Florida Housing, Hidden Assets, and Free Cash Flow

Is Manufactured Housing The Answer To Florida's Housing Affordability?

Florida is experiencing a long-term population boom that has set the State’s housing market on fire. Median home prices are expected to rise by 3.6% in 2025 and maybe higher. Despite these rising prices, the number of homes sold in Florida has been dropping this year as Floridians struggle with higher interest rates, home prices, and the State’s skyrocketing cost of home insurance.

A series of increasingly catastrophic hurricanes continue to hit Florida year after year. The cost of replacing the homes destroyed by the winds and flooding that these hurricanes produce continues to rise, as does the insurance costs associated with covering these homes. In fact Florida’s home insurance has been labeled a crisis by many media outlets.

The most significant cost increases related to insurance have been heavily centered around coastal areas where the effects of hurricanes are the worst. This has led many Floridians to forego having insurance on their homes or to insure their homes with coverage that, in the event of a hurricane, would not replace the total cost of rebuilding their house. When adding these increased insurance costs to the other problems that the rest of the country faces when trying to buy a home like high interest rates and rising home values, it should be no surprise that some people are being priced out of the area in which they live. The company I am going to talk about today makes low priced manufactured housing, usually farther inland and away from the costal areas most effected by these price increases. I believe that offering the lowest price for a house possible in a state that badly needs affordable housing should be a real win.

