A Million Acres Worth of Mineral Rights and a New Mine Opening Soon

Sitting on $3.4 Billion Worth of Copper

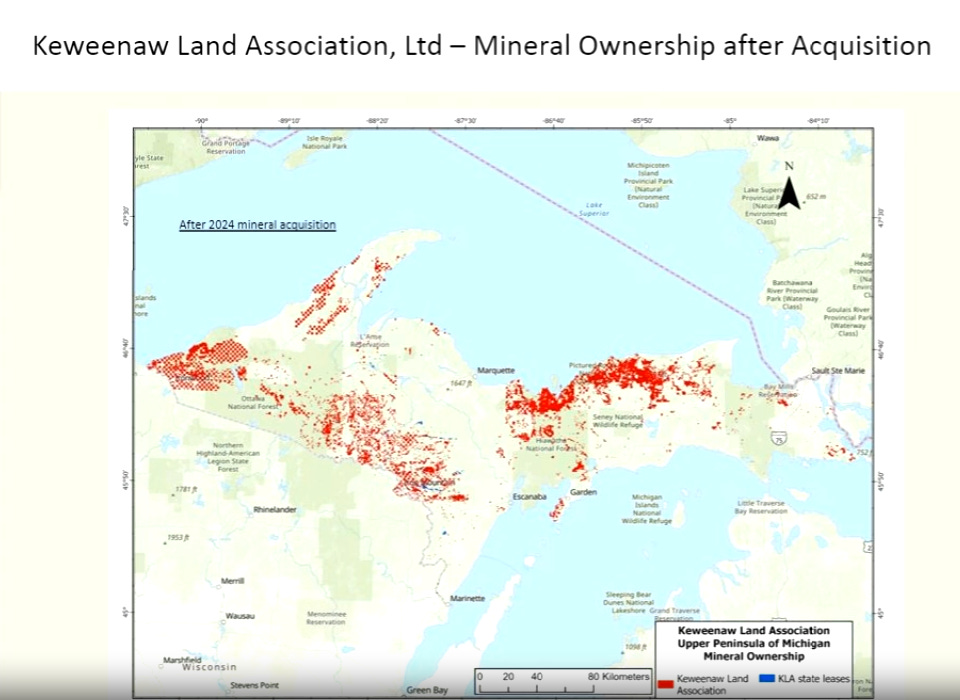

I’ve been following this stock casually for a long time. I’d check up on this company once, maybe twice a year but never pulled the trigger. Recently it’s been looking like current conditions may be presenting investors with an opportunity to buy in. This $36 million market cap owns over one million acres of mineral rights, mostly in Michigan’s Upper Peninsula (AKA the U.P. to Michiganders) but also Michigan’s Lower Peninsula (AKA the L.P. to Michiganders), and their properties also reach into Wisconsin a little bit.

The GAAP Land value for this company is stated at just $50k while the company’s mineral rights are valued at just under $8.0 million. If this company were to sell off their 1,060,855 acres worth of mineral rights for just $100 per acre (what they sold land for this past year) the company would get over $106 million for them. I don’t think the catalyst for a share price increase in the near-term is related to land sales however. I think this stock will see a share price bump when the first mine opens up on this land and the company starts receiving royalties from the $3.4 billion worth of the critical minerals estimated to be on a 505 acre patch of this property.

I’ve never thought of this company as a potential buy because they have never had a large catalyst to rerate. Now however the company has restructured its business away from timber to focus on income generated through royalties from the company’s mineral rights. The company has been able to cut out almost all of its COS and has greatly reduced their SG&A expenses. If their costs to operate can stay low this company should be able to just sit back and collect their royalties.

The Keweenaw Land Association, Limited ($KEWL) operates as a mineral land management company. The company leases mineral rights in Michigan and Wisconsin. Timber was once the main revenue source for the company but KEWL sold off those asset in 2021 and is in a transitional period. Below you can see the company’s sharp price drop from the sale of their timber assets.

Today the company is currently switching over to generating the vast majority of their revenues from mineral land management. The company’s highest priority near-term goal is to achieve financial independence by increasing their passive revenue enough to cover their fixed overhead costs for the foreseeable future. The company is also in the early stages of more extensive mineral exploration across it’s acreage in an attempt to market itself to mining companies. The company currently has what it believes to be several exploration ready projects for willing partners in an easily accessible, mining friendly jurisdiction with all the necessary infrastructure and amenities of an established mining district. Currently there is a copper mine undergoing site preparation that is still acquiring funding. KEWL also signed an option agreement with a hydrogen company last month to evaluate whether there’s potential and possible sources for any non-hydrocarbon gas and natural hydrogen in a three county region in Michigan’s Upper Peninsula.

