Get Exposure To The Cannabis Industry Without All Of The Risk

Leasing Real Estate To Dispensaries

The very first year I began investing I had very little knowledge of what I was doing. All I knew was that the market tended to perform over the long-term and that was good enough for me. In my ignorance I began to dump money into industries that I was sure were going to explode over the coming decade. I put money down on clean energy, technology, and cannabis. The funny thing is, I was the most certain that the cannabis industry would surely take off into an economically powerfully segment of the market. There was one problem though… I didn’t know how to perform proper valuations. I was investing (gambling) on a pure “gut feeling”.

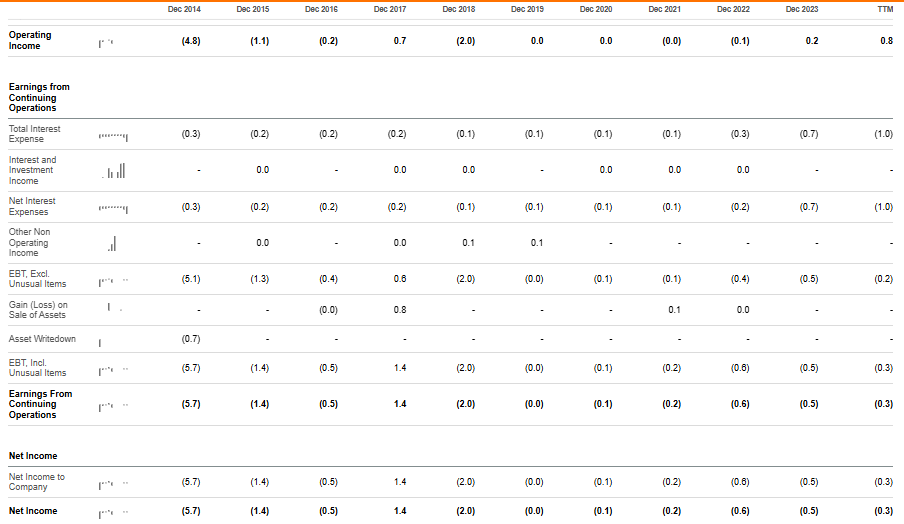

Had I been aware of how to properly valuation on a company, I would have seen that the companies in these ETFs were all overpriced. Most of them were bleeding money and few of them owned a significant amount of hard tangible assets. Fast forward to half a decade later and I’ve not not touched a cannabis stock since. Last week however, I came across a stock that may make me reconsider.

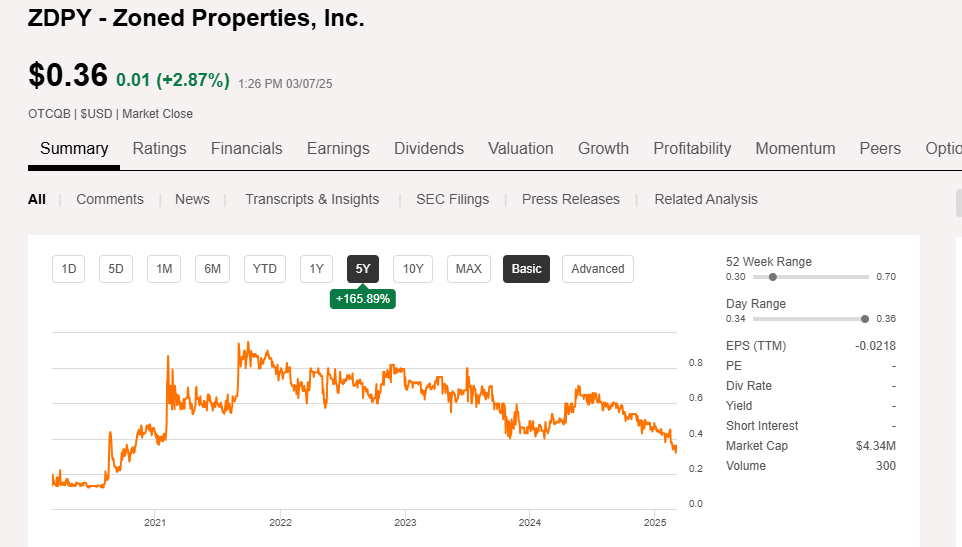

Here’s some key stats.

