Your AI Startup Lost Money. This Screw Distributor Made Millions.

How a Parts Middleman Crushed the Market While No One Was Watching

The company I’m writing about today isn’t a sexy exciting company that’s developing some new technology or making breakthroughs in the medical field. Many investors might let out a yawn as they scroll past this ticker on any screener or investment article they were reading about this stock. Nevertheless this company provides a vital service for hundreds of businesses across the country. They act as sort of a middle man usually to OEMs, supplying a variety of business’s with small component parts to be used for a variety of manufacturing processes.

The products this company sells are usually too cheap and too various for it to be worth it for a manufacturing company to source these products individually and so the company I’m writing about today does that for them. Oftentimes this company will “Kit” these items, putting several products together in one package to be used simultaneously in a manufacturing process. They do this primarily through a small army of a couple of hundred sales representatives that work with over 10,000 businesses to keep them supplied with the parts they need to keep producing the products they make.

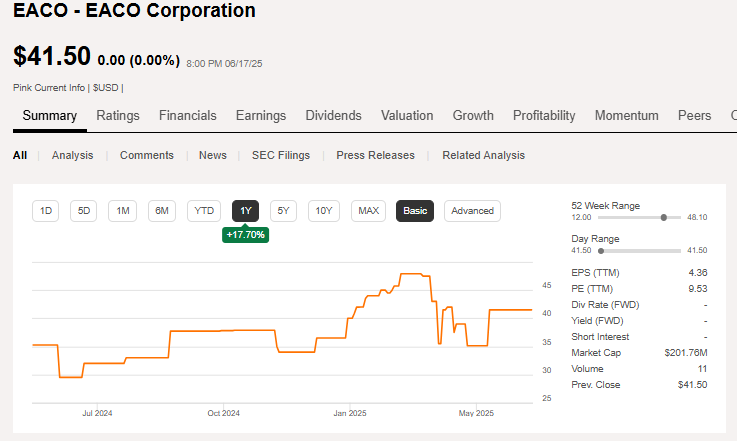

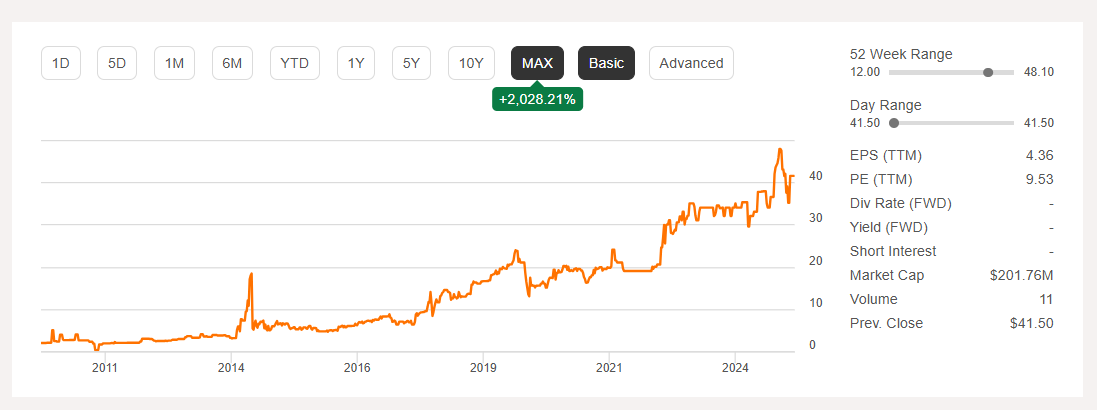

This business has had a long growth story. Their revenue has grown at an average annual rate of 17% since 2015, their operating income has shot from $5.7 million to $32.8 million from 2015 to 2024, and their net income went from $3.7 million in 2015 to $15.0 million in 2024. The company’s net income should actually pop back up into the $21 million range this year as the company had spent a considerable amount of their earning buying their headquarters the year previous. This steady growth over the past decade has led to the company experiencing a $532% increase in their share price during that time frame.

