An Extremely Hidden Asset Just Got More Interesting

One of the first articles I ever wrote up was titled “An Extremely Hidden Asset”.

The asset is a small coal mine. It produces around 2.5 million tons of thermal coal per year.

The company has a share price of $0.08 cents and a market cap of $15.5 million. There is $21.3 million of debt on the balance sheet for an enterprise value of $36.8 million.

I tweeted about this company last night. Over Valentine’s Day. When I was waiting for my girlfriend to get ready to go out.

The coal asset is interesting because not too many people would know about it unless they have read the financials of an obscure financial company that invested in non-conforming residential mortgage loans.

What makes the asset “hidden” is that this financial company added a single paragraph at the bottom of their last annual report saying they bought a coal mine.

That single paragraph got me interested. Very interested.

After some digging I realized this coal mine could generate some serious cash for this enterprise.

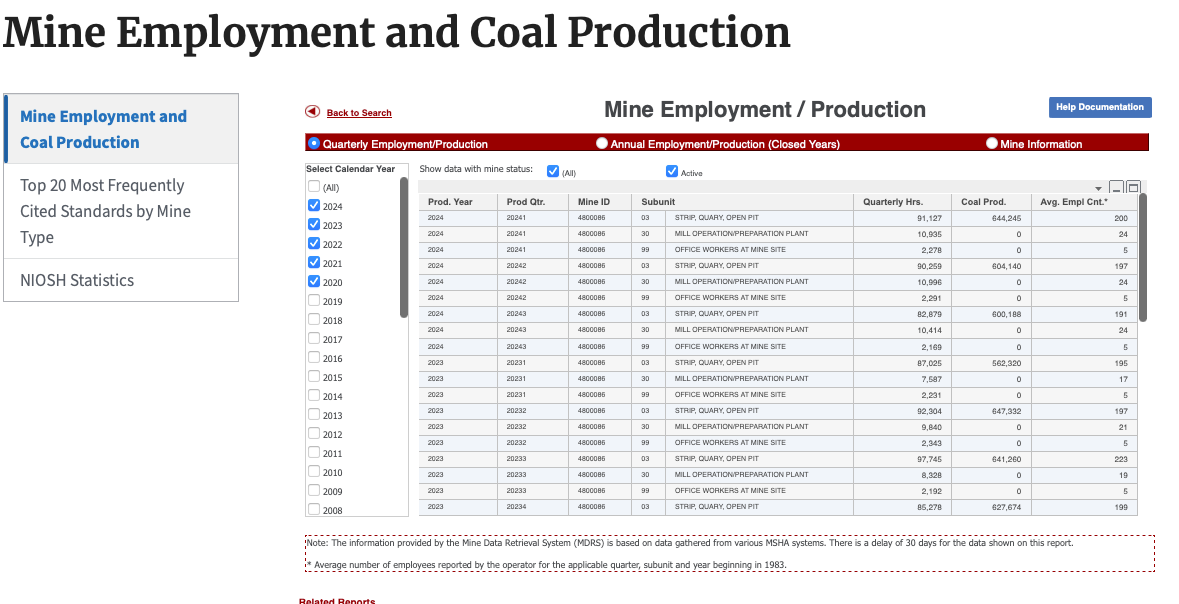

Even better, you can find mine employment and coal production data from government websites that shows this mine’s annual production — which was around 2.5 million.

After getting production data you just have to plug in a few assumptions to your model and you can value this asset.

My original assumptions were that the company was going to be generating 2.5 million tons of thermal coal and selling the tonnage for around $15 per ton.

Assuming the company made around $4 dollar per ton of margin, the asset should generate $9.6 million of mine level EBITDA per year.

Back out $2 million of corporate and $1 million of capex, you get a mine generating $7.6 million of free cash flow per year.

Not bad for an enterprise value of $32 million (the enterprise value when I originally wrote the company up).

But here is where things get better.

