My General Investment Philosophy

Why I Invest the Way That I Invest

My General Investment Philosophy

My general philosophy is to invest in stocks that are often overlooked because larger institutional investors are unable to buy shares in these companies without buying up so much stock that they’d be obligated to help manage the business. In many cases these stocks have market caps so small that if a hedge fund wanted to invest in these companies in any way that would have a material affect on their portfolio they would have to buy the whole company. Sometimes buying an entire company still wouldn’t produce results large enough to move the needle on a multi-billion dollar hedge fund.

When it comes to my own investment funds however, I'm not out here working with millions or billions of dollars. I have around $33,000 in a brokerage account. I can buy into these small companies when I find one that’s clearly been passed over or forgotten about by other investors. These stocks are cheap, sometimes trading significantly below NAV (Net Asset Value) and or EV (Enterprise Value). There is a bit more to it however…

The Nuance

Sometimes stocks are cheap because their business deserves to be priced so. An outdated business with falling revenues and no owned assets that’s just digging a hole for itself by taking out debt to continue to operate more and more poorly probably deserves a cheap market valuation. A company that has fallen out of favor with investors due to cyclical commodity pricing or because of a bad year that has no debt and enough cash to ride out their spat of unprofitability might, on the other hand, just be something worth taking a look at. Sometimes I find companies that are at the end of the road as far as being viable businesses but have an enormous surplus of assets (usually land or buildings) that could be attractive to another industry. In these situations the company will often be priced like they are going to go bankrupt even though they’re really sitting on an asset pile worth a ton of cash.

Investing in Smaller Companies

With smaller companies it can take longer for investors to catch wind of a business turn around which gives a small time investor like myself a chance to swoop in and buy shares while the stock is still cheaply priced. One of the only things I do know about the human condition is that people absolutely freak out and overreact about almost everything. Extreme pessimism can turn to extreme optimism. When a company has a bad year the market often overreacts sending the company’s share price far below what may be warranted. On the flip side, once any new news indicating that this bad business environment that the company has found itself in is dissipating, the market will often get ahead of itself driving the share price past what any current conditions might indicate the stock is worth.

Versus Investing in Billion Dollar Businesses

When you invest in big companies these huge value discretions lessen and the window of opportunity to buy into them usually closes much faster than with these smaller companies. This is due to the fact that large hedge funds and investment firms have entire floors of skyscrapers filled with market analysts who do nothing but pick apart every aspect of these companies every day. I can’t compete with that. Management at Apple, Inc. ($AAPL) isn’t exactly gonna talk to a guy with $30k invested into them and I’m never gonna out read and out research thousands of professional analysts with access to more resources than I could ever dream of. That’s why I invest in these small businesses that these big funds won’t touch. You can see value discretions, do a deep dive into the company, see if there’s a real catalyst for their future success, then invest and wait. Usually, eventually, the stock price will catch up to that company’s business performance.