The EACO Corporation

What The Company Does

The EACO Corporation ($EACO) primarily through its subsidiary, Bisco Industries, Inc., distributes and sells electronic components and fasteners. The company’s website is one of the most barebones websites I’ve ever seen but it does give a little more detail into EACO’s specific operations and says, “The divisions of the Company include Bisco industries, National-Precision and Fast-Cor. Bisco supplies parts used in the manufacture of products in a range of industries, including the aerospace, circuit board, communication, computer, fabrication, instrumentation, industrial equipment and marine industries. The Company operates in the United States and Canada.” The company has a wide array of electronic components that it distributes including spacers and standoffs, card guides and ejectors, component holders and fuses, circuit board connectors, and cable components.

While EACO doesn’t manufacture anything, the company does provide value to its customers through special packaging, bin stocking, kitting and assembly, bar coding, electronic requisitioning, integrated supply programs, and other similar services. EACO services over 10,000 customers. None of these customers make up a very large chunk of the company’s revenues and in fact the company’s top 20 customers combined make up just 16% of the company’s sales. The company is able to provide its distribution services to this many customers because of its 627 employees, 445 of which work in sales. The sales team members operate from one of the company’s 52 sales offices. 51 of those offices being located in the U.S. and Canada and one of those offices being located in the Philippines. While the company does sell its products internationally, less than 11% of their revenues come from outside of the United States. During the company’s fiscal 2024 that international sales figure was only 10%.

EACO’s Current Operations

EACO’s business model is actually pretty simple. The company found out a long time ago that if it keeps adding to its sales team the company’s operating income will increase faster than their SG&A expenses, growing the company’s bottom line. This is how EACO currently plans to keep expanding their business. Those employee numbers I gave earlier are substantially higher than EACO’s staffing levels at the end of their fiscal 2024. The company added 43 employees as compared to this time last year with 31 of the those being sales employees.

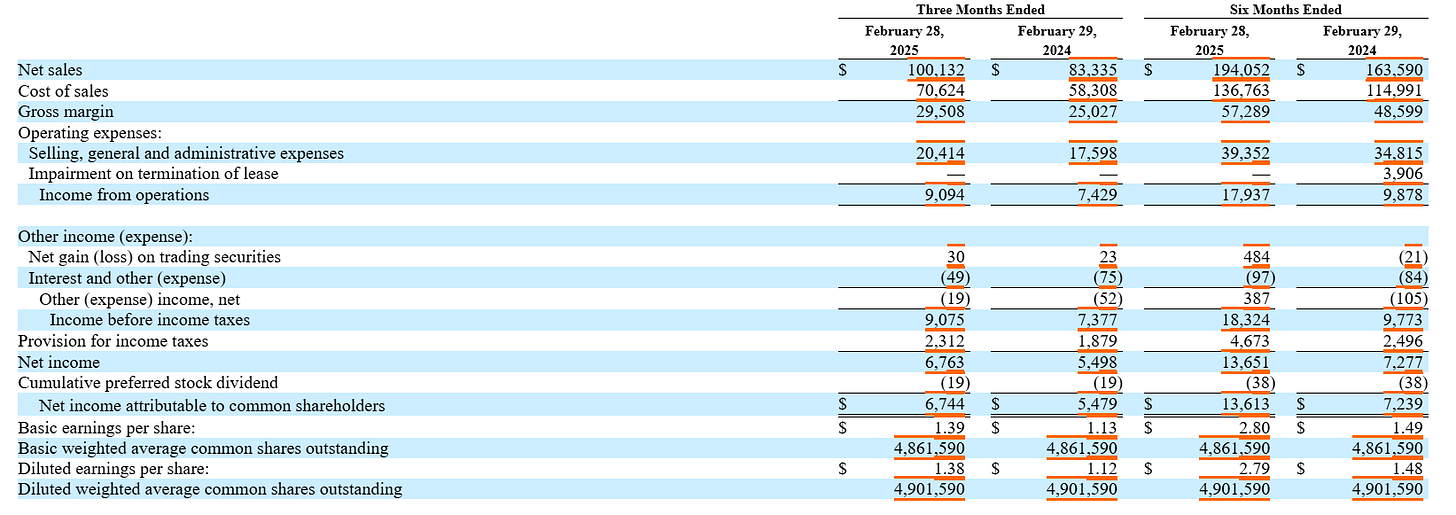

It’s looking like EACO’s growth model is continuing to work as these additional employees have helped raise the company’s YOY figures significantly. Their revenues are up 18.6%, their gross profit is up 17.9%, their income from operations is up 81.6%, and their net income is up 87.6%.

