A Rust Belt Bargain: Cash Flow, Dividends, and Underappreciated Assets

"A Dividend-Paying Industrial with Hidden Real Estate Value and a Conservative Balance Sheet"

The company I’m writing about today is a small industrial company with a long history, operational resilience, and hidden asset values. Despite a challenging 2024 that saw a modest decline in sales, the company managed to improve profitability through smart cost controls and operational efficiency. With a solid dividend yield, a conservative balance sheet, and a potential boost from newly acquired contracts, it looking like this company is positioned for a stronger 2025—provided external risks don’t derail its momentum.

This company focuses on doing one thing well—year after year, decade after decade. It manufactures real products, turns a profit, pays a dividend, and owns hard assets that don’t show up properly on the balance sheet. This particular business has been around for nearly a century. It operates in an unglamorous corner of the industrial world, serving customers in the auto, construction, and agriculture industries.

The market hasn’t paid much attention, and that may be where the opportunity lies. While short-term risks exist—especially around trade policy—the business is conservatively run, with a tangible asset base, and profitable operations. This isn’t a bet on explosive growth. It’s the kind of investment where time and patience could end up paying off.

Here’s a quick synapsis of today’s company.

Pros

Nearly a century in business demonstrates durability and operational know-how.

A 6.5% dividend yield, with consistent dividend payouts.

Low debt.

Their real estate holdings are potentially undervalued on the balance sheet by $3.6M–$8.4M, which adds hidden NAV and deepens the company’s moat.

Manufactures needed components across critical industries like auto, construction, and agriculture.

$4.7M in new contracts (would add a 10.4% increase over 2024 sales) may catalyze revenue growth, especially if paired with newfound operational efficiencies.

The family-led leadership team, while concentrated, has delivered consistent performance over time.

Cons

Roughly two-thirds of revenue depends on the auto industry.

Proposed tariffs on Canada (35%) and Mexico (30%) could negatively impact this business.

This isn’t a growth stock. It’s a value play that requires investor patience and may not attract momentum-driven capital.

Decker Manufacturing Corporation ($ DMFG)

The Decker Manufacturing Corporation ($ DMFG) is a tiny $36.5 million market cap company from Albion, Michigan. Founded in 1927, DMFG is a veteran manufacturer of heavy-duty fasteners, producing products such as hex nuts, wheel nuts, weld nuts, and more. Approximately two-thirds of DMFG’s products are sold to the automotive industry. The rest are sold primarily to the construction and agricultural industries. With just over 100 employees, it remains a tightly run, family-style business.

DMFG’s Balance Sheet

DMFG has a GAAP net asset value of $45.00 per share while the company’s stock is currently sitting at $59.75 a share. The company currently has 610,876 shares currently outstanding. This gives DMFG a market cap of $36.5 million. If we add to that DMFG’s mortgage and line of credit debt, we get a figure of $41.8 million. If subtract from that number the company’s cash and investments this gives us an enterprise value of $28.8 million.

