Cashing In on the Infrastructure Behind AI’s Growth

The Overlooked Play in AI’s Cooling Arms Race

AI is About to Change the World

AI is going to change the world. We all know it. Even if we don’t know exactly how. We know that AI is going to help make our world more efficient and more productive and the world is rushing as fast as it can to find out how to do that. People are so certain that AI is going to change how we work that we’ve become anxiety ridden as we also ponder what the work force will look like as these changes inevitably creep into every corner of our society. I ask myself these same questions too.

The market knows that semiconductors and microchip technology is going to be absolutely vital as is evident from events like NVDIA’s share price shooting through the roof over the past couple of years. Intel’s share price just recently had an impressive spike after stories dropped that the government might buy a stake in the chip maker as the U.S. looks to manufacturer these products domestically. The manufacturing of semiconductors and computer chips is vital to our national security but it is also of paramount importance that the U.S. be a player in this new phase of the 21st century global economy.

Deciding Where to Put Your Money

It seems pretty obvious we should all be dumping our money into the companies that will be making all of these semiconductors and computer chips right? Well, maybe but maybe not. Due to the fact that it is so obvious that semiconductor and computer chip manufactures are going to have to play an outsized role in the growth of the global economy, too many investor have these companies on their radar waiting for clues to tell them when to buy.

There are skyscrapers in New York City that have entire floors of analysts staring at INTC, NVDA, AMD, TSMC, MU, and all of the other companies that will likely prove to be major players in this AI revolution in one way or another. Finding an edge against all of those resources is going to be hard. It will be especially hard if you’re looking at the exact same companies as these analysts and expecting to find something new in the same information pile that a million other people have already rummaged through.

The AMREP Corporation

I’ve already talked in the past about how to profit indirectly from this rush for the U.S. government to play catch up in the semiconductor and microchip sectors of the economy. I have written an article on the AMREP Corporation ($AXR). This company owns 17k acres in New Mexico right outside of Albuquerque. The city of Albuquerque can’t expand for reasons I have explained in my write up. When additional housing needs to get built to support a rapidly growing tech industry in Albuquerque, that housing is going to have to be built just outside of the city. AXR owns and develops that land.

The ECC Capital Corporation

I’ve also written about various coal companies on my Substack including ECC Capital Corporation ($ECRO) and on my X account including Peabody Energy Corporation ($BTU). There’s very few things that are certain. I have no idea how AI and all of this processing will change the world. I don’t know who it will benefit and who will suffer from it. I do know one thing for certain though. If we really are going to build all of these data centers and semiconductor and microchip factories, we’re going to need a lot of energy to do so.

Even if the Trump administration was more supportive of the green energy industry we would still need more energy to fire up all of these data centers and factories. That energy will in part come from coal. This will push demand for coal back up, especially since the European Union just agreed to a huge increase in liquified natural gas imports from the United States. This will push up the price of natural gas and make coal an even more competitive energy option.

Today’s Topic of Discussion

This time around I’m going to be talking about a company tied much more directly with the AI and quantum computing industry yet they aren’t making state of the art never been seen products. Instead this company is making components that we should all be quite familiar with, especially for anyone who’s worked around computers or servers before. We’ve always needed these products to run the information systems that run our modern world but with the introduction of AI we’re about to need a whole lot more of what this company is producing.

