Own A Luxury Hotel For Free

And a preferred kicker with 25% upside if taken out and stable yield

The stock market seems to make new highs everyday. Valuations are lofty with ratios at nosebleed levels. The new presidential seat has extrapolated fears with the key fear gauge, gold, hitting new highs. Despite the new all time highs and potential for political instability, I continue to buy cheap stocks and search for ideas that will generate meaningful alpha.

But finding cheap stocks is becoming more challenging. I run screeners on a weekly basis and they are beginning to run dry. It is the same stocks every week, the same ones every value guy is purchasing. So I have decided to look in more obscure places for value. Places where eagles dare. The wild wild west. OTC stocks.

This will be Issue #1 of weird OTC stocks. Every week I will be reading through annual reports of obscure OTC stocks and if I find something interesting, I will publish my findings.

Today’s issue will cover a luxury hotel that is trading significantly below replacement cost with a massive land bank that you get for free. Here are some other interesting statistics:

The company owns an iconic luxury hotel. Enterprise value per room is only $89k. Replacement cost of a luxury hotel on a per room basis is closer to $400k on the low and $1mm on the high.

The company owns 5,500 acres of timberland surrounding the hotel. Land value on a per acre basis goes for $2,000-5,000 per acre in the area. Using the midpoint of $3,500/acre, the value of the land is $19mm, exceeding the current market cap of only $15.5 million.

A recent transaction of a hotel in the same area, with the same number of rooms, but not as luxurious and with less amenities, and with only 418.56 acres, sold for $17.8 million. This purchase price did not include an expensive capex program to refresh and update the hotel, that I estimate could exceed $6 million.

The company recently did a room refresh in 2023 and will have less capital expenditures in future years.

The balance sheet is strong with $586k of net cash, fixed 4.80% debt, and the hotel generates strong cash flows. At the current valuation, the company has an 18% cap rate.

The hotel is primed to be bought out by a REIT or strategic. Corporate G&A is $3.2 million and a platform buyer could eliminate all of these costs and realize immediate synergies.

As a going concern I think there is 58% upside through continued free cash flow generation and potential uplift in occupancy. In the event of a takeover, I think the company could have over 100-150% upside.

Given the extremely low valuation for an irreplaceable asset, a large base of owned land and continued free cash flow generation, I don’t see any downside at the current valuation.

The company also owns a publicly traded preferred stock that has 25% upside to the par plus owed preferred dividends. The management team has recently started to write annual letters to the preferred stock holders and my guess is they will look to take out the security over the next few years as cash begins to pile up on the balance sheet.

This is a very interesting stock with a ton of embedded value. I haven’t seen one person talk about this security publicly which gets me even more excited.

Let’s dig in.

Skytop Lodge Corp. $SKTP owns a single luxury hotel, along with 5,500 acres located in the Pocono Mountains in Skytop, Pennsylvania, a few hour drive from New York City. The company has 9,822 shares of common stock with a price per share of $1,575. The market cap is $15.4 million. The balance sheet consists of $5.2 million of cash and $4.6 million of debt. The debt is fixed at 4.80% through 2029 and then post 2029, the parties will negotiate a new rate through 2034, when the debt matures. The company also has a publicly traded preferred stock with 9,433 shares. The preferred has a 7% cumulative dividend. The preferred can be redeemed at $110 plus cumulative dividends. Cumulative dividends are $2.2 million, putting the takeout value of the preferred on a per share basis of $238.

