A Nano-Cap Real Estate Company Trading Significantly Below Liquidation Value

Significant upside on a sum-of-the-parts valuation

This is the sixth issue of “Weird OTC Stocks” I find by going A-Z.

The previous issues are here:

The key stats are below:

$21.6 million market cap, with $11.9 million of cash and a $9.7 million enterprise value.

9,061 acres of owned land. 7,632 of these acres are held for investment and the remaining 1,429 acres are held for development.

An owned 18-hole golf course on 203 acres of land.

An 8,800 square foot tavern on a lake.

A lake club which consists of a 175-acre lake, a swimming pool, a tennis court, boat docks and a variety of other buildings.

Three acres of vacant commercial property.

One single family house.

Two sewage treatment facilities.

A members-only fly fishing club

Their own corporate headquarters.

The most interesting part about this company is that it is controlled by a major real estate firm with a $15 billion market cap which owns 59% of the shares outstanding.

On a pure land valuation you are buying the land for around $1,075 per acre and you get the rest for free. The company made two large land transactions, one in 2020 where they sold 284 acres for $8.5 million or $30k per acre and another in 2022 where they sold 344 acres for $4.9 million, or $14k per acre.

They have also been selling off developed lots of land for $60-120k per pop and currently have 350 lots for sale.

Over the course of the company’s history, they have sold off a significant amount of assets including:

A ski resort and mountain

Land leased to Burger King

Hotels

132 resort homes

A shopping center

A commercial property to Walmart

A wildlands conservancy

And a variety of other real estate assets

From these asset sales debt has been paid down and now the company has a large net cash position along with valuable real estate.

Companies like this tend to sit on cash and assets for a long-time. They sit on these assets until they cannot sit on them anymore.

My best guess is the company will continue to sell-off assets and then start returning capital to shareholders.

And if they don’t, there is a large enough margin of safety where your downside is well protected.

In addition, if you run a sum-of-the-parts valuation on the company there is significant upside.

Let’s dig in.

Blue Ridge Real Estate Company $BRRE is owns a collection of real estate assets including 9,061 acres of land, Jack Frost National Golf Course, Boulder View Tavern, Boulder Lake Club, a commercial property with three acres of vacant land, one single family home, two sewage treatment facilities, a members-only fly fishing club, their corporate headquarters and a variety of other assets. In addition, Kimco Realty Corporation owns 59% of the shares outstanding. There are 2.4 million shares outstanding and a share price of $9.00. The market cap is $21.6 million and with $11.9 million of cash and marketable securities and only $41k of debt, the enterprise value is $9.7 million.

Land holdings

The company breaks down their land position into two buckets:

7,632 acres held for investment

1,429 acres held for development

The company breaks down their land holdings on this website.

In this writeup we will be valuing the following assets:

