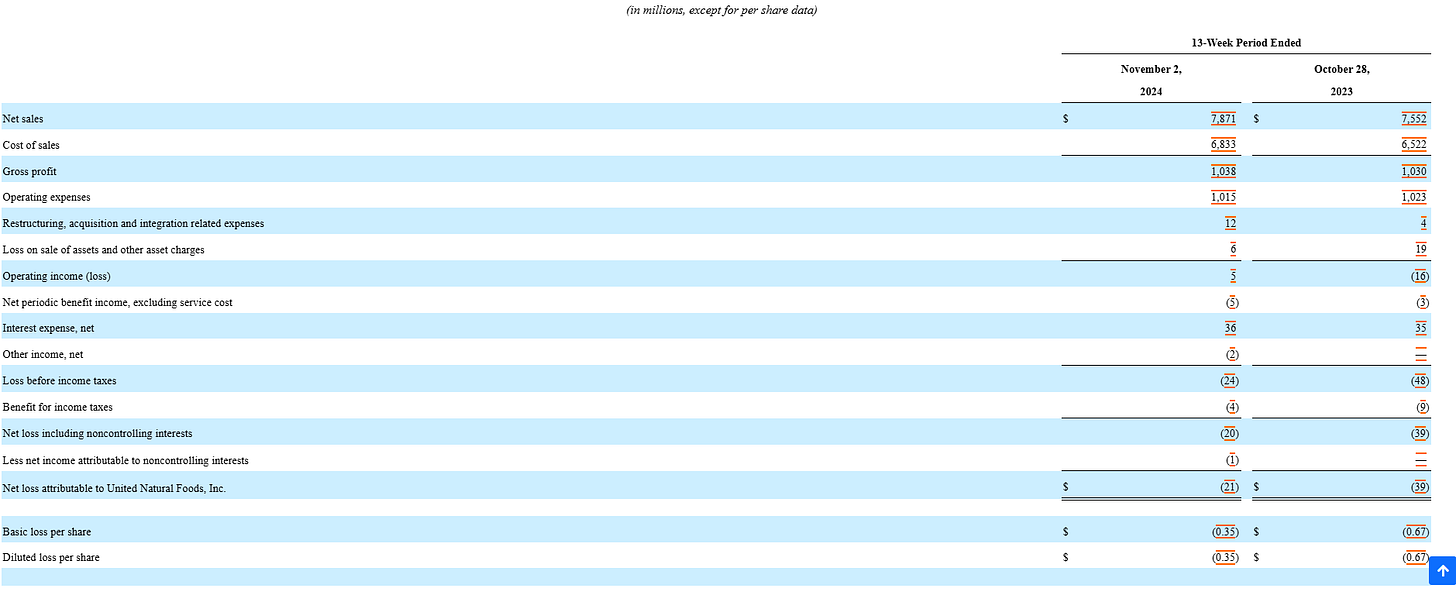

Thus far UNFI has only reported two quarters where these SSA fees have begun to take effect. These quarters have also been filled with announcements that UNFI is closing several of its warehouses and consolidating them into locations that are more central to the company’s shipping needs. All of this has helped the company steadily increase their profitability. During Q4 of UNFI’s fiscal 2024 the company experienced, improved wholesale margins, their adjusted EBITDA was 53.7% higher, and they reduced their debt.

The next quarter saw UNFI increase its sales while simultaneously decreasing its operating expenses compared with UNFI’s Q1 from a year prior. This led UNFI to earn $5.0 million in operating income versus a loss of $16.0 million a year prior. When comparing UNFI’s year over year figures, the company was able to cut its losses per share in half from a loss of $0.67 per share to $0.35 per share.

So far it appears like UNFI has made a lot of progress. The company continues to close and sell off distribution centers where it does not need them, further consolidating locations where it ships from and in turn, improving efficiencies. In their last earnings call Sandy had this to say.

“Our continued focus on network optimization has also proceeded as planned, and we have completed the closure of both our Billings and Bismarck conventional distribution centers, which we described last quarter. We have retained the vast majority of the business from these CCs, which is now being serviced from nearby, more modern UNFI facilities with larger assortments. We are now marketing the real estate.