The company has a market cap of $4.4 million.

The company has an enterprise value of $12.6 million.

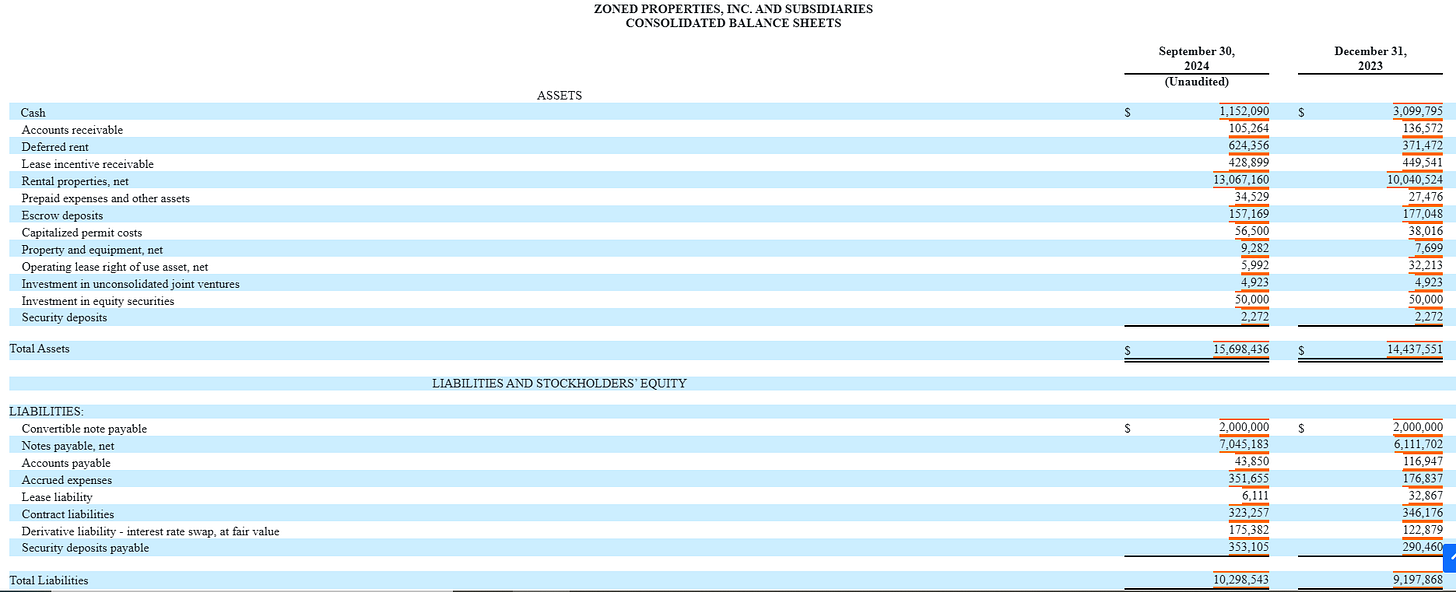

This company has a NAV of $5.4 million.

This company has a 5.7% cap rate (TTM).

They have recently made a large turn around in their business with net cash provided by operating activities coming in at $455K by Q3 of 2024 vs $28K by Q3 of 2023.

It’s currently looking like this company may finally generate a net income with their net income figure sitting at $123K for their first three quarters of 2024.

This company has seen its share price increase 165% over the past five years but is currently experiencing a one year share price decrease of 33.5%.

This company has 12.2 million shares currently outstanding.

The company has $2.0 million in convertible notes payable that it issued to fund operations. The conversion price for these notes is $5.00 a share however and the company’s share price is currently sitting at only $0.36 per share.

There are 2 million shares of preferred stock that the company has outstanding. These preferred shared are owned by Greg Johnston and Alex McLaren. These share’s can’t be converted into common stock they come with a 50-1 voting right over the company’s common stock.

