This Stock Has A Negative EV And A 98% Upside In NAV

A Phoenix Rising?

The company I’m writing about today has a GAAP NAV worth $2.55 per share. That’s a 97.7% increase over this company’s current share price of $1.29. Even better, almost all of these assets are cash. Once received with an incredible amount of enthusiasm on market news channels like CNBC, this company has actually recently emerged from bankruptcy. The company’s common stock wasn’t wiped out though and the business can use their $1.1 billion in NOLs accrued under their previous operations to help jumpstart a new venture. Their former management team and board have all been terminated and one man who was elected as the company’s new Chief Executive Officer, President, Secretary, and Treasurer is leading the company in conjunction with five newly elected directors through its bankruptcy emergence.

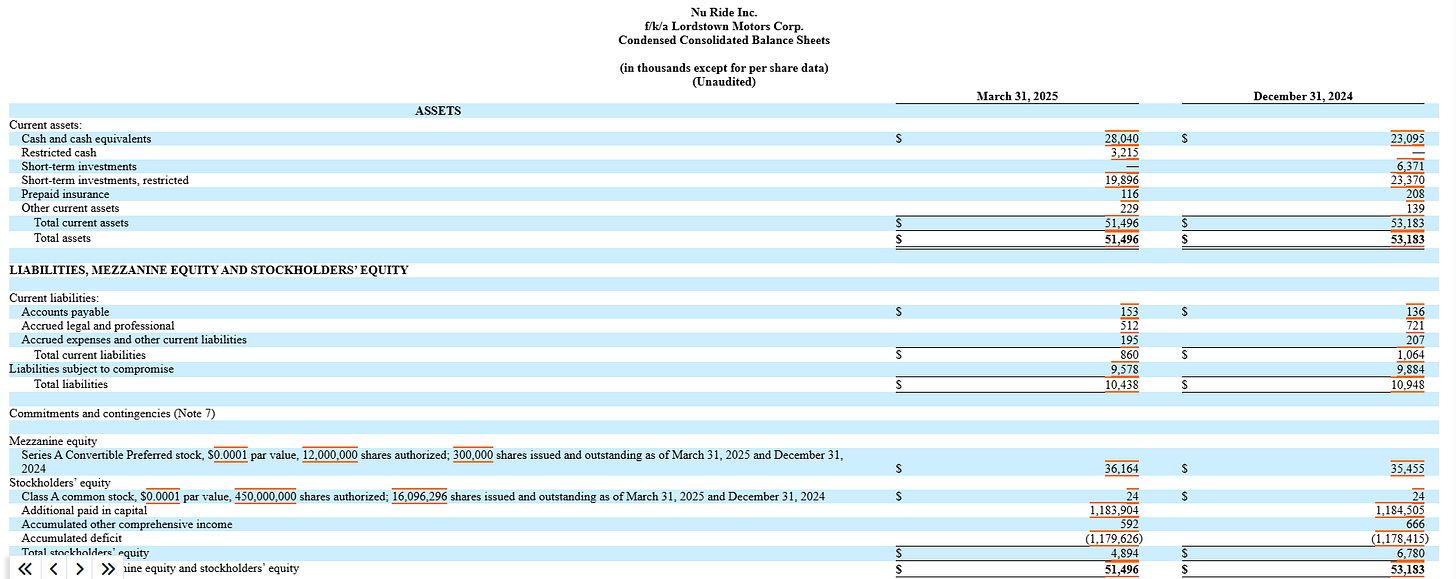

Nu Ride Inc. ($NRDE) has a market cap of $20.8 million, no debt, and $28 million in cash giving them a negative EV of $7.2 million. This company does have some liabilities though. It still has some potential bankruptcy settlement claims valued at $9.6 million. These claim liabilities are offset by the company’s $19.9 million in restricted short-term cash and $3.2 million of restricted cash that’s been set aside specifically to pay for claims like these.

Litigation Overview Between Nu Ride and Foxconn

Basically, it looks like Nu Ride will have an excellent head start when it decides to begin another operation. There’s another part of this story that could see a lot more cash drop into Nu Ride’s lap though. The company is currently in litigation with Foxconn, who had agreed to fund Nu Ride’s previous operations through, among other things, the purchase of preferred stock. Foxconn agreed to purchase one million shares of the preferred stock at $100 per share but only completed one transaction of 300,000 shares for $30 million before backing out of the agreement. Foxconn backing out of their preferred stock purchases left the company without liquidity and they petitioned the courts for a voluntary bankruptcy proceeding shortly thereafter.

Nu Ride is currently in litigation with Foxconn over their failure to provide the company with the funds they were promised and Foxconn has since asked the courts to dismiss the litigation or force it into arbitration. In August of 2024 the Bankruptcy Court upheld nine of Nu Rides litigation claims and forced two more into arbitration. Should Nu Ride be successful in retrieving the $60 million it would have made by selling the remaining 600,000 shares of preferred stock to Foxconn, the company’s share price could shoot up drastically.