Boulder Lake Village

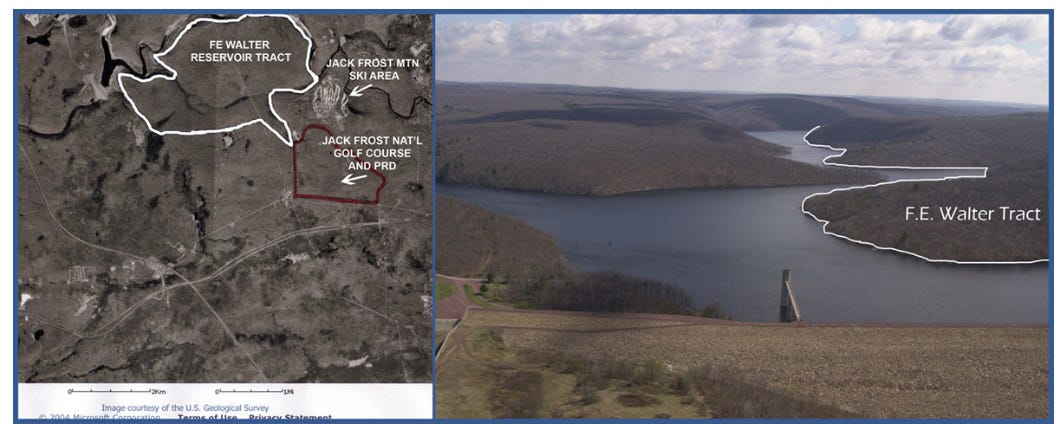

Jack Frost National Golf Course and Planned Residential Development

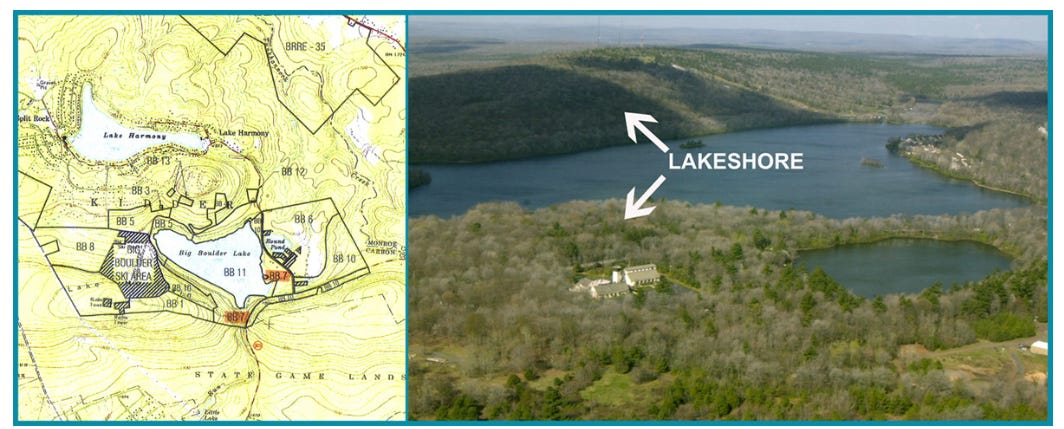

Lakeshore

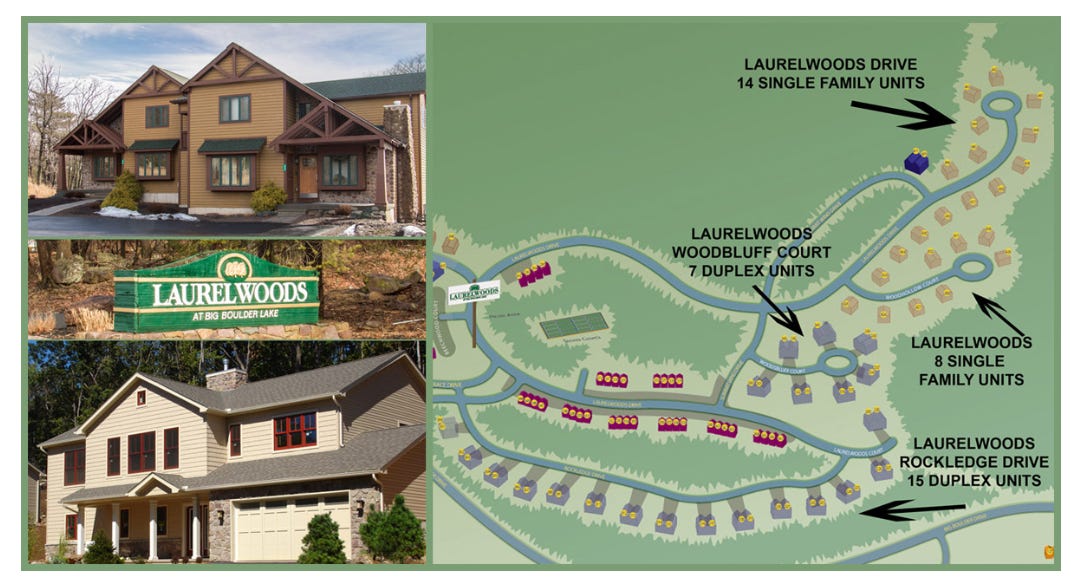

Laurelwoods II Community

Round Pond

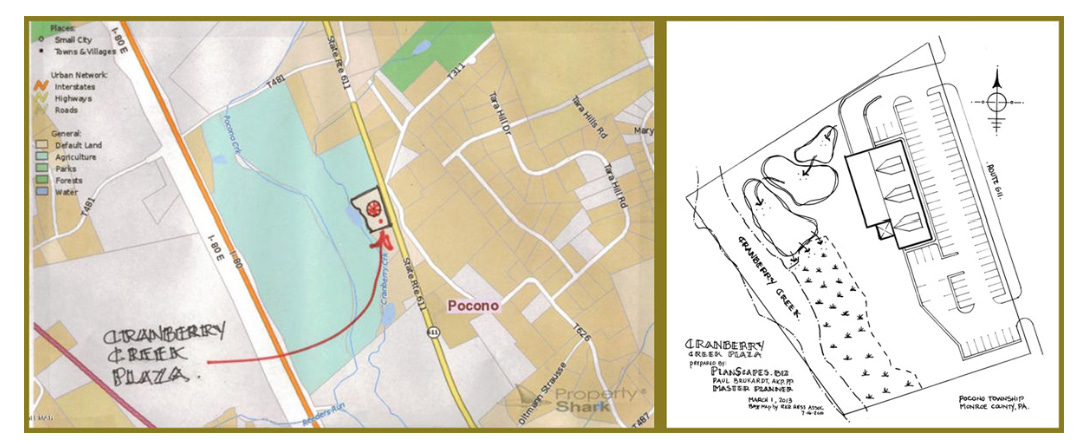

Commercial Acreage on RT 611 Bartonsville

FE Walter Reservoir Tract

Land Route 115 and Interstate 80

Boulder Lake Tavern

Members Only Fly Fishing Club

Other Acres

Boulder View Lake Club

Single Family House

Corporate Headquarters

Two Sewage Treatment Facilities

Boulder Lake Village - 126 units remaining to be developed

Boulder Lake Village is a lakefront property that sits on Big Boulder Lake and Big Boulder Ski Area. The housing units in this area are vacation homes and potential for seasonal rental. There has been one 18 unit condominium unit that has been completed and sold. And there are 126 units remaining to be constructed which would consist of 42 3-bedroom units and 84 2-bedroom units. All of the infrastructure including roads, curbing, concrete sidewalks, parking areas, storm water facilities, underground electric, phone and cable, sewer and water lines have been complete for the remaining 126 units. The property is located two hours from New York City and 1.5 hours from Philadelphia.

I cannot find the actual lots for sale, but homes within this community sell for around $370,000. Assuming that 25% of the home’s value is within the lot, lot prices should sell for around $90,000. I am valuing Boulder Lake Village’s 126 lots at $90k per pop, or a $11.3 million total value.

Jack Frost National Golf Course and Planned Residential Development

Located on 807 acres in the Pocono Mountains of Pennsylvania the Jack Frost National Golf Course and Planned Residential Development consists of 604 acres ready to be developed that overlook the 203 acre Jack Frost National Golf Course. The project would be served by sewage collection systems owned by Blue Ridge. An exterior road circulation plan is 75 percent complete comprising approximately 18,000 lineal feet of paved arterial roadway and State Highway. Interior roads are in various stages of completion with 2,500 lineal feet of paved road leading to the Golf Course Clubhouse. Environmental studies, engineered development plans and permitting are in place for portions of the Planned Residential Development. The acres could be developed into resort and commercial.

Given the lots at Jack Frost National Golf Course are not fully developed, I am valuing the 604 acres at $10k per acre for a total value of $6 million. The remaining 203 acres of the actual golf course are valued at $7k per acre or a total value of $1.4 million. There is a 160-acre golf course for sale in Northwest Pennsylvania at a sale price of $1.1 million.

