The $300M Company With a $1.2B Hidden Asset

Deep Value in Plain Sight: A Free Business With a Billion-Dollar Kicker

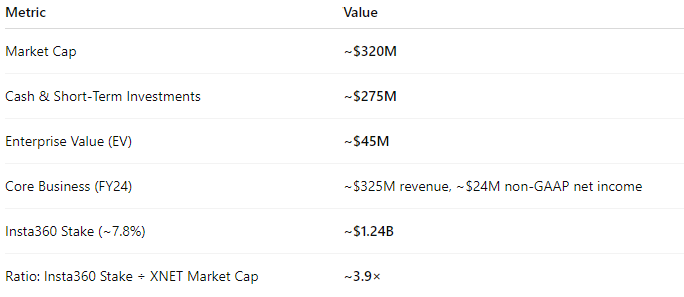

Every now and then, markets create a setup so absurd it almost looks like a misprint. Imagine being able to buy a real operating business — one with hundreds of millions in revenue, millions of paying subscribers, and a proven track record of throwing off cash — for essentially free. That’s the situation here. The company in question runs a modest but profitable subscription and cloud business generating ~$325M in revenue and ~$24M in annual profit, backed by a cash pile of roughly $275M. Yet the entire stock trades at a market cap of only ~$320M, with an enterprise value of just ~$45M once you net out the cash.

And here’s the kicker: that “free” operating business just happens to own a ~7.8% stake in a newly public consumer hardware company that’s now worth ~$16B on the Shanghai STAR Market, and has been the hottest IPO of 2025 in China. That stake alone is worth about $1.2B — three to four times the market value of the parent company. In other words, you can buy the whole business for less than the cash on its balance sheet, and you get a $1.2B equity kicker in one of China’s hottest IPOs thrown in for free.

Nobody on social media is talking about this. There are no viral Twitter threads, no Seeking Alpha hype pieces, no retail message board chatter. In fact, most investors don’t even realize this company owns the stake — and the few who do are dismissing it as “paper value” because of Chinese capital controls. But deep value investing is about these exact dislocations: when the market ignores or refuses to price an asset, yet the math is too big to hand-wave away.

What makes this even more compelling is the downside cushion. Even if the equity stake collapsed by 75% — a draconian scenario — it would still be worth ~$310M. Add the $275M in cash, and that’s ~$585M in hard value versus a $320M market cap today. That’s nearly double your money without giving a single cent of credit to the operating business that continues to make ~$24M a year.

This isn’t a sexy growth story or a meme-stock narrative. It’s the kind of overlooked, structurally mispriced setup that gets buried under governance fears, VIE complexities, and general investor disinterest in small-cap Chinese names. But for those willing to step into messy situations, it may be one of the most asymmetric opportunities left in public markets.

Xunlei ($XNET): The Deep Value Case Hidden Behind Insta360

When you invest in a Chinese ADR, you’re usually betting on one of two things:

The core operating business actually earns cash, and

The market hasn’t already “haircut” it to oblivion.

In the case of Xunlei (NASDAQ: XNET), investors get something rarer: a modest but real subscription/cloud company that trades for just ~$320M in market cap and an enterprise value of only ~$45M (after netting ~$275M of cash) — while quietly owning an equity stake in Insta360 worth an estimated $1.2B+ at current Shanghai STAR Market prices.

That means the market is valuing the entire Xunlei operating business at essentially zero (or negative), with shares priced almost entirely as an asymmetric “lottery ticket” on whether the company can unlock its Insta360 stake — one of the hottest consumer hardware IPOs in China this year.

The Corporate Structure: A Familiar China Tech Setup

Like many PRC internet firms, U.S. investors don’t actually own the Shenzhen operating company. Instead, you hold shares in a Cayman holdco, which consolidates the mainland opco via VIE contracts (in this case, Shenzhen Xunlei Network Technology Co., Ltd.). Each ADS equals 5 common shares.

The Cayman registered office is at Maples Corporate Services, Ugland House, while management operates out of Xunlei Plaza, Baishi Road, Shenzhen. Standard, if uninspiring, for a China ADR.

The Business Today: Modest, Cash-Generative, and Shrinking

Xunlei’s core operations span three buckets:

Subscriptions: ~6.38 million paying users as of Dec 2024, ARPU ~RMB 36.6/quarter. FY24 revenue: $133.7M, high-margin and sticky.

Cloud computing: Distributed CDN/edge services (Nebula/StellarCloud). FY24 revenue: $104.6M, down −15% y/y.

Live streaming & IVAS: Now focused mostly overseas after downsizing domestic operations. FY24 revenue: $86.1M, down −29% y/y but showing a Q4 rebound.

Total FY24 revenue: $324.4M. On GAAP terms, they barely broke even ($0.7M profit), dragged down by a goodwill impairment. On a non-GAAP basis: $23.9M net income, with Q4 gross margins at 51.7%.

Q1’25 revenue ticked higher to $88.8M. Cash has been deployed toward the Hupu acquisition (sports community platform), loan repayments, and buybacks.

This is not hypergrowth anymore. It’s a modest subscription + cloud business that throws off cash, but trades like a company in runoff.

Management

Jinbo Li – Chairman & CEO

Appointed in April 2020, Mr. Li has held the top leadership roles for over five years now.

He’s a serial entrepreneur with deep roots at Xunlei: he helped build its core R&D team between 2004–2009 before briefly departing and founding Itui International in 2014.

His tenure, ownership (~2.1%), and visible commitment all signal stability.

