A Hidden Industry That Will Benefit From Trump Winning

Episode II Carr Strikes Back

I had previously wrote a letter entitled “A Hidden Industry That Will Benefit From Trump Winning”. In this piece I talked about how President Trump’s pick to run the FCC Brendan Carr’s negative opinions on various FCC policies could set the stage for legacy broadcasting companies like Nexstar (NXST), TEGNA (TGNA), Gray Television (GTN), Sinclair Broadcasting (SBGI), E.W. Scripps (SSP) and Entravision (EVC) the potential to profit handsomely over the next four years.

Of these big names in legacy broadcasting I had picked out two stocks most likely to benefit from Carr’s appointment. Today’s letter will be an in depth coverage of one of these picks.

Entravision Communications Corporation and a Market Overreaction

Earlier this year Entravision Communications Corporation (NYSE:EVC) had proved itself to be the perfect example of how investors can over react when they hear bad news about a business that they own stock in. The company lost its Authorized Sales Partner status with Meta Platforms, Inc. (NASDAQ:META) which as of the company’s 2023 10-K made up 53% of EVC’s consolidated revenues. When the market heard of this news EVC’s share price fell from $3.79 per share down to $1.47 per share, a 61.0% decrease.

When looking into EVC’s old financial statements it was clear that, during the sell-off investors had also failed to factor in all of the revenue EVC was likely to receive being the largest primarily Spanish speaking TV broadcasting company in the United States during an election year. With each new political campaign cycle a greater emphasis of importance gets put on the Latino voter and therefore it should have been no surprise that the broadcasting company with the largest built in Latino viewership in the United States would benefit from this.

EVC’s Cash Flow Potential

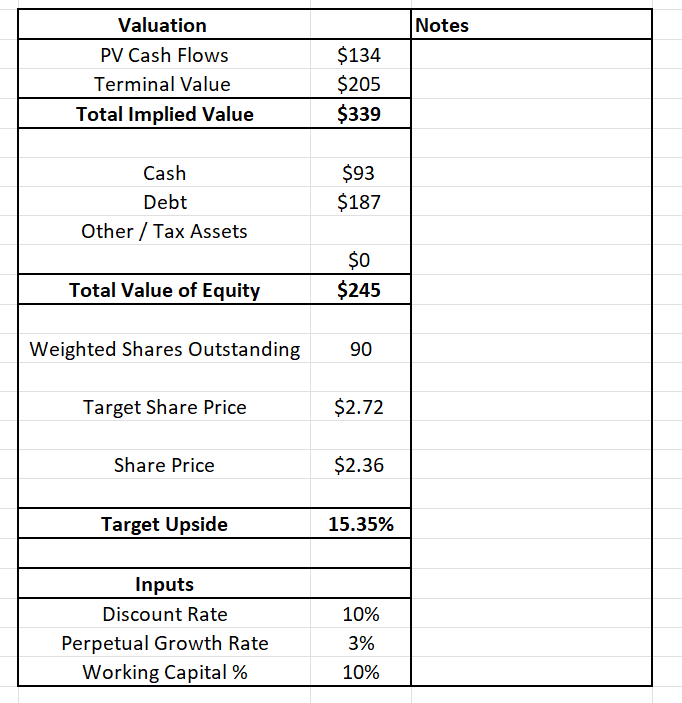

At the time it was pretty obvious that EVC’s share price tumble gave the stock a substantial margin of safety due to its large net asset value. I then ran a discounted cash flow based on the assumption that EVC’s revenues would decrease by 53%, the estimated amount of revenue that they had received from their META ASP program. I ran this DCF using a 10% weighted average cost of capital. When I ran this DCF EVC’s share price was at $1.44 and the value of the company’s cash flows came out to be $2.90 per share, a 101% upside. That’s a 22.9% upside from the company’s current share price of $2.36.

That DCF was ran right after EVC had announced that it had lost its ASP program with META. Last week I ran another DCF updating it to better reflect what EVC’s actual business performance has been since it had stopped this advertising partnership. So far in the first nine months of EVC’s 2024 they have made approximately $258 million in revenue. For EVC’s total 2024 I assumed they would make another $100 million in revenue for their fourth quarter. I also assumed their growth rate will probably be slowed down significantly to 16% as compared to the over 30% growth rate that the company had experienced between 2013 and 2023. I then assumed that EVC’s revenue growth would slow down to a 3% perpetual growth rate after 2033. My DCF ended up still showing an upside for EVC with a target share price of $2.72 per share, a 15% upside as compared to their current share price of $2.36.