The Copperwood Project

The biggest and by far most significant revenue stream for the company is a potential copper mine operation known as the Copperwood project. This project could produce very significant increases in KEWL’s revenue streams. This project is ran by a subsidiary of the Highland Copper Company Inc. ($HDRSF) and is described as a lower capital intensity project with a projected 10.7-year mine life that can rapidly reach commercial production. Site preparation was initiated in 2023 and is currently ongoing. Just this past February the Copperwood project received a new air quality permit from the Michigan Department of Environment, Great Lakes, and Energy, allowing the project to continue moving forward.

The mine and all of its facilities will sit on 505 acres and includes a processing plant, ore stockpile area, tailings disposal facility, and support facilities. The Michigan Economic Development Corp. passed a $50 million grant in 2024 to help fund infrastructure such as roads, utilities, and water systems, in preparation for the mine’s construction but has since been stalled by environmentalist groups. The grant was expected to pass in 2024 but is still hung up in the Senate. Michigan Rep. Greg Markkanen has put in an earmark request for this $50 million to be added to Michigan’s 2026 budget but for now it remains unclear whether or not this money will ever reach HDRSF. That being said, it is pretty much unheard of for a mining operation to receive state funds to open. If HDRSF was to receive this money however, it could attract other mining operations to the area as this would send a strong message that Michigan is a very miner friendly place to operate.

Despite this the Copperwood project is moving along and attempting to secure funding through private investment and debt. HDRSF has said that the copper mine will harvest at least $3.4 billion worth of the critical minerals and become profitable after just two years of operating. If this mine becomes operational KEWL should be able to become profitable once again and see a steady stream of income for the next decade. While it’s not disclosed yet what the arrangement between KEWL and HDRSF would look like, normally these lease agreements provide a royalty percentage ranging from 12% to 20% of gross production value. 12% of $3.4 billion is $408 million and 20% of $3.4 billion is $680 million.

Other Sources of Income for KEWL

There’s another copper mining operation ran by a company called the Kinterra Capital that’s mining just to the north of some of KEWL’s properties. Should CTMCF decide to expand their operations any farther south they would have to do business with KEWL. In another development, this past May KEWL gave a press release announcing that they had just entered into an option agreement with Hybrid Hydrogen, Inc. ($HYHY) to grant a three-year option to lease 5,742 acres of mineral rights across three counties in the Upper Peninsula. As mentioned earlier, this option lease agreement is for HYHY to evaluate the potential and possible sources for any non-hydrocarbon gas and natural hydrogen in the region.

KEWL’s Operations

While KEWL is waiting for this Copperwood project to come online the company has been hard at work to reduce the cost of running its business. The Company currently leases mineral rights to HDRSF for their Copperwood project. When HDRSF brings their mine into operation, the mineral leases will convert into a royalty-based arrangement where the mine will provide a passive income stream to the Company. KEWL saw a 25% increase in their lease and royalty income in 2024 as compared to their fiscal 2023, from $292k to $373k. They did this while decreasing their COS by 57%, from $242k to $103k. Cost of sales expenses for KEWL are predominantly lease applications and acquisitions from the state of Michigan, contract geologists, mineral title work, surface sampling and prospecting activities, and lab analysis. With income up and COS down significantly, KEWL saw a 438% increase in their gross profit from $50k in 2023 to $269k in 2024.

KEWL has just two employees with President and CEO Timothy G. Lynott being the sole executive officer. The company’s SG&A expenses increased 15% from $497k to $539k and their operating loss shrunk 20%, from $447k to $358k. It won’t take much in royalty payments from HDRSF to make KEWL’s operations profitable once again. Even with this operating loss the company received $366k in other income mostly from a land for mineral rights exchange that took place between the company and the Michigan Department of Natural Resources. KEWL’s $326k in interest income comes from cash invested in short term treasury bills and held to maturity treasury bonds. All of this led to a 56% increase in net income for KEWL from $167k ($0.14 per share) to $262k ($0.23 per share). The company has been using some of this money to repurchase shares. In 2024 they bought back over 51k shares and have repurchased over 169k shares since 2022.

KEWL has done a good job at reducing the costs of running its business and should this Copperwood project get off of the ground, the company’s operating income and net income should shoot through the roof. KEWL has set itself up to be a mineral royalties company and when those mineral royalties start to finally come in all the company will have to do is cash the checks. While KEWL’s COS and SG&A expenses might rise a little, that increase should be dwarfed by the increase in revenues from royalty payments.

