Hey,

Here's a newsletter I’ve been following myself called the Money Machine Newsletter.

I’m doing a collaboration with Money Machine Newsletter where I share an article written by Money Machine highlighting what I believe to be some valuable insights on companies and sectors that I don’t necessarily cover over here at The Value Road.

This newsletter covers some of the bigger names in the financial markets. Since I often do not cover these stocks I thought some of my readers interested in investing in some larger businesses may find this newsletter to be useful.

It’s designed to help you become a smarter, independent investor with two things:

Market-beating stocks in a 5-min read. Picked by elite traders. Delivered weekly to your inbox pre-market.

Market, investing, and business insights from insiders and experts outside the mainstream media.

You won’t find the same watered down stock picks like other services. Nor will you find the same regurgitated mainstream media information here. If you like what you read please give Money Machine Newsletter a sub!

I’ll let Money Machine Newsletter take it from here…

This week’s market, investing, and business insights from insiders and experts outside the mainstream media:

Apple’s chokehold just slipped—along with billions of dollars.

Building the operating system for public safety.

Solar’s surprise plot twist.

Visa and Mastercard want in on your wishlist.

And more. Let’s get to it!

Top Insights of the Week

1. 😳 Apple Just Lost Its Grip

The gate just cracked open — and ~$20B is walking out. Apple’s been playing toll booth operator for years. Build an app? Pay up. Use their payment system? That’ll be 30% off the top — the infamous Apple Tax. But a U.S. court just said: enough

Developers can now link to outside payment options (like Stripe, which charges ~2.9%). That means more money in their pockets — and potentially lower prices for you.

Apple tried to soften the blow with a “new” fee — 27% for using external links. The court shut that down too… that’s ~$20B annually back in the ecosystem.

This isn’t just about fees… It’s about freedom.

Developers don’t want to be boxed in. And users don’t want to pay more just because Apple says so. For years, the App Store was the only lane. Now There's a side road.

Stripe’s already rolling out tools to make external payments stupid simple to set up. Expect others to follow fast.

The App Store’s chokehold is loosening — just as AI is rewriting how we use software. The more we talk to our apps instead of tapping them, the more the old system feels like legacy infrastructure.

2. 💰 $2B Taser Empire Expands

Axon’s not just building Tasers. They’re building the OS for public safety. And it’s starting to look like a monopoly…

They’ve got the gear—body cams, stun guns, dash cams. They’ve got the cloud—evidence storage, report-writing AI, live crime centers. And they’ve got the customers—cops, cities, countries, even corporations.

In 2024, the stock surged 130%. That’s not hype. That’s $2.1B in revenue, $1B in recurring cloud subscriptions, and their 12th straight quarter of 25%+ growth.

This isn’t just a tools company—it’s infrastructure for modern law enforcement…

Axon’s mission? Cut gun deaths between police and the public by 50% before 2033.

Their TAM? $129B. Axon’s only tapped ~2% of it.

New clients? Canada’s RCMP and a Fortune 500 logistics firm.

New tools? Smart Tasers, auto-reporting AI, real-time drone surveillance.

Their moat? A full-stack platform so sticky, switching is almost impossible.

$2.1B in 2024 revenue (+33%)

$1B ARR from cloud subscriptions (+49%)

~$10B in bookings backlog locked in (5x current revenue)

International revenue? Up 101% last quarter

The risks…

Valuation’s rich—about 23x sales and 150x earnings. Any slowdown? The stock could get zapped.

Also, this is law enforcement tech. Public opinion shifts. Political pressure brews. And if a Taser fails in a high-profile case, Axon gets dragged into it.

4. ☀️ Solar’s Surprise Plot Twist

For years, solar builders followed one rule: follow the sun. Trackers — big metal arms that tilt panels all day — were the smart move. More sunlight, more power, fewer panels… But the game changed…

Solar panels got cheap. 58% cheaper just in the past ten years. Trackers? Not so much.

So builders started asking: what if we don’t move the panels at all?

Enter, East-West arrays. They don’t move. Half the panels face the morning, half the afternoon. No motors. No moving parts. Just sit, soak up light, and work.

They’re faster to install. Take up less land. Need less labor. And in cloudy places They often outperform trackers… Sure, they use more panels—but who cares when panels are dirt cheap.

The only real downside? Hail. Big storms can crack them. Trackers can tilt away. East-West arrays can’t.