EVC’s Balance Sheet Asset Value

While it does look like EVC appears to still have some upside left in the stock according to my DCF, the company’s share price appears to have since eclipsed EVC’s net asset value. While a 15% upside potential for a company’s share price sounds good, EVC’s forced realignment of its business operations makes the company’s future rather uncertain. Small misses in EVC’s earnings can add up fast, often making a DCF worthless. This is far more likely to happen after a major change in operations, similar to what EVC just went through with META. When a company displays a cash flow upside potential of just 15%, I would normally have to see that coupled with a large surplus of assets in order to label that stock a buy. EVC’s net asset value (excluding goodwill) comes out to $156.7 million. That’s approximately $1.74 per share, a 35.6% downside from the stock’s current price of $2.36.

EVC’s Hidden Asset

This leads me right to the topic of my last article “Hidden Asset Values”. EVC has something valuable that the rest of the world needs… spectrum. Spectrum simply put, are the radio frequencies used to transmit information across the air.

This spectrum can be used for satellite internet, TV programing, FM radio, AM radio, and much more. The FCC last bought and sold spectrum from March of 2016 to April of 2017. During this time period EVC sold off the spectrum rights to four of its Class A TV stations for $264 million. That averages out to $66 million a station. This $66 million average is enough to let us know that EVC, who owns 49 TV stations and 44 radio stations, has enough of a hidden asset value to give it an adequate margin of safety, provided they are allowed to sell off their spectrum.

In “A Hidden Industry That Will Benefit From Trump Winning” I specifically discussed how new FCC chairman Brendan Carr has explicitly stated that we clearly need to perform another spectrum auction in order to make way for the needs of this next generation of wireless technology. If Carr does allow another spectrum sell off, how much could EVC benefit?

EVC’s TV Station Spectrum Value

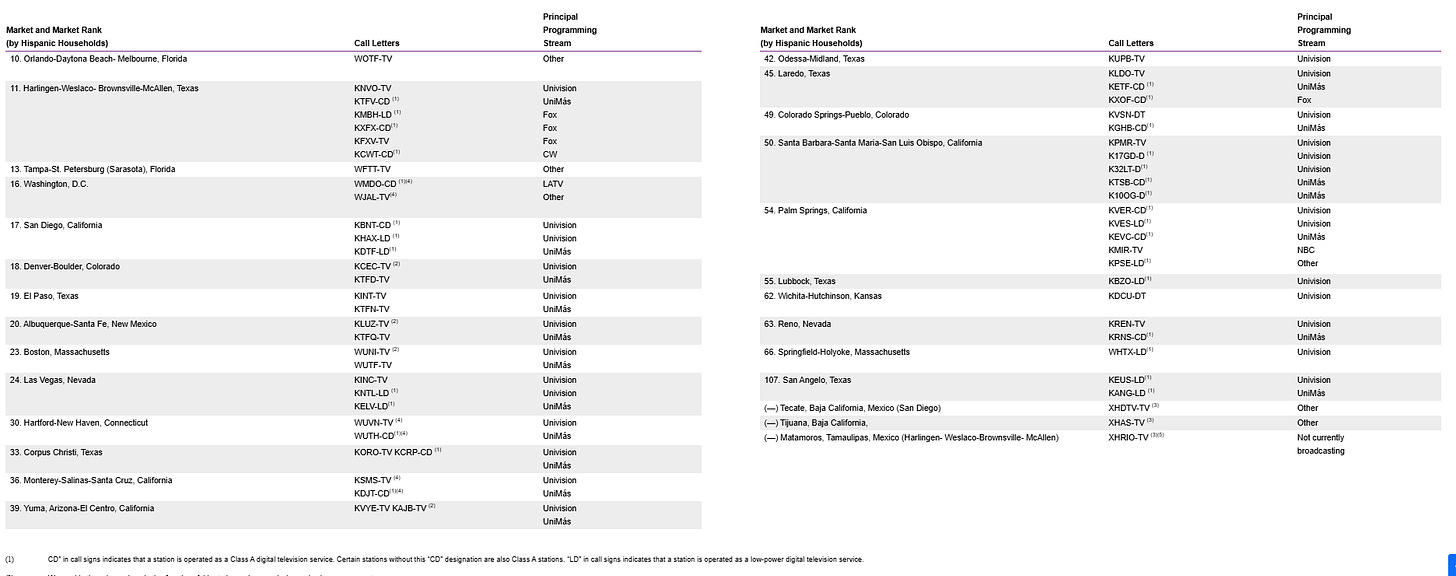

According to EVC’s 2022 10-K the company operates a total of 49 TV stations. When referencing the revenue that EVC was able to receive for each of the four stations that the company auctioned off in 2017 we can see that this $66 million average is not distributed evenly.

