A No Brainer Value Investing Pick?

A Pile of Gold or a Value Trap?

Sometimes when you’re scouring through the nooks and crannies of the internet for a potential investment you stumble upon a company that you think has to be a gold mine… at least initially. The Business’s NAV looks great, the stock is trading at a low, and it looks like the company is losing less money every quarter and is on its way to becoming profitable. When you begin to dive into their financials however you begin to get the sense that there’s a lot of potential for the company to diminish their NAV through expensive expansions that would require debt, the issuance of new shares, or shifts in the way their current operations are ran. These shifts could pay off maybe, but looking back it becomes apparent that the business has tried similar changes over the last couple of years and yet their results were always underwhelming.

Perhaps there’s some new management helping to steer the ship. How much can they change the fundamental businesses behind these assets to create shareholder value? Are they trying to do that? These are the questions I had been asking myself as I was reading up on today’s company. I had heard a lot of buzz over the last couple of weeks about them and it seemed like their business set-up was a no brainer value investing pick. This stock had officially caught my eye and over the next couple of days I was a bit back and forth on whether this company would be a good investment or not.

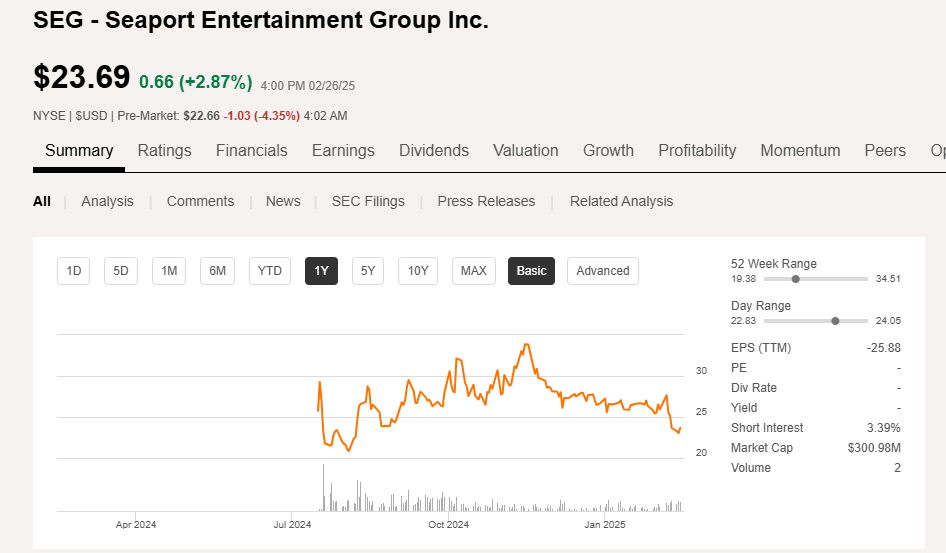

The company I’m talking about is the Seaport Entertainment Group (SEG).

SEG’s Asset Value

As a land based asset play this company has it all. The company has a GAAP net asset per share value of $77.79. Their buildings are likely worth even more. Before SEG was spun off from Howard Hughes Holdings Inc. (HHH) approximately $600 million was invested into Pier 17, the company’s most valuable property. The company also owns property at 250 Water St, New York that originally cost $180 million for just the land. HHH also invested $194 million into a luxury food court called the Tin Building that bleeds money regardless of how much the company tries to switch around the layout. If SEG was to sell these properties for what HHH put into them SEG would get somewhere around $980 million. That would put SEG’s NAV at somewhere around $140 per share. That’s just for these building, the company owns other properties too, most notably the Las Vegas Ball Park along with a Triple-A Minor League Baseball team, The Aviators.

Why I Haven’t Bought Any Shares From SEG

Why am I not scooping up shares of SEG as fast as I can? I’m not so sure these buildings are worth as much money as HHH has dumped into them. I also haven’t heard management mention that they’d be willing to sell off any of their buildings as a way of getting rid of underperforming assets. SEG had a very large $689 million write down on their first 10-Q which makes their latest 10-Q look like a much greater operational improvement. Once this write down is removed from the equation however it becomes clear that SEG has performed worse than I’d first assumed. I am also under the presumption that SEG may end up taking out a lot more debt or issuing new shares as their business ventures continue to lose money. A large part of why SEG seems so cheap is because the company has only 5.7 million shares outstanding. SEG is authorized to issue a total of 480 million shares. Any dramatic increase in shares issued will obviously have a dramatic effect on SEG’s overall per share value. The company is also talking about taking out additional debt in the future to finance new ventures as a way of growing their business.