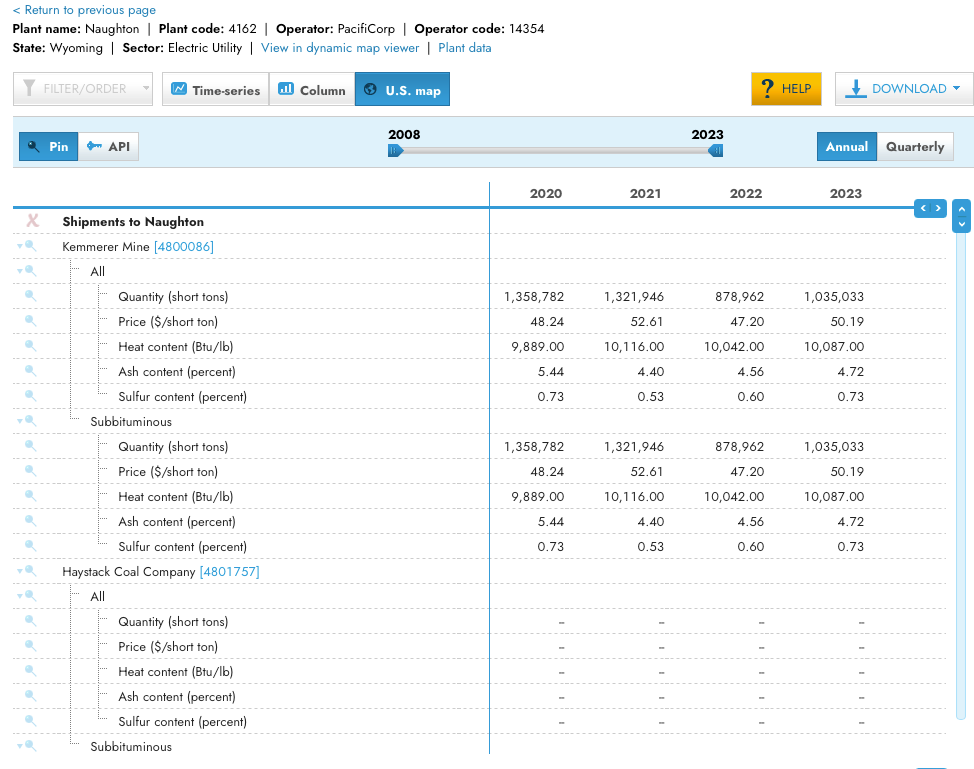

After spending more time looking at the data. It appears the company is actually selling the thermal coal for $50 per ton.

In addition, it appears as if the company could have $500 million of NOLs that will shield all cash taxes for years to come.

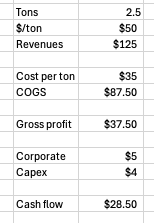

If I use the same assumptions as above ($11 per ton of costs, $2mm corporate and $1mm capex) and assume they sell their thermal coal for $50 per ton, we get a cash flow profile of $94.5 million.

Now this is just a little insane. Cost per ton is probably closer to $35 and corporate will probably increase to something like $5 million and capex will probably be closer to $4 million.

But even if we plug in these assumptions, we still get a company generating $28.5 million of free cash flow per year.

$28.5 million of free cash flow per year with an enterprise value of just $36.8 million.

Plug in any assumption you want. But with thermal coal selling at $50 per ton and the company producing 2.5 million tons of coal per year, things get really interesting.

Let’s dig into this some more.

The company I am talking about is ECC Capital Corporation $ECRO. ECC Capital was a former financial company that invested in non-conforming residential mortgage loans. The company elected to convert from a REIT to a C-Corp on January 1st, 2020 and continues to own and manage interests in securitization trusts which issued securities collateralized by residential real estate mortgages.

However, the company is not in the business of managing mortgage loans. In fact, the liabilities of the securitization trusts are not obligations of the company or any of its subsidiaries. This is important. If the mortgages are underwater, ECC Capital shareholders are not liable.

Per the annual report:

On April 9, 2024, subsequent to year ended December 31, 2023, PhenixFIN Corporation (“PhenixFIN”) has acquired 84,000,000 newly issued shares, representing approximately 44% of the outstanding shares of the Company, for $0.05 per share.