Future Demand and the U.P.

The U.S. is predicted to experience a copper supply deficit and in response President Trump had signed an executive order called “Immediate Measures to Increase American Mineral Production” to help expedite domestic mineral development and increase supply. The U.S. Geological Survey had also announced that it was performing a Geophysical Survey in the U.P. right in the middle of all of KEWL’s mineral rights. Results from this survey are expected to be released in 2026.

If Copperwood Fails

If this Copperwood project fails to come into being KEWL’s share price would surely take a hit and investors could be stuck waiting a long time for another company to come in and attempt to mine resources on these properties. The last large scale mining operation in Michigan’s U.P. shut down in the 1990s. China produces 60% of the world’s precious metals and recently there has been an added focus from politicians to source precious metals domestically when possible. All of the tensions surrounding trade between the U.S. and China might present an opportunity for KEWL somewhere down the line as Michigan is a particularly mineral rich state.

Michigan’s U.P. is home to some of the richest precious metal deposits in the country and was a major player in the U.S.’s history of industrialization. A lot of that metal was mined a long time ago with technology that has long ago gone out of date. The U.P. has an abundance of both copper, silver, and nickel as well as gold, iron, possibly platinum, and many other metals. Here’s a fairly extensive list of minerals found in Michigan. KEWL is the second largest holder of mineral rights acreage in the state, the largest being the State of Michigan itself. The U.P. is also home to the only domestic source of nickel currently being mined. It’s very likely that any future mineral projects in the U.P. would involve KEWL to some degree.

If KEWL fails to attract another mining company there’s always the option that they could sell off their mineral right assets. Mineral rights sell for wildly different prices depending on what resource is on the property and how much value that property is expected to produce. In Michigan that price usually ranges from $500-$5,000 per acre depending on these factors. In 2024 the company sold off 37 acres of mineral rights for $100 an acre. If KEWL sold off their 1,060,855 acres of mineral rights for just $100 an acre they’d get $106 million, 2.9X the company’s current market cap. Even if the company only got $50 per acre for their mineral rights that’s still over $53 million, a 47% upside from KEWL’s current market cap.

A Quick Recap

The company has 1,060,855 acres of mineral rights located in both Michigan Peninsulas and Wisconsin.

Northern Michigan and North Eastern Wisconsin are known for their large mineral deposits which includes copper, silver, iron, nickel, gold, possibly platinum, along with many other minerals and metals.

A Mining company is currently in the process of attempting to build a mine (The Copperwood project) using the company’s mineral rights.

The Copperwood project could produce up to $3.4 billion worth of the critical minerals.

While it’s not disclosed yet what the arrangement between these two companies looks like, normally these lease agreements provide a royalty percentage ranging from 12% to 20% of gross production value. 12% of $3.4 billion is $408 million and 20% of $3.4 billion is $680 million.

The mine does have strong opposition from activist groups but has also garnished a lot of support from local politicians as this mine would directly and indirectly create high paying jobs for the surrounding communities.

If the mine becomes operational KEWL will earn a ton of revenue in royalty payments and this stock will become a multi-bagger.

If the mine activists are successful in shuttering the mine, investors could get stuck holding a stock that’s years away from the prospects of generating real income.

This company is also in talks with a hydrogen mining company to begin preliminary studies on mining hydrogen in Michigan too.

This company is much smaller however and the revenue generated from them would likely be much less significant than from the copper mine.

Conclusion

If HDRSF is able to successfully bring their mine into operation then KEWL will undoubtedly become profitable and shareholders should expect the stock to handsomely rerate. KEWL saw only $373k in revenues in 2024. If this Copperwood project comes online KEWL could be looking at revenues in the range of $408 million to $680 million over the 10.7 year timeframe that the mine is expected to operate within. $40 million a year in royalty payments that require little to no input costs to collect would lift KEWL’s share price up substantially. If the Copperwood project does come online and shows success it could irk the curiosity of other mining companies eager to make a buck. On the other hand, if the Copperwood project falters, shareholders will in turn, get left in the dark waiting to see how, when, and if KEWL can strike another deal with another business to put the company’s mineral rights to work.

Disclosure: I do not currently own shares of The Keweenaw Land Association, Limited ($KEWL) but may buy a position anytime after this article is published. This is not investment advice. Do your own research

Never heard of the operator(s) involved. Their legitimacy is probably a key insight as it relates to the thesis here. Any opinion?