Due to this 50-1 voting superiority over the company’s common stock Greg Johnston and Alex McLaren have the ability to control the outcome of all matters submitted to a vote of stockholders effectively giving them full control over the business.

Zoned Properties, Inc.

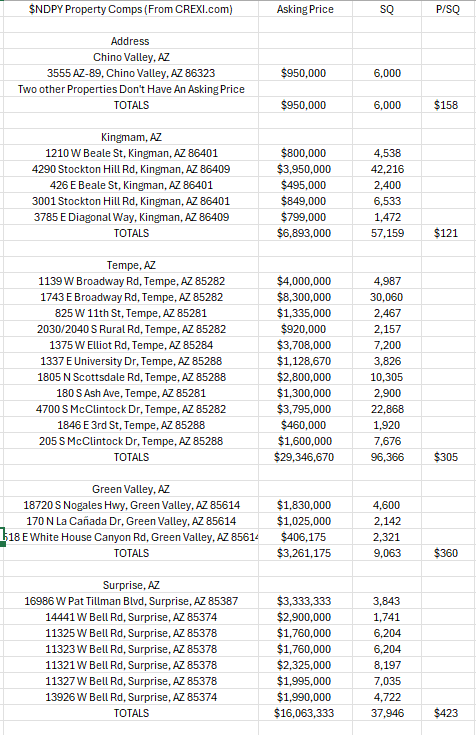

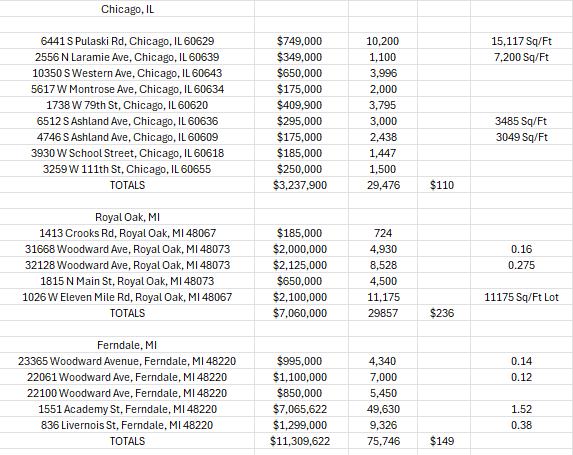

Zoned Properties, Inc. $ZDPY doesn’t actually sell cannabis. Instead they operate their business by leasing real estate to those who operate in the cannabis industries of Arizona, Michigan, and Chicago. Right now the company has real estate located in Chino Valley, AZ, Kingmam, AZ, Tempe, AZ, Green Valley, AZ, Surprise, AZ, Chicago, IL, and Pleasant Ridge, MI.

