This $7M Tech Company Prints Cash, Pays a Dividend, and Nobody’s Watching

I tweeted this the other day:

Found a tech company with 75% gross margins, a $7 million market cap, a pile of cash worth $3.1 million and zero debt. Revenues grew almost 20% last quarter and trading at 5.8x free cash flow. Nice 4.3% dividend yield too.

There isn’t much more to the thesis than that.

The company runs a tech business that I didn’t really realized existed. A super niche model that is seeing significant growth.

Then I dug into the industry and was fascinated.

The company is playing in a $12.6 billion dollar industry, strictly in the United States, that is expected to grow at a 20.8% range until 2030.

The global industry is even higher. A $101 billion industry expected to grow by to $443 billion by the end of 2033 or a 15.9% CAGR.

Growth is being driven by strong ROI and high conversion rates of customers who use the service to sell to their customers. Some sources say that for every one dollar spent, you get a $21-40 dollar return, with 52-70% of customers being influenced to make a purchase after using the service.

40-60% of businesses now use this service as part of their marketing mix and many are planning to increase budgets.

With that industry backdrop, the valuation is even more fascinating.

$7.1 million market cap, $3.1 million of net cash and an enterprise value of just $3.9 million.

Revenues in the past three quarters grew 15%, 15.3% and 18.2%, respectively.

The company has generated free cash flow every year since at least 2014.

Growth looks impressive over the past five years: 17% in 2019, 45% in 2020, 18.1% in 2021, 3.2% in 2022, -1.8% in 2023, 9.3% in 2024 and 18.2% in the last quarter.

But if you look exclusively at the core business, and back out of the three marginal segments the company appears to be winding down and selling, growth is even more impressive: 23% in 2019, 67% in 2020, 25% in 2021, 7% in 2022, 5% in 2023 and 11.2% in 2024.

Despite the small market cap, the company is returning capital via dividends, with a nice 4.3% dividend yield.

Growth is likely to continue and I would not be surprised to see the company eventually bought out by a larger player.

Transactions in the space have historically traded in the 3-4x revenue multiple, implying significant upside.

Overall, the stock is cheap. Insiders own a significant amount of the company giving them a strong incentive to maximize shareholder value. There is real growth from an industry standpoint. And this company is riding this growth wave and dropping cash to the bottom line. At the current price, I don’t see much downside, and significant upside.

Let’s dig in.

FullNet Communications Inc. $FULO operates a tech platform that sends out mass notifications using text messages and automated telephone calls, mostly to churches and non profits. The company also runs a live help desk and colocation services that seem to be in winddown mode and represent a minimal part of the free cash flows. The company has 19,623,917 common shares outstanding and 768,257 preferred units. The preferred units have a $0.12 per share annual dividend, are cumulative and get two votes per share. They can also be redeemed at $1.00, plus all unpaid dividends. With a share price of $0.36, the company has a market cap of $7.1 million. There is $3.1 million of net cash on the balance sheet and zero debt, giving us an enterprise value of just $3.9 million.

Investment Thesis:

FullNet Communications is a cheap tech stock that is trading around 5.8x free cash flow and pays a 4.3% dividend yield. In addition, the company has grown their revenues pretty significantly. On a consolidated basis revenues have grown 9.6% in 2018, 16.9% in 2019, 44.7% in 2020, 18.1% in 2021, 3.2% in 2022, negative 1.8% in 2023 and 9.3% in 2024. In the first quarter of 2025, revenues were up 18.2%.

But if you dig into FullNet’s corporate history, you can see a trend of the company selling off non-core assets and dialing down other marginal segments that generate revenue.

For an example, FullNet used to have a Internet Access Services revenue line, but they appeared to have shut this down in 2023. In addition, the Colocation and Live Help Desk revenue lines have been shrinking for the past decade and now only represent a small portion of the revenue base.

So if you backout of those marginal revenue line items, the growth rate of the core business, mass notifications, looks even more attractive with revenue growth rates of the following: 29.2% in 2018, 23.3% in 2019, 67.3% in 2020, 25.4% in 2021, 6.8% in 2022, 4.9% in 2023 and 11.2% in 2024. The company only provides segment level revenue in the annual reports so we don’t have the growth rate for Q12025, but I am assuming it is higher than the consolidated number.

The industry in which this company operates—mass notifications delivered via text messaging and automated phone calls—is both substantial and experiencing rapid, sustained growth. In the United States alone, the market for mass notification services is currently valued at approximately $12.6 billion and is projected to grow at a compound annual growth rate (CAGR) of 20.8% through 2030. Globally, the market is expected to expand from $101 billion today to $443 billion by 2033, representing a 15.9% CAGR.

This is not a speculative or emerging concept—it is an established, high-ROI communication channel increasingly adopted by organizations across industries. Mass notification systems, particularly those utilizing SMS and voice broadcast technology, have proven to be highly effective tools for customer engagement, emergency alerts, sales promotions, and organizational communications.

The return on investment is particularly compelling. Industry data suggests that for every $1 spent on these services, businesses can expect between $21 and $40 in return. Moreover, customer influence metrics are striking: between 52% and 70% of recipients are motivated to make a purchase after receiving a message via text or phone call. As a result, mass notification is becoming a core component of business communication strategies. Current estimates indicate that 40% to 60% of U.S. businesses already use this form of outreach, with a growing number planning to increase their budgets as adoption accelerates.