Nobility Homes

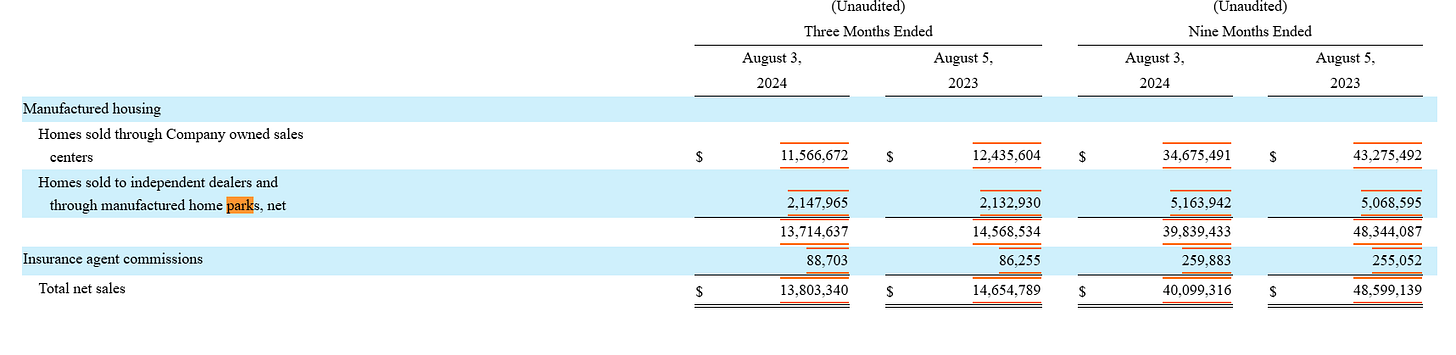

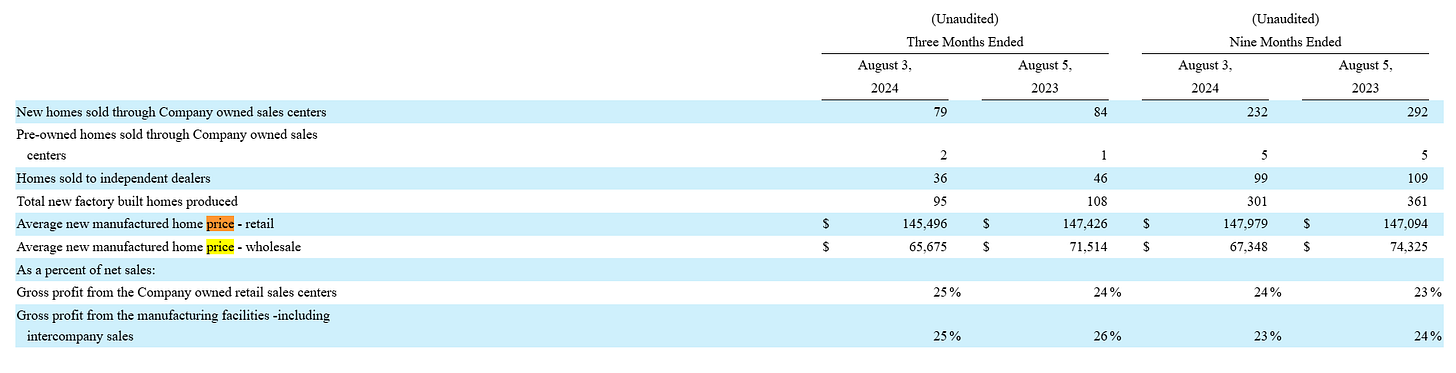

Nobility Homes, Inc. (OTC Markets: NOBH) manufactures and sells manufactured housing to customers in Florida as well as to the southern parts of Georgia and Alabama. NOBH is the only vertically integrated manufactured housing company in the state of Florida. This means that NOBH not only owns the facility that builds these houses but they also own the sales centers where these homes get sold. While the company does also sell to independent dealers and directly to manufactured home parks, the vast majority of their homes are sold through company owned sales centers.

This means that NOBH has a tremendous advantage when it comes to being able to control the price at which they sell their products.

