Broadcast Deregulation and Hidden Assets

A Small Broadcaster With Big Assets, Political Catalysts, and M&A on the Horizon

I continue to maintain my stance that owning a basket of television broadcasters heading into this political cycle will likely outperform indices. Not only are they all cheap from traditional valuation metrics, but there is significant political tailwinds that could significantly change the economics of the core business.

The few of the key tailwinds that I am monitoring are the following:

A lift in local and national station caps: This would allow broadcasters to consolidate markets that they want to be in and divest markets they don’t want to be in. If this occurs there will be a significant amount of M&A which will lead to higher operating margins from lower costs. Nexstar has publicly stated that duopolies in a single market can lift incremental margins 50-70%.

A congressional approval for a spectrum auction: The last time there was an incentive spectrum auction was in 2017. A significant amount of broadcast spectrum was sold and the broadcasters who participated in the auction make hundreds of millions. Based on the movements that I am seeing, there is potential for a second incentive auction.

Enable stations to negotiate vMVPD agreements: If a regulation was passed that allowed local broadcasters to negotiate distribution deals with virtual multichannel video providers (vMVPDS) this would level the playing field and lift operating margins.

Two of these are starting to play out and I am sure the third is right behind the first two. First, with respect to local and national station caps, John Malone recently purchased Cox Communications through Charter in a $21.9 billion deal. While not specifically a broadcast asset, this is a major communications deal and will need FCC approval. Should the FCC approve the deal, it signals a green light to others in the industry that M&A is open and allowed under the current administration. A second deal that occurred is Verizon Wireless’ $20 billion deal with Frontier. The FCC approved this deal just five days ago. I think the next deal that occurs is Apollo's Cox Media Group which includes 12 television stations and 50 radio stations. My best guess is that Nexstar gobbles up these assets.

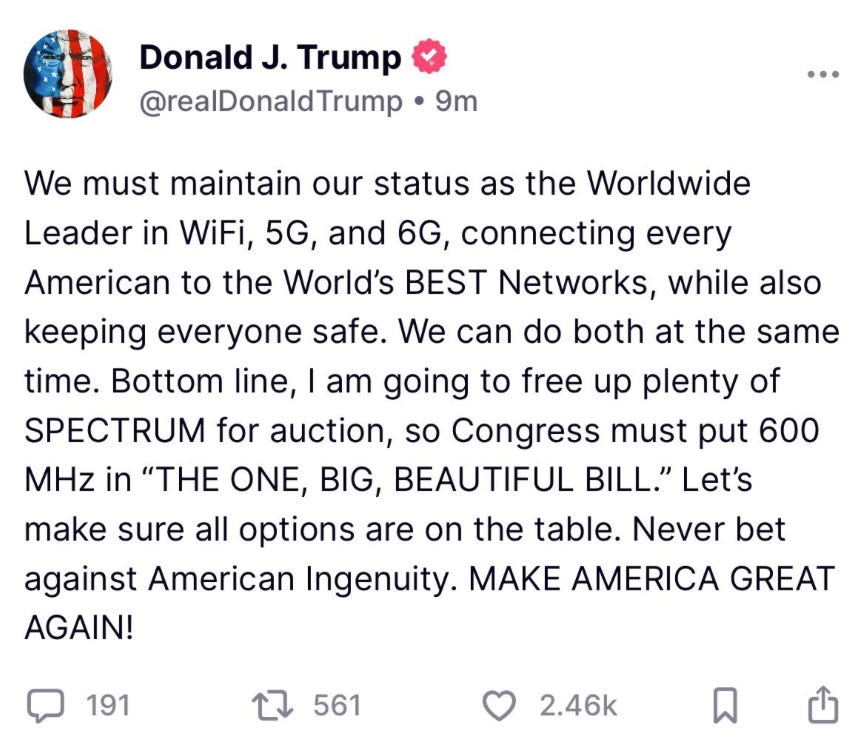

The second deal that is starting to play out is the potential for a spectrum incentive auction. Just yesterday, President Trump tweeted the following:

While this doesn’t indicate that an incentive auction is coming in the near-term, directionally this is a positive sign for anyone who is long spectrum. An administration who is actively looking to repurpose spectrum is extremely bullish for anyone who owns spectrum.

The third point is mute right now, but I am sure as time passes, the ability for local broadcasters to negotiate directly with vMVPDs will happen.

I write this today to talk about my favorite little broadcaster. A tiny little broadcaster with a market cap of $177 million and an enterprise value of just $279 million. Despite the small size of this security, it has one of the least levered balance sheets and a handful of hidden assets that I think the market is missing.