Top 3 Charts of the Week

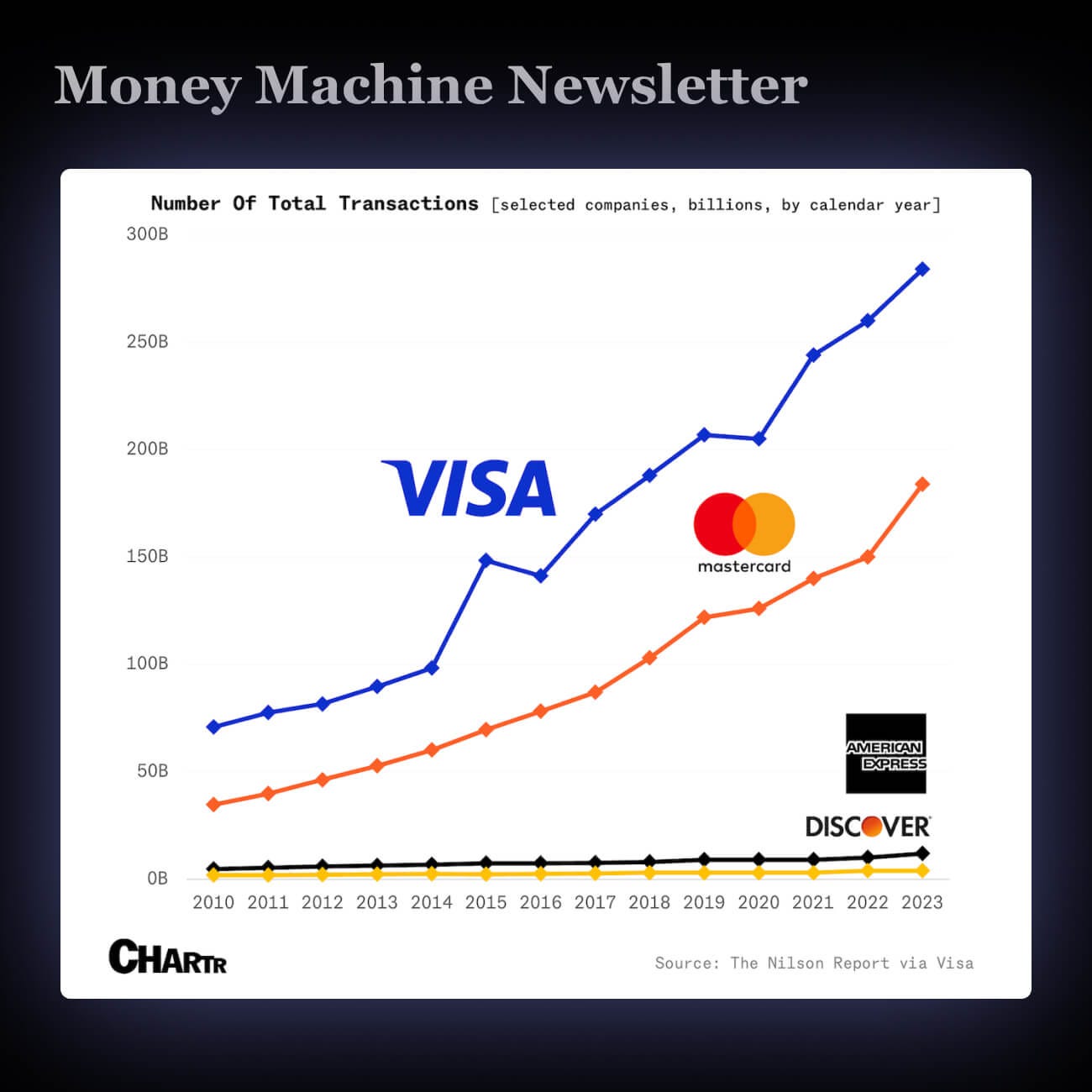

1. 💵 Visa and Mastercard Have Ruled Payments for Years

Visa and Mastercard are adding AI shopping assistants to help you pick outfits and gifts, using tech from OpenAI, Microsoft, and others.

They’re not just processing payments anymore — they want to own the whole shopping journey. From "what to buy" to "how to pay."

These two already handle 80% of U.S. card payments. Now they want your decisions too — not just your swipes.