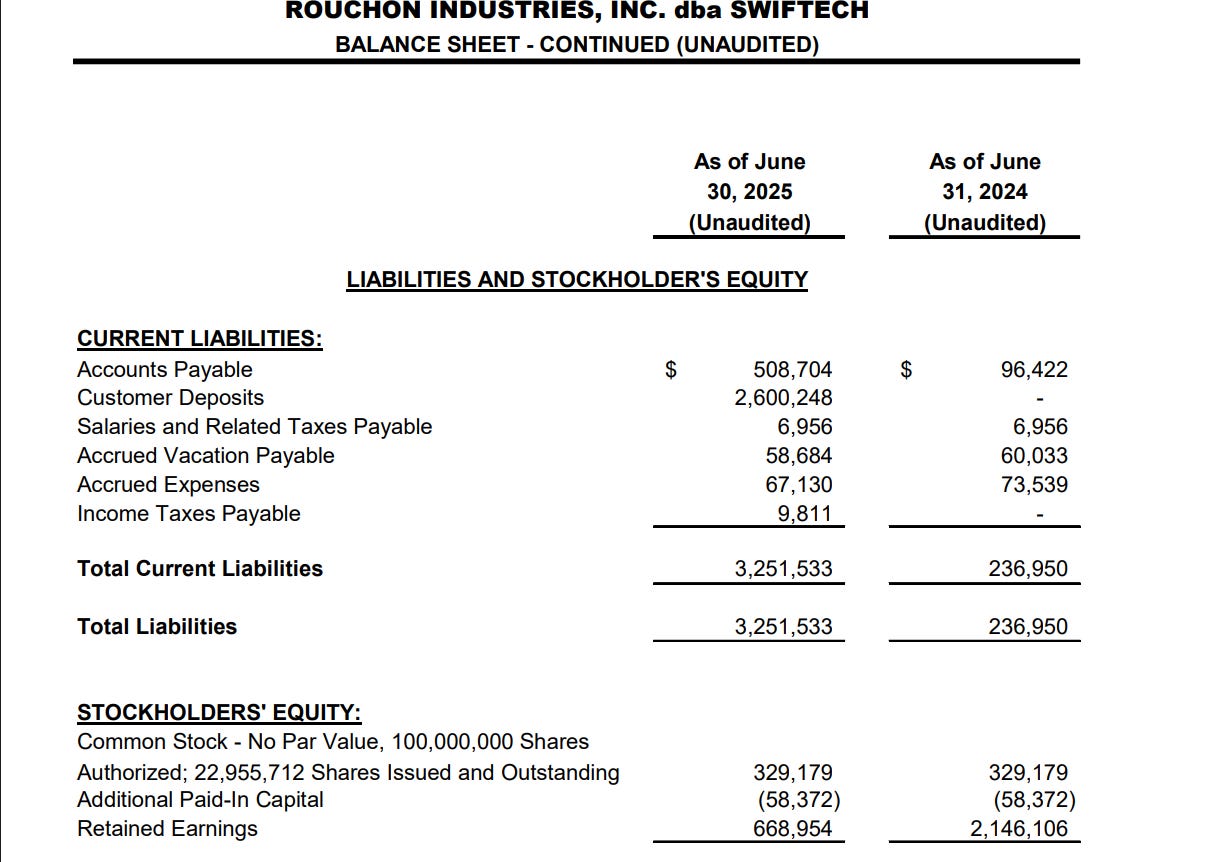

This company is as tiny as it is cheap with just an $872k market cap, a negative enterprise value of -$1.05 million, and a NAV that’s 8.0% higher than the current stock price. This company also has some signs of revenue increases on the horizon. There’s a huge surge in customer deposits showing up on the company’s balance sheet and this company is seeing large rises in expenses like commissions and travel and meal expenses. It looks like this business may be getting ready for a large ramp up in production.

Rouchon Industries, Inc. ($RCHN) was founded in 1994 and under the name Swiftech the company engineers, manufactures, and distributes thermal management devices for microprocessors and electronic components for the computer industry. Swifttech offers air cooling products which include CPU heat sinks, chipset heat sinks, SMC and graphics card heat sinks, fans, and liquid cooling systems. The company’s products are compatible with Intel and AMD central processing units and AMD and Nvidia graphics processing units.

Swiftech was one of the first companies to produce a successful liquid cooling system to consumer brand PCs back when overclocking your PC led to problems with your computer overheating. The company was also very successful with its heat sinks being used in industrial applications and in recent years has heavily steered Rouchon towards industrial cooling applications.