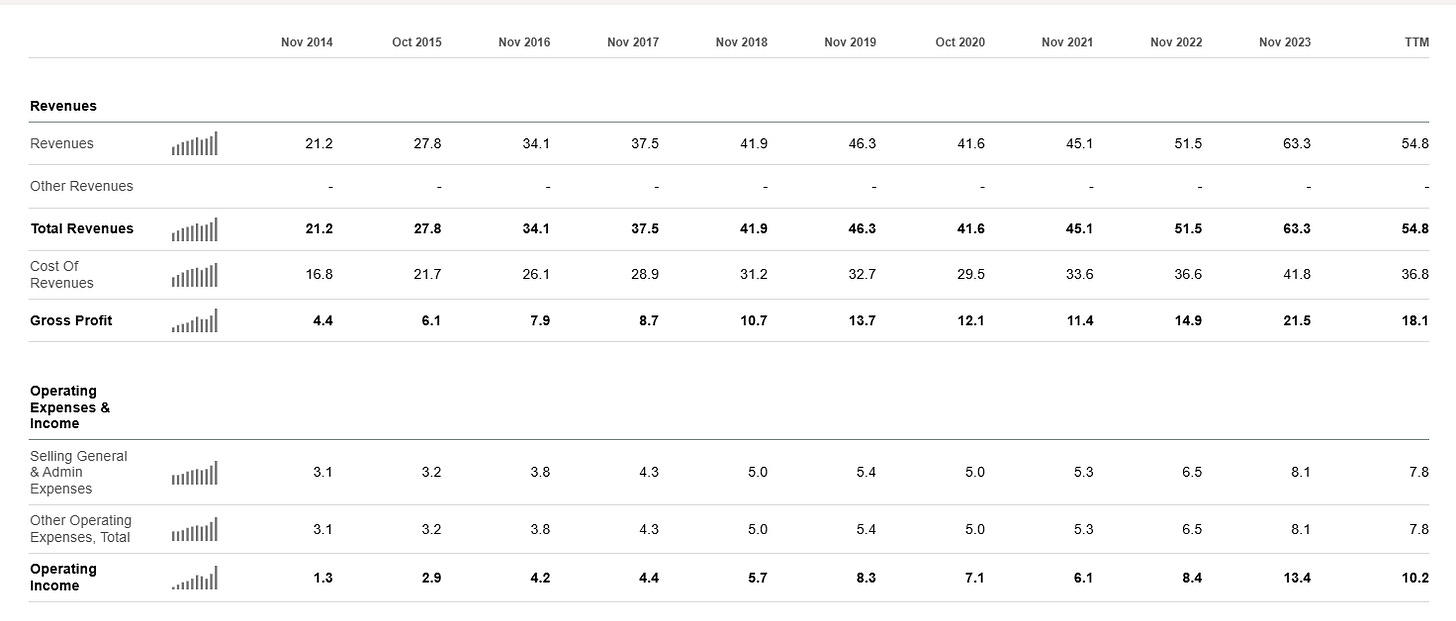

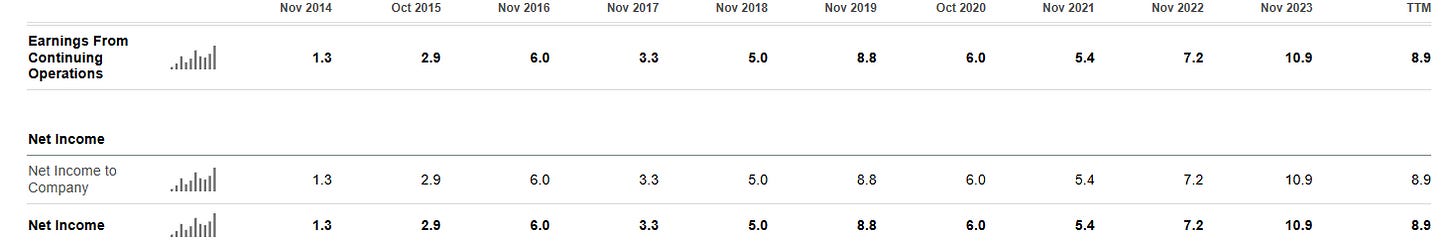

While NOBH has experienced a sales slump over the past year, the company has no debt. While NOBH’s revenues, operating income, and net income may vary from year to year, NOBH does have a history of growing these figures long-term.