Let’s dive into Nu Ride’s former business ventures.

Nu Ride’s Former Business

Nu Ride used to have the much more recognizable name of Lordstown Motors, named after the town the company’s products were going to be produced in. This company roused a lot of excitement over it potentially being the first company to produce an all electric powered truck that could compete other big electric vehicle brands. This was before the Ford F-150 Lightning or Rivian R1T had been released. Lordstown’s electric pickup truck was going to be called the Lordstown Endurance. The fact that this company was going to be making its vehicles in Lordstown, Ohio garnished additional attention as this plant was formerly a GM site.

Lordstown Motors went public in October of 2020 and quickly saw its market cap shoot up to hundreds of millions of dollars. Investors where chomping at the bit to find a new Tesla and Lordstown looked to be that company. The company said that it had 27,000 pre-orders for their Endurance truck and things seemed to be looking good.

Problems At Lordstown

This facade Lordstown had portrayed quickly melted away as the company’s 2021 became filled with controversies, accusations, and vehicle fires. In January of 2021 minutes into the company’s first road test of their Endurance pickup in Farmington Hills, Michigan, the truck burst into flames completely destroying the vehicle. The company then had another vehicle catch fire while in storage at their Lordstown facility. To add some metaphorical flames to Lordstown’s literal fires, Hindenburg Research released a rather damning report accusing the company of, among other things, fabricating their pre-order volumes. This then led to an SEC investigation into Lordstown Motors. The company had also announced in their financial reporting that they needed additional liquidity to begin production. Prior to these developments the company’s stock had traded as high as $435 per share but after all of this bad news it began to tumble well below $200 a share within just a couple of months. Shortly thereafter CEO Steve Burns was fired.

This is where Foxconn steps onto the scene. Foxconn had stated that it intended to enter into the electric vehicle market in a similar fashion to how the company operates within the cell phone market. They wanted to manufacture electric vehicles for a variety of companies all under one roof. Lordstown needed capital and Foxconn had expressed interest in acquiring a manufacturing facility to produce electric vehicles, which Lordstown was in possession of. The two businesses struck a deal where Foxconn was to buy Lordstown’s Ohio plant for $230 million in exchange for Foxconn producing the Endurance.

Production finally started in late 2022 and then quickly ground to a halt in early 2023 when Lordstown put out a recall for faulty wiring in their vehicles. The company had only produced 19 vehicles and all of them were duds. It was around this time that Lordstown had one of their vehicles catch fire while in storage. It was one bad news headline after another and all of this sent Lordstown’s share price below $1.00 for over 30 days which triggered the company being delisted from the NASDAQ. Lordstown attempted a reverse stock split with a ratio of 1:15 to get the company relisted but Foxconn ended up pulling the rug on their agreement. Foxconn announced they were ending their agreement with Lordstown in April of 2023 and by June 27th of 2023 Lordstown had petitioned for chapter 11.

On the same day that Lordstown filed for bankruptcy the company filed proceedings against Foxconn seeking relief for fraudulent and tortious conduct as well as breaches of the Investment Agreement. As I had mentioned earlier, Foxconn has tried to have these motions dismissed or at least knocked down to arbitration but the court has upheld nine of these litigation claims and forced two more into arbitration and this is where the matter stands as of today. During Lordstown’s bankruptcy proceedings the company sold off all of their assets to LAS Capital LLC for $10.2 million. The company also has to keep a cash reserve of $45 million dollars to pay for any disputed claims to general unsecured creditors. As of the company’s last 10-Q, there was still $22.9 million left in this fund. Once these claims have all been settled the rest of this money should, if there’s any left, go back into the company’s normal cash holdings.

Lordstown Emerges From Bankruptcy As Nu Ride ($NRDE)

Lordstown emerged from bankruptcy under the name Nu Ride ($NRDE) in March of 2024. At the time the company stated that it had $78 million in cash and "$1 billion of net operating loss carry forwards and various causes of action." Nu Ride had also stated that the company may "enter into a business combination, acquire a target company or business or enter into strategic alliances" with companies seeking to go public. Sounds to me like a SPAC with a huge tax asset and a large cash reserve built right into the deal.

Some Key Points about Nu Ride (Formerly Lordstown Motors).

Lordstown Motors went public in October of 2020 and quickly saw its market cap shoot up to hundreds of millions of dollars.

The company aimed to make the first all electric pickup truck.

Investors where hoping to find a new Tesla and Lordstown looked to be that company.

The company said that it had 27,000 pre-orders for their Endurance Pickup Truck.

The company then had a test vehicle catch fire a few minutes into the company’s first street test drive.

Hindenburg Research then released a rather damning report accusing the company of fabricating their pre-order volumes.

This then led to an SEC investigation into Lordstown Motors.

All of this downward pressure on the stock left Lordstown needing liquidity.

