This Asset Pays a 9% Dividend For You to Wait—and Could Pop 36%

This Quiet 9.2% Yield Could Deliver a 36% Bonus

What if I told you there’s a stock that’s been quietly paying out a 9.2% annual dividend, has 36% upside potential baked in, and yet no one is talking about it?

Today’s analysis isn’t on a common stock. In fact, you can’t even buy this company’s common stocks through most brokerages. But the real opportunity lies in their preferred shares that are trading at a discount and who’s future dividends are supported by solid cash flow from a well-performing loan portfolio.

On top of those juicy dividends, if the company calls these shares, which it can beginning in 2026, you could lock in a 36.6% capital gain. But this isn’t your average dividend yield trap. This company has $59 million in cash, another $188 million in credit, and is more than covering its dividends with real earnings. In fact, they’re even talking about “strategic alternatives”—language that usually signals a major sale or some type of other shareholder-friendly event.

Want the name of this stock?

Become a paid subscriber to unlock the full report.

Inpoint Commercial Real Estate Income, Inc. ($ICRP)

Inpoint Commercial Real Estate Income, Inc. ($ICRP) ($ICR/PRA) is a REIT that focuses on originating, acquiring, and managing a portfolio of commercial real estate investments in the United States. These commercial real estate investments include floating rate first mortgage loans, subordinate mortgage and mezzanine loans, and floating rate commercial real estate securities, such as commercial mortgage-backed securities and senior unsecured debt of publicly traded real estate investment trusts.

Inpoint’s Preferred Stock

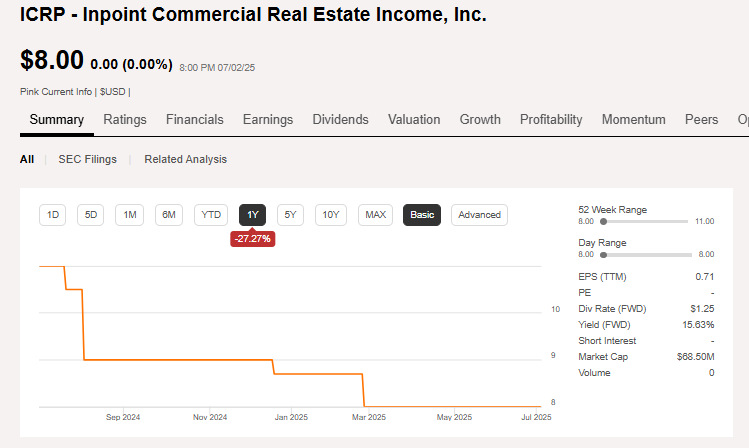

ICRP has six different types of common stock that are very illiquid. I am actually unable to find anywhere to buy their common stock but the company does have some Preferred Stock for sale that comes with an annual dividend of 9.2% and a 36.6% upside when or if the company decides to call the shares. These preferred share are callable starting in 2026.

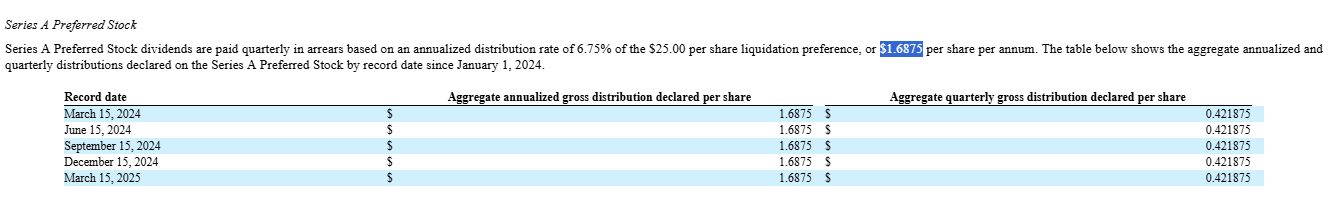

These shares actually pay a 6.75% dividend on a $25.00 preferred share, which is $1.6875 annually. The liquidation preference for these shares is also $25.00. They’re currently selling for $18.30 per share, giving us that annual dividend rate of 9.2% and a 36.6% liquidation upside.

ICRP has been up to date on paying these preferred share dividends and is able to fund these obligations entirely through the company’s cash from operations. The company’s common stocks are trading at $8.00 per share while ICRP’s GAAP NAV sits at $16.35 per share.

Inpoint’s Loan Portfolio

The company’s 104.4% NAV upside is due to the value of the company’s commercial mortgage loans and real estate owned. Much of this commercial real estate debt is backed by the assets that this debt is funding and very often these properties are worth more than the debt backing them.