Yubo Zhang – Director & President

Holds dual leadership titles and has been in these roles since 2020.

Previously served as CEO at Beijing Nesound International Media Corp., demonstrating executive experience beyond Xunlei.

Naijiang (Eric) Zhou – CFO

Serving as CFO since September 2017, Eric Zhou brings nearly eight years of continuity and financial leadership.

He holds extensive experience across corporate finance, investment diligence, and past interim roles at ChinaCache and Sutor Technology.

His education (including an MBA and Ph.D. from UT Austin plus CFA charter) further underscores credibility.

Headquarters: Shenzhen. Registered office: Cayman. Nothing fancy, but they are long-tenured and have kept the lights on.

The Crown Jewel: Xunlei’s Stake in Insta360

Here’s where things get interesting.

Xunlei owns ~7.8% of Arashi Vision (Insta360), the global leader in 360° and action cameras. The company went public on Shanghai’s STAR Market on June 11, 2025, in one of the hottest tech listings of the year.

IPO price: ¥47.27 → day-one surge to ~¥180 (+285%).

August 2025 price: ¥287.99.

Shares outstanding: ~401M.

Market cap: ~CNY 115.5B (~US$16B).

That makes Xunlei’s stake worth ~CNY 9B (~US$1.24B).

For perspective: XNET’s current market cap is only about ~$320M, with an enterprise value of just ~$45M once you net out ~$275M in cash. That means the market is pricing the whole subscription + cloud business at essentially zero (or negative), despite generating ~$24M in non-GAAP net income last year.

The kicker: Xunlei’s Insta360 stake alone is worth nearly 4× its market cap. If the company were ever able to unlock and distribute even part of that value, the upside from today’s share price could be 200%–300%+ without assuming any growth from the core business.

Insta360 Is Real — But Exuberantly Valued

Skeptics will ask: “Is Insta360 another Chinese fraud?”

Short answer: No.

Real global brand: Products sold in Apple Stores, Best Buy, Amazon, Costco.

IPO on STAR Market: Full CSRC-approved prospectus, audited financials.

VC pedigree: Backed early by IDG Capital and Qiming Venture Partners.

Founder/CEO: JK Liu, Shenzhen-based, Forbes-profiled.

Financials (RMB):

2022 revenue: ¥2.0B → 2023: ¥3.6B → 2024: ¥5.6B (+53%).

2024 net profit: ~¥995M.

2024 GM: 52.2%.

Valuation today: ~21× sales, ~116× earnings. That’s nosebleed territory for hardware. To justify it, Insta360 would need to nearly quadruple revenue in 3 years while holding margins.

It’s not fake, but it’s priced like perfection.

Why Is XNET So Cheap?

VIE discount: Foreign investors only hold a Cayman entity; Beijing could always pull the plug.

Governance discount: Management has a history of chasing fads (see: 2017 blockchain “LinkToken” fiasco).

China small-cap ADR curse: U.S. investors often mark these down to liquidation value regardless of cash.

Liquidity trap: Xunlei can’t sell Insta360 shares until lock-ups expire, and even then, cashing out requires SAFE approvals.

The result: the market values Xunlei as if the core business is worth zero and the Insta360 stake might never be monetized.

The Deep Value Setup

At today’s marks:

Core business → ~$325M in revenue, ~$24M in non-GAAP profit.

Cash & short-term investments → ~$275M.

Insta360 stake → ~$1.2B+ (3–4× Xunlei’s entire market cap).

Even after applying steep discounts for lock-up, capital controls, and governance risk, the asymmetry is glaring. If management can unlock even part of the Insta360 value — or if the market begins to recognize it — XNET rerates.

And here’s the kicker: even if Insta360’s market value fell by 75%, Xunlei’s stake would still be worth ~$310M. Add the ~$275M in cash, and you’re looking at ~$585M of value against today’s ~$320M market cap. That’s still ~83% upside — before assigning any value to the subscription/cloud business that generates ~$24M a year in profit.

This is why XNET screens as one of the most asymmetric setups on NASDAQ today.

Risks

China risk: VIEs can be voided overnight.

Insta360 valuation risk: Trading at 20× sales and 116× earnings — multiples can collapse.

Governance risk: Past history of chasing trends. Management may squander value.

Liquidity risk: Insta360 stake is “paper value” until monetized.

Bottom Line

Xunlei is not a sexy growth story. It’s a cash-yielding subscription business stapled to an illiquid but extremely valuable equity stake in one of China’s hottest consumer hardware companies.

Right now, the market cap is dwarfed 3–4× by the Insta360 stake alone.

This is classic deep value asymmetry: if management does nothing, you still have a modest subscription business with real cash flows. If they unlock Insta360, you could see multiples of upside.

It’s messy, it’s China, it’s small-cap — but for the patient, it may be one of the most undervalued lottery tickets on NASDAQ.

Disclosure: I own Xunlei Limited $XNET. I will buy or sell my shares anytime following this article. This is not investment advice. I am not an investment advisor. Do your own research.

There are some risks associated with Chinese companies;

- there have been a large number of frauds of Chinese firms in US

- legal proceedings in China are pretty much futile,

- There are also problems transferring cash abroad. If a company cannot transfer any cash to the United States, the stock may be worthless.

- There have also been efforts to remove such companies from the US market altogether. I think that inspections of the auditor in China are still not possible by US authorities.

- VIE structures and high cash balances without substantial dividends are red flags.

That does indeed appear to be significantly undervalued. However, there are many similar companies in Hong Kong that are extremely cheap. Confidence in China is evidently very low.