Two New Mines Coming To Michigan's Upper Peninsula?

Copper, Silver, and an Executive Order to Increase Mineral Production

One of the last articles I wrote up was on a company who, through their extensive ownership of mineral rights in Michigan’s Upper Peninsula could benefit immensely from Washington’s focus on increased mineral independence. This company has copper, silver, iron, nickel, gold, possibly platinum, along with many other minerals sitting on its properties waiting to be pulled from the ground. While there are multiple catalysts for new revenue streams for this company down the road, the most optimistic catalyst for future revenues is a new copper mining operation that’s currently in the process of being built on this land. If this mine opens it’s expected to extract up to $3.4 billion worth of the critical minerals from the ground. Today I’m going to be covering the company that’s opening up this mine.

The Highland Copper Company Inc. ($HDRSF) is a Canadian based copper mining company. Although HDRSF operates out of Vancouver their two mining operations are both located in Michigan’s Upper Peninsula. I talked about HDRSF’s Copperwood project quit a bit in my last article because this project falls on property that the Keweenaw Land Association, Limited ($KEWL) has mineral rights over. HDRSF currently has leases with KEWL which will switch to a royalty based payment once the Copperwood mine becomes operational.

HDRSF’s other mining operation is at a location called White Pine North. This White Pine North mining operation is a joint venture with Kinterra Copper USA, LLC and is not far from the company’s Copperwood site. HDRSF did have full control of the White Pine project but had recently sold off a large portion of their ownership and now retains a 34% interest in the project. The company did this to focus their efforts on Copperwood as this mine is much closer to opening up than White Pine is.

White Pine North Project

HDRSF acquired the White Pine North project in 2021. From 1953 to 1995 White Pine North produced over 4.5 billion pounds of copper. This mine is expected to produce around 40k tons of copper annually for 20 years. HDRSF teamed up with Kinterra Copper USA, LLC. who will actually be performing the mining once operations finally begin.

In 2023, HDRSF and Kinterra Copper signed a joint venture agreement on the White Pine North project in which Kinterra holds a 66% stake and HDRSF a 34% stake. If the White Pine North Project does produce 40k tons of copper per year and copper stays at $4.00lb or higher, Kinterra is looking at pulling $320 million out of the ground a year. 34% of that would be $108.8 million. Copper prices are also much closer to $5.00lb than $4.00lb. White Pine North is currently still in the process of undergoing geological studies to determine the best course of action for mining this copper while they prepare their permit submissions. HDRSF’s most recent updates to White Pine North on their website include.

Copperwood Project

The Copperwood project is fully owned and will be operated by HDRSF. HDRSF describes the Copperwood project as a lower capital intensity project with a projected 10.7-year mine life that can rapidly reach commercial production. The mine and all of its facilities will sit on 505 acres and includes a processing plant, ore stockpile area, tailings disposal facility, and support facilities. The company has said that the copper mine will harvest at least $3.4 billion worth of the critical minerals and become profitable after just two years of operating.

While HDRSF does wholly own the mining operation, The Keweenaw Land Association, Limited ($KEWL) owns the mineral rights. HDRSF will have to pay KEWL a royalty when it begins to pull material from the ground. While it’s not yet disclosed what the arrangement between KEWL and HDRSF would looks like, normally these lease agreements provide a royalty percentage ranging from 12% to 20% of gross production value. 12% of $3.4 billion is $408 million and 20% of $3.4 billion is $680 million. That would leave HDRSF with revenues somewhere between $2.99 billion and $2.72 billion.

Right now HDRSF is finishing up its commitments to its wetlands and Streams Permit where the company is actively creating wetlands and planting trees to mitigate or completely offset any environmental impact the mine will have on the surrounding habitat. The company is also wrapping up the last of its sitework in preparation for mine construction. This work is expected to be completed in 2025 and is the last things HDRSF needs to complete before making a final decision on mine construction.

Project Timelines

White Pine North

The White Pine North project still has quite a ways to go before a mine is constructed and brought online. HDRSF has yet to run a feasibility study on this project and is still performing several core sample studies as well as various other geological studies in preparation to begin the lengthy process of permit applications. When you’re this far out from actually designing and building a mine it’s hard to put a timeline on this project but… I would expect at least five or six years before this mine produces metal and I would be unsurprised if it took over a decade to bring this mine online. That’s one of the reasons that HDRSF sold off 66% of their share in the White Pine North project. They needed to concentrate all of their resources on Copperwood which has a much shorter timeline to being completed.

Copperwood

HDRSF’s Copperwood project is at a critical junction where the company is about to make a final construction decision and it’s looking like it’s going to get greenlit. HDRSF has estimated that it’ll take 25 months for Copperwood to become operational once official mine construction begins. The final decision to begin mine construction is expected to be made later in 2025. The company has some money to begin construction but will still need to secure the majority of the funds to complete the project. The company expects most of these funds to be acquired through debt although Michigan may give the company a $50 million grant to help fund infrastructure such as roads, utilities, and water systems, in preparation for the mine’s construction. This grant has stalled out in the senate but has a lot of political advocates in favor of this funding.

With or without this grant HDRSF shouldn’t have too much trouble securing funding for this project. Even if Michigan’s politicians don’t support handing out a $50 million grant to the company, most are in support of opening up this mine and bringing good paying jobs and a new source of tax revenue into Michigan’s Upper Peninsula. A little over 300k people live in the U.P and most of the jobs available in that area don’t pay very much so when a company wants to bring hundreds of jobs to the area, they generally have the support of local politicians. The Copperwood mine is projected to provide more than $15 million annually in local, county, state, and federal revenue and increase business spending across the state by more than $130 million every year. Those are not insignificant statistics when the average annual wage of a Michigander living in the U.P. is just under $52k.

