Assets That Are Hard To Value

The Monarch Cement Company (MCEM)

So far in my newsletters I have focused on stocks that have fairly easy assets to assess the value of. While the estimated values of these assets may not be exact, they are usually close enough for us to be able to make a good judgment on the total intrinsic value of a company. This happens frequently when the business that you are evaluating has most of its assets tied up in tangible objects like buildings or land. Today however we are going to talk about a company that has an asset that, while extremely hard to put a precise value on, is clearly worth a lot.

The Monarch Cement Company

The Monarch Cement Company (Pink Sheets: MCEM) is a company with this type of asset. MCEM makes cement and is based out of Humboldt, Kansas. The company sells the vast majority of its products in the States of Kansas, Iowa, Southeast Nebraska, Western Missouri, Northwest Arkansas, and Northern Oklahoma. Founded way back in 1908 the company has been in the business for a very long time.

With a price to book of 2.10 and an $800 million market cap, MCEM doesn’t stand out as a business that could make up this asset deficit by owning buildings or properties that are so severely understated due to GAAP accounting policies that they could have a hidden asset value that’s worth that price gap of over $400 million. Instead MCEM has something quite intangible that you can’t put an exact dollar value on but it’s very clear that it’s worth a lot of money. What exactly is this intangible and hard to price asset?

The Cement industry

The Cement industry is very capital intensive. This extreme capital expense acts like a moat that helps to keep competition from entering into the industry. The capital needed to birth a new cement business is large enough and usually requires enough debt to keep out new competition. Starting up a new cement plant in the United States today would also require a company to jump through a series of newer regulatory hurdles that didn’t exist 40, 50, or even 100 years ago when a lot of these cement companies were initially founded.

While it seems certain that the world is going to need cement far into the foreseeable future, the production of cement is often cited as causing a disproportionate amount of CO2 emissions. This puts a large bullseye on the cement industry’s back when it comes to future EPA regulations. While this could put pressure on the margins of established cement companies, these regulations would put a far greater strain on anyone that is considering starting up a cement business.

Due to the fact that it is so capital intensive to start up a cement company, with so many regulations to jump through, established cement companies have a lot of pricing power. This pricing power is even greater when you consider how expensive it is to ship cement over large distances. I’m sure very few would be shocked to hear me say that “cement is very heavy”. Cement’s large weight results in large shipping expenses in relationship to the volume of product being shipped. This means that it would be extremely difficult for one cement company to come in and establish national dominance over the shipping industry without having to lay down massive capital expenditures or take out a lot of debt in order to be able to open up new plants.

Instead most companies that produce cement restrain themselves to smaller delivery areas to maintain profitability. While this makes expanding into new markets much more expensive, the added shipping expenses help keep other cement companies out of MCEM’s areas of operation, which in turn further helps MCEM maintain pricing power. If a new cement company wanted to set up shop, or an existing cement company wanted to expand their operations, then they’re probably going to be looking at the vast concrete jungles of the East or West Coasts or another very large population center like Texas. The markets MCEM sells its products in, mainly Kansas, Iowa, southeast Nebraska, Western Missouri, Northwest Arkansas, and Northern Oklahoma aren’t as appetizing of a business center as the large revenue potentials of areas like New York, LA, Houston, or Miami might be to a business that is looking to recoup the immense expense they are going to have to incur to start up or expand their operations into a new market.

While it is hard to tell how much of an asset the large capital expenses and regulatory headaches are exactly, I am fairly confident that this moat built around the cement industry is in fact substantial. This moat should also help cement companies to rake in some profits from the Bipartisan Infrastructure Deal.

Bipartisan Infrastructure Deal

It should be no surprise to anyone that America is in desperate need for a major infrastructure repair. This can mean only one thing, a substantially larger amount of cement will need to be produced to meet this need. In the Bipartisan Infrastructure Bill we can get a glimpse at just how enormous of a task it is going to be to repair this infrastructure.

