Sitting on a Backlog, Undervalued, and Overlooked

Deferred Revenues Could Spark a Rare Profit For This Nanocap

The company I’m writing about today has just made a large investment in their future. They have a large backlog of services to perform and once these new assets come in, they can put them straight to work. The services this company provides benefits a wide variety of endeavors including carbon capture and sequestration projects, oil and gas drilling, and potash mining. This company hasn’t exactly displayed rockstar operating performance and has lost money every year this past decade. Now things might just be changing as there’s signs this company just walked into a lot of new business.

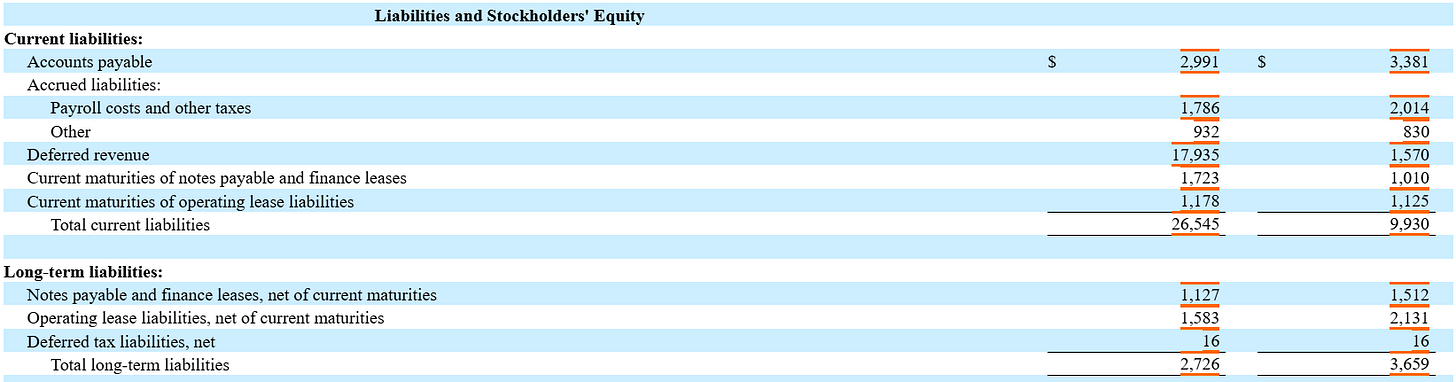

This company has an extra $17.9 million in deferred revenues that have popped up in the liabilities section of the their latest 10-Q, much higher than any other deferred revenue I’ve seen them record. The company’s market cap is only $47.5 million and with $16.2 million in cash and $2.9 million in outstanding debt, this company’s enterprise value is only $34.1 million. Once this $17.9 million worth of revenue is able to be counted as a sales figure this company should see a big boost to their share price.

Dawson Geophysical Company ($DWSN)

Founded in 1952 and based in Midland, Texas, the Dawson Geophysical Company ($DWSN) provides onshore seismic data acquisition and processing services in the United States and Canada. The company acquires and processes 2-D, 3-D, and multi-component seismic data for its clients, including oil and gas companies, and independent oil and gas operators, as well as providers of multi-client data libraries and carbon capture sequestration projects. Its seismic crews supply seismic data to companies engaged in the exploration and development of oil and natural gas on land and in land-to-water transition areas, as well as the potash mining industry.

DWSN’s Operations

DWSN hasn’t pulled in a profit in a long long time.