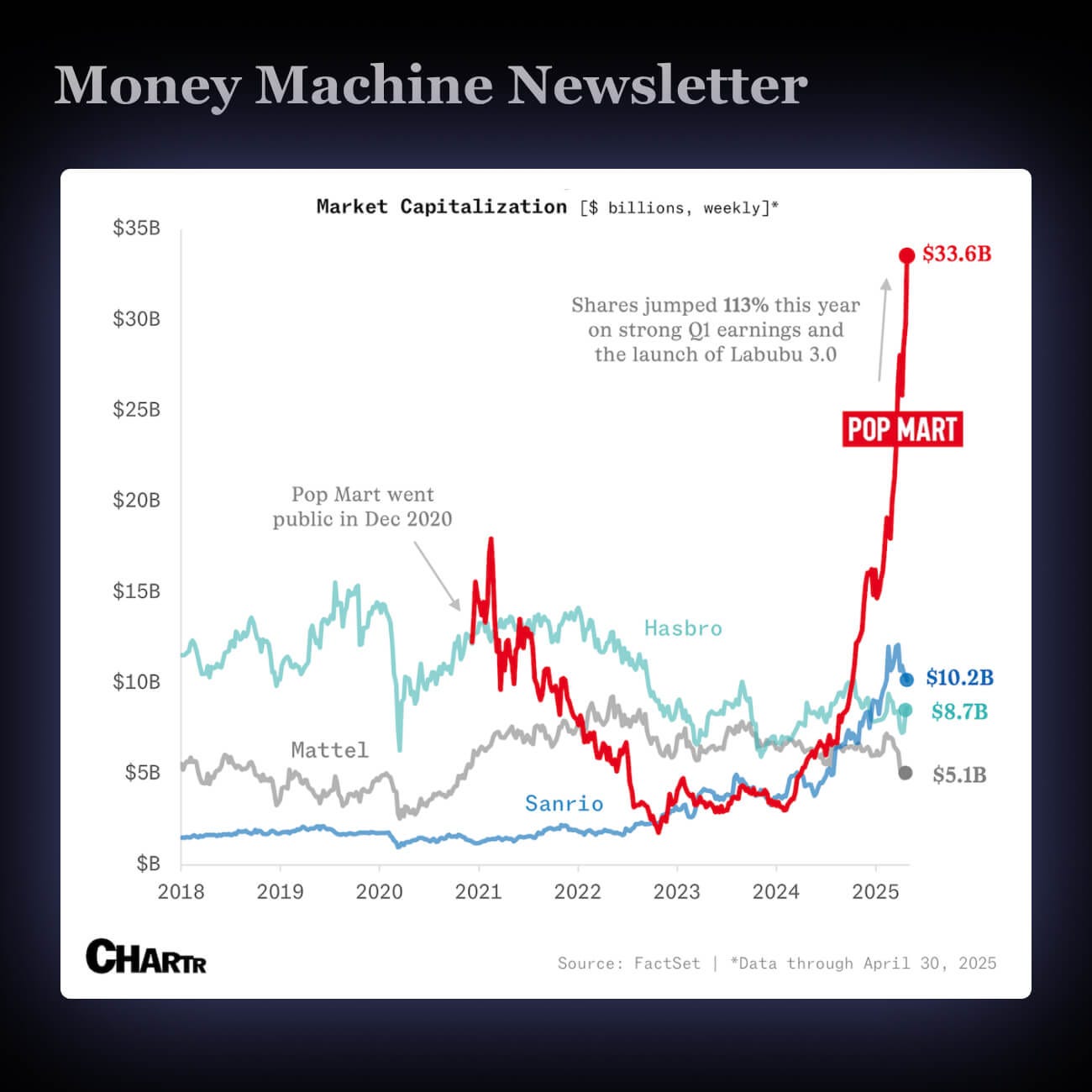

2. 📈 Pop Mart Is Now More Valuable Than The Three Global Toy Giants Combined

A Chinese toy company called Pop Mart is now worth $33.6B — more than Barbie, Hello Kitty, and Transformers combined.

Pop Mart turned designer toys into a cultural obsession. Even with bumpy sales, its stock soared 460% this year, making its founder $1.6B richer in just one day.

This isn’t just toys. It’s proof that new brands — especially from China — can outgrow legacy giants.