As part of the aforementioned transaction with PhenixFIN, the Company acquired from PhenixFIN 100% of the membership units of Kemmerer Holdings, LLC (“Kemmerer”) and indirectly acquired its wholly-owned subsidiary, Kemmerer Operations, LLC. Kemmerer Operations, LLC, located in Kemmerer, Wyoming, runs an open pit mine that produces sub-bituminous coal for electrical generation and industrial uses.

Additionally, PhenixFIN provided senior secured seller take-back $34 million debt financing to the Company as consideration for the Company’s acquisition of Kemmerer. Interest on this promissory note is accrued at a variable rate per annum equal to the sum of the applicable three-month term SOFR rate plus 500 basis points. The unpaid principal balance of this note shall be due and payable from the excess cash flow according to the senior secured promissory note agreement. The note matures December 31, 2031, without regard to cash flows and is secured by substantially all assets of the Company. As contemplated and as a part of the transaction, on April 10th, 2024 the Company paid down the financing balance by $12.7 million leaving a current outstanding balance of $21.3 million.

If you pull up MSHA.gov date on Kemmerer you can see that the mine was formerly owned by Westmoreland Coal Company and is a currently operating thermal coal mine. In fact, the mine has generated 2.41 million tons in the last twelve months.

What is most interesting is that mine production has increased every quarter since the ECC Capital took it over:

Q4 2023: 562k tons produced

Q1 2024: 568k tons produced

Q2 2024: 600k tons produced

Q3 2024: 604k tons produced

Q4 2024: 644k tons produced

The operation looks legit and there are many sources confirming that ECC Capital Corporation has bought this mine. And buying the mine for only $30 million or so seems like a steal. In 2011, Westmoreland bought the mine for $193 million. The mine was then seized by creditors when Westmoreland went bankrupt. Then billionaire Tom Clarke, formed a new company to buy the mine, Western Coal Acquisition Partners LLC, but the takeover failed. Although this valued the mine at $215 million.

Here is where things get even more interesting.

If you go to the EIA.gov you can find more mine level data. And according to this government website, the Kemmerer Mine is selling their coal for $50 per ton.

I threw together a quick model of what this mine could look like below:

Assuming the company generates 2.5 million tons of coal and with a price for ton of $50, the company should be generating around $125 million of revenues. With a cost per ton of 35, gross profit should be around $37.5 million. Then back out of $5 million of corporate and $4 million of capex and we have cash flow of $28.5 million. I am also not assuming any cash taxes are paid as the company has $500 million of NOLs.

It should be noted that these are all my assumptions. The only thing we know is the number of tons produced and the price per ton the company is selling this coal at. I am just guessing on the cost per ton of $35 million and threw my best guess at corporate costs and capex.

All of this back of the napkin math makes sense to me. Especially since Westmoreland Coal purchased this asset in 2011 for $193 million. That would be around a 6.7x price-to-free cash flow multiple, assuming cash flow are $28.5 million — which really isn’t that aggressive.

The biggest risk in my opinion is the semi-dark nature of the company. ECC Capital only files an annual report once per year. The annual report usually comes out at the end of April. So an investor in ECC Capital will be in the dark about how operations have been for a year at a time. In addition, this is a one asset company. Coal mines tend to have issues. They blow up and catch on fire. A single coal asset is risky business.

Despite the risks, this is a really interesting asset. And if the company is really generating this level of free cash flow, I expect the stock to re-rate substantially when they report at the end of April.

Disclosure: I do not own ECC Capital Corporation $ECRO. I will buy or sell my shares anytime following the publication of this newsletter. I am not an investment advisor. This is not an investment recommendation. Do your own research.

This is such a neat find. Even coal specialists are asleep at the switch here. Wabuffo (Bill), who I like, knows about ECRO. Bill noticed Berkshire-owned Pacificorp announced coal plant life extensions in Utah last month. Guess who owns the two plants Kemmerer supplies. I’m about to set Google News alerts for variations of +pacificorp +coal +extend.

https://cowboystatedaily.com/2024/09/13/kemmerer-coal-mine-operation-sold-to-southern-california-real-estate-company/