POWW: When Tailwinds and Headwinds Collide

Asset Sales and Lawsuits

Today I have a stock that at first glance, appears to be pretty undervalued. Its net asset valuation according the company’s balance sheet makes the stock look like it has some serious potential for some upside. Sitting at $1.75 a share with what appears to be $2.88 per share’s worth of net asset value, AMMO, Inc ( POWW 0.00%↑ ) caught my eye and made me pause my research into other areas of the market. It wasn’t until closer inspection that my exuberance over this company began to subside into a more normalized and realistic set of expectations. Today I wanted to go over why POWW’s high net asset valuation doesn’t excite me quite the same way that other companies with high asset values like MLP 0.00%↑ or ALCO 0.00%↑ tend to do. I will also be exploring if POWW is still a stock worth buying into or just another business worth passing over.

The Asset Value Behind Ammo, Inc.

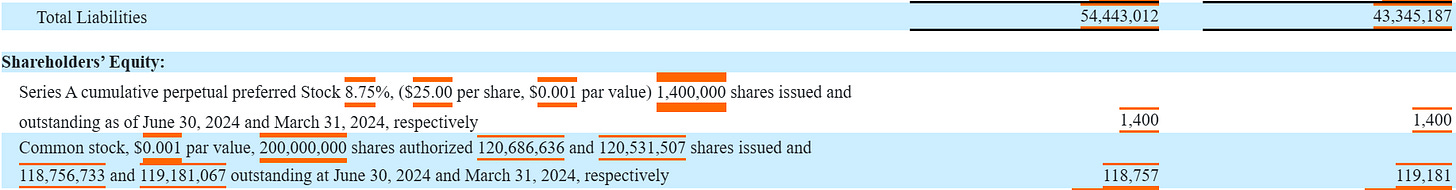

Right off the bat, POWW’s relationship between their assets and liabilities are eye catching.

Once I had begun to look at POWW’s balance sheet a bit closer however, it became more apparent that some of the company’s assets might not be worth as much I’d had hoped they would be.

Of POWW’s $402 million worth of assets, $199 million worth comes in the form of intangible assets and goodwill. Goodwill is just a plug variable for how much a company overpaid for an asset. POWW justifies having this $90 million worth of goodwill on its balance sheet by stating that it consists largely of the growth and profitability expected from their merger with SpeedLight Group I, LLC to obtain the website GunBroker.com, which is an on-line auction marketplace dedicated to firearms, hunting, shooting, and related products. POWW’s $108 million worth of intangible assets are also related to GunBroker and its related tradename, customer relationships, intellectual property, software, and domain names.