WUVN - Hartford-New Haven, CT - $ 125,568,545

KSMS-TV - Monterey-Salinas, CA - $ 54,300,688

WJAL - Washington, DC - $ 25,492,333

WMDO-CD - Washington, DC - $ 58,231,415

Since there are a lot of variables that go into the valuation of a radio station I am using the EVC station with the lowest auction price (WJAL - $ 25,492,333) to attempt to be conservative on how much EVC’s total spectrum rights may be for their Class A TV stations. According to EVC’s 2023 10-K the company had 15 class A TV stations.

If those stations are to be valued at $25.5 million a piece we end up with a value of $382.5 million. If we estimate the remaining 34 TV stations to be worth only $10 million a piece, we would still end up adding another $340 million to EVC’s total spectrum value. If these numbers are correct the end value of EVC’s TV station spectrum is $722.5 million. That value is 3.3 times higher than EVC’s $220 million market cap and could pay off the company’s debt 3.8 times over.

I believe that I am likely undervaluing EVC’s spectrum. If EVC was to get an average of $25 million per TV station their spectrum would be worth $1.25 billion. If the average sale price of $66 million for their spectrum of four stations in 2017 is indicative of what the average value for their spectrum of their other 49 station is, then EVC’s TV spectrum value would be worth a whopping $3.23 billion. When uncertain I never let myself get excited by the higher end of estimations. It is always better to be on the low end of being wrong about a company’s value while value investing. Therefore I am only pricing in a $722.5 million value for EVC’s TV spectrum but it is very likely that the company’s intangible assets may be worth a lot more than that.

Another way to value the spectrum that Entravision owns is on a MHz-per population. To calculate the MHz-per population you take the total population that the contour of a station touches, multiply the population by 6.0x (the MHz) and then place a multiple on the population. In the 2017 spectrum auction, the median MHz-per population multiple was $2.26. The remaining stations that Entravision owns touches 40 million households. This gets us a valuation of $542 million for all of the spectrum that Entravision owns:

(40,000,000*6.0x*$2.26 = $542,400,000)

Another Hidden Asset

A second hidden asset Entravision has is their digital marketing business comprised of two businesses: Smadex and Adwake. In the most recent quarter the digital marketing business generated $37 million of revenues and grew 30% in the quarter. They also generated $2.7 million of EBITDA in the quarter. My estimate for full year 2024 revenues is $160 million with full year EBITDA of $9-10 million.

The programmatic advertising business is growing at a 20-30% clip per year and Smadex is focused on mobile game ads. At the Gabelli Media Conference, CEO, Michael Christensen said all options on monetizing Smadex and Adwake are on the table, include the outright sale of the business.

A good comp to figure out the value of Smadex and Adwake is the recent transaction that occurred on April 1, 2024 when AdTheorent Holding Company, was acquired for $3.21 per share or a total valuation of $324 million. At the time of the acquisition, ADTheorent was generating $168 million of revenue and $10-11 million of EBITDA.

ADTheorent was a programmatic advertising company that focused on Television advertising. If Entravision sells Smadex and Adwake, they could receive the entire market cap, or more, in cash proceeds.

The Point

I do believe that the market has yet to price in the value that EVC has locked away in its broadcasting spectrum rights. This is because legacy TV companies have very rarely ever been afforded the opportunity to sell off this spectrum. An asset isn’t really worth a whole lot if you aren’t allowed to sell it however… times are changing.

As we progress into a new age of wireless technology there are few things that can be certain. I have no idea exactly how important AI will be or in what unimaginable and exciting way a new piece of technology will benefit society. The only thing I know is that all of this wireless spectrum that will be needed to operate these new technologies will have to come from somewhere.

Although it is extremely easy for us to forget about all of these nontangible radio frequencies passing by us everyday, they do operate on the same principles of physics as the rest of the universe does. Cramming more spectrum into an already crowded space will only lead to massive data pileups that would likely have devastating effects on the American economy. In order to make room for all of this new spectrum one thing has to happen, another spectrum consolidation.

As I have talked about earlier in this article and in greater detail in my article “A Hidden Industry That Will Benefit From Trump Winning”, Brendan Carr has been pretty adamant about wanting to initiate another spectrum auction. Now that he is in charge of the FCC he has the ability to make that happen. While I most certainly can not tell the future, I can listen to what the people in charge of running our institutions repeatedly say they are going to do.

As for Brendan Carr, everything that I’ve heard repeatedly come out of his mouth will benefit the owners and operators of legacy broadcasting companies. The prospects of another spectrum auction, his disdain for the 39% of US markets broadcasting cap, and his dislike for large tech companies all play in to the favor of EVC. If Carr does anything that he says he’s going to do, I expect traditional media broadcasting will benefit greatly.

Disclosure: I own Entravision Communications (EVC) and will buy or sell my shares anytime after this article is published. This is not investment advice. I am not an investment advisor. Do your own research.