For similar reasons, we made the decision to close our Fort Wayne, Indiana, distribution center and transfer that volume to neighboring facilities in Pennsylvania and Illinois where we expect customers to see assortment and service level benefits. Associates and customers were informed of this in mid-November, and we expect to complete this move early in calendar 2025. Fort Wayne is another owned DC, which we’ll begin marketing at the appropriate times. We will continue to evaluate other similar optimization opportunities.”

- Sandy Douglas - UNFI CEO

Management has also been rolling out new lean ways to run its distribution centers which was also highlighted in their last earnings call.

“As Matteo described on our last call, we begun the process of pushing the lean framework into our distribution centers where local operators are involved in the process of creating and taking ownership of operational KPIs. These same associates are at the center of problem-solving and creating action plans where performance is not meeting expectations. We've piloted the process in two distribution centers, and are pleased with the initial results. Next, we'll begin further aligning our organization to deploy this methodology across more of our facilities.”

- Sandy Douglas - UNFI CEO

“During the quarter, we also moved natural volumes from our York DC into our 50% larger soon-to-be-automated Manchester DC, which we expect will yield service quality and efficiency benefits for our customers, suppliers, and UNFI in the region. We can see the combination of adding value for customers and suppliers to support their sales alongside our efficiency focus, delivering tangible operating and financial improvement.”

- Sandy Douglas - UNFI CEO

Sandy had also said that UNFI is hyper focused on running a leaner company and said, “Reducing or eliminating waste is a big part of what we're trying to accomplish over the next three fiscal years.”