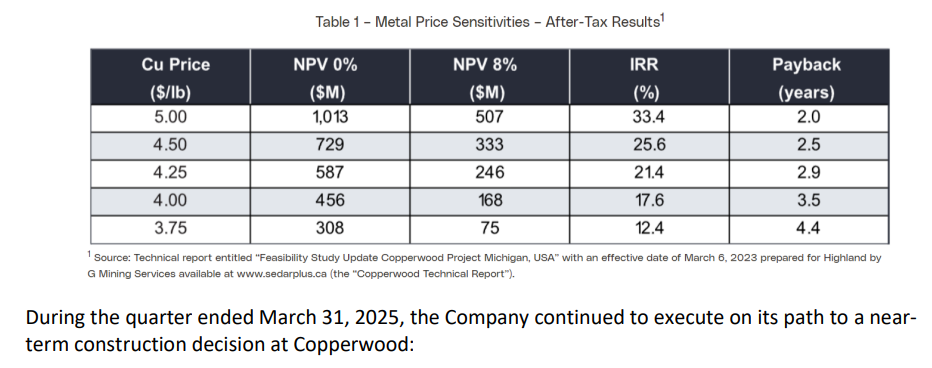

Copperwood is also expected to become profitable after just two and a half years of operating if copper prices hover around $4.50lb.

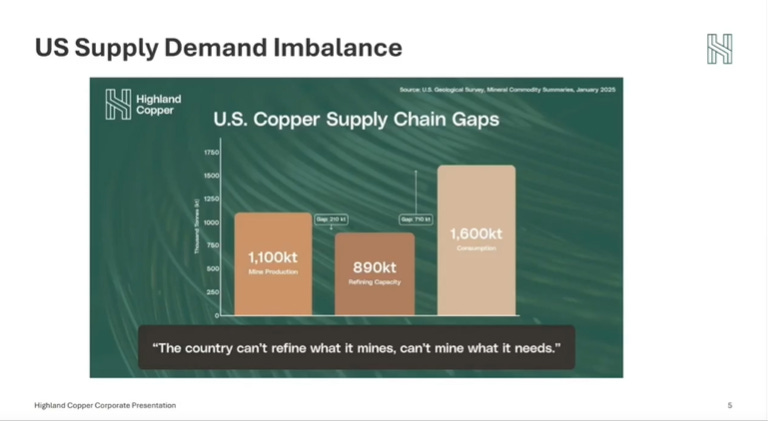

Copper is currently sitting at a price of $4.88lb and the U.S. has a copper supply deficit.

Currently domestic demand is sitting at 1,600kt and domestic mine production levels are sitting at 1,100kt.

With that considered I don’t think they should run into too much trouble finding someone to lend them the money but never the less this project is estimated to cost somewhere around $425 million. That’s a lot of money to raise and we’ll have to see who’s interested in funding this project once HDRSF makes their final decision to build.

HDRSF might even find some joint venture partners to invest in Copperwood as this project is currently one of the only fully permitted copper mines ready to move forward into a construction phase in the country. If HDRSF can’t fund this project to completion they may be forced to issue new debt in the form of additional shares or bonds which could prove to be very dilutive.

Federal Government Support

In Response to the copper supply deficit, but also various other critical mineral supply deficits that the U.S. faces, President Trump has signed an executive order called “Immediate Measures to Increase American Mineral Production” to help expedite domestic mineral development and increase supply.

To help provide resources to would be miners of these critical minerals that Trump has named in this bill, the U.S. Geological Survey had also announced that it was performing a Geophysical Survey in the U.P. right in the middle of all of KEWL’s mineral rights and where HDRSF wants to mine. Results from this survey are expected to be released in 2026. The results from this survey could help spur additional investment interests.

Conclusion

If HDRSF fails to bring their Copperwood project online investors will probably lose most of their investment. The White Pine North project is a long ways away from beginning mine construction and the amount of money the company is looking to gain from this investment having just a 34% interest in the operation, is a lot less enticing than their 100% ownership of the Copperwood project. It’s looking extremely promising that HDRSF will pull the trigger on building this mine. Even after that decision is made though the company is going to have take on a lot of debt to build and bring this thing online. As the company makes progress, HDRSF’s share price should increase but if HDRSF has to sell more equity to fund this project the effects could be very dilutive and weigh down on the company’s share price.

Investors that wait until the future of this project and its funding become clearer would definitely be playing it safe and I wouldn’t blame anyone for waiting on the sidelines a bit before buying in. It is important though to remember that you do so at the risk of losing out on a lot of the gains HDRSF will likely experience each time a news story and press releases comes out marking HDRSF’s progress towards completing Copperwood. By the time the mine is up an running a lot of your potential ROI may have already taken place. By the time the mine finally turns a profit most investors will have had ample time to run a bunch of cash flow analyses on HDRSF and run the stock up to an appropriate or possibly even expensive price.

Disclosure: I do not currently own shares of the Highland Copper Company Inc. ($HDRSF) but may buy a position anytime after this article is published. This is not investment advice. Do your own research.

Highland Copper exec team leans heavily finance. Not seeing much history among them as mine builders or operators. Means best case exit strategy is either a JV or to be sold. No in-house mine builders. Highland faces some major financing hurdles (good thing they are finance people) for the capex of that mine, and wrong entry point on the Lassonde Curve for my taste. Copperwood does seem likely to be built eventually, perhaps not by Highland, so the safer play here seems to be via any royalty through KEWL, but even that's a few years off.