Rouchon’s Valuations

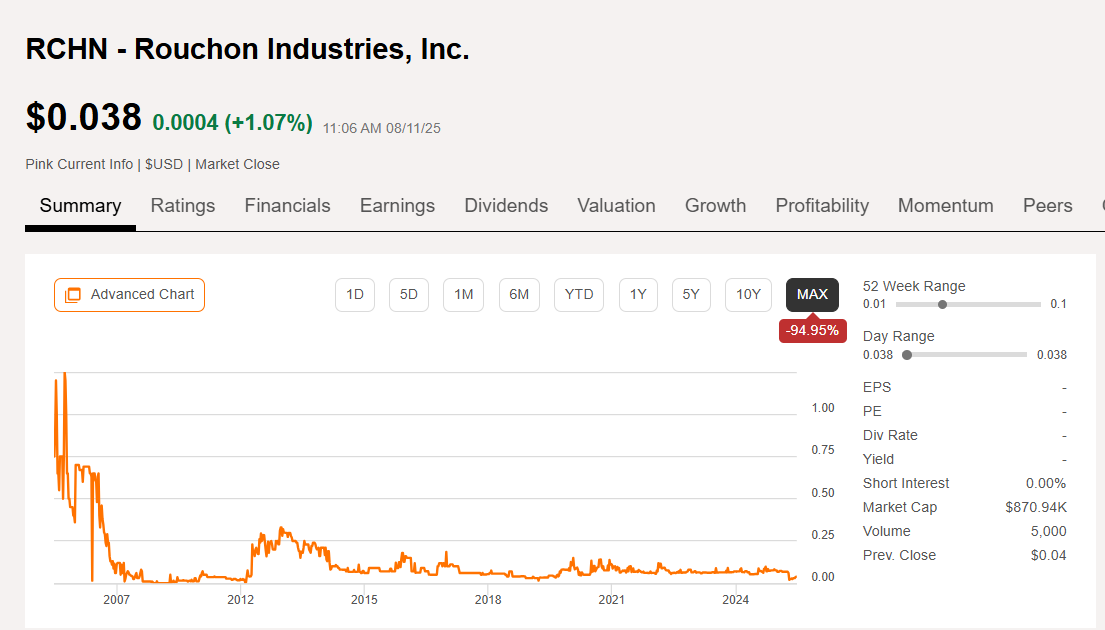

Rouchon is tiny. They have a little under 23 million shares outstanding that are currently trading for just $0.038 per share giving RCHN a market cap of just $872k. Rouchon has no long-term debt and $1.9 million in cash on their balance sheet giving the company an enterprise value of -$1.05 million. That’s right! RCHN has a negative EV! Their net asset value doesn’t look too bad either at $0.041 per share an 8.0% increase from the company’s current share price.

Rouchon has always traded cheaply but the only time that it’s traded this cheap was after the Great Recession post 2008 and in 2019.

Management’s Stake in Rouchon

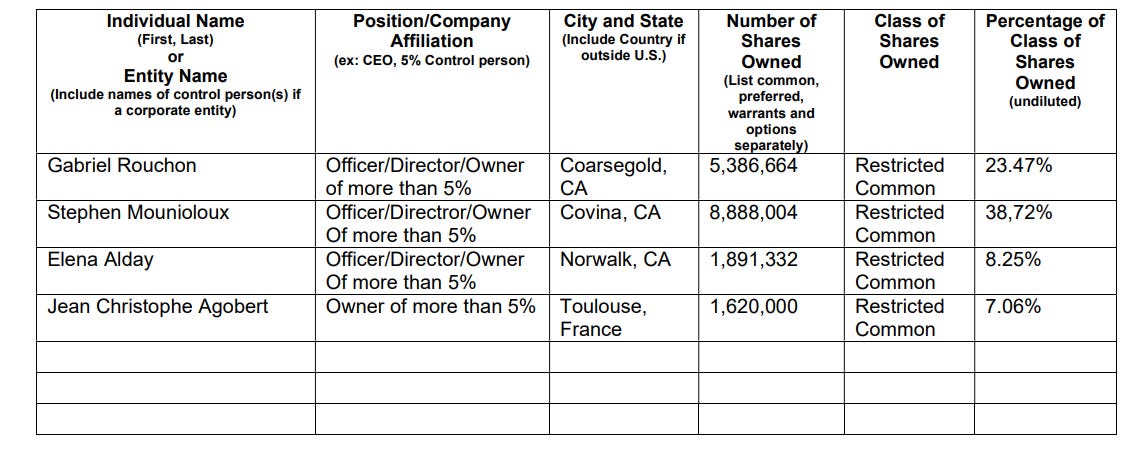

Management owns 77.5% of all of the company’s outstanding stock. It also appears that management does not have an incentive program to award stock to employees. The only way that Gabriel, Stephen, Elena, and Jean are going to make money from their shares is if those shares increase in value.