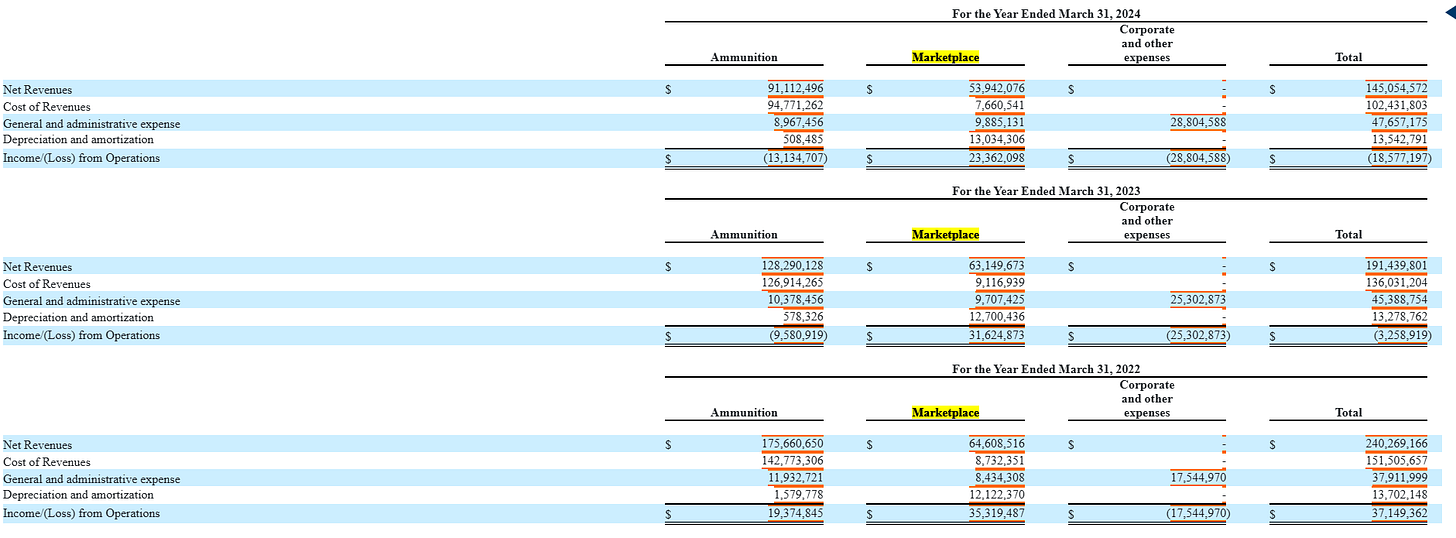

While POWW’s GunBroker sales are the company’s only source of profitable revenue, I think carrying almost 1/4 of the company’s asset value in goodwill seems a bit steep, especially when you consider that sales from GunBroker have been declining for a while now. Due to GunBroker being profitable however, I do believe that POWW’s intangible assets are likely worth a decent amount of money. A $108 million asset valuation on GunBroker would put the value of the brand at just over 3.4X of its EBITDA. I would say this is a fair value for GunBroker although again, as you can see from the charts below, the company’s GunBroker sales labeled “Marketplace” have been decreasing year over year for some time now.

Ammo, Inc. is Selling Off Their Ammunition Business Segment

On January 21st, 2025 POWW announced that they were going to be selling off their ammunitions business segment for $75 million. In an 8-K the company said that:

“On January 20, 2025, AMMO, Inc., a Delaware corporation (the “Company”), together with its subsidiaries AMMO Technologies, Inc., an Arizona corporation (“AMMO Tech”), Enlight Group II, LLC d/b/a Jagemann Munition Components d/b/a Buythebullets, a Delaware limited liability company (“Enlight”), Firelight Group I, LLC, a Delaware limited liability company (“Firelight”, and together with AMMO Tech, and Enlight, collectively, the “Sellers” and each a “Seller”, and the Sellers together with the Company, the “Seller Group”), entered into an Asset Purchase Agreement (the “Purchase Agreement”) with Olin Winchester, LLC, a Delaware limited liability company (“Buyer”), pursuant to which Buyer agreed to (i) acquire all assets of the Sellers related to the Sellers’ business of designing, manufacturing, marketing, distributing and selling ammunition and ammunition components (collectively, the “Ammunition Manufacturing Business”) along with certain assets of the Company related to the Ammunition Manufacturing Business, and (ii) assume certain liabilities of the Seller Group related to the Ammunition Manufacturing Business, for a gross purchase price of $75,000,000, subject to customary adjustments for estimated net working capital and real property costs and prorations (the “Transaction”).” - POWW’s 8-K Dated January 21st, 2025

While this should excite investors as POWW is shedding a business that has done nothing but bleed money almost every year since 2017 it will also lower the company’s net asset value. POWW’s net asset value may drop down to $1.60 per share, although this value could end up being a little bit higher because POWW will be getting rid of a lot of their liabilities through this sale too. That being said, there’s another reason I would be very cautious about purchasing stock in POWW.

A Lawsuit That Could Cause Some Serious Trouble

“On April 30, 2023, Director and shareholder Steve Urvan filed suit in the Delaware Chancery Court against the Company, certain Directors, former directors, employees, former employees, and consultants, seeking rescission of the Company’s acquisition of GunBroker and certain affiliated companies. Plaintiff Urvan’s claims include rescission, misrepresentation, and fraud.” - POWW’s 10-k for the year ending March 31, 2024

Steve Urvan was the person who owned Gunbroker before it was acquired by POWW and now it is looking like he wants a court to rescind that transaction. Obviously if this happens it would absolutely devastate POWW’s ability to continue its business generating revenue through GunBroker, which would be the company’s only remaining business segment after the completion of the sale of the company’s ammunitions business. This lawsuit is taking place in the Delaware Court of Chancery and on May 8, 2024, the Court ordered a case schedule culminating in a five-day trial on July 28, 2025. I will not personally be touching this stock until these initial court proceedings have happened and POWW’s future becomes more predictable. Until then I will be watching closely and seeing how things play out.

