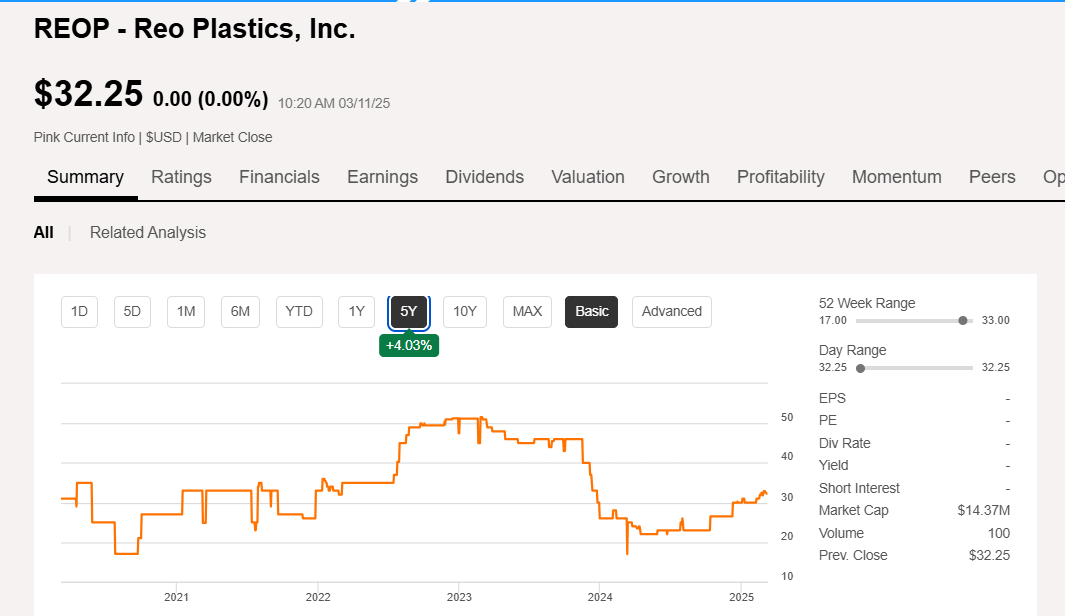

An Update on a Cheap Stock at 2.5x EBITDA and Growing 90%

Company trading at 2.5x EBITDA, revenues up 90% and under liquidation value

I had written an article entitled “A Cheap Stock at 2.5x EBITDA and Growing 90%”. That company just filed their quarterly report for their 3rd quarter of 2025. I wanted to take a break from writing a much larger article to touch base on this company’s progress.

In my last write up on Reo Plastics, Inc. $REOP I had discussed how I suspected that the company was gearing up for new business with with its two largest customers as they “retooled” their plastic machines. REOP had dramatically increased their working capital and was showing signs of inventory build up. Revenues in Q1 were up 55% and in Q2 they were up 88%. With the company’s inventories at all time highs it looked like REOP’s revenues were set to continue at this pace. A week ago REOP dropped the quarterly report for Q3. Let’s dive in and see how they’re doing.

REOPS’s Revenues

REOP saw Q3 revenues hit $12.4 million. In my last article I had stated that if REOP’s revenues were to continue at the $13 million run-rate for the next two quarters the company would generate $50 million of revenues for their fiscal 2025. While $12.4 million is a bit short of that $13 million revenue mark it is worth noting that in 2024 the company received $9.2 million of their total $30.6 million of revenues in Q4. If REOP can earn just a little over $13.4 million in sales next quarter they’ll hit their $50 million in revenues and will be back to their 2023 figures more or less. Even if REOP doesn’t hit $50 million in revenues in 2025 they’ve still seen a 71% revenue increase so far this year with their Q3 revenues increasing by 70%.

REOPS’s Balance Sheet and Inventory

Looking at REOP’s balance sheet they are still increasing their inventory. Again, I think this is a sign that the company is going to continue to ramp up their production which should in turn continue to further increase their revenues. This makes me excited for their upcoming annual report. Even if REOP’s revenues were to fall shy of that $50 million mark, the rise in inventory levels should pass through as revenue going into the company’s fiscal 2026.

A Return To Profitability In 2025

The real story is REOP’s return to profitability. The company’s operating expenses have barely increased. This sent the company’s operating income skyrocketing up 166%. As it looked like the company was gearing up for a new product launch, the company had a significantly higher figure under their other expense line of their income statement in 2024 versus thus far in 2025. All the while the company’s interest expense barely moved upward at all leaving the company with a net income increase of 166%.

I think that REOP looks to be setting itself up for a 2025 annual report that should be sure to excite investors. It may take some time before Mr. Market catches up with REOP’s return to profitability but I believe that there is still a good amount of upside waiting for this stock. With smaller company’s like this bigger reports can often yield share price results that more closely resemble a company’s actual business operations.

The Assets Behind REOP

As always REOP has a large pile of assets to act as a margin of safety should the company fall on hard times and need to generate cash to gain flexibility in their operations. The company owns a 478,777 square foot facility on 10.99 acres. Refer to my original write up on the company here for complete details but, it looks like this facility could be worth $20 million in a sale and leaseback, or $41 per square foot, for a nice industrial property. The property tax data says the property is worth $8.6 million however, property tax data is always substantially low.

Disclosure: I am long REO Plastics, Inc. $REOP and will buy or sell my shares anytime following this article. This is not financial advice. I am not a financial advisor. Do your own research.