NOBH’s Asset Value

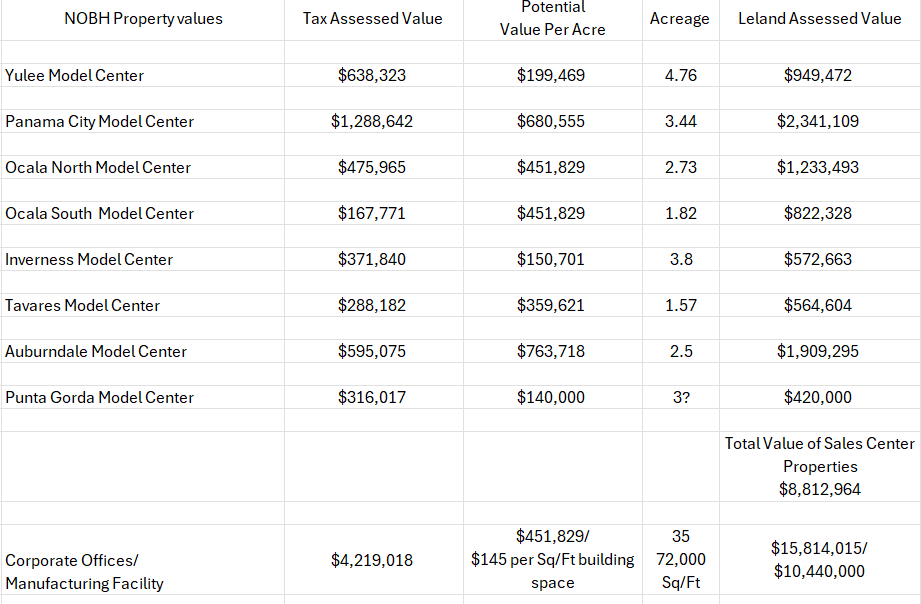

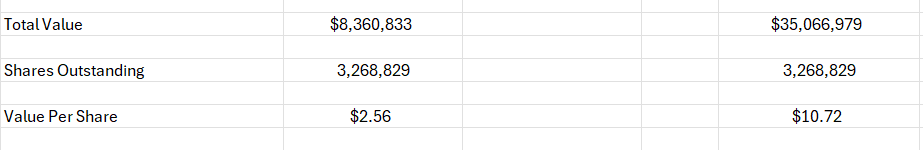

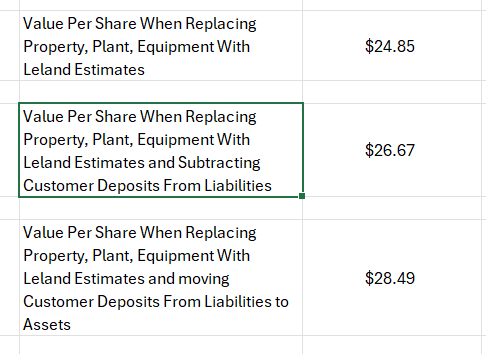

When first looking into Nobility’s net asset value it looks like the business is only worth $16.67 per share, a 40.5% downside from the company’s current share price of $28.00. I then took a deeper dive into the properties that NOBH owns. The company owns a very large 72,000 Sq/Ft manufacturing facility that sits on 35 acres in Ocala, Florida. It also owns the properties for 8 out of its 10 sales centers. Under the properties, plant, and equipment section of their latest 10-Q, NOBH listed a value of $8.3 million which works out to $2.56 per share’s worth of value. Tax assessments usually significantly under value property and when comparing NOBH’s tax assessed property values with their GAAP properties, plants, and equipment section of their balance sheet, these numbers pretty much matched up. It wasn’t until I began looking at what lots of land were going for in the areas directly surrounding NOBH’s sales centers that I began to see how much more money their properties might be worth.

NOBH’s sales centers are pretty easy to understand. They set up a manufactured home on the site that acts as an office for the sales team and staff. The rest of the lot has manufactured homes parked on it waiting to be sold. In my opinion this makes these properties easier to assess than if the company had brick and mortar manufacturing facilities or store fronts on each of these properties. I used empty land lots in the areas close to NOBH’s sales centers in order to be able to compare how much NOBH’s land might be worth in the event that they sold it off today. A lot of NOBH’s sales centers are located at or close to large highway or freeway intersections in Florida and the potential sale price for these properties reflects that.

Just a quick gander on Crexi.com is enough for someone to begin to see that some of these sales center locations could go for more than double what their assessed tax value is. Below is my property value assessment chart.

The total potential value that I came up with for NOBH’s properties ends up at $35.1 million compared to the $8.4 million from their tax assessed property values. That’s a 318.8% difference.

Customer Deposits

NOBH has another section of its balance sheet that makes their total asset value appear lower than it otherwise would be. Under the company’s liabilities section they have an item entitled “customer deposits” with a value of $5.9 million weighing down on NOBH’s net asset value. We can subtract this figure from the company’s liabilities as this is not an expense that NOBH would have to pay back out of its existing pile of cash but just a pile of cash that NOBH can not put onto its asset side of its balance sheet until they can deliver their products to their customers.

If anything, this cash pile of a liability would just be returned to the customer if NOBH was unable to keep their end of the deal. In fact, so long as NOBH is able to keep building manufactured housing, these deposit values should eventually end up as cash on the asset side of NOBH’s balance sheet. In the chart below I have calculated NOBH’s total value per share should their properties be valued at their potential sale value in the market today. This chart also includes a value per share scenario where NOBH’s customer deposits have been removed from their liabilities as well as a scenario where NOBH’s customer deposits have actually been transferred to the assets side of their balance sheet.

When Would It Make Sense To Buy Into NOBH?

As I am typing this NOBH’s share price is at $28.00. Due to the Company’s small share count of 3,268,829 shares, NOBH’s stock price has, as of late, been hovering between $28.00 and $33.00 a share. NOBH usually releases its 10-K in February and when it does, this might drop NOBH’s share price down into a $28.00 or lower range until the company is able to show meaningful year over year gains again. I believe that this price range will represent a potential buying opportunity for anyone that wants to own cheap land in one of the fastest growing states in the country, as well as own a profitable business that appears to be pretty undervalued from a cash flow perspective.