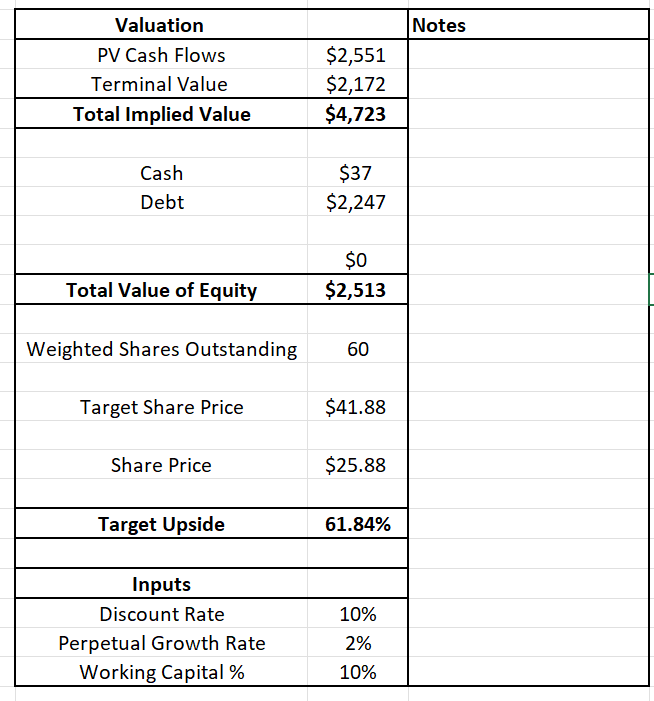

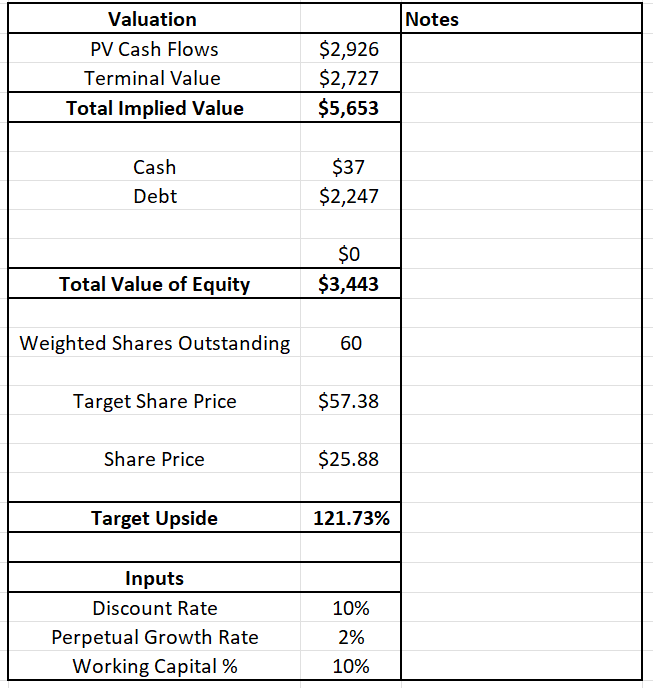

Discounted Cash Flow

I ran two DCFs in an attempt to capture what UNFI’s cash flow values would be should management be successful in turning around the business. If we run a DCF using a 10.0% discount rate, assuming that UNFI experiences a 4.5% growth in year over year revenues through 2033, a 2.0% perpetual growth rate after that, with UNFI having to pay an average effective tax rate of 18.0%, with capital expenditures and D&A expenses set at 1.0% of the company’s revenues, and with UNFI increasing their working capital by 10% of the company’s revenues, we get a surprising amount of upside. If UNFI turned the company around to pre-COVID margins they would be experiencing EBIT margins of 1.2%-1.5%. Because of the company’s implementation of a 2.5% SSA fee and the fact that management has been putting the axe to the grind when it comes to reducing operational costs, I ramped up UNFI’s EBIT margins to 1.7% by 2027 for my first DCF. I then ramped up UNFI’s EBIT margins to 2.0% by 2027 for my second DCF. Below are my results.

Conclusion

As you can see, slight improvements to UNFI’s EBIT margins go a long way. When I bought into UNFI back in August the company had a GAAP net asset value that far exceeded the company’s share price of $12.24. With a share price sitting around $25.88 today, UNFI’s GAAP net asset value of $27.31 per share gives us just a 5.0% upside. As mentioned in greater depth in some of my previous newsletters such as “Assets Hidden Behind GAAP Accounting” and “Hidden Asset Values”, companies that hold a large amount of their asset value in property are often times undervalued due to the fact that, according to GAAP accounting principles, land and buildings are generally carried at cost and not at the estimated price that these assets might fetch in the current marketplace. As the price of buildings and property have done nothing but skyrocket over the past couple of years, I have a fair amount of confidence that UNFI’s 31 million square feet of warehouse space spread out across 53 different facilities combined with their 76 retail grocery stores are worth a bit more than their GAAP accounting would show.

Considering UNFI’s asset value, the company’s future cash flow potential, and management’s consistent focus on making their company a less capital intensive, higher margin business, I would consider UNFI a BUY still. I believe that as UNFI continues to progress towards these business initiatives investors will continue to gain excitement about the future prospects of the company. I would expect to see another spike in share price once UNFI returns to being profitable once again.

When Opportunity Comes Knocking

For me UNFI is a good example of seizing an opportunity when it’s presented to you. I kind of stumbled upon this stock and at the time didn’t have as much liquidity sitting on the sidelines as I would have liked to. I did however have an underperforming stock in my brokerage account (RICK) that continued to, time and time again, disprove my original thesis I had for the company. I was at a crossroads where I could sit around and wait for a company to get its act together so I could break even or possibly, best case scenario, squeeze out a couple of percentage points of profit or, I could abandon ship and hop on board the UNFI train.

Largely due to the company’s newly implemented SSA fees and warehouse selloffs, UNFI looked poised to make real headwinds with their revenues and margins plus, they had just changed some of the company’s management as well as having activist investor James Pappas join the team. All of this gave me the confidence to pour my money into an UNFI investment. It can be hard to decide when to eat the losses from a bad investment. Each scenario is different but I would offer one rule that has helped me make the most out of my capital. Do not be afraid to trade in a stock that has continually disappointed and underperformed as a business for another stock that seems to have, after very close examination, real prospects of exceeding your prior investment.

UNFI is one of the few companies I have looked at where, after 60 seconds of looking at their balance sheet and a couple of minutes reading about their SSA fees, I just knew this investment was going to make me money. If UNFI can continue to reduce their operational costs and can return back to being profitable, I would think it reasonable to see the company’s share price sit somewhere between $40.00 and $50.00, possibly more.

Disclosure: I am long United Natural Foods, Inc. (NYSE:UNFI) and may buy or sell my shares at any time following this article. I do not own shares of RCI Hospitality Holdings, Inc. (RICK). This is not financial advice. I am not a financial advisor. Do your own research.

Cutting losses and reallocating is often wise, but isn’t there merit in holding for the long-term if the fundamentals remain intact? That said, I admire your discipline and optimism in seeking better opportunities—thank you for sharing your thought process!