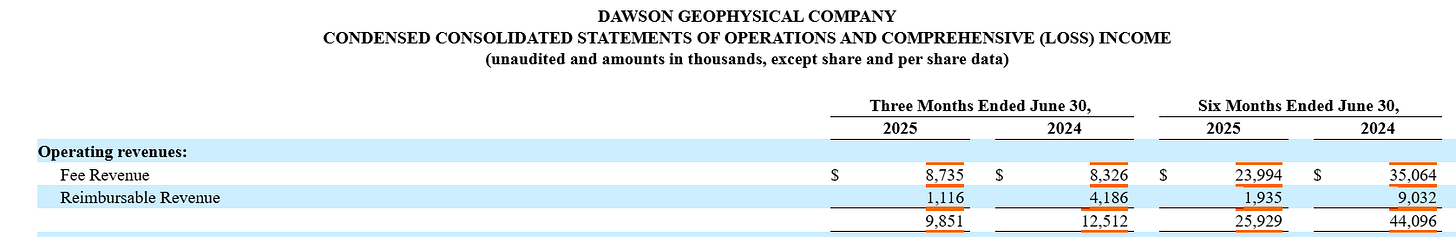

They might be on the brink of pulling in a profit soon though. While DWSN has only made approximately $24 million in fee revenue so far in 2025 vs $35.1 million during the first six months of 2024, the company has $17.9 million in deferred revenue on their current liabilities section of their balance sheet.

This would put the company’s fee revenue at $41.9 million, a 74.5% increase if this deferred revenue ends up being counted as sales this year.

Reimbursable revenue comes from unforeseen job expenses and can vary greatly from job to job. Reimbursable revenues are also either entirely or almost entirely offset by reimbursable expenses and do not add any significant gains to DWSN’s bottom line. Fee revenue on the other hand is pre agreed upon fees between DWSN and their cliental specifically covering how much DWSN will get paid to fulfill its services for these clients. If the company is able to realize this deferred revenue as revenue on the company’s income statement, DWSN could be looking at a profitable year of operations.

Nodes and Seismic Data Collection

DWSN uses what are called nodes to perform their business operations. These nodes are set on the ground. A vibratory source is used to send vibrations into the area of ground that needs to be measured. These nodes then record those vibrations in detail. DWSN can then perform analysis on these signals to get a better sense at exactly what’s going on under the ground at these sites where a company may want to dig for potash or frack for oil or natural gas.

New Working Capital

In the fourth quarter of DWSN’s fiscal 2024 the company began testing newer single node products from various vendors. These newer nodes have the ability to raise the company’s margins through increased efficiency and higher resolution. The company announced recently that it was going to be spending $24.2 million on these nodes. $18.2 million of this will be funded in notes with a fixed interest rate of 8.75% with the rest being paid for in cash.

DWSN plans on having this equipment ready to deploy by the end of August and has several small crews ready to begin utilizing this new working capital as soon as it’s ready. This should help the company speed up the completion of its outstanding jobs and take on more work in the future. DWSN should be sending these crews out on these jobs right about now and hopefully their next 10-Q shows some signs that the ball is beginning to roll on these contracts. DWSN’s next 10-Q will be for the months of July, August, and September. This means that September may be the only month where stronger revenues might begin to pop through but this extra job capacity should shine in DWSN’s fourth quarter financials. Even better, DWSN should enter their 2026 with a lot more capacity for work without their income and cash flow statements showing all of those payments for new machinery.

Conclusion

I think that DWSN is a buy. They seem to have a lot of work lined up for them, new assets to perform this work, and should be deploying crews with this equipment as we speak. While the company is going to have to take on a lot more debt to fund these new nodes, the extra work the company should be able to perform with them will help the company’s bottom line.

I would look at this as a catalyst driven trade. It might take until Q4 of 2025 or even until 2026 for DWSN’s income and cash flow statements to look better as these node expenses, especially the cash transaction part of it should show up on DWSN’s 2025 Q3 statement. Either way if DWSN is able to keep these nodes out in the field making money, the company’s share price should respond.

The company’s revenues have been falling since 2023 and a big swing in the other direction should excite investors. I would sell off my shares of DWSN once the good news of increasing revenues begin to catch the ears and eyes of other investors unless the company specifically states that they’ve been seeing large increases in job inquiries.

Disclosure: I do not own shares in the Dawson Geophysical Company ($DWSN) but may buy shares anytime following this article. This is not investment advice. I am not a financial adviser. Do your own research.