Short and Sweet: Unrealized and Realized Losses on Bonds and Mortgage Backed Securities

Potential Problems For U.S. Banks

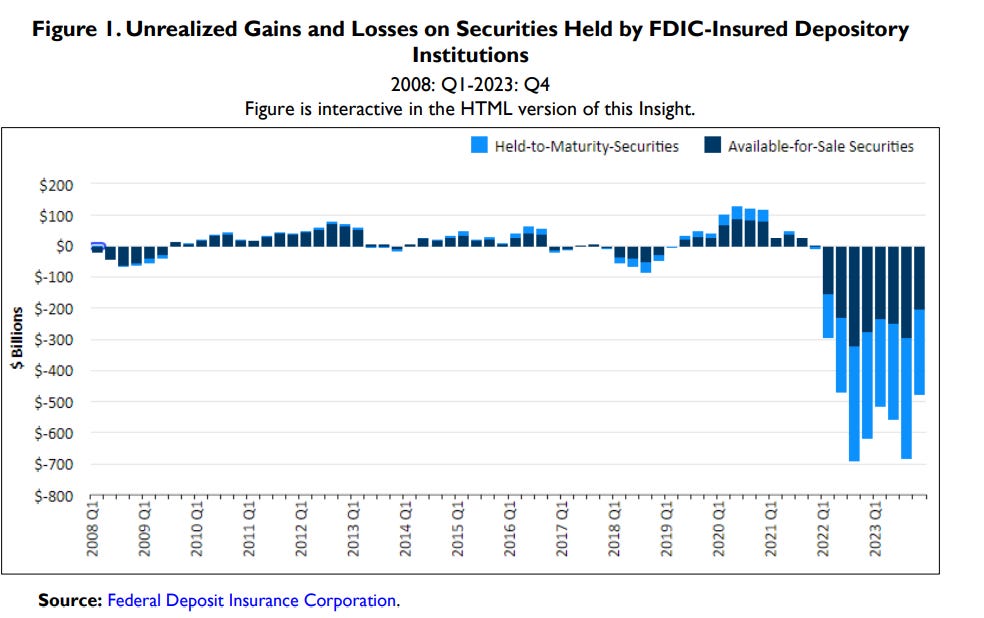

Unrealized and realized losses on bonds and mortgage backed securities are what caused the banking crisis in early 2023. These losses could lead to the banks not having enough assets to back-up consumer deposits and therefore trigger a bank failure.

Congress put a band-aid on this to stop the bleeding by letting these banks take out interest free loans to shore up cash, using these bonds and mortgage backed securities as collateral.

The thought behind this was that once the Fed cut interest rates, the interest rates on bonds would go down. This is important because these high yielding bonds make bonds bought at much lower yields worth much less money, triggering losses on a bank's balance sheet. Interest rate have however thus far ceased to come down. This federal loan program has ended too.

Not trying to paint a doom and gloom picture but these losses will have to be dealt with one way or another. Another bank bail out means printing more money, that means inflation. Letting these banks become insolvent means an enormous economic meltdown. One way or another this will effect the wider US economy. How or to what extent depends on a whole number of variables. Definitely something to watch out for.