I have written up this company a few times since starting this newsletter. I am writing an update because there are a few important things to note as the company recently reported their Q1 2025 results.

The company owns a “hidden” ad-tech business that is growing like a weed and recently achieved operating leverage. In Q1 revenues were up 57%, comping a 30% quarter. Even better, EBITDA margins hit 13.8% from 9.5% year over year. This is real operating leverage and growth. At the current run-rate, with no more growth, annualized EBITDA is $28 million. Assets in this space trade for 12-15x EBITDA. This implies a valuation of $336-420 million.

The traditional media assets are in turnaround mode. In Q1 2025, EBITDA was at breakeven. Management stated on the recent call that revenues are beginning to improve and costs are getting streamlined. It should be noted that these media assets have historically generated $50+ million of EBITDA and have spit out a ton of cash. A strategic buyer of these assets could drop these into their business and remove a significant amount of costs.

The company has moved out of their long-term headquarters and moved directly inside a competitors building. This competitor is ran by a serial acquirer in the traditional media space who is looking to acquire additional assets. The assets this company owns is the perfect fit for this company as they would leverage cost and go head to head with one of the largest media companies who target this demographic.

This company is at the forefront of deregulation. But I don’t think you need deregulation to occur for this company to eventually realize its true intrinsic value. The hidden ad-tech segment is likely worth the entire enterprise value, if not more, and it appears as if the traditional media assets are in play. The most interesting part of the media assets, I don’t think you will need station caps to be lifted for a number of buyers to come in a purchase these assets. They are so off the radar and in markets that are not big four that the FCC will likely just give them a waiver.

However, if deregulation does occur and there is a second incentive spectrum auction, watch out. This company owns a significant amount of valuable spectrum that is likely worth twice the enterprise value.

Let’s dig in.

Entravision Communications EVC 0.00%↑ is a microcap broadcaster with a market cap of $177 million and an enterprise value of $279 million. Entravision owns 49 Hispanic television stations, 44 Hispanic radio stations and Smadex, a Barcelona headquartered programmatic advertising business that places ads predominately on mobile gaming apps. The last time I wrote up the company was on March 26th, 2025 in an article titled: “a sub-scale broadcaster that could get bought out”. Since the article, there are a couple points that I thought I should highlight.

For those new to the story, I urge you to read my previous post as that will give you an idea of what assets this company holds and my general thesis.

There are a couple of new points to highlight since the original thesis:

First, Smadex is growing like a weed and has real operating leverage now. In Q1 2025, Smadex grew 57% year over year. EBITDA margins also expanded from 9.5% to 13.8%. EBITDA came in at $7mm and if we annualize these numbers, we now have a business with $28 million of EBITDA that is growing faster than a 50% clip. The most recent transaction that occurred in this space was ADTheorent in April of 2024. ADTheorent was acquired for $324 million (purchase price included $124 million of cash on the balance sheet or enterprise value of $200 million). At the time of the acquisition, ADTheorent had $15.6 million of EBITDA and zero growth. The EV/EBITDA multiple was 13x. A 13.0x multiple on Smadex with EBITDA of $28 million is a valuation of $364 million. There is a a real case to be made that Smadex could be worth double the entire valuation.

Entravision recently moved out of their long-term Santa Monica headquarters. Not only will this save costs, but if you look at the front page of the newly printed 10-Q, you can see that their new headquarters is 1 Estrella Way, Burbank, California. If you Google that address, you can see that the owner of 1 Estrella Way is Estrella Media. Estrella Media was recently acquired by MediaCo MDIA 0.00%↑ which is a sidecar of Standard General, which is ran by a guy named Soo Kim. Soo Kim is a media mogul who tried to acquire TEGNA before the previous FCC shut him down. He also built up Young Broadcasting in the past and sold that for a few billion. Estrella Media owns Hispanic media assets and is a likely buyer of Entravision’s traditional media assets. Given the recent shared headquarters, it is likely something is occurring behind the scenes.

Given the recent explosive growth at Smadex, the new headquarters move and the deregulation movement behind the scenes, I have grown even more positive on Entravision being the right asset to own on the broadcast side. The valuation is cheap. There are hidden assets. Positive regulatory changes are likely. And management appears to be getting ready to sell the traditional media segment. At the current valuation I don’t think there is much downside and there is substantial upside.

Disclosure: I own Entravision Communications $EVC. I will buy or sell shares following this article. This is not investment advice. I am not an investment advisor. Do your own research.