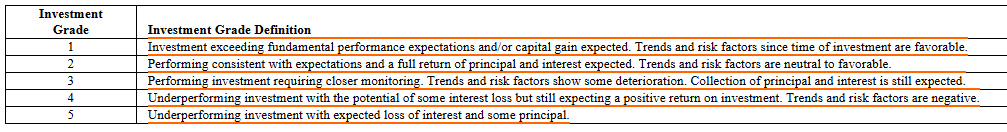

ICRP currently has 25 loans in it’s commercial real estate portfolio. 22 of these 25 loans are current on their contractual interest payments. ICRP has a numerical risk rating system to determine the likelihood that their outstanding commercial real estate loans will get paid off. The ratings range from one to five. With a one rating meaning that the loan exceeds fundamental performance expectations while a five rating means that the company expects to loss interest and some principle on the investment.

Of the three loans currently holding a non-current payment status, two of them have a risk rating of five. In the case of the other loan, ICRP has actively worked with their customer to extend out the maturity and interest payments of the loan and ICRP doesn’t currently expect to incur losses from this customer.

Inpoint’s Operations, Liquidity, Ability to Pay Their Preferred Dividends

ICRP’s operating expenses dropped significantly YOY in 2024, due largely to the company not having any asset impairments and to an 84.7% decrease in real estate operating expenses. While asset impairments are non-cash transactions, real estate operating expenses do draw down your cash pile leaving less for money to pay down debt, pay out dividends or call back those preferred shares. Total operating expenses dropped 60.9% from $26.5 million to $10.4 million YOY from 2023 to 2024.

In 2024 ICRP had a net income of $12.7 million before dividends. The dividend expense for ICRP for their preferred shares was just a little under $6 million. In Q1 of 2025 ICRP’s net income was $3.9 million with a preferred dividend payout of $1.5 million. As of ICRP’s last 10Q the company had $59.1 million in cash and could borrow an additional $188 million from their undrawn lines of credit. In any case, ICRP should have the liquidity to provide their Preferred shareholders with steady dividends for a while.

Will ICRP Call Their Preferred Shares?

ICRP has 3.5 million of these preferred shares currently outstanding. The call price on them is $25.00 per share. That means if ICRP was to recall all of their preferred stock all at once they’d need approximately $88.6 million to do so. I think that ICRP could begin calling back this stock. They definitely can afford it but I am skeptical they’d be in a hurry to do so as a 6.75% interest rate isn’t too bad considering some of the higher risk loans in the company’s portfolio. The company’s financials do talk about “strategic alternatives” when the commercial real estate market improves. In my personal experience this usually means that management is interested in selling their business, whether it be just segments of it or the whole thing. ICRP’s last 10-K stated,

“We are currently focusing on positioning the portfolio to pursue a potential future strategic alternative when capital market conditions have improved, in order to maximize stockholder value and potentially provide our investors with access to some level of liquidity.” - ICRP’s 2024 10-K

That sounds to me like ICRP is trying to position itself to sell off at least part of its business to fund some share buybacks for the company’s shareholders that have been holding onto these illiquid shares for a while now. Even if ICRP was to just resume their buyback program for their common stocks, the good news would probably lift the price of the preferred shares too as this signals the company might move on to calling up its preferred stock in the future. Investors who bought in at $18.30 could enjoy a decent upside, all while getting paid a 9.2% dividend to wait and see. If these preferred shares do get called or their price does shoot back up anywhere near the $25.00 per share range you’re looking at a gain hovering around 36%, not bad!

Conclusion

It’s not too often that you find an income generating asset yielding a 9%, backed by real cash flow, trading at a discount.

ICRP’s offers preferred shares paying a reliable 9.2% yield, with the potential for a 36.6% capital gain if called. The company is sitting on $59 million in cash, access to $188 million in credit, and a well-performing loan portfolio. They're even hinting at a possible sale or major restructuring. This news could boost the share price of all of ICRP’s stock including their preferred.

ICRP might not call their shares in which case you’d be stuck collecting a $1.68 annual dividend until you wanted to sell the shares for whatever they’re going for at the time. ICRP does have the cash to keep paying out those dividends though and that helps out immensely to reduce the downside risk.

Disclosure: I do not currently own shares of Inpoint Commercial Real Estate Income, Inc. ($ICRP) but may buy a position anytime after this article is published. This is not investment advice. Do your own research.