Bottom Fishing

Buying the Dip

Greeting to all of our Value Road friends. Leland Roach here again and today I am going to further elaborate on ways to not lose money investing in the stock market. Last time I wrote about how stocks undervalued on a net asset basis that also have little to no debt can often be found when looking into smaller capitalized companies. These stocks offer quite a bit of protection from an investor losing all of their money. Companies with no debt do not go bankrupt and therefore your chances of losing all your money while invested in them are about as reduced as they could possibly be.

While the share price of a company with a surplus of assets and little to no debt may decrease from adverse business climates, the margin of safety the company has built around itself will give it the flexibility to be able to make adjustments to its operations as needed. This should help to decrease how far the stock’s share price falls. Most importantly, when a company enters into a period of economic downturn this margin of safety in the form of no debt and a lot of assets will help the company recover faster once economic conditions return to normal.

I would recommend that any of our readers unfamiliar with value investing go back and read my two former newsletters on this topic entitled “Welcome to my Newsletter” and “Finding Value Where Others Can’t”. Each of these letters adds a concept of value investing into it. If these newsletters are read in order, our readers should be able to better make the case for why a stock is a buy, sell, or hold all on their own, independent of the stocks we talk about here. Today our lesson delves into another contrarian investment philosophy that many stock analysts would warn against… bottom fishing.

Bottom Fishing

How do you mitigate the risk of a large share price decline after you purchase a stock? Buy it when the price is near a low point compared to the company’s share price history. If a company is suffering a large decline in its share price because of economic factors that are fairly broad in nature and effect not just the company in question but the company’s competitors… this may be a buying opportunity. If the businesses you are looking at have a substantial surplus of assets and little to no debt, you should be able to tell if they are going to be able to weather this particular economic storm. If the share price is sitting at or near its lowest point in a long while and it’s apparent that the company in question can pay its bills, you can oftentimes expect a share price bounce back once problems in these businesses subside.

While it is true that an investor may have to exercise some patience when applying this investing strategy to their portfolio, these kind of bottom fishing opportunities are not that uncommon. Investors normally rush out of a stock once that business starts to fall on hard times. Those investors probably have good reason to sell too. When you follow a trend and purchase a stock at or near all time highs any reduction in price can be both dramatic and sustained. The fear of missing out will make investors blindly buy into “stories” instead of balance sheets and comprehensive statements of income. When this happens people will purchase these stocks no matter the price and no matter how overvalued the stock has become. This creates a large cliff for the share price to fall from.

As was discussed in my last newsletter, once a sell-off begins it can keep going for reasons that do not have to necessarily line up with the economic conditions of the company. People generally speaking, have an enormous disposition to being overly dramatic. They’ll run a stock up too high then sell it down lower than the business’s actual economic reality would suggest is fair. This is because when people panic sell they aren’t taking their time to take a deep dive and assess the economic reality of the business, they’re just worried they’re going to lose a lot of money and want to stop the bleeding. This type of mindset is what creates bottom fishing opportunities. The best way to avoid becoming the panicked investor selling on a dip is to simply buy a stock at a severely undervalued price. When you buy a stock at or near a historic low the distance to the floor price is fairly close but the distance to that stock’s share price ceiling is probably much farther away than buying into companies whose share prices are already at all time highs.

Now let’s take a closer look at some an example of a company that has been down on their luck.

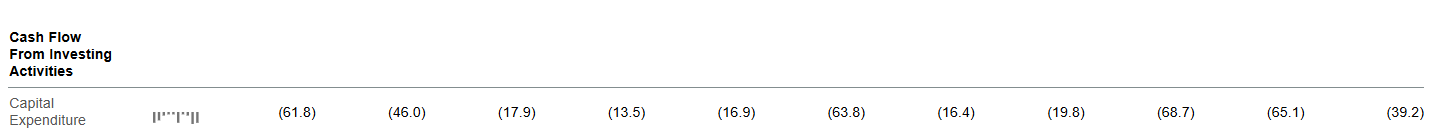

Intrepid Potash, Inc. (NYSE:IPI) has had its stock beaten down over the course of the last couple of years for several reasons. The products it sells (mostly potash, brine water, and agricultural fertilizers) have seen price slumps. The company has spent a lot of money attempting to improve the output of these products, leading to substantial capital expenditure costs. To top off all of this bad news, the company’s long time CEO and Director of the Board Bob Jornayvaz was left incapacitated after a bad polo injury which left him unable to fulfill his role at the company.

