This OTCQX Aerospace Player Just Doubled Its Income Per Share

Costs Down and Income Up

It’s not every day you find a company that pairs a Kansas casino with a rapidly growing aerospace business, but that’s exactly what this company is doing. While gaming revenues have softened, income from their aerospace segment has shot through the roof. This company has experienced a 32% increase in operating income and a 64% surge in net income thus far in 2025. With the help of steady debt reduction, share buybacks, and rising interest income, they’ve managed to double their per share earnings. A couple of DCFs that I ran (one pretty conservative and one with more realistic expectations), suggests that this stock could have an upside ranging anywhere from 44% to 92%. With global demand for aerospace products climbing, driven in part by global conflict, this weird OTCQX stock may have a lot more upside to it. Let’s dig in, shall we?

The Butler National Corporation ($BUKS) has a very odd pairing of businesses which caught my eye immediately the first time I saw it. The company operates a casino in Dodge City, Kansas as one of their business segments and then operates a bucket of aerospace businesses as their other business segment.

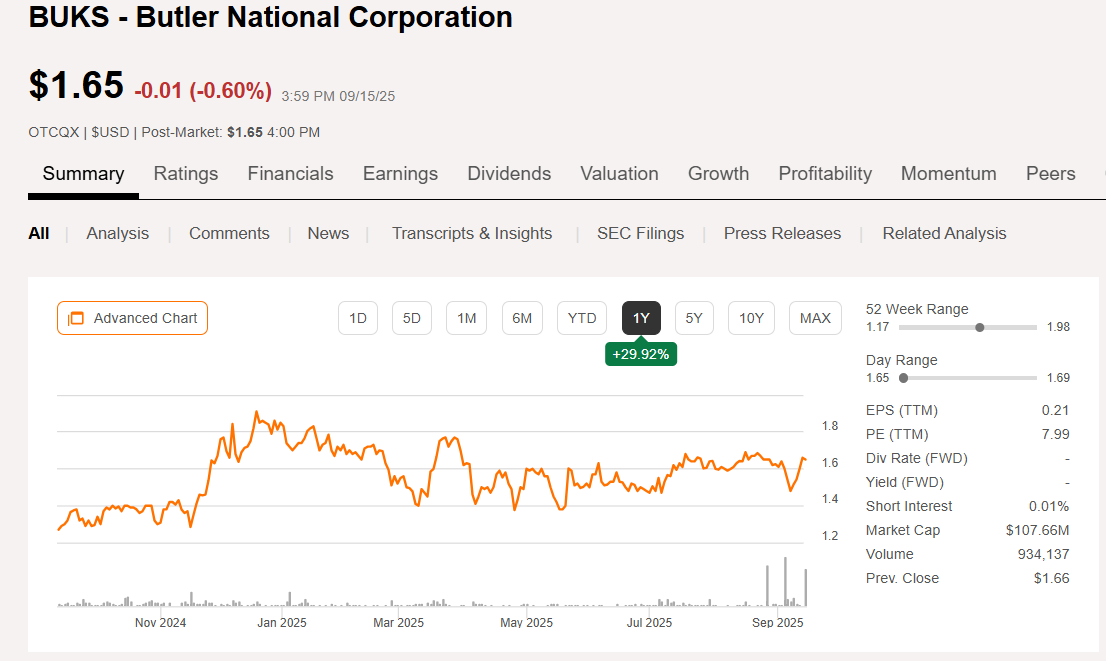

BUKS’s share price is currently sitting at $1.65 per share. The company currently has 64.9 million shares outstanding giving them a market cap of $107 million. The company has $33.9 million in debt and $33.4 million in cash giving them an enterprise value of $107.4 million.

BUKS Seeing Gains

While BUKS might seem like an odd business they have done nothing but run a tight ship since I’ve started following the company. I’ve written about BUKS before at The Value Road here, here, here, and here. Read through them if you’d like as I do go into much more detail about $BUKS’s operations. While the company’s casino revenues have been flat as consumer spending has petered out, their aerospace product demand continues to increase at a rate that more than makes up for this.