Lakeshore

Lakeshore is located on the 175 acre Big Boulder Lake in the Lake Harmony area of Pennsylvania. The property is 72 acres and consists of 55 lots for single family homes. 37 of these lots have lake front exposure and the remaining 18 lots have lake views. No infrastructure has been complete. The property is also adjacent to the Big Boulder Ski Area to the west.

I am valuing these 55 lots at $100,000 per piece or a total valuation of $5.5 million. They are valued slightly higher than Boulder Lake Village given lake front exposure of 37 lots.

Laurelwoods II Community

The Laurelwoods II Community is 4 miles from Exit 284 off of I-80 and, once constructed, 6 miles from the proposed Route 903 exit of the Northeast Extension of the Pennsylvania Turnpike. This tract has access through Big Boulder Drive. This property is located 2 hours from New York City and 1.5 hours from Philadelphia, Pennsylvania. The parcel consists of 59 Planned Residential Units. There are 41-fully improved building pads which can accommodate 23 single family homes and 36 duplex units in 18 duplex buildings. All infrastructure, including roads, storm water facilities, underground electric, telephone, cable, sewer and water lines have been completed. DEP approval is being sought.

I am valuing the 59 lots at Laurelwoods II at $105,000 per pop. The company recently sold a single lot at Laurelwoods II, lot 439, for $120,000. Total valuation for Laurelwoods II would be $6.2 million.

Round Pond

Round Pond is 154 acres located in Lake Harmony, Pennsylvania. This property is 4 miles from Exit 284 of I-80 and, once constructed, 6 miles from the proposed Route 903 exit of the Northeast Extension of the Pennsylvania Turnpike. This tract will have access off Lake Harmony Drive. This property is located 2 hours from New York City and 1.5 hours from Philadelphia, Pennsylvania. The parcel consists of 110 single family lots and surrounds a 10 acre pond. No infrastructure has been complete but central sewer is available. The property is also adjacent to Boulder View Tavern and Lake Mountain Club.

Round Pond’s 110 lots are valued at $15,000 per pop given no infrastructure has been complete. This values the asset at $1.65 million.

Commercial Acreage on Rt 611 Bartonsville

The commercial acreage on Route 611 in Bartonsville is a 2.96 acreage plot located on the west side of State Highway Route 611 in Bartonsville, Pocono Township, Pennsylvania, just two mile north of the Route 33 and Interstate 80 interchange. This lot is located across the intersection of Route 611 with Serfas Drive and Beehler Road. The lot has existing utilities including central water and sewer, electric and telephone. The acres are zoned as commercial.

I believe the address for this property is 3152 PA-611, Stroudsburg, PA, 18360. If you plug this address into Google Maps it lines up with the photo above. It looks like the property is currently for sale at $349,000.

FE Walter Reservoir Tract

The FE Walter Reservoir Tract is 2,500 acres of unimproved land. Located in the Pocono Mountains of Pennsylvania 2.5 miles from the Northeast Extension of the Pennsylvania Turnpike exit 95 at its intersection with Interstate Route I-80 exit 278. This tract has access through other lands of Blue Ridge Real Estate (Jack Frost National Golf Course Planned Residential Development Tract). This property is 2 hours from New York City and 1.5 hours from Philadelphia, Pennsylvania. The property is zoned for recreation and resort commercial.

I am valuing this land at $2,000 per acre for a total value of $5 million. Timberland sells for in excess of $2,000 per acre.