“The Bipartisan Infrastructure Law is a historic opportunity to repair the one-in-five miles of our roadways and more than 45,000 bridges in the United States rated as in poor condition.”

All of this is going to need cement. With Cement being so expensive to transport, most of the cement companies in the US should be able to benefit substantially from this bill. When these cement companies and other construction material businesses become favored by investors they will probably be looking for bargains among these companies.

With over 100 cement plants operating in the US today, is MCEM the right cement manufacturing company to invest in?

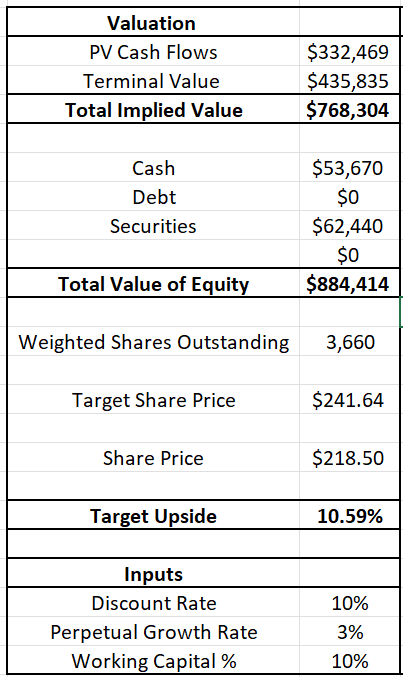

MCEM’s Discounted Cash Flow Analysis

When I ran a Discounted Cash Flow on MCEM (to learn more on how to perform a Discounted Cash Flow analysis please refer to The Value Road newsletter entitled: A "How To" On Discounted Cash Flows) I found the company to have a cash flow upside potential of just 10.6%. That’s not exactly the estimated cash flow value of the century.

So what would make MCEM a better investment than other cement companies? To answer this question we’re going to have to take a look at how some of MCEM’s key statistics stack up compared to some of its rivals. By comparing MCEM with other similar cement companies we can begin to see who has the greatest potential to experience the biggest gains in share price.