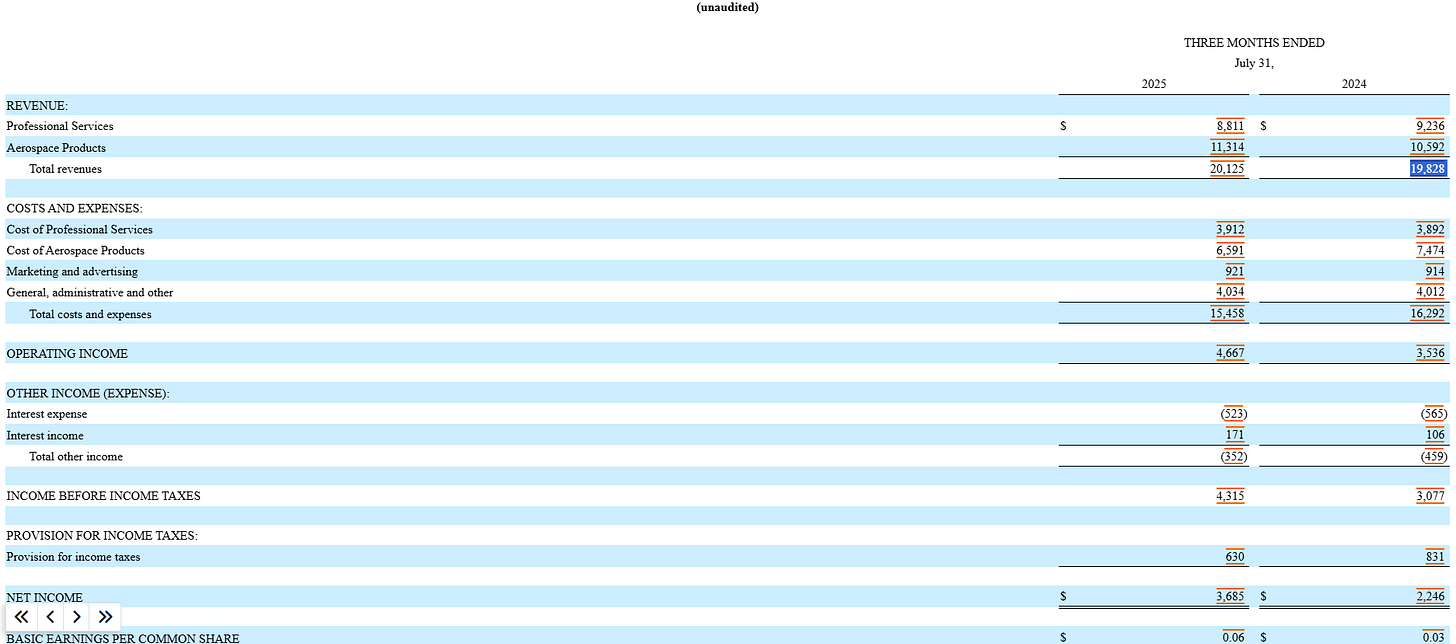

Revenues from BUKS’s casino fell by 4.6% but their aerospace products segment made a 6.8% gain in sales. Costs and expenses rose slightly across all of the company’s segments except for their aerospace products. This category of expenses and costs fell enough to drop total costs down by 5.1% YOY. As a result BUKS’s operating income increased by 32% from $3.5 million to $4.7 million when comparing quarters.

Interest Income, Interest Expense, and Debt

BUKS has been working on paying down the debt they had used to expand their aerospace segment and therefore currently have less interest due on this debt lowering the company’s interest expense while simultaneously increasing their interest income via a combination of more attractive rates on their investments and from having more cash to invest with.

This lowered other expense combined with a slightly lower tax bill resulted in BUKS seeing a 64.1% increase in net income from $2.2 million to $3.7 million. Once you factor in the fact that BUKS has reduced their share count by 1.8 million shares since last year, the company’s income per share comes out to $0.06 per share versus $0.03 per share last year, a 50% increase despite one of the company’s segments seeing a decrease in revenues.

Discounted Cash Flow #1

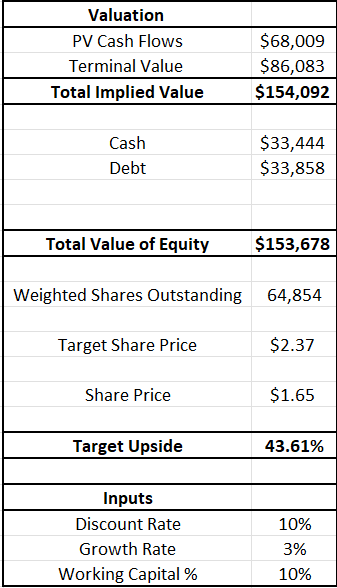

I ran a DCF on BUKS to get a sense of what the company’s future cashflows could look like. I set assumptions for the company based on what their five year averages have been which gives us an 8.2% revenue growth rate, a 16.1% operating income margin, and a 25% tax rate. Capital expenditures were set at 10.8% of the company’s revenues and D&A expenses were added back in at 8.1% of the company’s revenues. I left the company’s working capital flat through 2028 as BUKS has actually averaged a net decrease in the company’s working capital over the past five years. I then increased BUKS’s working capital as a percentage of their revenues by 10% through 2035 to account for the added expenses of an expanding business. Finally, I set the company’s perpetual growth rate at 3.0% after 2035, and then applied a 10.0% discount rate to finish things off.