Land Route 115 and Interstate 80

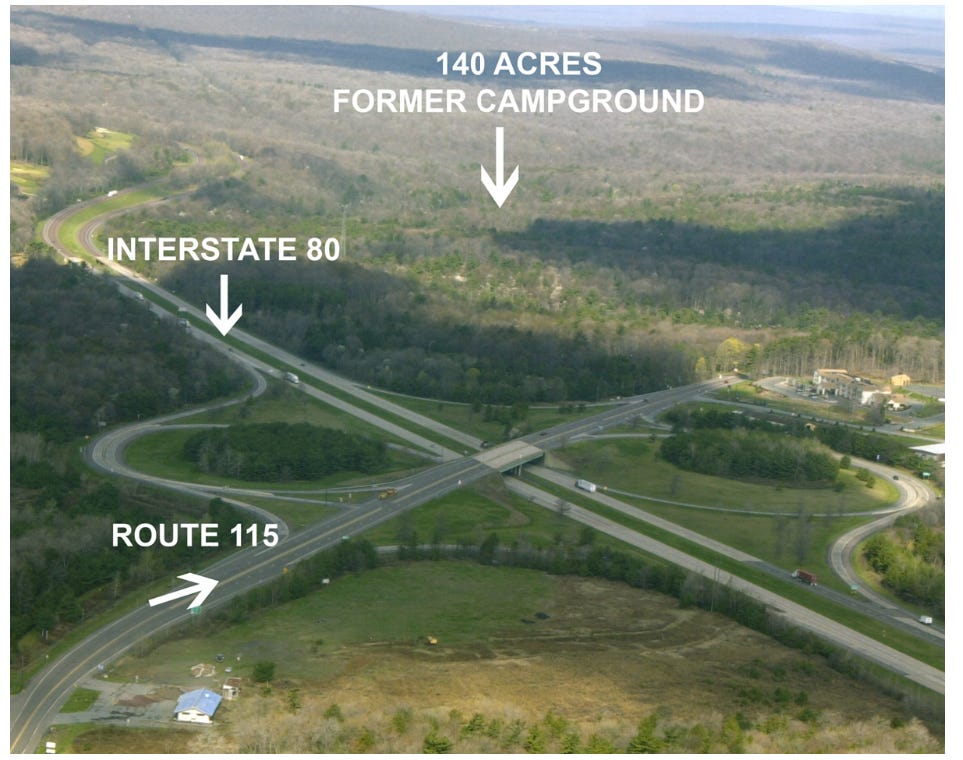

This acreage is 140 acres which includes 133 acres in Tobyhanna Township and 7 acres in Kidder Township. The property is conveniently located off of PA Route 115 just south of Blakeslee, Pennsylvania at the northwest quadrant with intersection of Interstate 80 at exit 284. This property is 2 hours from New York City and 1.5 hours from Philadelphia, Pennsylvania. Located in a pristine woodland setting, this parcel has frontage on Tobyhanna Creek and Tunkhannock Creek, both exceptional for trout fishing. Formerly operated as a campground from 1979 until October 2004. Some campground buildings remain on site. The tract of land has high-yielding water well and a possible connection to a central public sanitary sewer. The 133 acres are zoned commercial industrial and the seven remaining acres are zoned low density residential.

I am valuing the 133 acres of commercial industrial land at $25,000 per acre for a value of $3.3 million. The seven acres of low density residential are being valued at $15,000 per acre or $105k.

Boulder View Tavern

Boulder View Tavern is Pocono’s premier lakeside location for casual drinks, family fare and live entertainment. There isn’t much information about the tavern online but it is on a lake and all of the photos I have found look pretty legit. There is a restaurant for sale in the Pocono area listed online for $2.65 million. The listing claims the business has $350k of cash flow and $1 million of real estate.

I am valuing Boulder View Tavern at $2 million for conservative purposes.