Comparing Financials

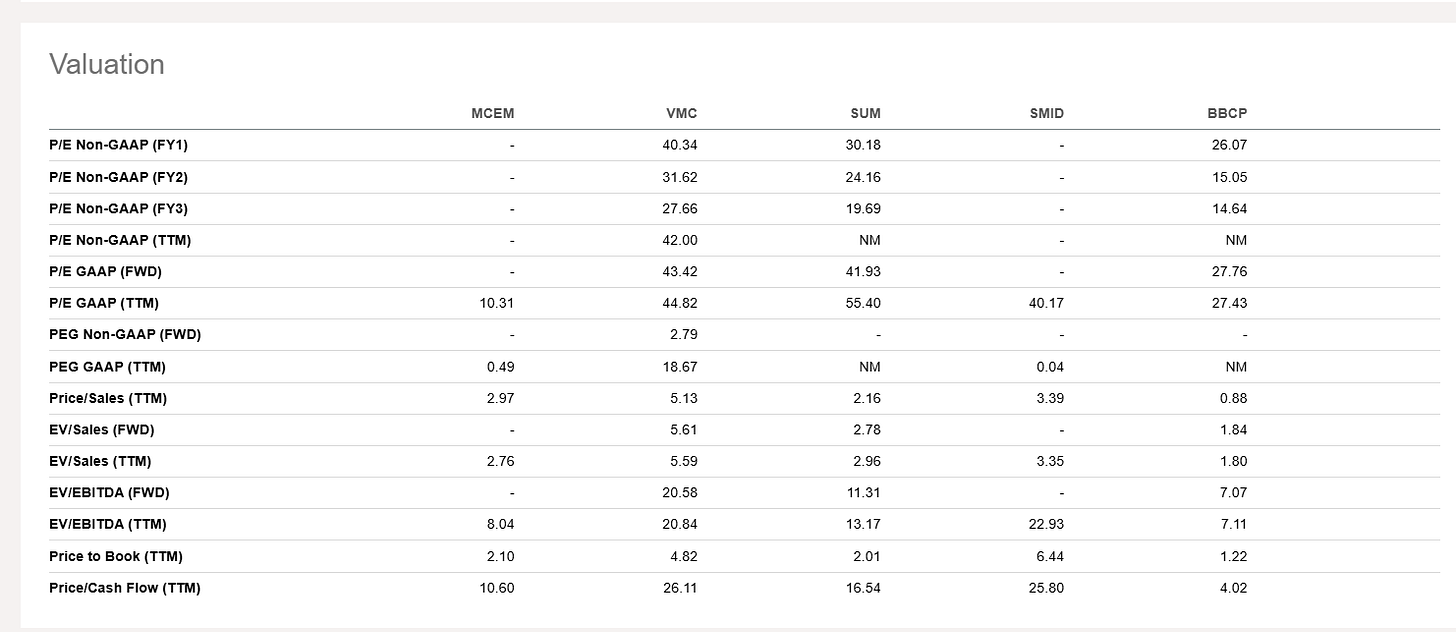

On most finance websites like Seeking Alpha, Yahoo Finance, and CNBC to name a few, you can compare the valuation multiples of the stock you are looking at with the valuation multiples of whatever other companies you choose. For this comparison I chose to stack MCEM up against Vulcan Materials Company (NYSE: VMC), Summit Materials, Inc. (NYSE: SUM), Smith-Midland Corporation (NASDAQ: SMID), and Concrete Pumping Holdings, Inc. (NASDAQ: BBCP). While a lot of construction materials companies handle cement in their business operations, I wanted to compare MCEM to other companies whose operations are made up mostly of cement production in an attempt to compare apples to apples as much as possible.

As you can see from the image below, MCEM’s P/E ratio is far below the competition. MCEM also displays the second best EV/Sales and Price/Cash Flow figures as compared the comparison sample group.

When looking at MCEM’s growth figures you can see that the company had the second highest 3 year growth in EBITDA (CAGR) and the highest rate in three year net income growth (CAGR). MCEM also had the second highest earnings per share growth (YOY) behind only SMID which had a wild 1,025.92% growth in EPS.