Discounted Cash Flow Analysis

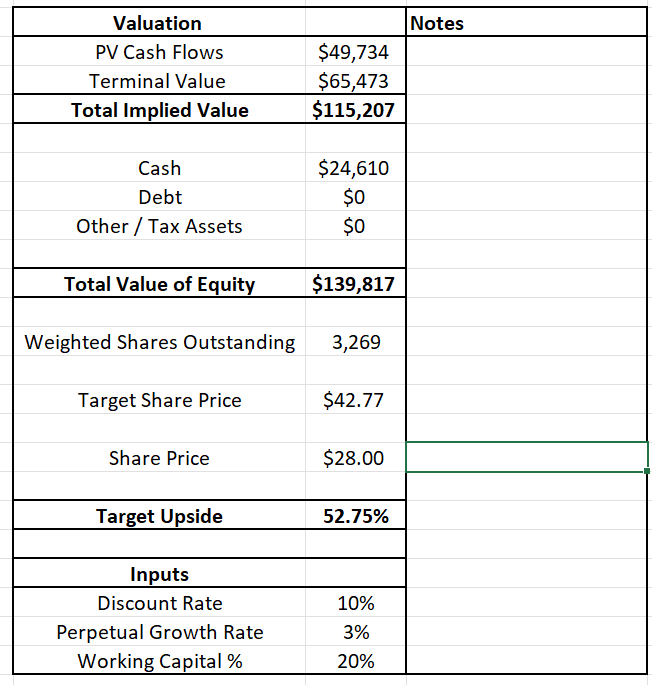

When I ran a discounted cash flow analysis on NOBH, I got some pleasantly surprising and promising results. I set the company’s revenue growth rate at 8.0% YOY from 2025 through 2034, then gave NOBH a 3.0% perpetual growth rate afterward. EBIT margins for NOBH were set at 17.5%, taxes at 25.0%, and the company’s changes in working capital as a percentage of their revenues at 20.0% as homebuilding can be a very capital intensive business sector to operate in. I set NOBH’s capital expenditures at 1.7% of the company’s revenues and set their D&A expenses at $340,000 a year for the next ten years as this was their average D&A expense over the course of the past five years.

As you can see from the chart above I ended up with a 52.75% potential increase in NOBH’s cash flow potential as compared to the company’s current share price of $28.00.

Concluding Thesis

I believe that NOBH is a BUY at or below the share price of $28.00. NOBH’s potential cash flow value is impressive however, this is not the only reason I think that NOBH is a buy. Right now it looks like the company is priced fairly on a net asset basis but I believe that over time NOBH will more than likely experiences a huge increase in the value of their assets, especially on a per share basis.

The first reason for this is NOBH’s property values are likely to continue to rise. Florida’s is still experiencing a population boom despite worries about hurricanes, rising insurance prices, and housing costs pushing people out. The realization that these rising costs are forcing people to move may play into NOBH’s favor. The bulk of these price increases are felt around the costal regions of Florida where hurricane and flooding damage is by far the worst.

In order to seek relief from these hurricane and insurance costs, Floridians may find themselves moving farther inland away from these dangers. To be able to find some relief from the rising cost of buying a home in Florida, more and more residents will likely be forced to consider a manufactured house instead of a traditional site built home. A small silver lining to this is that manufactured homes are built much more sturdily than they used to be, specifically in places like Florida where they now have to meet wind standards and have to be anchored to the ground. I believe that these new population shifts would be tailwinds for increased sales in Florida’s manufactured housing industry. The realization that many Floridians may be forced to move further inland could also create increased competition for these inland properties. This would help to increase the speed at which NOBH’s properties appreciate in value at.

While NOBH’s assets will likely continue to appreciate in value specifically because they exist in areas with rapidly increasing populations, their asset value per share will probably increase much faster than that. NOBH does not pay dividends but they do buy back stock. Over the past ten years NOBH has decreased their total share count by 19.5% from 4.1 million shares to 3.3 million shares. NOBH became a public company in the 1970’s to raise equity in order to be able to expand their business but has since not issued stock and has for a long time, been continuously buying back these shares. If they buy back stock at the same rate over the next decade NOBH’s asset value per share could increase another 20% or 30% without even factoring in how much Florida’s housing and property prices could appreciate over that time period.

Quick Recap

While NOBH seems to be fairly valued from a net asset perspective, currently it looks like they are traveling down a path of asset value appreciation. Part of this has to do with Florida’s demographic shift that’s been favorable to home builders. Part of this has to do with NOBH running a company that doesn’t carry debt (the management team does not believe in taking on debt unless absolutely necessary) and that has been chipping away at buying back their stock for a while now. Combine this with a potential 52.75% upside in cash flow value and I think that these factors converging together gives NOBH a real chance of seeing large share price increases over the coming years.

Disclosure: I am long Nobility Homes, Inc. (OTC Markets: NOBH) and will buy or sell my shares anytime following this article. This is not financial advice. I am not a financial advisor. Do your own research.

Nice write up. I’ve looked at Legacy Housing a bit, it would be interesting to compare these two companies.

I'll take a look into it and consider a write up.