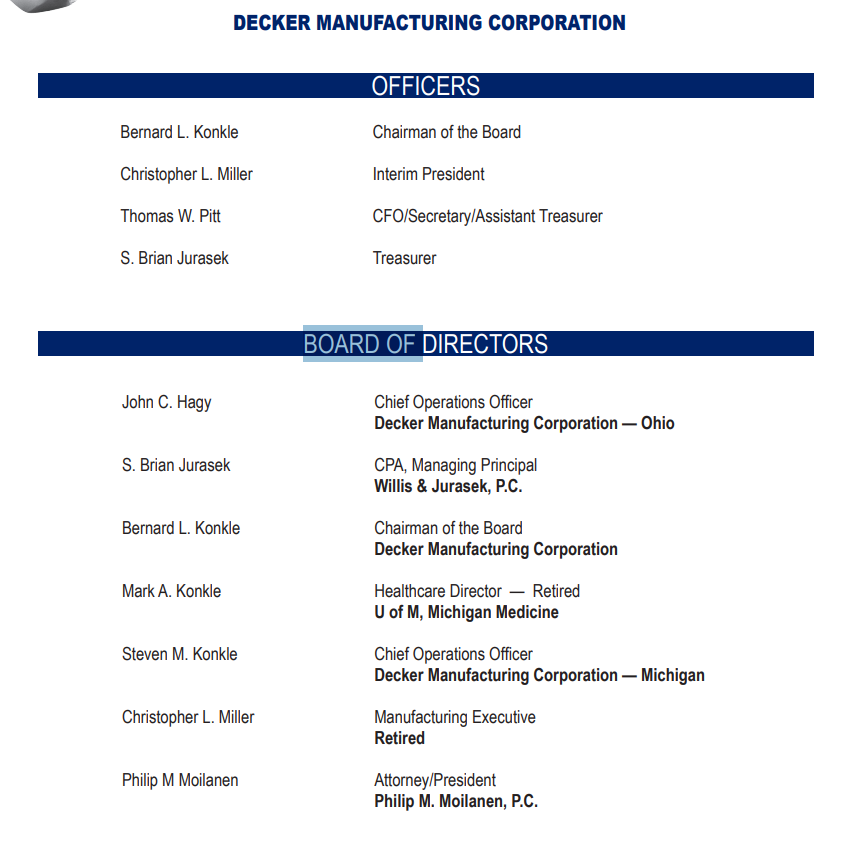

Decker Manufacturing’s management team

As you can see, the Decker Manufacturing management team has a lot of Konkles on it.

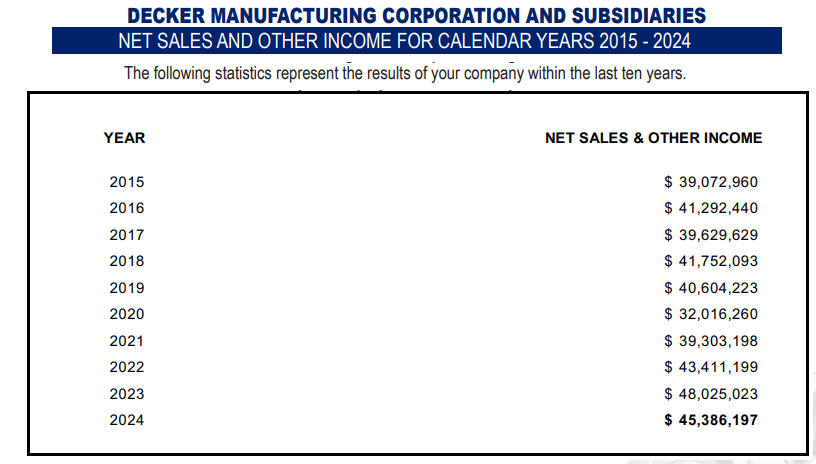

Although there’s a lot of family running the company, they’ve done a decent job. While the company’s sales and other income figures have seen some volatility, they trend in the right direction.

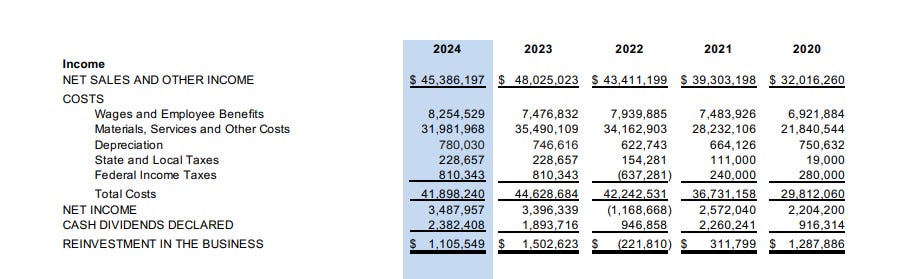

So does DMFG’s net income figures.

Decker Manufacturing’s Operational Performance

While the company’s sales fell by 4.9% YOY in 2024 that drop in revenue was felt throughout the industry and occurred almost totally during Q4 of 2024. Despite the sales drop DMFG was able to improve their operational income by 15.0% due to their increased focus on reducing the cost of sales, getting a better control over operational expenses, and enhancements to their manufacturing processes. This helped increase the company’s net income from $3.4 million to $3.5 million despite that 15.0% drop in sales. DMFG does pay a 6.5% dividend, with $2.4 million of those funds going to dividend payments in 2024 and $1.9 million going towards dividend payments in 2023.