Stock Price

While IPI’s stock might not be at an all time low, it is suffering from a multi-year slump due to prices of potash and other fertilizers falling from their latest price peaks which occurred in 2022 as a result of Russia’s invasion of Ukraine. As you can see from the charts below whenever the price of potash spikes, IPI’s stock price spikes dramatically and whenever potash prices decline IPI’s stock crashes.

You can see that an increase or decrease in potash prices results in a rather volatile increase or decrease not only to IPI’s share price but also to the company’s net income figures.

Three Reasons Why IPI’s Cyclical Fortunes May Finally Be Turning Around

IPI’s Potash Asset Revitalization

One of the reasons why IPI’s share price has cratered so much in recent years is that the company was spending large quantities of money on a “potash asset revitalization process” that aimed to significantly increase the company’s potash output. IPI has spent a lot of money on capital expenditures over the past two years revitalizing its assets and making its processes more efficient and now it appears like the first fruits of these efforts are starting to show.

The most expensive parts of this project look to be in the company’s rear view mirror. IPI just completed Phase Two of the HB Brine Injection Pipeline. This project helps the company pump more salt water into its underground caverns. This brine collects potash and other minerals in these caverns which is then pumped back into the surface to fill ponds. These ponds are then left to evaporate in the hot desert sun. Once the water is evaporated the only thing that remains is salt, potash, and other minerals that IPI pumped up from its mines. This new brine injection line upgrade has upgraded wells that will allow the company to pump an additional 2,000 - 2,500 gallons of water per minute into its caverns.

IPI has also placed two continuous miners into service in 2023 to mine another fertilizer chemical called Trio® which makes up the other large portion of the company’s product sales. In doing so IPI has reduced the cost of goods sold for this product from $328 per ton through Q3 of 2023 down to $280 per ton through Q3 of 2024, a 14.6% decrease in cost. While the price of potash was lower in the company’s 2024 Q3 as compared to their 2023 Q3 their potash segment gross margin as a percentage of sales increased 1.9% from 12.4% in Q3 of 2023 to 14.3% in Q3 of 2024 as IPI made improvements to their cost of goods sold.

Global Supply Decrease

Another reason why IPI’s tide may be shifting is that the global supply of potash may be decreasing. Just last week Belarusian President Aleksander Lukashenko said that state-owned Belaruskali should cut production of potash by 10%-11%. These cuts would take place in both Belarus and Russia. Those countries combined make up 35% of global potash production. An estimated 10%-11% production cut would reduce global supply by about 4%. As America’s only producer or potash, IPI would almost certainly see improvements to the company’s margins. If IPI’s efforts to reduce costs and improve its production capacity intersect with an increased demand for potash and fertilizer products, the company should experience sizable gains.

A Potential Management Shakeup

As of October, 2024 CEO and Director of the Board Bob Jornayvaz has officially stepped down due to his unfortunate polo accident he incurred this past April. When Mr. Jornayvaz’s medical leave was first announced shortly after he sustained his injuries, the Board appointed Matthew D. Preston, the Company’s Chief Financial Officer, as “acting principal executive officer” of the Company. Mr. Preston continued to serve as IPI’s CFO while getting an additional $50,000 a month for his services. The following September IPI’s management then made several changes to the company’s bylaws, including several related to how and who gets nominated to various management positions. This did not go over well with the company’s largest shareholder.

Clearway Capital Management LLC owns approximately 9.6% of IPI and in a letter to the company Clearway Capital states very bluntly its dissatisfaction with IPI’s recent business decisions and stated

“Clearway has serious concerns and objections regarding the Board’s recent actions, particularly its intended appointment of a new Chief Executive Officer (“CEO”) without prior consultation, involvement, and support from Clearway and other key Company shareholders, while none of the current Board members hold a relevant shareholder stake in the Company and the attendant financial risk.”

Clearway Capital then goes on to accuse IPI’s management team of failing to carry out Mr. Jornayvaz’s vision for the company. They also accused them of redirecting Mr. Jornayvaz’s shares to insulate themselves from being voted off of the board. This Clearway argues only lines up with the interest of the company’s board members and not with the company’s shareholders and therefore raises concerns regarding good governance compliance with the board member’s fiduciary duties. Clearway Capital then goes on to say

“The existing effectively temporary Board should refrain from making long-term decisions that cannot be reversed, without penalty and disruption, by the Company shareholders or a newly appointed board and management with long term Company interests, or risk facing the consequences of a serious breach of fiduciary duty inquiry.”