Potential Tailwinds

I think that Rouchon is likely looking at a couple of nice tailwinds as we move through a Donald Trump Presidency and an AI revolution. The majority of Rouchon’s customers are located in the U.S. and I think that the company has a unique opportunity to capture some extra business as Trump’s tariffs, which are especially bad for overseas semiconductor and microchip companies, make some of RCHN’s customers rethink their product sourcing in an attempt to mitigate any economic damage that an imposed tariff might bring them.

To be honest, when reading through Rouchon’s financials, I was less than impressed with the company. There’s grammatical errors in there, they mention time periods that have already passed like they’ve yet to happen. If you can find this companies investor relations page on the Swiftech website you’ll notice all of their graphs indicating business performance end at the year 2011. There is some real reasoning to think that things could soon be looking up for Rouchon though.

Other Signs that Things May be Looking Up for Rouchon

Their customer deposits have exploded as you can see from the Rouchon’s balance sheet. $2.6 million in customer deposits is a lot for Rouchon. Over the past couple of years the company may have customer deposits that reached $600k but this $2.6 million figure is definitely pretty significant. When you look back to the company’s 2022 financials they weren’t even listing customer deposits on their balance sheet.

For a company who’s market cap is only $872k Rouchon has one of the most detailed general and operating expense breakdowns I’ve ever seen on an annual report.

Rouchon’s travel and business meal expenses were up big time coming in at $26.4k in Q2 of 2025 versus just $3.7k in Q2 of 2024. Commissions are up from $14.1k in Q2 of 2024 to a whopping $572.5k in Q2 of 2025. R&D costs came down dramatically for the company’s YOY Q2 figures, from $263.6k in 2024 to just $68.3k last quarter.

To me this looks like Rouchon has finally moved from product development to product deployment. The company is finally starting to be more aggressive about trying to capture more of the industrial computer cooling market and from the looks of their customer deposit figures, commissions, and travel and meal expenses it looks like they’ve had some initial success.

While this increase in customer deposits and sudden increase in commissions and travel expenses seems to have happened all of a sudden, Rouchon has over the past couple of years been maneuvering Swiftech into a company geared almost exclusively towards supplying the industrial market and moving away from the consumer market. We can observe that change in the company’s product mix over the past half a dozen years and you can see Swiftech talk about it on the company’s X account.

Conclusion

I think that the company’s sales will pick up quite significantly over the next year or so as Rouchon fulfills these new orders and those $2.6 million in customer deposits can start transferring over to actual sales figures instead of being accounted for as liabilities. I presume these customer deposits will only be a portion of the future sales figures that Rouchon expects to receive as I’ve never paid a full price deposit for anything before a service was rendered or a product was delivered to me.

According the Rouchon’s annual statement, 80% of the company’s products are intended for industrial use and since the company’s products are compatible with Intel and AMD central processing units and AMD and Nvidia graphics processing units, they can be used in a wide variety of applications and are well positioned to capture the growth we’re continuing to see in the AI market. This company hasn’t experienced a FY net income since 2023 but it looks like they’re on the brink of experiencing sales figures that this company hasn’t seen in a very long time.

I think that Rouchon is a buy here but I don’t think this company is a long-term hold. I view this company as more of a churn and burn investment. It appears they’re poised for a huge spike in sales, that spike should result in a spike in the company’s share price. Once that occurs I would sell off any shares I had bought. Rouchon might enjoy long-term success but the sloppiness of their website and their annual report, coupled with the long-term decline in the company’s share price leads me to believe that might not be a good idea. I would buy Rouchon and get rid of it after this spike in sales drops down to the company’s bottom line and then move on to your next investment.

Disclosure: I do not own Rouchon Industries, Inc. ($RCHN), but I may consider taking a position anytime following this article. This is not investment advice. I am not an investment advisor. Do your own research.