Management’s Ability To Manage

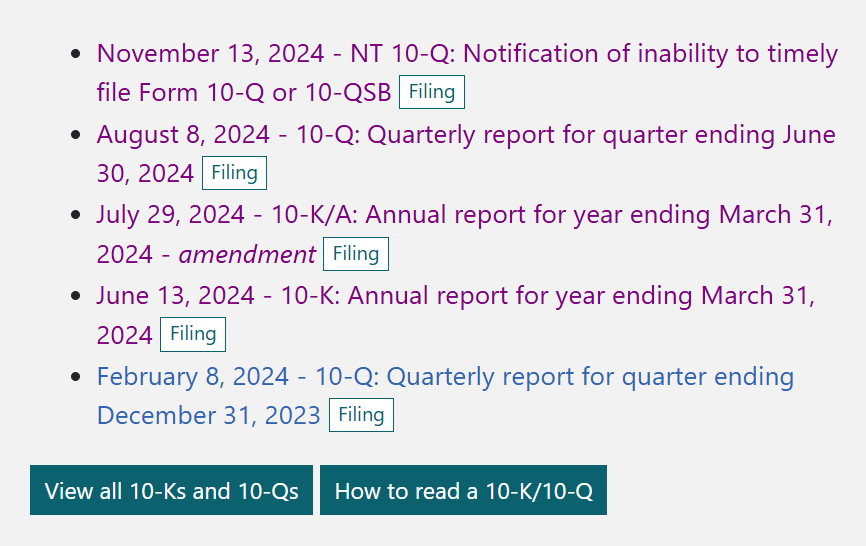

I am not even sure that if POWW was able to sell off their ammunitions business, while being able to keep GunBroker, that they’d be able to turn the business around anyway. A lot of the company’s financial reports are filled with notes such as POWW not maintaining effective internal control over their financial reporting. I have never read through so many financial reports that so consistently had reporting problems. Their SEC page is full of “inability to timely file” notices and amendments to their financial statements.

Problems Add Up

Problems like this really add up and can make me very uncomfortable investing in a company. POWW might see a significant share price rise as more and more news comes out about the company selling off their ammunitions segment but, they could also lose their ability to operate their remaining online marketplace business. Settling out of court would likely be very expensive and even if they are able to win this upcoming lawsuit, they could still incur large expenses from this court case. While members POWW’s management may or may not be found guilty in this trail, just the idea that Steve Urvan, an ex employee and current director of the company, is alleging that the company committed fraud in their acquisition of GunBroker raises some red flags for me.

Final Thoughts

I would not buy into POWW due to the fact that currently, the company is more than likely not worth what the balance sheet says it’s worth. If the company’s GunBroker marketplace does survive this lawsuit it is still seeing a decrease in sales every year, leaving the future of their only profitable business segment very uncertain.

Once POWW’s lawsuit is over and their ammunition business is sold off I will be looking back into POWW. It is hard to say what the company will look like six months from now. If during the company’s business reorganization, POWW’s share price falls well below what might be justified by their revenue or their asset value, then I would consider possibly buying into the company. That disconnect between value and share price would have to be pretty large however, for me to become more comfortable with the company’s management team. You guys can trade on POWW’s upcoming business sale if you’d like, you might do quit well for yourselves. I however am going to be sitting this one out.

A Quick Recap

At first glance it seems obvious that POWW is undervalued with a share price of $1.75 with what appears to be $2.88 worth of net asset value to back it up.

However, it became apparent that some of the company’s assets might not be worth as much what they say they are on POWW’s balance sheet.

On January 21st, 2025 POWW announced that they were going to be selling off their ammunitions business segment for $75 million.

Steve Urvan filed a lawsuit against POWW seeking rescission of the Company’s acquisition of GunBroker. Steve Urvan’s claims include rescission, misrepresentation, and fraud.

This lawsuit could potentially strip POWW of what would be their last business segment after they complete their sale of their ammunitions business.

A lot of the company’s financial reports are filled with notes such as POWW not maintaining effective internal control over their financial reporting and their SEC page is full of “inability to timely file” notices and amendments to their financial statements.

POWW might see a significant share price rise as more and more news comes out about the company selling off their ammunitions segment but, they could also lose their ability to operate their remaining online marketplace business.

This leads me to believe that POWW is too much of a gamble for me to invest in.

I will be monitoring POWW’s progress in case their business becomes more predictable in the future.

I do not own shares of AMMO, Inc ( POWW 0.00%↑ ). This is not financial advice. I am not a financial advisor. Do your own research.

You'll probably get some haters complaining about this write up. Don't listen to them. Part of what you do for us is teach us how to look at and evaluate a company. This write up does that. Not every write up needs to end in a buy recommendation to be valuable to your readers.