Discounted Cash Flow

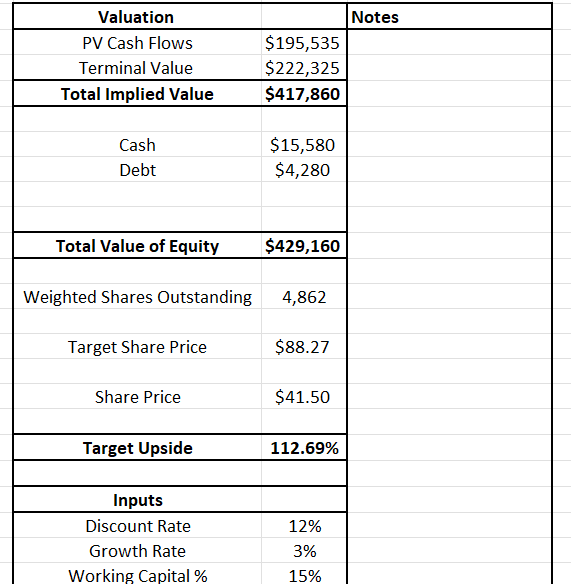

I ran a discounted cash flow analysis on EACO in order to get a better sense of what the company’s future cashflows might be worth. I set the company’s figures to what their five year averages have been which gives us a 13.0% revenue growth rate and an 8.6% operating income margin through 2035. Capital expenditures for EACO were set at 0.36% of the company’s revenues and D&A expenses were added back in at 0.5% of the company’s revenues through 2035. I’ve got the company’s changes in working capital set at 1.9% of the company’s revenues through 2028 and then increased their working capital as a percentage of revenues by 15% through 2035 to account for the added expenses of an expanding business. Finally, I set the company’s perpetual growth rate at 3.0% after 2035, and used a 12.0% discount rate.

As you can see from the image above, my DCF ended up spitting out an $88.27 per share price target. That is a 112% upside from EACO’s current share price of $41.50.

Management

As is unfortunately common with these tiny companies, EACO is controlled by a singular individual who owns 4.7 million of the company’s 4.86 million shares currently outstanding. That’s 95.9% of all of EACO’s outstanding common stock. Glen F. Ceiley is EACO’s Chairman of the Board and Chief Executive Officer (principal executive officer and principal financial officer) and has for all intents and purposes total control over what happens to the company. Usually this is a negative thing but EACO has had a very long record of profitability and growth.

I think the old saying “If it ain’t broke, don’t fix it” applies here. Most of the members of management have been working for the company since the early 2000’s or even earlier and their diligence has led to an impressive amount of growth for the company since that time. While a company’s past success is no guarantee for success in the future, it does look like EACO is continuing to move in the right direction and it’s looking like there’s still room for the company to grow.

Conclusion

I would and probably will buy some shares of EACO. They’re a simple company that’s easy to understand and that provides a vital service to a lot of industries. While EACO’s voting power rests in the hands of just one man Glen Ceiley, the company has seen steady growth for decades and that growth doesn’t look to be slowing down much. While EACO may experience some growing pains from time to time, I think they have a very solid and simple business model that works for a wide variety of industries which gives them a lot of flexibility with their operations.

EACO services over 10,000 customers with the help of 627 employees, 445 of them working in sales. The company plans to continue its growth through growing their sales team and it looks like it’s going great. EACO has thus far in 2025 grown their revenues by 18.6% YOY, a 13.0% YOY average over the past five years, and a has grown their revenues at an average rate of 17.0% since 2015. This revenue has consistently made its way to EACO’s bottom line over the years too. Their operating income has shot up 475%, their net income 305% since 2015 and these figures are still continuing to grow.

Disclosure: I do not currently own shares of The EACO Corporation ($EACO) but may buy a position anytime after this article is published. This is not investment advice. Do your own research.