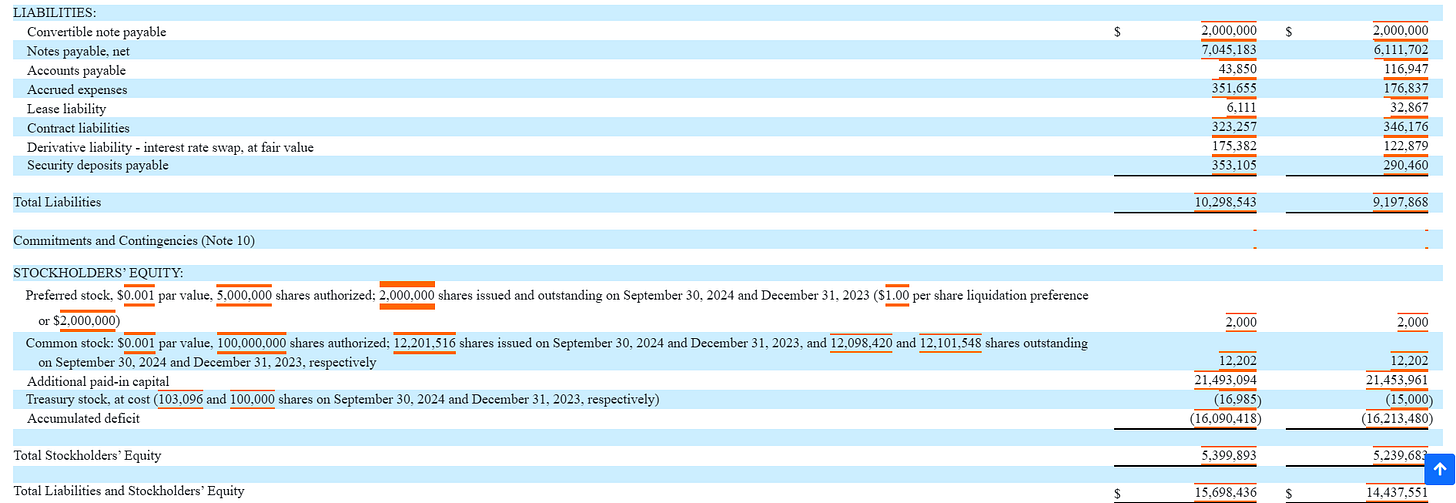

Zoned Properties’ Assets

Zoned Properties has 12.2 million shares currently outstanding. With a share price of $0.36. That puts us at a market cap of approximately $4.4 million. If we subtract from that ZDPY’s $1.2 million in cash and add in the company’s $9.4 million in total debt expenses, we get an enterprise value of $12.6 million. When you look at ZDPY’s asset side of their balance sheet it shows the company’s rental properties valued approximately $13.1 million. This means you could buy the entire company for less than the value of their rental property.

The GAAP net value of ZDPY’s rental properties likely understates those properties actual market values, especially for their “legacy properties”. While it is difficult to find the exact details on things like square footage for all of the company’s properties, you can see just from the potential value of their Chino Valley, AZ location that the company has some value behind the property that it leases.

I messed around on Crexi in order to get a sense of what each of the company’s locations might be worth per square foot should they be sold off. I just looked up the areas where ZDPY has property and tried to compare locations that could be used to perform similar cannabis operations in order to get a sense of what commercial buildings were going for in these locations.

Just a small note to add. I could not find comparable commercial properties for sale in Pleasant Ridge, MI. I instead took my comps from the surrounding Ferndale and Royal Oak areas that butt up to Pleasant Ridge. I live about an hour north of this township and I believe these areas to be an accurate representation of Pleasant Ridge. This area is considered “wealthy” when compared to surrounding areas around what we call the “Greater Metro Detroit” area. The property that ZDPY owns here happens to be right next to the Detroit Zoo and is in extremely close proximity to an indoor concert venue, a popular comedy club, and the huge nightlife scene that is downtown Royal Oak.

ZDPY’s financial statements do specifically list the square footage of their Chino Valley property because their tenant had completed improvements to the building which enhanced its overall size to 97,312 square feet. With my property comps from Chino Valley coming in at $158 per Sq/Ft that would put the potential market value of ZDPY’s Chino Valley property at approximately $15.4 million. That’s $2.4 million more than the ZDPY’s total net property rentals value. The company has properties in seven other cities, one of them being their headquarters. While ZDPY seems to have been focused more on leasing to dispensaries rather than cultivation facilities, the company does have two cultivation properties, one of them being their Chino Valley site. The company had this to say about those properties on their last 10-Q.

“As of September 30, 2024, the Company leases land and/or building space at the six properties in its portfolio to licensed and regulated cannabis tenants in areas with established cannabis regulations and zoning procedures. Four of the leased properties are zoned and permitted as regulated cannabis retail dispensaries, and two of the leased properties are zoned and permitted as regulated cannabis cultivation and processing facilities. The Company considers the two cultivation sites in its portfolio as legacy properties, and may consider selling or leveraging those properties to unlock equity and create capital availability in the future. The Zoned Properties investment thesis has evolved over the years as the cannabis industry has emerged, and is currently focused on investing capital into direct-to-consumer properties, located in state-markets with robust cannabis consumer demand in the industry.”

ZDPY’s 2024 3rd Quarter 10-Q

Even if ZDPY was to only get half of that $158 per Sq./Ft value for their Chino Valley property the company would still pull in $7.7 million. That’s $3.3 million more (75% higher) than ZDPY’s $4.4 million market cap. If ZDPY was to get the full $15.4 million out of just this property that would be $2.8 million higher than the company’s $12.6 million enterprise value.