As you can see from the image above, my DCF ended up spitting out a $2.37 per share price target, a 44% upside from BUKS’s current share price of $1.65. I actually think that this price target is conservative as BUKS will be paying down a lot of their debt over the next couple of years. The company has also been very consistent on reducing their share count. Both of these events are catalysts for large increases in future cash flow potential.

Discounted Cash Flow #2

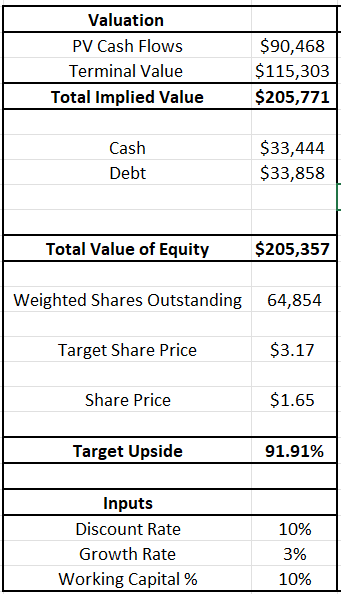

BUKS has seen such a large increase to their operating income margins since they’ve added buildings and equipment to their Aerospace operations. I believe that these figures are sustainable, especially as BUKS brings down their debt. For this reason I ran a second DCF. The company’s operating income margin as of this recent quarter was 23.4% and last year it was 20.0% so I ran my second DCF assuming a 20.0% margin. Here are the results.

This DCF ended up spitting out a $3.17 per share price target, a 92% upside from BUKS’s current share price of $1.65. Personally, I’m happy with a return anywhere in the middle of that 44% to 92% share price increase range.

Conclusion

I’ve written about BUKS rather extensively on The Value Road several times before and periodically check in on the company as I hold them in my portfolio. As usual the Butler National Corporation ($BUKS) is doing right by their shareholders. The company had invested in new buildings and equipment to be able to grow their aerospace segment and that segment is indeed still continuing to grow.

Today we have by far the most global conflict that I’ve seen in my lifetime. The war in Ukraine isn’t showing signs of letting up. Israel has started bombing other countries in the Middle East. Neither of these conflicts seem anywhere close to a ceasefire agreement. China has also increasingly become more and more escalatory in Asia. All of this is happening while the Trump administration has pushed for countries to become less reliant on American military aid or less reliant on the promise that America would step in if one of these points of tension was to escalate further. This means that America’s allies around the world have begun to increase purchases of military equipment.

This is a positive catalyst for BUKS as the company does sell their products overseas and this quarter experienced a large increase in aerospace sales to Asia. This time last year it was to Europe. I unfortunately do not see a reason why this trend wouldn’t continue into the future until the U.S. and our allies felt more secure about the current state of our international relationships. If BUKS’s casino revenues can rebound while these global tensions are still hanging in the air, it would send BUKS’s share price soaring. Running a casino has certain fixed costs and anything over that drops right down to the company’s bottom line.

The first DCF I wrote up for this article uses a rather low operating income margin of 16.1% as this was the average operating income that the company experienced over the past five years. The company’s operating income was at 16.8% in 2024, 20.0% in 2025, and rose to 23% for Q1 of 2026. I think that BUKS can likely maintain these margins as their debt is coming down. I bought into BUKS at $0.85 per share and I plan on holding this stock for a while. I believe BUKS to be worth at the very least $2.37 per share. I actually think the stock is worth much more than that as their operating income margin will probably stay around 20% for the foreseeable future so long as BUKS keeps paying down their debt. If BUKS can keep these margins at 20% then their stock could be worth $3.17 per share a 92% increase from the company’s current share price of $1.65.

Disclosure: I am long on the Butler National Corporation ($BUKS) and will buy or sell my shares anytime following this article. This is not financial advice. I am not a financial advisor. Do your own research.

Do you think they’ll ever sell the casino? I feel that would unlock a lot of value.