Aerospace Ambitions Meet Casino Cashflow

Betting on Jets and Jackpots

Before I dive into today’s article I wanted to let my readers know that I was recently featured on an episode of the Event Driven Daily podcast. I’ll leave the link here for anyone that wants to watch it. If you like the episode make sure to give Event Driven Daily’s YouTube channel a sub and X account a follow. As always you can also follow my X account to stay updated on all of the other podcasts that I do in the future.

Today’s topic of discussion is about a company that operates both a regional casino and an array of aerospace engineering businesses. Sounds bizarre right?

Tucked away in nanocap land is a firm that’s been rapidly expanding its aerospace segment while maintaining a steady hand on its gaming operations. With new catalysts emerging - including favorable tariff developments, significant debt reduction, and meaningful share buybacks — this under-the-radar business’s operations are most impressive. This company isn’t out chasing growth by loading up on debt to try and push their way into a brand new business venture. They’re doing what they do best, rapidly growing one of their existing business segments while maintaining cashflow from their casino.

The Butler National Corporation ($BUKS) has a very odd pairing of businesses which caught my eye immediately. The company operates a casino in Dodge City, Kansas as one of their business segments and then operates a bucket of aerospace businesses as their other business segment.

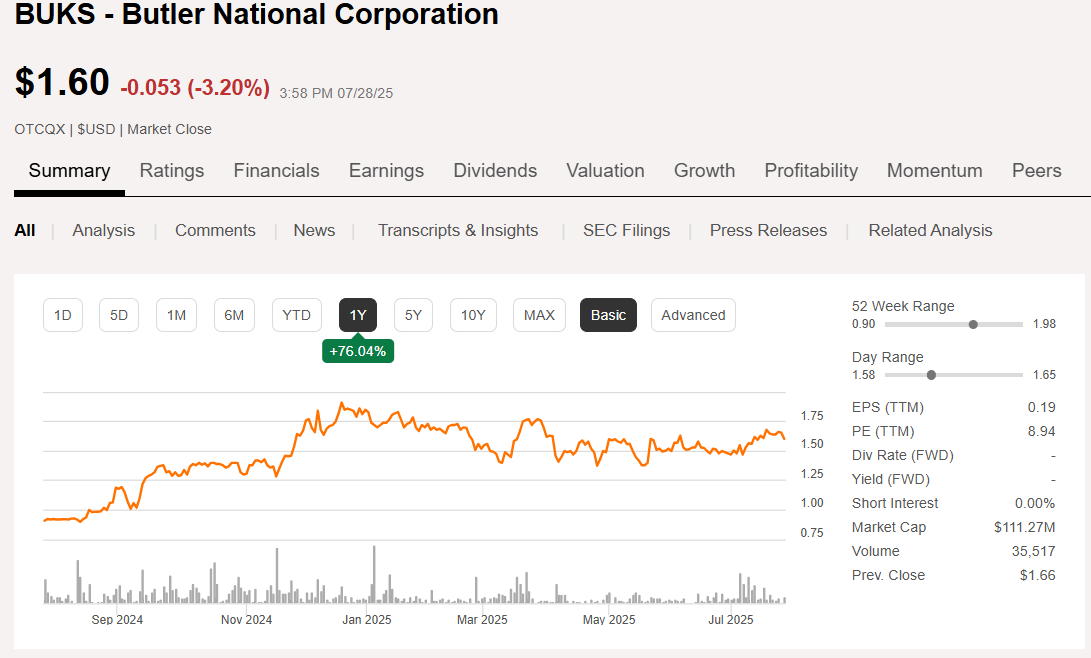

As I begin to write this article, BUKS’s share price is sitting at $1.60 per share. The company currently has 67.2 million shares outstanding giving them a market cap of $107.6 million. The company has $35.2 million in debt and $25.2 million in cash giving them an enterprise value of $117.5 million.

Catalysts For BUKS Seeing Gains

There are several reasons why I expect to see BUKS continue to increase their cash flow and their stock price over the course of the next several years.

An Expanding Aerospace Segment

BUKS’s aerospace segment saw a 15% revenue increase and a 27% increase in operating income YOY. This drove the company’s aerospace operating margins up YOY from 17% to 20%. In fact, the company’s aerospace segment has expanded so fast that BUKS has had some unexpected capital expenditures arise including the company expanding their fabrication facility to be able to take on the increased business. As the company wraps up these expansions throughout 2025, future expenditures should drop. When CapEx drops upon the completion of these new building expansions, the added business these expansions will help facilitate, mixed with the drop in CapEx, should create an environment that fosters margin expansions and higher operating income.

Paying Off Debt

The company has $4.6 million in debt due in October of 2026. The company pays an interest rate of 5.75% on this $4.6 million of debt. When the company pays this debt off next year they’ll save $265k a year in interest payments and reduce their total long-term debt by 13.1% (BUKS’s total long-term debt currently sits at $35.3 million).

The company has another large debt obligation of $27.4 million due in December of 2027 with an interest rate of 5.32%. This puts BUKS’s interest payment on this debt at almost $1.5 million a year. This $27.4 million in notes payable makes up 77.6% of the company’s current long-term debt. If the company paid off this debt they’d obviously be saving a lot of money. While there’s still two years before this principle payment is due, if the company did pay off this debt completely in 2027 they’d probably drain their cash pile. I imagine that BUKS will probably roll some of this debt over into a new loan. While it probably won’t be paid off completely, this debt should be reduced significantly by this time.