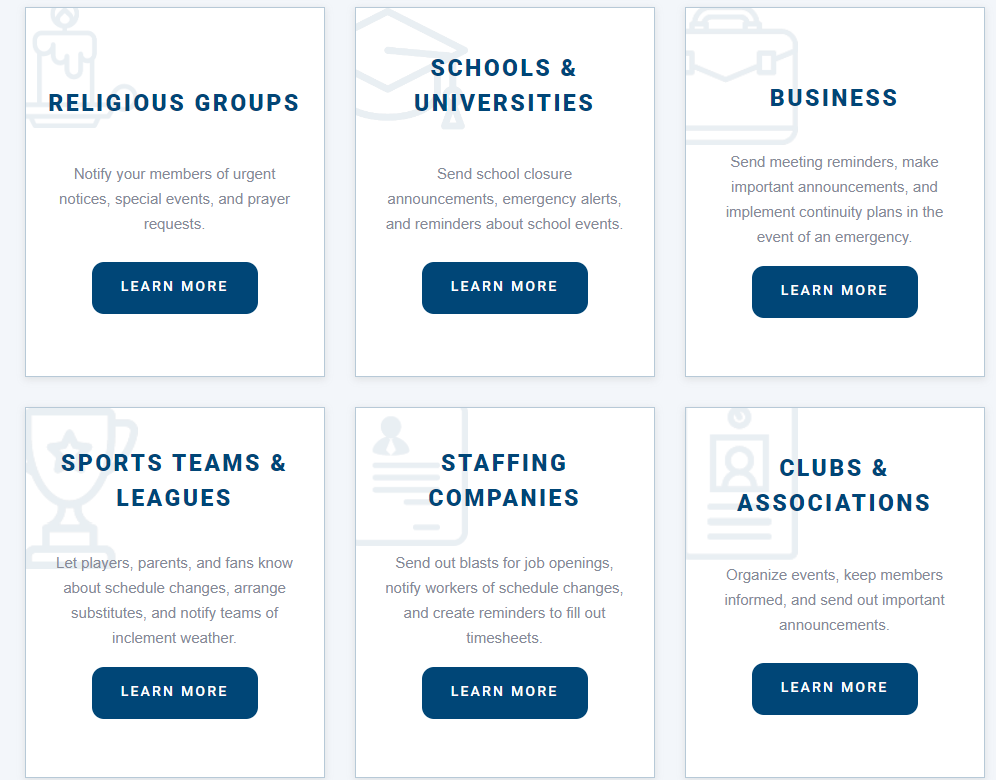

Given the industry backdrop, FullNet is playing in a niche portion of this market, targeting churches and non-profits. If you go to the company’s website, you can see a pricing model and groups they serve.

In addition, the Chairman of the Board, Timothy J. Kilkenny, seems to be extremely active in his local church, via LinkedIn, and is using his personal connections to sell to more churches.

The interesting part of the business is the multiples of what a potential buyer is willing to pay for an asset like this. The biggest public competitor is Twilio Inc. TWLO 0.00%↑. Twilio is a $20 billion market cap and is trading at 4.0x EV/Sales. Other transactions that have happened in the space include the following: Message Broadcast for 14.1x EBITDA, Nexmo for 2.0x revenue, Kaleyra for low mid-single digits EBITDA and IMImobile for 3-4x revenue.

Valuation isn’t hard to back into. Assuming the company continues to grow the mass notifications business at a 10% rate through 2030, we will have revenues of $8 million. The company will likely see operating leverage if they continue to grow revenues at this rate. I think operating margins can hit at least 17.5%. With revenues of $8.0 million in 2030, operating income will be $1.4 million. Capex is minimal and the company is a full tax payer. Free cash flow in 2030 with these assumptions is around $1.0 million.

Utilizing a discounted free cash flow model, with an 11% discount rate and a 3.5% perpetual growth rate (after 2030), I arrive at a price target of $0.73, or 100% upside.

I feel like the biggest risk is someone building a CallMultipler clone. However, they would need to get carrier-approved throughput, stay TCPA compliant, handle thousands of simultaneous calls, serve customers 24/7 with a support desk and avoid getting fined or shut down. The tech stack is easy to code up, but marketing the product and staying compliant provides some barriers to entry. My best guess is if someone wanted to get into the industry the best way is to buy out FullNet.

FullNet Communications represents a rare combination of value, cash flow, dividend yield, and exposure to a growing, high-ROI communications sector. At just 5.8x free cash flow and a 4.3% dividend yield, the stock is already compelling from a deep value perspective. But beneath the surface, the company's repositioning toward its core mass notification business reveals a much more attractive growth profile than the consolidated numbers suggest.

This niche—mass alerts via voice and SMS, particularly for churches and nonprofits—is expanding rapidly, and FullNet is carving out a defensible position through both domain expertise and direct outreach via its leadership. With industry multiples ranging from 2–14x revenue or EBITDA, and with comps like Twilio trading at 4x sales, FullNet’s valuation appears heavily discounted—especially if its core segment continues growing at a double-digit clip.

A conservative forecast points to $1 million in free cash flow by 2030, which, discounted back, implies 100% upside from today’s share price. In a world of expensive tech and questionable cash flows, FullNet offers the rare opportunity to buy a boring, cash-generative business operating in a hot industry.

Disclosure: I do not own FullNet Communications Inc. $FULO but might buy some shares anytime following this article. This is not investment advice. Do your own research.

I think a analysis of several fundamentals as per 31 Dec 2024 could be interesting (hopefully my calculations are correct):

Price earings ratio: 13 - 20 (ok)

Price / book: 4.7 (expensive)

Price / sales: 1.7 (ok)

EV / EBIT: 8 (cheap)

Earnings did go down a bit from EPS 0.05, 0.03, 0.02, 0.02 (from 2021 - 2024)