While squabbles between the board and shareholders can be a bad thing, I believe in this instance it may be a positive driving force that creates value for IPI’s shareholders. Sneaking in new management without the consent of large blocks of your shareholders isn’t in anyone’s interest except someone on the board. Clearway calling out Matt Preston and IPI’s board members on shady business deals should help draw attention to the problem and help put pressure on IPI to act in the interest of its shareholders. If Clearway is successful in forcing IPI to redirect its efforts back towards running the company in a more shareholder friendly manner, the share price of IPI should increase.

IPI’s Net Asset Value

As with 99% of my stock picks, IPI only becomes a candidate for my investment portfolio if it can pass the basic stress test of having a margin of safety in its net assets. IPI has $806.2 million in assets on its balance sheet, $38 million of which is cash. The company also has an enormous $195.4 million in net deferred tax assets. These tax assets will help the company’s net income figures tremendously when IPI does return to being profitable, simply because their tax bill will be substantially lower which in turn will raise the company’s year over year growth in its net income more than would be the case should IPI be required to pay a normal tax bill.

IPI’s total assets dwarf IPI’s total liabilities of just $125.6 million. Even this figure is actually misleading. When you look at IPI’s balance sheet you’ll notice that $46.1 million of these liabilities are under the row deferred income. While deferred income is a liability because the company can not spend this money until an agreed upon service or product has been provided, this liability isn’t something the company would have to pay for out of its own pile of cash. It’s just a payment that sits off to the side until a future date when both parties of the transaction have fulfilled whatever predetermined product or service that they have agreed upon.

Most of this income is related to a drilling agreement between IPI and an oil drilling company XTO Holdings, LLC to drill on the company’s property. This money should eventually end up on the asset side of IPI’s balance sheet as cash. I would also note when looking at the liabilities on IPI’s balance sheet, that the company does not have any outstanding debt. A company with no debt on the edge of a turn around will be able to keep more of those future profits providing more upside potential for the share price.

If we subtract from IPI’s total asset value of $806.2 million, the company’s $125.6 million in total liabilities, we get a net asset value of $680.6 million. If we took IPI’s deferred income out of the equation and just subtracted the remaining $79.6 million of liabilities from the company’s assets we would get a net asset value of $726.6 million. If we divide IPI’s net asset value including their deferred income by the company’s 12.9 million shares outstanding we get a net asset value per share of $52.73. If we use IPI’s net asset figure which excludes the company’s deferred income from our calculations, we end up with a per share value of $56.29. These asset value values present a 90.5% and 103.4% upside in value as compared to the current stock price of $27.68 per share.

Conclusion

I am long IPI in my IRA account. I believe that the stock has some significant upside potential while having a relatively low downside potential. The massive amount of assets the company owns, coupled with the fact that the company has no long-term debt with a very limited number of other liabilities, gives me the confidence that the company can weather out the volatility and cyclicity that comes with investing in products used in the agricultural industry. While it is reassuring to know that IPI is in a good position to be able to withstand a lot of adversity, the real reason I own this stock is because of the coupling of the company’s asset value safety net with multiple other converging developments that should help boost IPI’s profitability.

The potential for Belarus owned Belaruskali to cut its potash production by 10%-11% would create an increase in global potash demand. IPI’s asset revitalization efforts are beginning to show signs of paying off. This should greatly reduce IPI’s operating costs and increase their total production to maximize profitability when demand increases and fertilizer prices go up. Clearway Capital, LLC stepping in and putting pressure on the company after management acted out in what appears to have been acts of self interest and threatening a breach of fiduciary duty inquiry should put pressure on the board to act accordingly and focus on producing shareholder value for the owners of IPI. All of these factors coming together should foster an environment that is ripe for profitability. It appears that IPI is a company on the cusp of turning their business around from a cyclical swing. If this proves to be the case I believe any one holding shares of IPI bought near the price of $27.00 per share should expect to see some handsome gains on their investment.

Disclosure: I am long Intrepid Potash, Inc. (NYSE:IPI) and will buy or sell my shares anytime following this article. This is not financial advice. I am not a financial advisor. Do your own research.

What is the current situation regarding its business and corporate governance?