Cap Rate

I’m going to take ZDPY’s operating income at $677k so far this year and add into that the company’s $64K of operating income from their 2023 Q4 to make this figure a trailing twelve month average. When we do that we get a TTM operating income of $741k. If we take that operating income figure and divide it by the company’s GAAP net rental property value figure we get the company’s CAP rate. That CAP rate ends up coming in at 5.7%. The company is likely selling for an even cheaper CAP rate considering their properties are likely worth more than GAAP accounting would suggest.

The Cannabis Industries’ Access To Banking

One of the biggest, if not the biggest drag on the cannabis industry is its lack of access to banking. It’s basically up to the bank whether or not they want to shoulder the risk of doing business with an industry that is federally illegal. A memoranda written by Deputy Attorney General James Cole in 2013 offered guidance to federal enforcement agencies as to how to prioritize civil enforcement, criminal investigations, and prosecutions regarding marijuana federally. It laid out eight priorities which include.

●Preventing the distribution of marijuana to minors;

●Preventing revenue from the sale of marijuana from going to criminal enterprises, gangs, and cartels;

●Preventing the diversion of marijuana from states where it is legal under state law in some form to other states;

●Preventing the state-authorized marijuana activity from being used as a cover or pretext for the trafficking of other illegal drugs or other illegal activity;

●Preventing violence and the use of firearms in the cultivation and distribution of marijuana;

●Preventing drugged driving and the exacerbation of other adverse public health consequences associated with marijuana use;

●Preventing the growing of marijuana on public lands and the attendant public safety and environmental dangers posed by marijuana production on public lands; and

●Preventing marijuana possession or use on federal property.

Attorney General Jeff Sessions rescinded the Cole’s Memorandum by issuing a new one which urged prosecutors to follow the federal law when deciding their prosecutions. The Biden administration, under Merrick Garland, never updated this policy although Garland did say the administration was actively working on one that would closely resemble Cole’s memo. Obviously the Biden administration is out of the White House and Trump has, at least to my knowledge, not said anything lately about how the federal government would treat cannabis prosecutions. This leaves the banks with uncertainty around the legality of lending money to the cannabis industry. Most banks would rather play it safe and not deal with cannabis altogether rather than take on the risk of being penalized at some point in the future. For this reason banking in the cannabis industry has been massively curtailed. For a while in Michigan you could use an ordinary debit card to purchase marijuana at almost any dispensary. Now however, most businesses have returned to using strictly cash for product purchases.

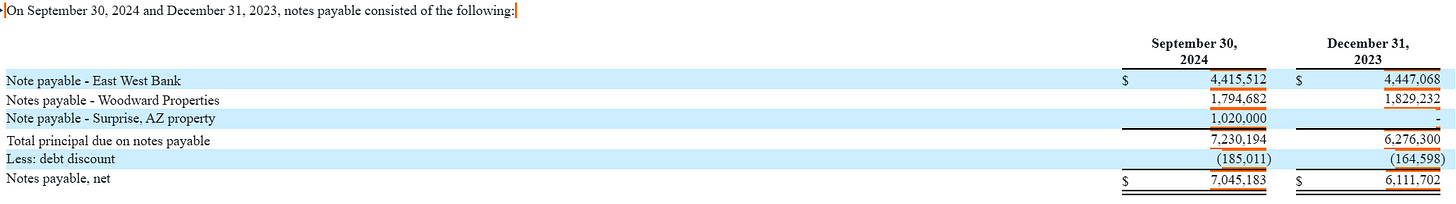

ZDPY’s Debt Notes, Preferred Stock, and Conversion Price

Due to these restrictions the cannabis industry has often had to rely on banking alternatives to partially or sometimes fully fund their businesses. Some of these alternatives such as ZDPY’s convertible note can make investors nervous. ZDPY has funded its operations through a series of notes. One being “notes payable” the other being the company’s convertible note payable.