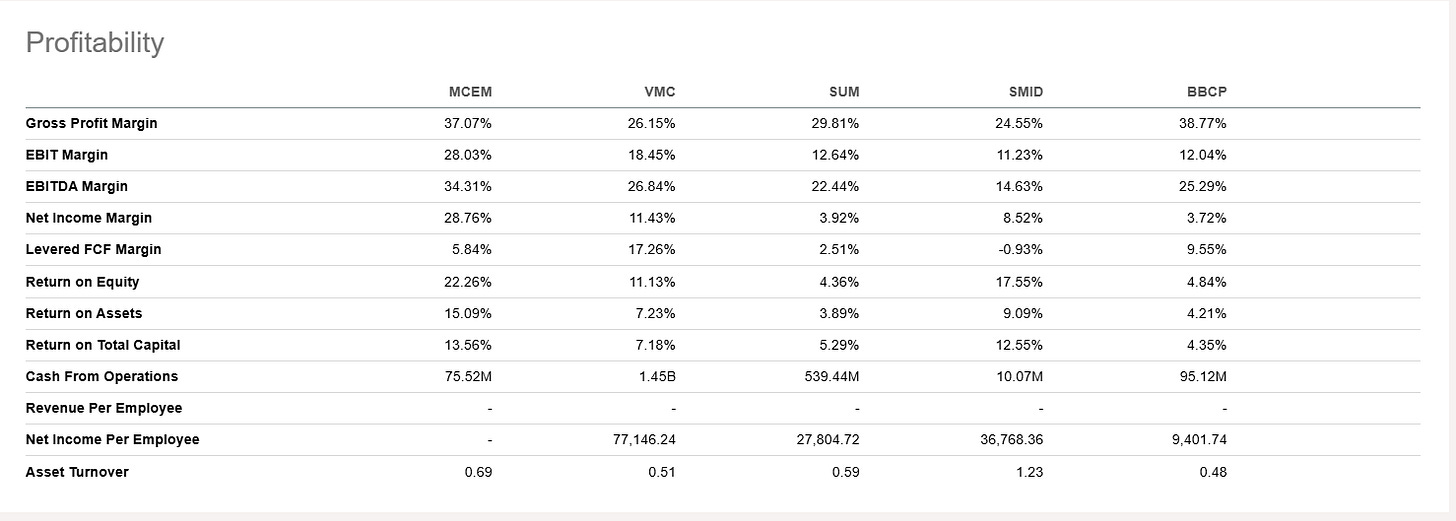

Profitability

The profitability section of this comparison is where MCEM really stands out. It’s not just MCEM’s low valuation multiples as compared to its competition that makes me so fond of this company. MCEM’s profitability multiples are hand over foot better than its competition. While some of MCEM’s competition has better growth figures, a lot more of MCEM’s new cash flow can be utilized to further grow its business or return money to shareholders.

There is a common misconception that all growth is good. I myself do not believe that to be the case. Growth can be very expensive and can cut into a company’s profit margins substantially. What’s worse is that sometimes a company can pay too much money to grow an operation outside of that company’s realm of competency. This can leave margins decreased indefinitely as the company fumbles running these new business ventures. This can make a business take on more debt from this expansion than initially intended which in turn, further degrades a company’s profit margins.

Income and Price Performance

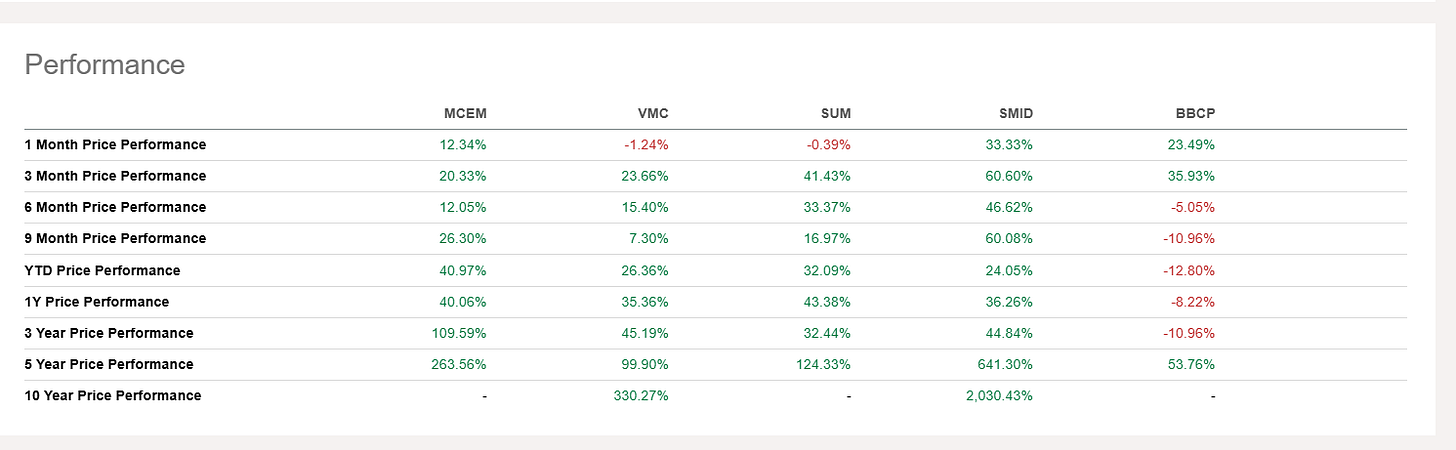

I very much appreciate MCEM’s attention to profitability. It shows a great deal of focus from the management team. As you can see from the chart below MCEM outperforms every one of these comparable companies by quite a bit. It should also be noted that MCEM and VMC are the only companies listed below that have shown a positive net income every year since 2014.