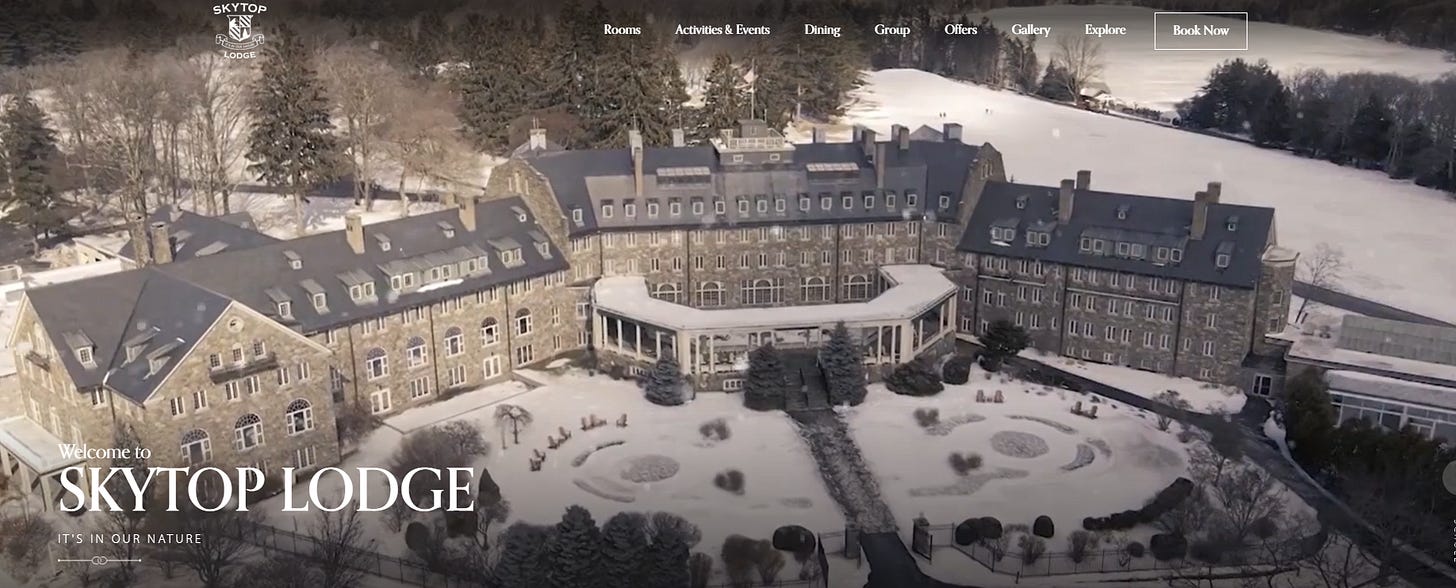

Before digging into the thesis I would like to share some images of the hotel and resort. The resort has 192 rooms on 5,500 acres. The property includes a 75-acre lake, 30 miles of hiking trails and a 18-hole golf course. I would recommend everyone to visit the hotel booking site before reading my thesis to truly understand the asset we are buying.

Here are some pictures that do the hotel some justice.

Skytop Investment Thesis:

The valuation is cheap. Skytop Lodge has a total of 192 rooms including a 124 room luxury hotel, a 22 room luxury inn and variety of luxury cottages nestled in the woods. With an enterprise value of $17.1 million (including preferred stock) the valuation on a per room basis is only $89k. The replacement cost of a hotel is $150-400k per room, with luxury hotels potentially exceeding $1 million per room. In 2023, JLL wrote a report that said it is cheaper to buy a full service luxury hotel than build one given the replacement cost per room is $819k. For a price per room of only $89k, we are buying Skytop significantly below replacement cost. The replacement cost to rebuild the hotel, assuming a $300k per room cost, would be $57.6 million, not including the owned land.

In addition to the hotel, Skytop also owns 5,500 acres of land. According to the website, 4,500 of the acres are preservation under the Pennsylvania “clean and green program” which means 1,000 of the acres could potentially be developed. I value the 4,500 preserved acres at $1,750 per acre or a value of $7.8 million. The remaining 1,000 developable acres I value at $6,000 per acre or $6.0 million. Total valuation of the land is $13.875 million — my estimate.

A direct competitor, the Pocono Palace Resort, located 22 miles away was just sold for $17.8 million. The Pocono Palace sale only came with 418.56 acres and is much less luxurious and what I could call “cheesy”. The hotel had 165-rooms at the time of the purchase and the new owner plans to shut the resort down and renovate the asset as something else. Assuming the cost to renovate the hotel is $40k per room, this increase the “all-in” purchase price to $24 million.

Skytop Lodge recently went through a $2.2 million capex program. The program included six new pickle ball courts, pine room floor replacement, 26 premium guest room refreshments, Skytop vehicle purchases, infrastructure and additional IT investments. This has been one of the heavier capex programs and I suspect capex could drop back to $1.2-1.5 million per year.

The company generates strong NOI and free cash flow. In 2023 the company generated $4.1 million of cash from operations. Capital expenditures was $2.2 million, resulting in free cash flow of $1.9 million. The free cash flow yield is 12%, which includes a heavier capex program that will likely decrease. In addition, I estimate the company is currently trading at an 18% cap rate. Hotel assets tend to trade a single digit cap rates.

The income statement is burdened by $3.1 million of corporate G&A. A strategic buyer with a platform of hotel assets could eliminate all of this G&A and realize significant value. Assuming a 10% WACC, a strategic should be able to extract $31 million of cost savings.

Average occupancy has been only 50% in the recent years. If the company is able to close the occupancy gap, there is significant upside from a cash flow basis as fixed costs will remain fixed.

I think the common equity is worth $2,500 per share on a going concern basis or a market cap of $24.5 million. This is 58% upside from the current price. On a takeover basis, I think the equity is worth $4,000 per share, or a $39 million market cap.

There is also a publicly traded preferred stock listed as $SKTPP that has 9,433 shares with a par of $100 and 7% cumulative dividends. The preferred is redeemable at $110 per share, plus unpaid dividends which are $2.2 million. The total takeout of the preferred on a per share basis is $238 per share. The current trading price of the preferred is $190 per share, which implies there is 25% upside should the security get redeemed. I believe the security could get redeemed in the near-term as the company has recently started talking about the preferred stock in the annual letters. In addition, the company paid the regular $7 dollar dividend this year and an extra $7 dollar dividend, which represents one year of arrears. I expect as cash is generated and capex is wound down, the company will continue to pay down the preferred stock, making the preferred an attractive investment opportunity.

Risks include: a single asset with no diversification, hotel occupancy rates drop, poor capital allocation from management and liquidity in the common stock. But even during COVID, one of the worst times ever for hotel assets, the company only burned $3.3 million of cash.

Skytop Lodge seems like a no brainer investment. The stock is dirt cheap, it generates cash and the replacement value well exceeds the current valuation. I hope you guys enjoyed Issue #1 of weird OTC stocks.

Disclosure: I do not own $SKYP or $SKYPP but might purchase shares following this newsletter. I am not an investment advisor and this is not investment advice. Do your own research.

Hi, great find and great writeup. Preferred equity takeout is $238 or is it $348 ($238 owed in arrears + $110 redemption)?

Is higher value per share ascribed to an equity take over due to fact that in the case of a takeover G&A costs can be pared down?