A $1.6 Million OTC Nano-Cap Trading Around 1X Earnings That Comes With a Possible $19 Million Cash Payout

Deep Value Investing at its Finest

In issue number one of “Weird OTC Stocks” I highlighted a company with a single luxury hotel trading at an 18-cap and sitting on 5,500 excess acres of land. In issue number two I highlighted a real estate company that is going through strategic alternatives and a billionaire Israeli who is buying shares via tender offer. In issue number three of “Weird OTC Stocks” I highlighted a company that is selling all of their land operations, for more than double their market cap. Now for Weird OTC Stocks issue number four I am looking into a nano-cap trading around 1X earnings that comes with a possible $19 million cash payout.

Once in a while you stumble across a stock that looks so good that you actually have to pause to make sure you’re staring at the right set of numbers when you’re looking into them. It’s not overly hard to find an OTC nano-cap trading below liquidation value but, the stock I managed to stumble across earlier this week may just be a one of a kind find.

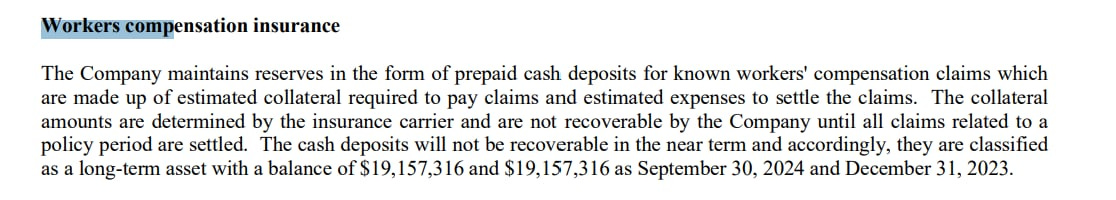

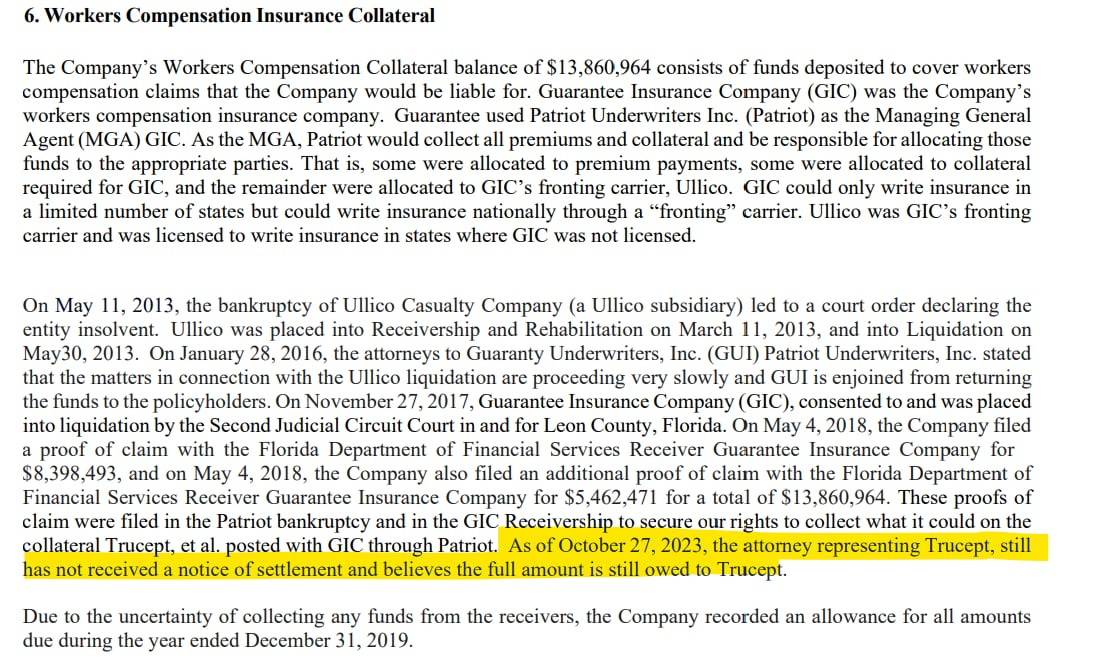

When I stumbled across them they were trading at a 1.1X P/E ratio at $0.03 per share with a net asset value (excluding goodwill) of $0.38 per share. That’s a net value upside of 1,166%. This company is growing quickly too. Their profit from operations grew almost 42% YOY from 2022 to 2023 and 13.6% in their first nine months of 2024. They also have a very large $19 million potential cash reserve sitting in the long-term assets section of the company’s balance sheet in the form of a workers compensation collateral balance.

Trucept, Inc.

Trucept, Inc. ($TREP) is not a complicated company. Their business is divided up into human resources, insurance, accounting, payroll, risk management, and marketing services. Their insurance is sold in 25 states with plans to become licensed to sell policies in all 50 states. The company describes their business segments as follows.