MCEM’s year to date and three year price performance are much better than everyone else’s. MCEM’s five year price performance is only outperformed by SMID.

Another big factor that plays into MCEM’s favor is the company’s small share count. With only 3.66 million shares outstanding, MCEM’s impressive profitability isn’t spread thin across 10’s of millions of shares. We can see from MCEM’s revenue per share and diluted earnings per share figures the magic of a small share count as compared to MCEM’s competition.

Please keep in mind that when you are invested in a company with such a small share count like MCEM, it is important to make sure that the business is ran exceptionally well. MCEM’s long history of profitability and higher than average margins gives this company a bit of a safety moat. The company’s profitability margins could afford to fall quite a bit before beginning to resemble comparable cement company’s.

How MCEM Stacks Up

When comparing MCEM to these other companies the only company that stuck out to me was SMID. They seem to have had a very compelling growth story over the course of the last couple of years. With that being said, the company is way more overvalued on an asset basis than MCEM is. In fact SMID’s Price/Book ratio is much larger than all of the other companies we are comparing MCEM against with a Price/Book ratio of 6.44 versus MCEM’s 2.10. SMID also has a much worse EBIT margin, net income margin, return on assets margin, and return on capital margin than MCEM does. SMID also carries debt which will cut into their income for the foreseeable future whereas MCEM has no debt at all. In my opinion MCEM looks to be the Buy when compared against these four other companies.

Conclusion

The Bipartisan Infrastructure bill is set to invest over $300 billion in repairing and rebuilding America’s roads and bridges. This is the largest investment since President Eisenhower’s investment in the interstate highway system. So far this has led to 7,800 bridge repair projects and 135,800 miles of road improvements. This bill is also allotting $17 billion to upgrade the United State’s ports and waterways. As more of this money flows into new projects, investors will likely look towards construction material companies to invest in and a large amount of cement is going to be needed in every one of these projects.

When investor’s start comparing cement companies side by side MCEM’s impressive profitability figures should shine through. MCEM’s net income margin, earnings per share margin, EBIT margin, return on equity, return on assets, and total return on capital are all better than their peers. Even in areas where the company doesn’t pull away from the competition, like the company’s growth ratios for instance, MCEM still consistently comes in second place, usually behind SMID who is extremely overpriced on a Price/Book ratio basis.

Overall I think that MCEM is a good solid company. It might not be the shining example of a Ben Graham company but I would consider MCEM to be a Charlie Munger play. If you buy into MCEM I believe that you are buying a great company at a fair price. While I don’t have a tangible figure to apply to the value of already having been long established in an industry whose competition is largely kept at bay via extremely high capital start-up costs and a tangled weave of regulatory hurdles, I do believe that it is worth something valuable, especially in an industry that needs to exist in order for our society to function properly.

As the Bipartisan Infrastructure Deal adds to the growth in cement demand and investors hear more about large ongoing building projects, interest in building materials will probably start to pick up. When investors begin looking into demand for cement, I believe MCEM should stick out as a prime investment candidate due to its absolutely stellar margins, non existent debt, and long history of continuous profitability.

I do not own MCEM right now because I am actually a bit torn on whether the company’s long establishment, high profitability margins, and lack of debt makes up for the company’s lack of net asset value. I am curious as to what my reader’s opinions on this company are. What do you guys think? I think that MCEM would be worth holding onto if I had bought into the company at a better price to net asset relationship. I don’t know if I would necessarily buy into MCEM at its current share price strictly because of the company’s asset value. If there was a sudden market shock that dropped prices across the market and MCEM’s Price/Book ratio dropped to around 1.5 I would probably buy in.

Disclosure: I do not own shares of The Monarch Cement Company (Pink Sheets: MCEM). I may at some point in the future buy shares from MCEM, I may not. This is not financial advice. I am not a financial advisor. Do your own research.

Why do all the other cement companies trade at such high multiples? Is it in anticipation of the Bipartisan Infrastructure Deal? If so, why didn't that impact the DCF enough to make the upside on MCEM significantly larger?