Investors tend to get nervous when they see convertible notes on a balance sheet and for good reason. A convertible note has a stipulation that if a stock reaches a certain price the holder of this note could have their debt exchanged for equity in the company that issued the note. This has the potential to massively increase a company’s share count. This in turn dilutes shareholder earnings. In the case of ZDPY, their convertible note has a conversion price of $5.00. ZDPY’s share price currently sits at $0.36. Shareholders would experience a 1,289% gain in the price of the company’s stock before dilution became an issue and by that point in time you’ll have made so much money off of the stock that dilution shouldn’t really be a concern anymore. This conversion note comes with a 6.0% interest rate and a maturity date set for January 9th, 2030.

ZDPY does have some banks that have given them access to capital in the form of notes payable. These amount to a little over $7 million and are more or less about what you’d expect from a lending agreement through a bank.

ZDPY’s Preferred Stock

The other issue that investors may have with ZDPY is the company’s control structure. ZDPY has 2 million shares of their preferred stock outstanding. These shares aren’t there to pay its shareholders dividends. While each share of common stock gives its shareholder one vote when deciding things like directors or CEOs, ZDPY’s preferred stock gives its shareholders 50 votes. This essentially overrides all voting power held by the owners of the company’s common stock. There are only two holders of this preferred stock. This is what the company had to say about their preferred stock in their 2023 10-K.

“Each of our preferred stockholders beneficially owns 1,000,000 shares of our preferred stock. Each share of preferred stock entitles the holder to 50 votes per share. In contrast, each share of our common stock has one vote per share. Each of our two preferred stockholders holds approximately 45.5% and 45.8% of the voting power of our outstanding capital stock, respectively. Because of the 50-to-1 voting ratio between our preferred stock and our common stock, our preferred stockholders together control a majority of the combined voting power of our capital stock and therefore are able to control all matters submitted to our stockholders for approval. The preferred stockholders may also have interests that differ from yours and may vote in a way with which you disagree and which may be adverse to your interests. This concentrated control may have the effect of delaying, preventing or deterring a change in control of our company, could deprive our stockholders of an opportunity to receive a premium for their capital stock as part of a sale of our company and might ultimately affect the market price of our common stock.” - ZPDY’s 2023 10-K

ZDPY’s Operating and Net Income

It looks like ZDPY has recently turned a corner and is about to finally produce some net income. So far as of September 30th, 2023 they’ve shown an operating income of $677K and a net income of $123K. That’s a huge improvement over their first nine months of 2022 figures where ZDPY had an operating income of only $91K and a net loss of approximately $153K. If ZDPY does end their fiscal 2024 with a net income it might become an eye catching moment for potential investors.

Conclusion

ZDPY generates cash from its operations and has recently seen a large increase in its ability to do so. The company looks like it’s on its way to producing a net income for the first time since 2017 which would likely excite investors. While ZDPY operates within the cannabis industry, the company isn’t involved directly with cannabis but instead leases its real estate out to businesses that sell or cultivate cannabis. This means that if the federal government were to start cracking down and enforcing the Unites States’ federal ban on Marijuana, ZDPY could pivot its business and use its real estate for other purposes.

If ZDPY were to think that a pivot in its business operations was too much of a headache, they could just sell off their business altogether. A complete sell-off could bring in the value of ZDPY’s market cap a couple of times over. ZDPY’s preferred stock is not an ideal corporate structure for investors but with the company selling at a such a discount I believe this risk is already priced in. If our federal government was to set standards for banking within the cannabis industry ZDPY could see a substantial share price increase just from investors who, after sitting on the sidelines for years, would finally be willing to invest in this industry once the uncertainties around banking begin to ease.

Disclosure: I do not own shares of Zoned Properties, Inc. $ZDPY but I may purchase shares anytime after I publish this article. This is not investment advice. I am not an investment advisor. Do your own research.

This stock doesn't itself grow, process, or distribute, weed. They lease property to cannabis companies under terms that are pretty beneficial to the company. Their leases cover things like property and building improvements which in turn increase the value of their properties.

How do they compare to fintweets darlings like hash.v and leef?