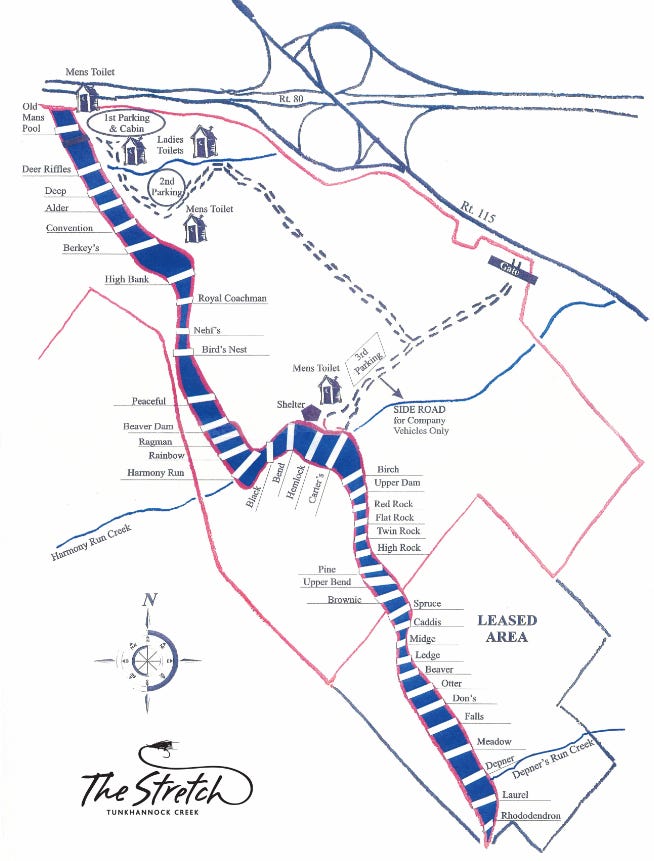

The Stretch “Members Only Fly Fishing Club”

The Stretch is a private, members only fly fishing club located along the Tunkhannock Creek. The Stretch is owned and operated by Blue Ridge and consists of 450 acres of land that includes two miles of Tunkhannock Creek. Currently, membership to The Stretch is a 5-year wait. Annual fees are $2,050 and if you want to add your spouse it is an additional $1,350.

I cannot find private fishing clubs that have sold in the past. So I am valuing this land on a per acre basis of $2,000 per acre, or a total value of $900k.

Other Land

Other land includes 4,935 acres. I arrived at this number by taking the 9,061 acres and subtracting all of the acres that I valued above. This land is mostly timberland and I am valuing it at $2,000 per acre for a total valuation of $9.8 million.

The company made two large land transactions, one in 2020 where they sold 284 acres for $8.5 million or $30k per acre and another in 2022 where they sold 344 acres for $4.9 million, or $14k per acre. The $2,000 per acre valuation could be extremely conservative.

Boulder View Lake Club

Boulder View Lake Club is a private membership community for homeowners of Blue Heron Villages, Laurelwoods 1 and 2, Big Boulder Lake, Boulder Lake Village Condominiums, Midlake on Big Boulder Lake Condominiums and Snow Ridge Village at Jack Frost. The club is located on Lake Harmony and includes a swimming pool, docks, tennis court, volleyball, etc. The club rents various non-motor boats for members.

I am valuing the Boulder View Lake Club at $850,000. I am assuming that is the replacement costs to rebuild the club. The valuation also does not account for the 175-acre lake that Blue Ridge owns.

Single Family House

I can’t find any information on the single family house that Blue Ridge owns. I am valuing this home at $350,000. If you pull up homes for sale in Pocono Township, they tend to sell for around $350-500k. In the 1992 annual report Blue Ridge owned 132 resort homes and I am assuming that this last remaining houses is one of them.

Corporate Headquarters

The corporate headquarters is located at 5 Blue Rdg CT, Blakeslee, PA 18610. I can’t find any information about the property and the Google Map street view is blocked by trees. It does look like a decent sized building from aerial view. I am valuing the headquarters at $750,000.

Two Sewage Treatment Facilities

The company owns two sewage treatment facilities. One of them serves 400,000 gallons of wastewater per day to the resort housing of Jack Frost Mountain Ski area. The second one serves 225,000 gallons of wastewater per day to the Big Boulder Ski area. The cost to buy a sewage treatment facility can range from hundreds of thousands of dollars for a smaller, industrial-scale system to millions of dollars for a larger municipal plant, depending on factors like the treatment capacity, location, required level of effluent quality, and necessary equipment, with an average estimate around $500,000 to $1.5 million for a 150,000 gallons per day (GPD) system including design, engineering, installation, and startup costs.