Foxconn had expressed interest in acquiring a manufacturing facility to produce electric vehicles, which Lordstown was in possession of, so the two businesses struck a deal where Foxconn was to buy Lordstown’s Ohio plant for $230 million in exchange for Foxconn producing the Endurance for Lordstown.

Production started in late 2022 and then quickly ground to a halt in early 2023 when Lordstown put out a recall for faulty wiring in their vehicles.

The company had only produced 19 vehicles, all of them duds.

It was around this time that Lordstown had one of their vehicles catch fire while in storage.

This sent Lordstown’s share price below $1.00 for over 30 days which triggered the company’s delisting from the NASDAQ.

Lordstown attempted a reverse stock split of 1:15 to increase their share price and get the company relisted.

Using the delisting as cause, Foxconn announced they were ending their agreement with Lordstown in April of 2023 and by June 27th of 2023 Lordstown had petitioned for chapter 11.

On that same day Lordstown filed proceedings against Foxconn in Bankruptcy Court seeking relief for fraudulent and tortious conduct as well as breaches of their Investment Agreement.

Foxconn has tried to have these motions dismissed or at least knocked down to arbitration but the court has upheld nine of these litigation claims and forced two more into arbitration and this is were the matter stands as of today.

During the company’s bankruptcy proceedings the company sold off all of their assets to LAS Capital LLC for $10.2 million.

The company also had to keep a cash reserve of $45 million dollars to pay for any disputed claims of general unsecured creditors.

As of the company’s last 10-Q, their was still $22.9 million left in this fund.

Lordstown emerged from bankruptcy under the name Nu Ride ($NRDE) in March of 2024.

At the time the company stated that it had $78 million in cash and "$1 billion of net operating loss carry forwards and various causes of action."

Nu Ride had also stated that the company may "enter into a business combination, acquire a target company or business or enter into strategic alliances" with companies seeking to go public.

Long Story Short

Right now Nu Ride is in the process of beginning their “fresh start.” Nu Ride has no debt, a $20.8 million market cap, and $28 million in cash giving them a negative EV of $7.2 million. The company also has a GAAP NAV worth $2.55 per share. That’s a 97.7% increase over this company’s current share price of $1.29. This is on top of over $1 billion in NOLs. If the company can successfully retrieve all or a portion of the money promised to them by Foxconn it could boost these figures substantially.

That being said this court case could take a long time. The longer it takes the more it’s going to eat into Nu Ride’s $28 million pile of cash. If the company ends up losing or not recovering what they believe they are entitled too, it could be materially damaging for Nu Ride. The company might even run out of money before they’re done navigating litigation. While I doubt that the company would go completely bust before they get their final day in court, it’s not out of the realm of possibilities.

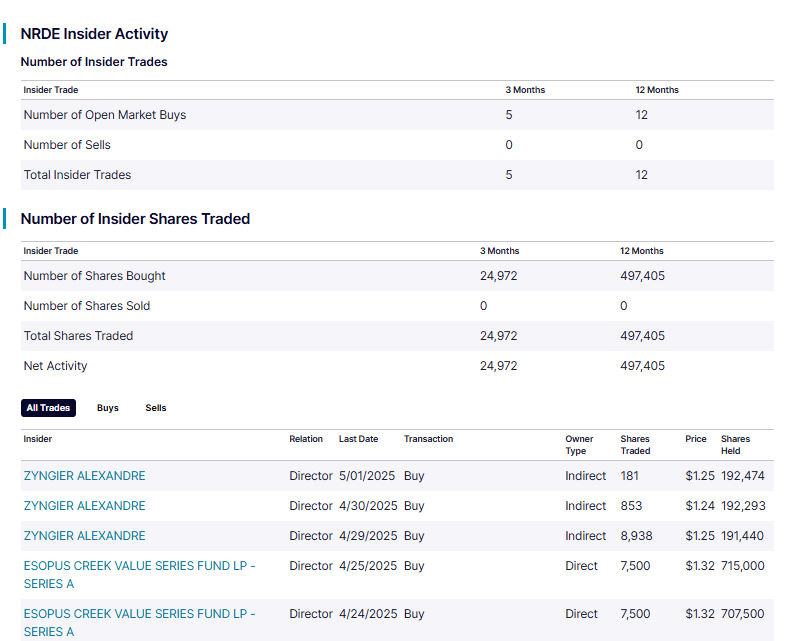

Some good news is that management seems to be confident that things are going to work out well for the company. 2025 has seen a lot of insider buying. That might be as good of an indication as you’re going to get that management believes things will work out in court.

It seems to me like this company is either going to be a big multi-bagger or a complete bust. I think it more likely than not that Nu-Ride does end up bringing another business public, or beginning some other type of operation. With that being said, a lot of value investing is about being risk adverse and you could definitely lose your entire investment in Nu Ride. If you do buy into the company I would personally only lay down what you’re willing to lose.

Disclosure: I do not currently own Nu Ride ($NRDE) but may buy a position anytime after this article is published. This is not investment advice. Do your own research.