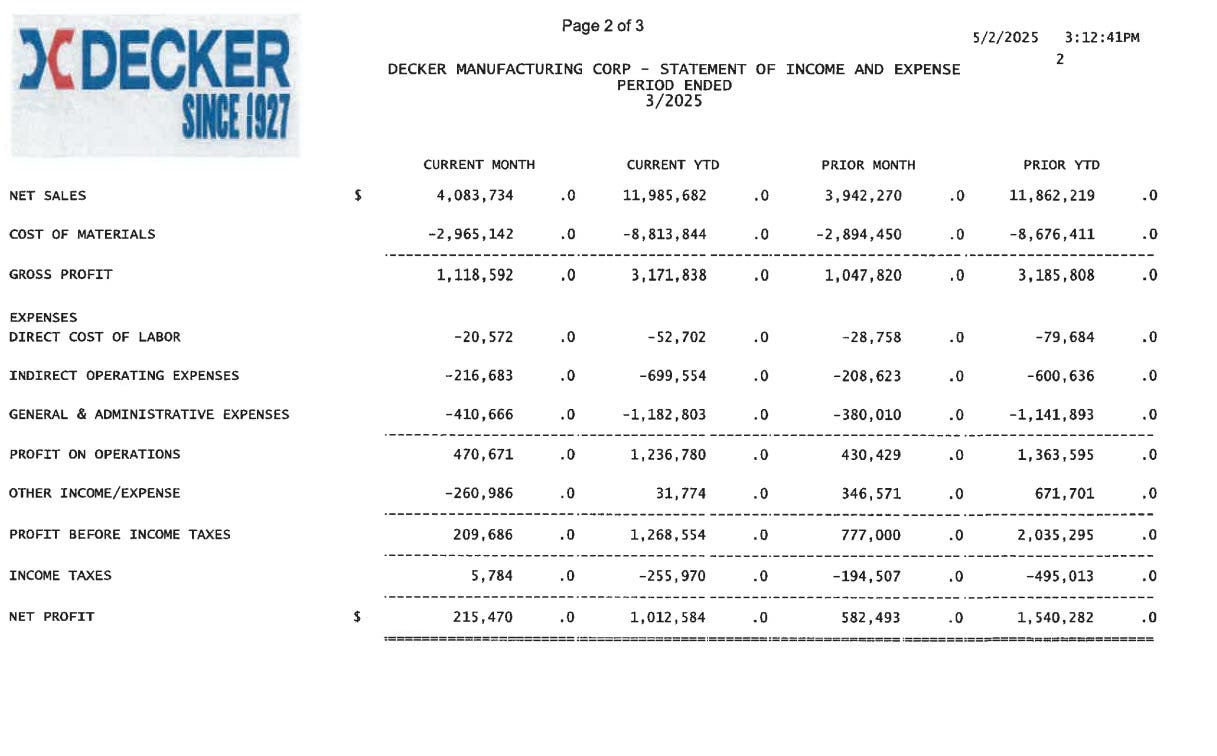

While future business conditions remain unclear, DMFG did acquire over $4.7 million dollars in new contacts for future business which should help get them off to a better 2025. Those new jobs would be a 10.4% increase over 2024’s sales figures. If DMFG can mix these new found operational efficiencies with higher revenues, we could be looking at a catalyst for a rerating. While we’ve only got info on Q1 of DMFG’s 2025 thus far the company’s net sales have increase a bit from approximately $11.9 million to $12.0 million YOY.

Business Risks to Decker Manufacturing’s Operations

DMFG might have a hard time keeping the cost of their materials down though if tariff’s do ramp up come August. If we do implement these 35% tariffs on Canada and 30% tariffs on Mexico it has the potential to wreak havoc on the company. I’m a Michigander myself and just about every shop around me supplies parts to the auto industry. In Michigan, shipments of car parts or partially assembled vehicles get shipped back and forth between the U.S. and Canada all day long. A 35% tariff could really disrupt this incredibly complex supply chain. The tariffs would also likely increase the price of vehicles, which could reduce the demand for them too. Since about two-thirds of DMFG’s business is to the automotive industry, any disruption to the automotive supply chain or to the end consumer’s ability to afford the final product could have devastating effects on the company’s future financials.