I am valuing the two sewage treatment facilities at $2.5 million.

Corporate Costs

There is around $1.5 million of annual corporate costs that will eat into the valuation. I am using a discount rate of 13% for a total corporate burden of $20.1 million.

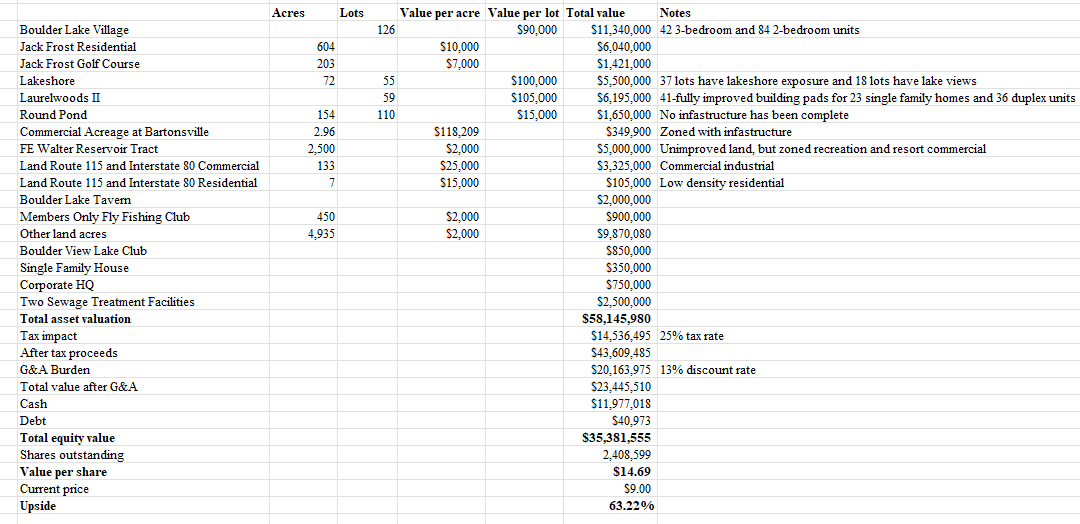

Sum of the Parts

I valued Blue Ridge Real Estate using a sum-of-the-parts analysis. Total valuation off all of the assets is around $58 million. I then tax impacted these assets with a 25% tax rate. I also subtracted a $20 million G&A burden. Then I added the $11.9 million of cash and subtracted $40k of debt. My price target is $14.69 per share or 63% upside from the current price of $9.00 per share.

Risks

Real estate development is risky business and goes through cycles. In the past the company had a significant amount of debt and a variety of other assets. In 2006 it was valued at $47 per share and then collapsed when the Great Recession hit. The company’s real estate development slowed down and management was focused on selling assets and paying down debt. Now the company has paid off all of their debt and they are in a strong net cash position. I am assuming the company will be looking to spend money on infrastructure work and entitlements to get more of their land ready for sale. The biggest risk is if the company levers up again and then the real estate market collapses.

Another risk is that minority shareholders will not have a say in the future direction of the company as 59% of the shares outstanding are owned by Kimco.

Conclusion

Blue Ridge Real Estate owns a collection of very interesting assets and appears to be trading under liquidation value. Even if we tax impact the potential assets and put a $20 million G&A burden there is strong upside. Real estate is a long-term game and value will not be realized next year. However, real estate tends to hold its value very well during inflationary cycles and these assets should appreciate in value as time passes.

Disclosure: I do not own shares of Blue Ridge Real Estate Company $BRRE but might buy shares following the publication of this article. I am not an investment advisor. This is not an investment recommendation. Do your own research.