Over 50% Upside In Liquidation No One Knows About

In the first edition of “Weird OTC Stocks” I wrote about a single luxury hotel that is trading at an 18% cap rate, significantly under liquidation value, an owned base of 5,500 acres of land, generating strong free cash flow and a recent hotel transaction in the same area with a valuation that implies at least 50% upside should a strategic acquirer make a bid. In addition, there is a publicly traded preferred stock tied to the common equity that has at least 25% upside — and it appears management is intent on taking the preferred stock out over the next 12-18 months. The opportunity to own this asset — which by the way no one has wrote about besides me — got me excited about the opportunity of value investments in OTC land.

Today I am writing about an idea that is even more exciting than this luxury hotel. In Edition #2 of Weird OTC stocks I am going to cover a hidden liquidation of a commercial real estate company that no one appears to even know of. The company is so off the radar that I have yet to see one person write an article on the common equity or even a single X.com post on the company besides some spam bots. In fact, the only individual who seems to know of the situation is a billionaire Israeli individual who is scooping up shares on the low through tender offers.

The situation is so unique and actionable that I had to take time over the weekend to write it up. Here is the high level thesis:

The company owns high quality commercial real estate in the United States primarily grocery-anchored properties with over 90% occupancy.

The company recently announced strategic alternatives with an intent on selling all of the properties and returning capital back to shareholders.

The real estate properties are trading significantly under replacement costs and management’s internal NAV. Using management’s internal NAV calculation there is over 50% upside.

A month after the announcement of the strategic alternatives, a billionaire Israeli individual filed a tender offer to acquire $15.7 million worth of the stock.

The billionaire Israeli was then able to acquire $1.8 million worth of the stock via tender offer and now collectively owns $9 million of the common equity.

If you dig deep enough into the financials, the billionaire Israeli individual has filed at least five different “tender offers” with the SEC, since 2022, to acquire shares in this company.

Given the high quality nature of these real estate assets, I expect an outright sale to occur anytime for a substantial premium to the current equity valuation.

In addition, the Company recently filed an update with the SEC to amend their “Real Estate Management Agreement” to give the company a right to terminate the “Real Estate Management Agreement” if the company closes or completes a “Liquidity Event”.

Given the announcement of the strategic alternatives, the tender offers and the recent amendment to terminate the “Real Estate Management Agreement” should a liquidity even occur, I think an outright sale of the company is imminent.

The best part about this stock is that the price has not moved since all of these developments — meaning no one knows about this idea at all. Even better, the company pays a 4.5% dividend yield, meaning you get paid to wait for the transaction to occur.

Let’s dig in!

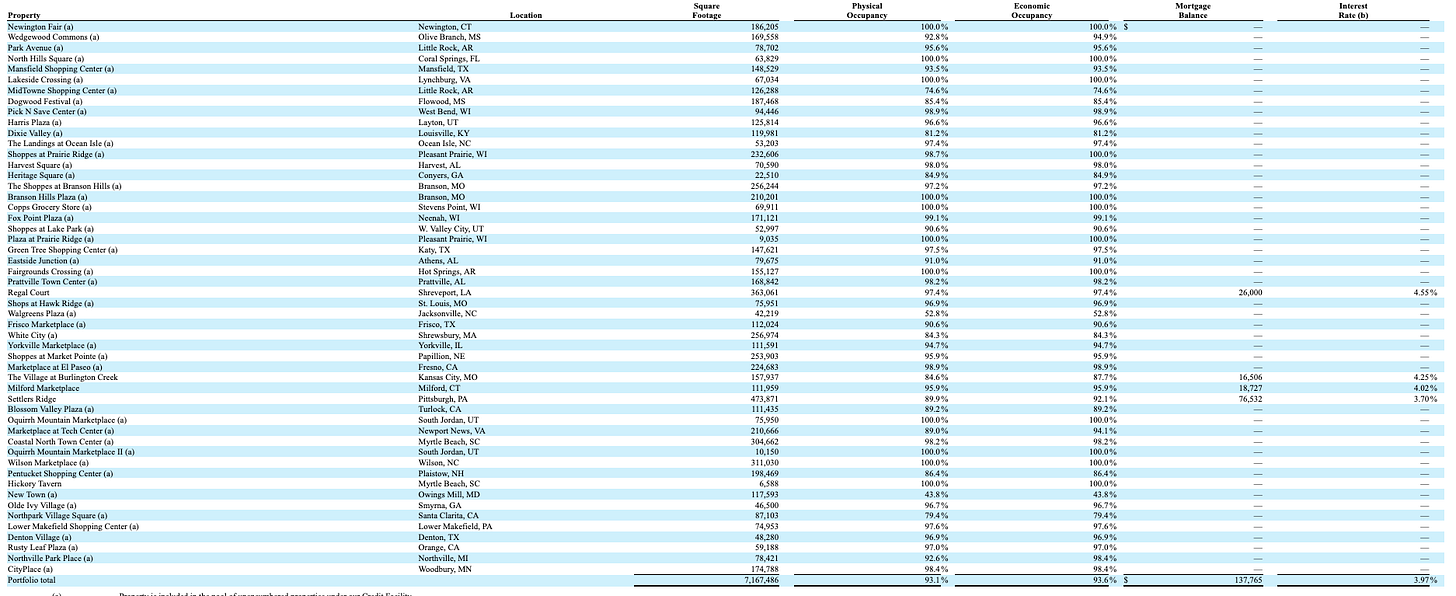

Inland Real Estate Income Trust, Inc. $INRE was formed in 2011 to acquire and manage a portfolio of commercial real estate investment in the United States. The company primarily focuses on owning retail properties and targets specifically assets that are anchored by grocery tenants. The company owns 52 properties in 26 different states with 7,167,486 square feet and an occupancy rate of 93.10%. With 36.1 million shares outstanding and a share price of $12.10, the company has a market cap of $436 million and an enterprise value of $1.26 billion. I attached a list of the owned properties below along with my investment thesis.