GAAP vs. Comped Property Values

Decker Manufacturing does own their manufacturing facilities. On DMFG’s balance sheet they have their building’s valued at $5.2 million. According to the company’s financials and website it looks like they operate out of two facilities, one in Albion, Michigan at 703 NORTH CLARK STREET ALBION, MICHIGAN 49224 and another facility in Peninsula, Ohio at 90 CUYAHOGA FALLS INDUSTRIAL PARKWAY PENINSULA, OHIO 44264.

According to the company’s website DMFG’s Michigan facility is 130,000 sq/ft. and their Ohio facility should be about 68,000 sq/ft. When looking at comparable properties in Calhoun County, Michigan I found nine properties for sale. Only 3 of them looked comparable to DMFG’s operational capacity however. These three properties were all well over 100,000 sq/ft and are also used primarily for automotive industry purposes. The other six industrial buildings were well under 30,000 sq/ft and used largely to grow cannabis in. The three buildings that remained were selling for $51.10, $106.10, and $28.40 per sq/ft. That gives us an average price of $61.90 a sq/ft. That would give DMFG’s Michigan facility a value of approximately $9.3 million. Even if we exclude that $106.10 per sq/ft property from our comp averages DMFG’s Albion property still looks like it’s worth $6.0 million at an average price of $39.75 per sq/ft. That’s $800k more than the value for their properties on the company’s balance sheet.

In Cuyahoga Falls their industrial property pricing was pretty similar. It was compromised mostly of a lot of buildings selling for $30 sq/ft to $60 a sq/ft with an occasional $100 plus a sq/ft buildings spread out here and there. I actually got an average price of $63.42 per sq/ft for Cuyahoga Falls, $41.79 per sq/ft if I take out the $100 a sq/ft buildings from the equation. That still ends up giving us a value for DMFG’s Cuyahoga Falls property of $2.8 million to $4.3 million.

As you can see DMFG’s properties are likely worth a lot more than what is recorded on their financials and helps to deepen the moat around the company. We’re looking at a potential property value that ranges from $8.8 million to $13.6 million compared to the $5.2 million that DMFG has written down on their balance sheet. If DMFG decided that these tariffs were going to be too disruptive for the management team, they could potentially sell off their business and just walk away. So long as prices hold up, DMFG’s real NAV should be somewhere closer to between $50.95 to $58.81 per share.

Risks to Decker Manufacturing’s Property Value

The real risk here is that, if tariffs do go into full effect, especially between Canada and the U.S., the value of the companies and the buildings and properties used to manufacture these car parts that cross these borders could also take a huge hit. Large industrial buildings can be used to produce a lot of other goods other than car parts but states like Ohio, Michigan, Illinois, Indiana, and Pennsylvania have a lot of factories that primarily produce these parts. If the U.S. auto industry takes a hit and these factories start shutting down, there’s going to be a large abundance of empty industrial manufacturing plants laying dormant. This will almost certainly drive down the selling price for those facilities left standing. That’s a real risk.

Conclusion

The Decker Manufacturing Corporation is a small industrial company with a long history, operational resilience, and hidden asset value. Despite a challenging 2024 that saw a modest decline in sales, the company managed to improve profitability through smart cost controls and operational efficiency. With a solid dividend yield, a conservative balance sheet, and a potential boost from newly acquired contracts, DMFG is positioned for a stronger 2025—provided external risks don’t derail its momentum.

The most pressing threat comes from looming tariff increases, which could significantly disrupt the automotive supply chain and by extension, DMFG’s core business. Furthermore, while the company’s real estate holdings appear undervalued on paper, that margin of safety could erode quickly if the Midwest industrial real estate market weakens under economic pressure caused by a disrupted automotive industry.

Overall, DMFG offers long-term value with a solid foundation and upside potential, but its future remains tightly tied to broader macro and geopolitical developments. Investors should keep a close eye on trade policy shifts and auto industry trends before backing this quiet but compelling Michigan manufacturer.

Disclosure: I do not currently own shares of the Decker Manufacturing Corporation ($ DMFG) but may buy a position anytime after this article is published. This is not investment advice. Do your own research.