Afinida Payroll:

Afinida offers a full suite of valuable benefits designed to help them grow their businesses and increase their operating efficiency. Services include:

i) Payroll Services, which includes, Payroll processing, Cloud based software, Direct deposits, new hire reporting, and others.

ii) Payroll Tax Services, which includes, Payroll tax payments, filings and compliance services.

Afinida Insurance Services, Inc. (formerly UWS Insurance Services, Inc.):

(i) Employee Benefits - Medical/Dental/Vision Plans, Supplemental Insurance, Life Insurance & Cafeteria Plans.

(ii) Commercial Lines - Workers Compensation, Business Owners Policies, Property Insurance, General Liability Insurance & Employment Practices Liability Insurance.

(iii) Individual Policies - Medical, Dental, & Vision Plans, Supplemental Insurance, Life Insurance & Home Owners/Condo/Renters Insurance.

Afinida Accounting: Monthly financial statement preparation, Sales Tax compliance, Cash flow management, Budget analysis and assist with SEC audits and quarterly reviews.

Afinida Marketing: is a full-service agency that uses a holistic, data-driven approach that tackles everything from web design to digital ads, social media, printed ads, direct mail, printed materials, and beyond.

Afinida HR Services: offers various services, including Salary Benchmarking and Pay Equity, RIF/Termination Meetings, Management Training and Coaching designed to empower your employees and foster a thriving work environment. Tailored specifically for the small business owner, Afinida HR offers the tools and support needed to streamline your HR processes, ensuring that your most valuable asset – your people – are positioned to excel.

Afinida Risk Management: provides risk management solutions to help companies improve their safety programs with measurable results. Our consultants have worked with companies of all sizes and many different industries to make safety a value that improves the bottom line.

-TREP’s 2024 Q3 10K

TREP also has a little over $19 million set aside for a workers compensation collateral balance that the company believes is owed to them. Should this payment go through I suspect that TREP will return this capital back to shareholders. That $19 million sitting on TREP’s balance sheet works out to be $0.34 per share. That would be a 594% gain on your investment just from a single cash payout….for a stock that has only been trading between 1X and 2X earning! Here’s a more comprehensive explanation behind these funds.

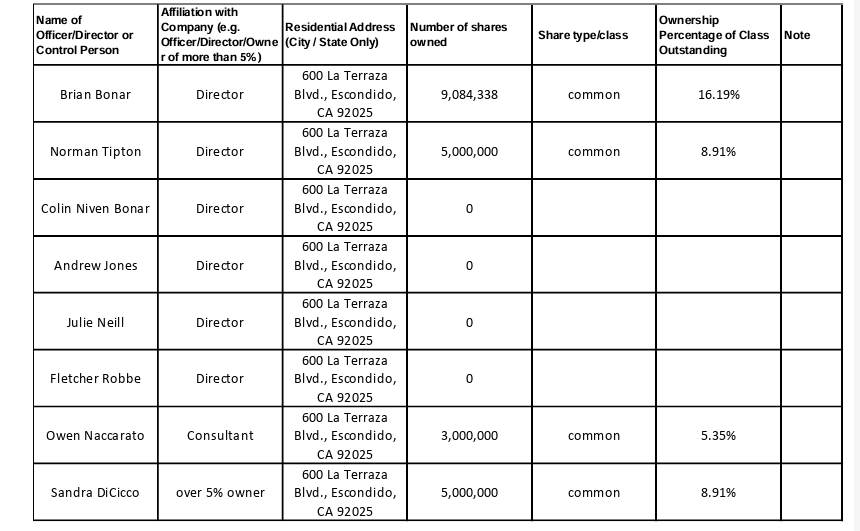

A number of management have very sizable positions in the company so they’re well incentivized to keep focused on growing TREP’s operations.

TREP’s business model and services provided are very easy to understand. With the stock trading at low earnings multiples while growing rapidly, I think this stock is a steal. I think that TREP could easily be a multi-bagger. Right now the stock is trading between 1X-2X of the company’s earnings. Larger insurance companies trade around 5X EBITDA.

If TREP is able to recover this $19 million in workers compensation insurance collateral then I would expect the stock to absolutely shoot through the roof. With a market cap of just $1.6 million it should only take a couple of excited investors stumbling across this story and buying into the company to make increase TREP’s share price increase substantially. My brokerage account is only worth $26,753 and out of that I laid down $520 on TREP. While it’s just 2.0% of my total portfolio value, the potential upside this stock has with the huge margins of safety built around it in terms of the company’s growing business, earnings multiples, net asset value, and potentially large cash payout are enormous and I wasn’t about to let TREP pass me by.

Disclosure: I own $TREP and will buy or sell shares anytime following the publication of this newsletter. I am not an investment advisor. This is not investment research. Do you own research.

Very interesting idea thx for sharing

Smells really fishy , audited and non audited financials don’t match 🕵️♀️