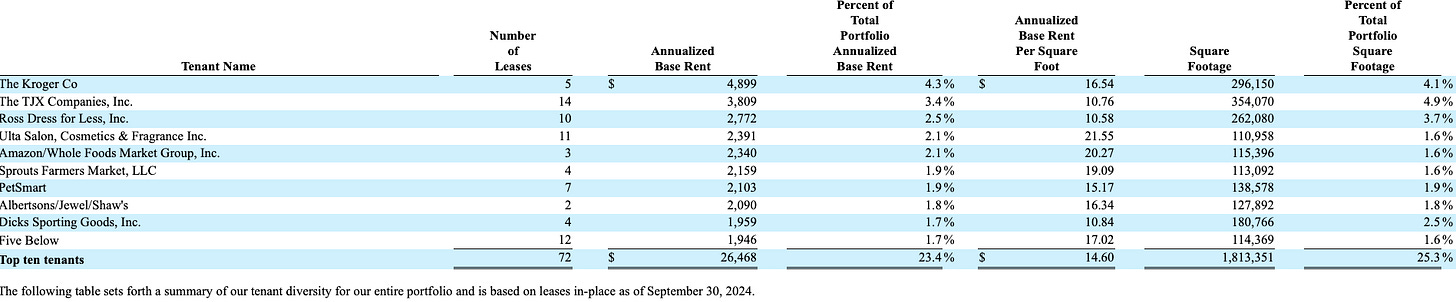

The largest tenant is The Kroger Company, followed by TJX, Ross Stores, Alta, Amazon/Whole Foods, Sprouts Farmers Market, PetSmart, Albertsons, Dicks Sporting Goods and Five Below.

The entire portfolio has a 93.1% physical occupancy, a 93.6% economic occupancy and a weighted average lease term of 4.7 years. The purchase price of all of the properties was $1.624 billion, with the majority of the purchases occurring in 2014-2015, or a decade ago.

Investment Thesis

Inland Real Estate has a market cap of $436 million and with $10.9 million of cash and $835 million of debt the company has an enterprise value of $1.26 billion. The company owns 7.16 million square feet of high quality retail real estate with Class A tenants and is trading at an enterprise value per square foot of only $176/SF.

On September 18, 2024, the company announced that the board of directors begun a strategic review including the sale of the entire company. The company has hired an outside financial advisor, BMO Capital Markets, to assist with the strategic review.

Then on October 15th, 2024, Comrit Investment 1, Limited Partnership filed a “tender offer” to purchase up to 1,300,000 shares of the common stock at a price of $12.11 per share or up to $15.73 million of the company. Comrit Investment 1 is ran by Ziv Sapir who recently raised money to acquire US real estate companies.

On November 6th, 2024, the company amended their “Real Estate Management Agreement” to give the company a right to terminate the agreement following a “liquidity event”.

On November 26th, 2024, the company amended the employment agreement with CEO Mark Zalatoris to extend his employment agreement until February 2, 2026. However, as noted in the agreement, the employment agreement will be terminated upon a “liquidity event”.

On December 13th, 2024, Comrit Investment 1 announced they acquired 155,150 shares and now owns 743,836 shares or 2.1% of the total outstanding shares.

Given the timetable of events, I speculate that a liquidity event including the outright sale of the company is imminent and shareholders at the current valuation could receive a substantial premium.

Per the recent quarterly report, the company’s board of directors estimates the per share net asset value of the common stock is $19.17, a 58% premium to the current stock price, or a price per square foot of $211/sf.

The company generated $98.8 million of NOI in 2023 and the annualized NOI for 2024 is now over $100 million. At the current valuation the implied cap rate is 7.96%.

Comps are trading around 5.60-6.0% cap rates and north of $250 per square foot.

The company acquired almost all of their properties in the 2014-2015 time period for a total investment of $1.624 billion. Assuming that commercial real estate only increased at a 5% annualized rate since then, the current replacement value would be $2.64 billion or a price per square foot of $369/sf, compared to the current valuation of $176/sf, or 109% increase.

Assuming the company is only able to sell the company for a 5.95% cap rate, upside is 33% from the current valuation.

I believe the company will sell itself for $16-19 per share or 33-58% upside.

In the meantime, the company pays a stable 4.5% dividend so you get paid to wait.

Risks include: the company might not sell itself, a downturn in commercial retail, higher interest rates, and illiquidity of the common equity.

I believe Inland Real Estate is an interesting opportunity to acquire a company in the midst of a strategic alternatives with the potential to realize up to 50% upside in a short duration. The stock is extremely illiquid and only trades by appointment. Be aware that if you acquire the stock, it might be hard to monetize your position unless the company sells itself or if another tender offer occurs. I take comfort in knowing that smart money, Comrit Investment 1 is acquiring shares following the announcement of strategic alternatives. Following smart money has always paid off for me.

Disclosure: I do not own Inland Real Estate Income Trust $INRE but may acquire shares following this article. I am not an investment advisor and this is not investment advice. Do you own research.

What is your rational behind looking at NOI? Is it because due to liquidation of company assets the SGA and D&A expenses do not factor into business operations?

What're your thoughts on the likelihood of the sale going through vs not.

Thanks for sharing research on a Saturday! Never seen a tender offer from outside the company after a strategic alts announcement, it’s compelling.

Have you done the by-appointment thing before? Was it basically like normal ordering but with slower and worse fills?