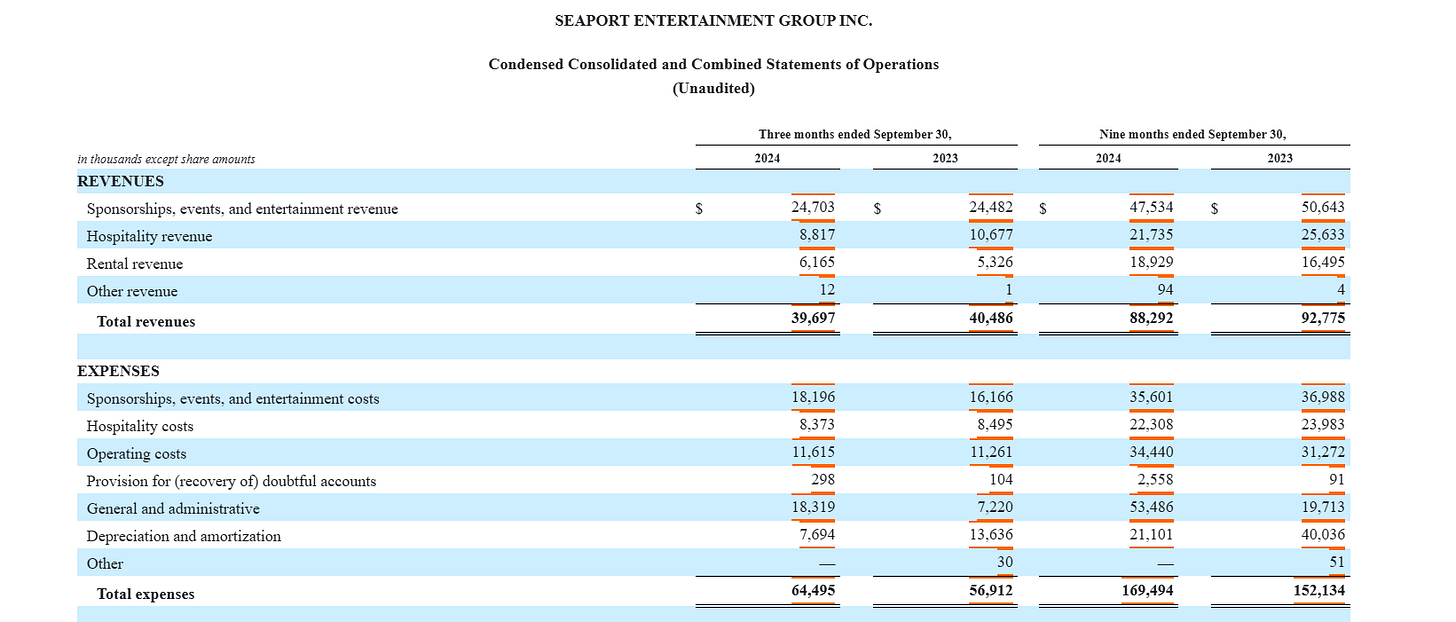

Total occupancy for the company’s leased office space sat at just 68% as of their last 10-Q, which is not very impressive. SEG’s revenues fell 4.8% and 1.9% YOY for their nine months ended September, 30th and three months ended September, 30th. A more worrying matter however is SEG’s expenses increasing 11% and 13.3% YOY for their nine months ended September, 30th and three months ended September, 30th.

Decreased revenues combined with double digit expense increases, and a limited cash pile of $23.7 million isn’t exactly a recipe for creating shareholder value. Add on top of that a large pile of stock that SEG could still issue or the added debt it could take on to hold this company over until a business turn around occurs and I think you could be sitting on this stock for a while waiting for some shareholder friendly news.

Would SEG Be Willing To Sell Off The Tin Building Or Its Other Properties When They Become Unfeasible Businesses?

SEG doesn’t look like it’s willing to sell off any of its properties that are losing money. The company seems to have a very close relationship with famous chef Jean-Georges who through his subsidiaries operates the Tin Building. SEG has a 25% ownership stake in Jean-Georges Restaurants. Closing down a building ran by a long-time business partner might be something that the management team at SEG are unwilling to do. SEG’s CEO Anton Nikodemus has had business relationships with Jean-Georges long before coming to SEG. While this relationship may or may not affect management’s decision to sell off the Tin Building, it really does seem like SEG is putting in more effort than other company’s might be willing to in order to turn around this unprofitable building.

When Would I Consider Investing In SEG?

All in all I think that SEG could be a great value investment if (and only if) management can set forth some kind of catalyst that could finally get the company to generate a profit. Right now all of the business catalysts I’m seeing from SEG look to be pointing the company in the wrong direction. These catalysts include rising expenses, falling revenues, and low rental occupancy without any talk from management about looking for strategic alternatives for their underperforming assets. Attempting to run these businesses as they’ve been ran in the past makes it hard to imagine these buildings making the dramatic turn around that would be needed to excite investors. I think this is an especially important factor considering that the places where SEG owns its properties are hyper competitive spaces for both real estate and entertainment. It’s much harder to be the best restaurant, have the best office spaces, or provide the best entertainment in town when that town is Lower Manhattan or Las Vegas.

If management was to all of a sudden start talking about strategic alternatives to their real estate portfolio or if SEG was to begin to show a path toward profitability by improvements to their bottom line I would possibly consider buying this stock. Until then I am going to sit back and watch SEG from the sidelines and just see what happens.

Disclosure: I do not own Seaport Entertainment Group $SEG but I may purchase shares anytime after I publish this article. This is not investment advice. I am not an investment advisor. Do your own research.

Could HHH have used SEG to off-load weak assets to make HHH look better? I'm assuming HHH still has a significant ownership interest. On one hand they were a liability, now they are on the balance sheet as an asset?? I'm making a lot of assumptions here LOL!