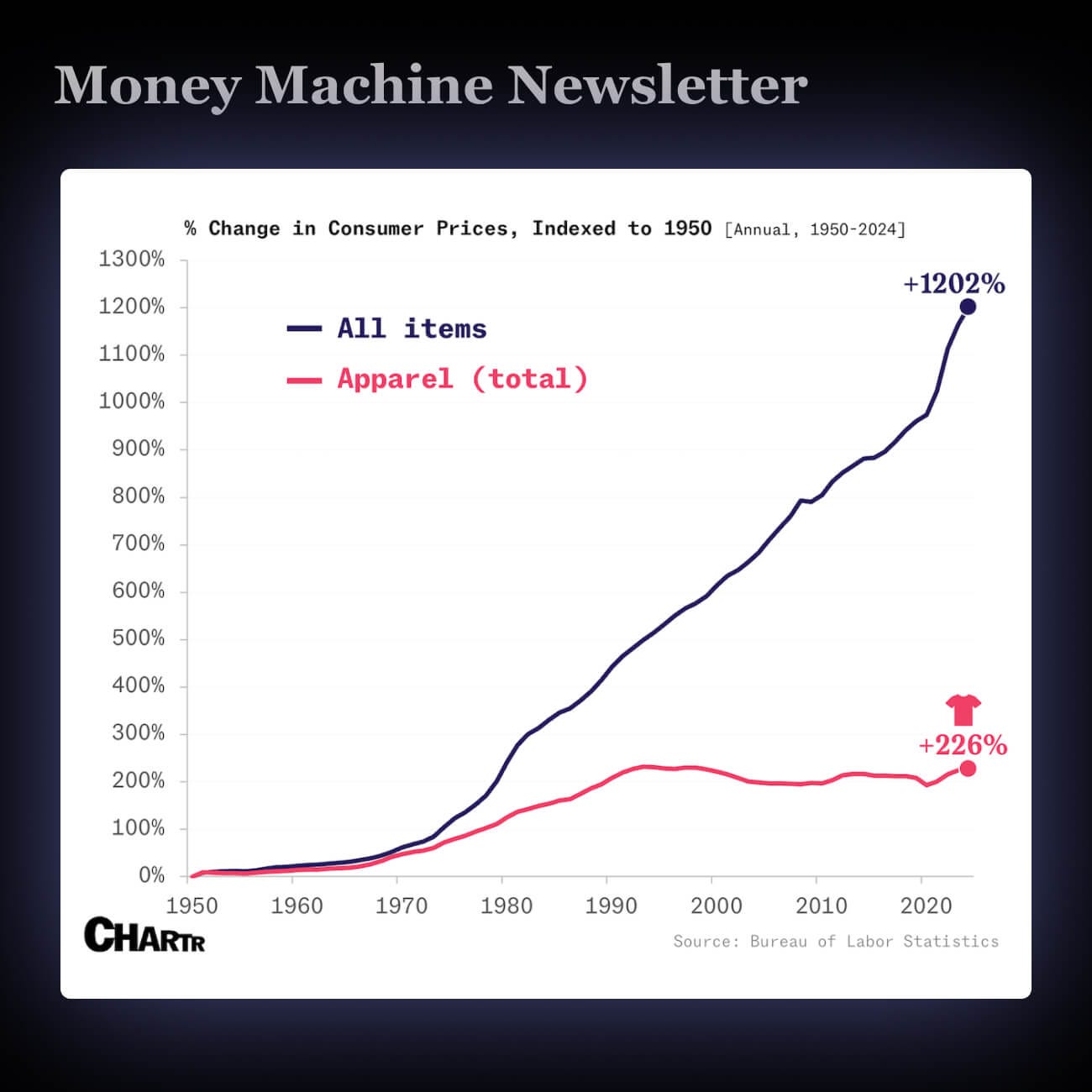

3. 👕 Clothing Prices Stayed Flat While Everything Else Got Expensive

U.S. just ended a rule that let small packages under $800 skip tariffs. Now, even cheap items from China face a 145% import fee.

Over a billion packages used this loophole last year. Without it, prices from sellers like Shein and Temu will likely shoot up — especially for clothes.

Clothes have stayed cheap for decades while everything else got pricey. That streak may be over.

Join 6,000+ self-directed investors who have already placed themselves on the path to greater wealth by making $500, $1,000, $2,000, $3,000, or more every month with Money Machine Newsletter’s trade ideas.

See you in there!

Best,

Money Machine Newsletter