A $92 Million Land Deal Just Reset the Market — And It Could Unlock a Hidden Fortune Next Door

Earlier this month, a Florida land transaction closed with almost zero media coverage — but make no mistake: this was no ordinary deal.

A private developer paid nearly $93 million for a sprawling 2,700-acre property in Southwest Florida. On paper, it's just another real estate purchase. But for investors paying attention, it quietly revalued every acre around it — including one massive, publicly traded landholding directly next door.

The adjacent property is nearly twice the size. It has far more aggressive development plans. And thanks to this recent comp, the implied land value could exceed the entire enterprise value of the company that owns it.

Even more interesting? Wall Street hasn’t caught on yet. No sell-side coverage. No headlines. This might be one of the most asymmetric land-backed plays in the market today.

In this week’s full report, we walk through the deal math, apply updated comps, and outline why this sleepy company’s 4,600-acre parcel — and the 50,000+ acres it still controls beyond that — may be hiding hundreds of millions in untapped value.

If you’re interested in public companies with hard assets, low coverage, and explosive revaluation potential…

This is the one to read…

This might be the most significant news I’ve seen on Alico in the past five years.

On June 13, 2025, it was announced that Estero-based developer Cameratta Companies purchased the Kingston property—2,700 acres—for $92.8 million, or $34,370 per acre. Cameratta plans to build 1,118 homes on the site, with 60% of the land to be restored as wetlands. This equates to approximately $83,005 per lot.

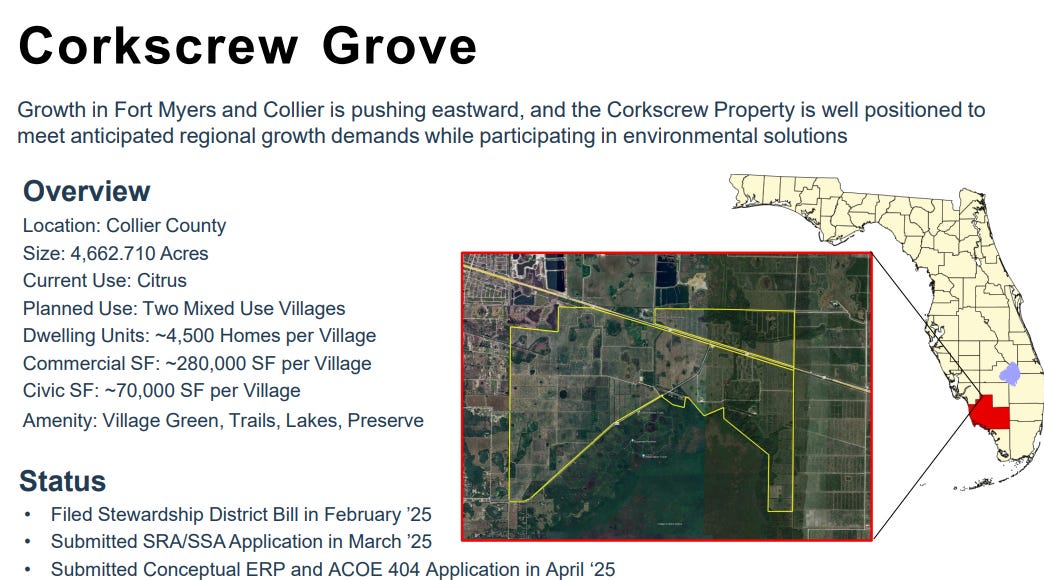

What makes this transaction so notable is that the Kingston property is directly adjacent to Alico’s Corkscrew Grove, which spans 4,662 acres. Alico is currently working through the entitlement process for Corkscrew, which would allow for 9,000 residential units, 560,000 square feet of commercial space, and 140,000 square feet of civic development.

Even applying just the $34,370 per-acre comp from the Kingston deal implies a valuation of approximately $160 million for Corkscrew alone. Considering Alico’s market cap of $238 million and enterprise value of $313 million, that’s extremely meaningful.

However, Alico’s plan allows for a much denser development—9,000 homes versus Kingston’s 1,118—so the per-acre value should arguably be much higher.

In a bull case using the $83,000 per-lot figure, Alico’s 9,000 entitled lots would imply a valuation of $747 million. While that may be aggressive, a more conservative estimate in the $400–500 million range still represents substantial upside.

Cameratta has stated that it has only acquired half of the Kingston site thus far, with the remainder expected to close over the next 12 months. Major homebuilders—including Taylor Morrison, Neal Communities, Lennar, and Pulte—are already lined up to begin construction.

Bottom line: based on this transaction, Alico’s Corkscrew property alone may be worth more than the company’s entire current enterprise value. The cherry on top? Alico still owns another 50,000 acres of land—outside of Corkscrew—that likely holds significant additional value.

Disclosure: I am long Alico $ALCO. I will buy or sell ALCO anytime following this article. This is not investment advice. Do your own research.