Reducing Their Share Count Through Share Repurchases

The company has been consistently reducing their share count through share repurchase programs. BUKS has consistently increased the amount of money the company is allowed to spend on share buy-backs and the company has steadily been spending the money allotted to repurchase shares. In July of 2023 the Board of Directors increased the size of the company's repurchase program from $4 million to $9 million, then from $9 million to $11 million in 2024, then from $11 million to $15 million in 2025. The program is authorized through April 15, 2027 and still has an allotted $2.3 million left for repurchases.

The European Union Tariff Treaty

The new tariff treaty signed with the European Union this week makes exemptions for aircrafts and aircraft parts. Sales to European customers account for 31.2% of the company’s aerospace segment sales. Since metals and aircraft parts make up the lion’s share of BUKS’s materials used in production, these tariff exceptions should help the company lower their cost of production and help BUKS maintain a good and profitable relationship with their European customers.

Any Rebound In The Company’s Casino Operations Would Further Compound These Previously Mentioned Catalysts

The company’s rise in their sales for fiscal 2025 was driven entirely by their aerospace segment. BUKS’s Casino segment saw a 1% drop in revenues which the company attributed to Dodge City, Kansas’s economic reliance to the cattle market. The U.S. is currently seeing a very large drop in the number of cows being raised for meat. Dodge City’s economy is very closely tied to the beef industry as there’s large cattle auctions and meat processing facilities in the area.

As the cost of raising beef has skyrocketed and problems such as drought have wreaked havoc on the U.S.’s cattle supply, the jobs tied to the industry have seen a cutback in hours or a pull pack in overall employment altogether. This has left the surrounding residents with less discretionary spending money to gamble with. If the beef industry straightens out over the next couple of years while BUKS pays down some of this debt, it could be a kind of triple whammy. The company is already set up for a prolonged period of growth in their aerospace segment. Their debt will also be reduced as will their interest payments, lowering the company’s expenses. If these things mix with BUKS’s Casino entering into another period of revenue growth it could send the stock soaring.

Discounted Cash Flow

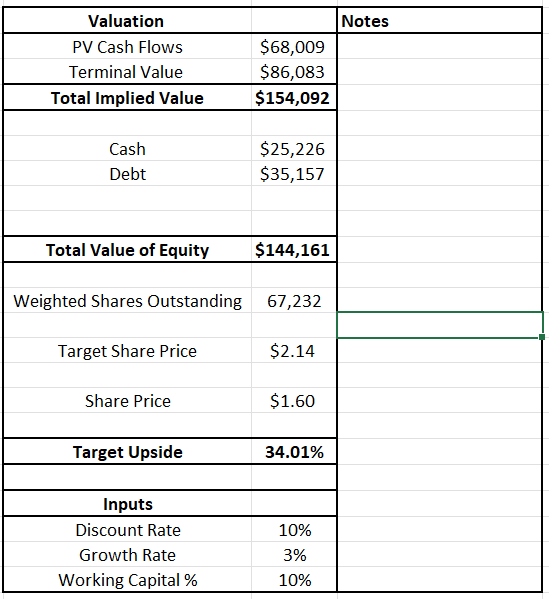

I ran a DCF on BUKS to get a sense of what the company’s future cashflows could look like. I set assumptions for the company based on what their five year averages have been which gives us an 8.2% revenue growth rate, a 16.1% operating income margin, and a 25% tax rate. Capital expenditures were set at 10.8% of the company’s revenues and D&A expenses were added back in at 8.1% of the company’s revenues. I left the company’s working capital flat through 2028 as BUKS has actually averaged a net decrease in the company’s working capital over the past five years. I then increased BUKS’s working capital as a percentage of their revenues by 10% through 2035 to account for the added expenses of an expanding business. Finally, I set the company’s perpetual growth rate at 3.0% after 2035, and then applied a 10.0% discount rate.

As you can see from the image above, my DCF ended up spitting out a $2.14 per share price target, a 34% upside from BUKS’s current share price of $1.60. I actually think that this price target is conservative as BUKS will be paying down a lot of their debt over the next couple of years. The company has also been very consistent on reducing their share count. Both of these events are catalysts for large increases in future cash flow potential.

Conclusion

In a market crowded with overleveraged promises and speculative hype, The Butler National Corporation stands out as a rare example of quiet, calculated execution. With a rock-solid gaming asset providing stable cash flow and a rapidly expanding aerospace division poised to benefit from global tariff changes and operational leverage, BUKS is positioning itself for durable growth. The consistent share buybacks, ongoing debt reduction, and strategic capital expenditures reveal a disciplined management team focused on long-term value creation. While the company may not fit into a traditional mold, it’s the underlying fundamentals that make BUKS a compelling story for investors.

Disclosure: I am long on the Butler National Corporation ($BUKS) and will buy or sell my shares anytime following this article. This is not financial advice. I am not a financial advisor. Do your own research.

Yes I own this company actually.

I believe you wrote about this company before right?