Wrapping It Up

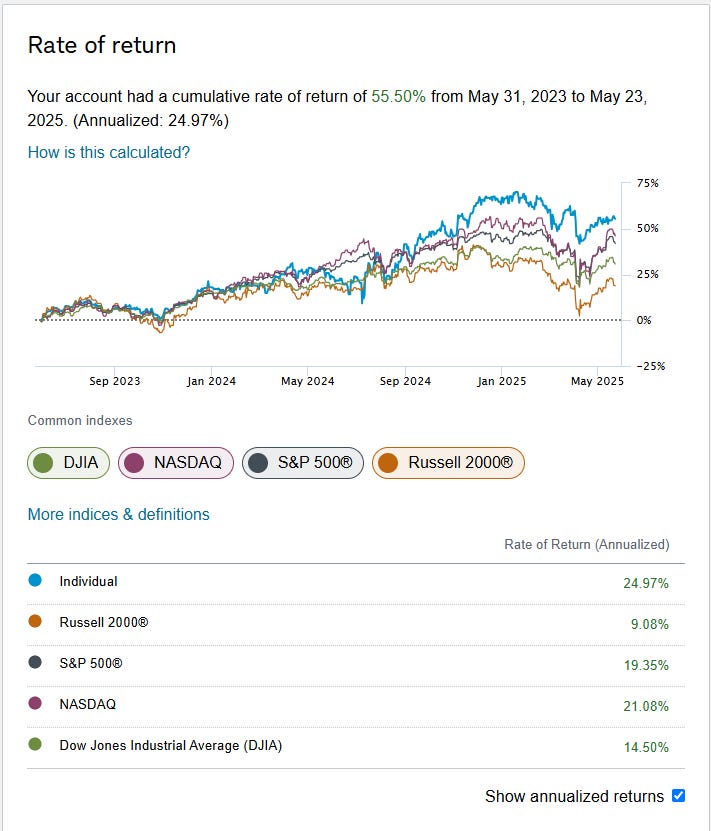

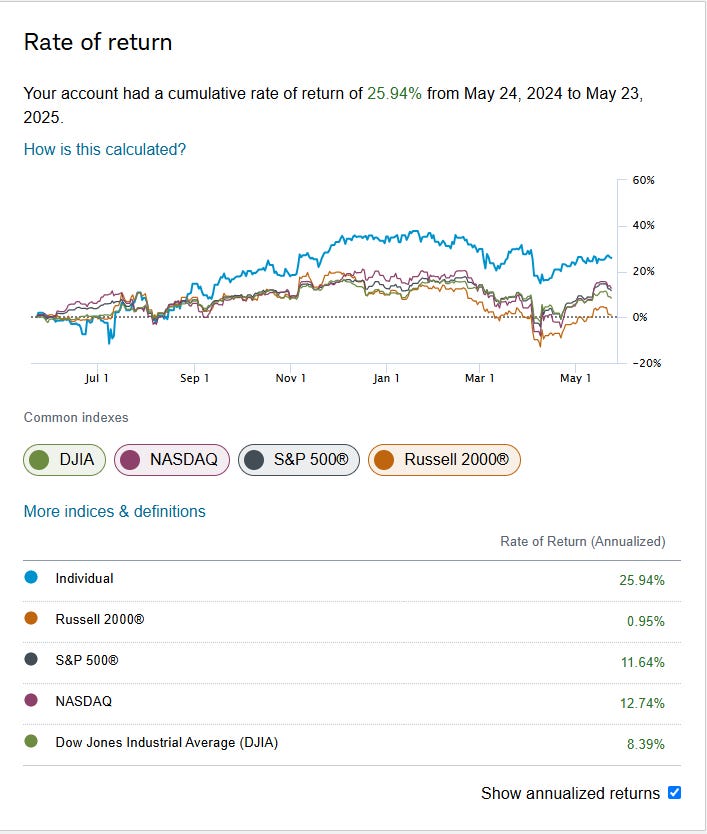

Ever so often, I’d like to reiterate my investment philosophies in my articles. This is mainly to give any of my readers that may be unfamiliar with value investing a little run down of what I am generally looking for when I am scouring the web looking for investment opportunities. My value investing principles aren’t very complicated and most investors probably can’t afford to dump hundreds of thousands or even millions of dollars into the market yet they learn their investment principals from famous investors who do have to invest that much money into a business just to make a dent in the their portfolios. Obviously these big time investors are geniuses at their craft but I personally believe that their potential returns are bogged down by the size of their portfolio and small time investors like myself have an edge by being able to exist in these spaces that big money can’t touch. Of course there are many that disagree with my approach to investing and I’ve seen some volatility in my portfolio at times, including early in 2025, but thus far I’ve had great success. If you’d like to hear more about my specific investments and investing ideas please consider becoming a paid subscriber to The Value Road.

Disclosure: I am not an investment advisor. Do your own research.

This is a great article! One question I have is what are the market cap of the companies that you usually invest in ?

Lol cherry picking dates to look positive. Bro is negative ytd but ain't man enough to say it