A Diversified Quiet Compounder with a Hidden Asset Worth Its Entire Market Cap

Debt-Free, Cash-Rich, and Growing

In a market dominated by flashy tech stories and speculative plays, sometimes the most intriguing opportunities come from the quiet operators. One such firm based in Southern California has been steadily building value through a mix of investment management, commercial real estate, and even cattle ranching. It’s an unusual combination of businesses, but the results speak for themselves: steady revenue growth, a pristine balance sheet, and a stock price that has consistently tracked higher over the past few years.

This firm has shown disciplined execution across its diverse operations. Investment fees form the backbone of its income, while property rentals and ranching provide additional streams of revenue that help balance the business against different market cycles. Revenues and net income have both grown meaningfully since 2019, reflecting a story of slow but steady compounding growth. This company may not grab headlines, but they could offer the kind of stability long-term investors appreciate. On top of this the company owns a 26,000 acre cattle ranch that they have expressed interest in selling. Proceeds from this sale could easily exceed the company’s market cap. Both of these catalysts could provide substantial upside for the patient investor.

Subscribe Now and Get 25% Off Forever.

Right now if you Subscribe to The Value Road you’ll get 25% off of your subscription. This is not a gimmick or a short-term coupon. If you subscribe now you’ll lock in that discounted rate for life. I’m doing this because I’ve crossed an important threshold and have written 100 articles on Substack and wanted to give something back to my supporters. Thank you guys so much. This is article 101, I am looking forward to writing the next 100.

Queen City Investments, Inc. (QUCT)

Queen City Investments ($QUCT) was originally formed as an investment holdings company within the framework of the Farmers & Merchants Bank of Long Beach ($FMBL). Queen City Investments was then spun off into its own company in the 1970’s. QUCT is not your run-of-the-mill financial firm. Based in Long Beach, California, this nano-cap company operates at the intersection of asset management, real estate, agriculture, and fiduciary services. Quite the unusual blend for the investor who is accustomed to more mainstream businesses.

Queen City’s first annual report filed on OTCmarkets.com was filed in September of 2021. Since then the company’s stock has trended upwards very consistently.

Queen City Investments Valuation

QUCT only has 47.5k shares outstanding with those shares selling for $1,799.96 giving Queen City a market cap of $85.4 million. The company has no long-term debt and had closed out its revolving line of credit a year ago. Queen City does have $13.5 million in cash sitting on their balance sheet giving them an enterprise value of $71.9 million.

Queen City Investments’ Operations and Financials

Queen City earns about 76% of its revenues through the fees it collects as payment to manage money for its clients. On top of this the company owns and leases commercial properties in California. In a surprising twist they also operate a cattle ranch in Central California. Rental income accounts for about 14% of Queen city’s revenues with sales from cattle making up the majority of the rest of QUCT’s income. This is appealing because a multi-asset exposure like this could offer natural hedging during changing market cycles.

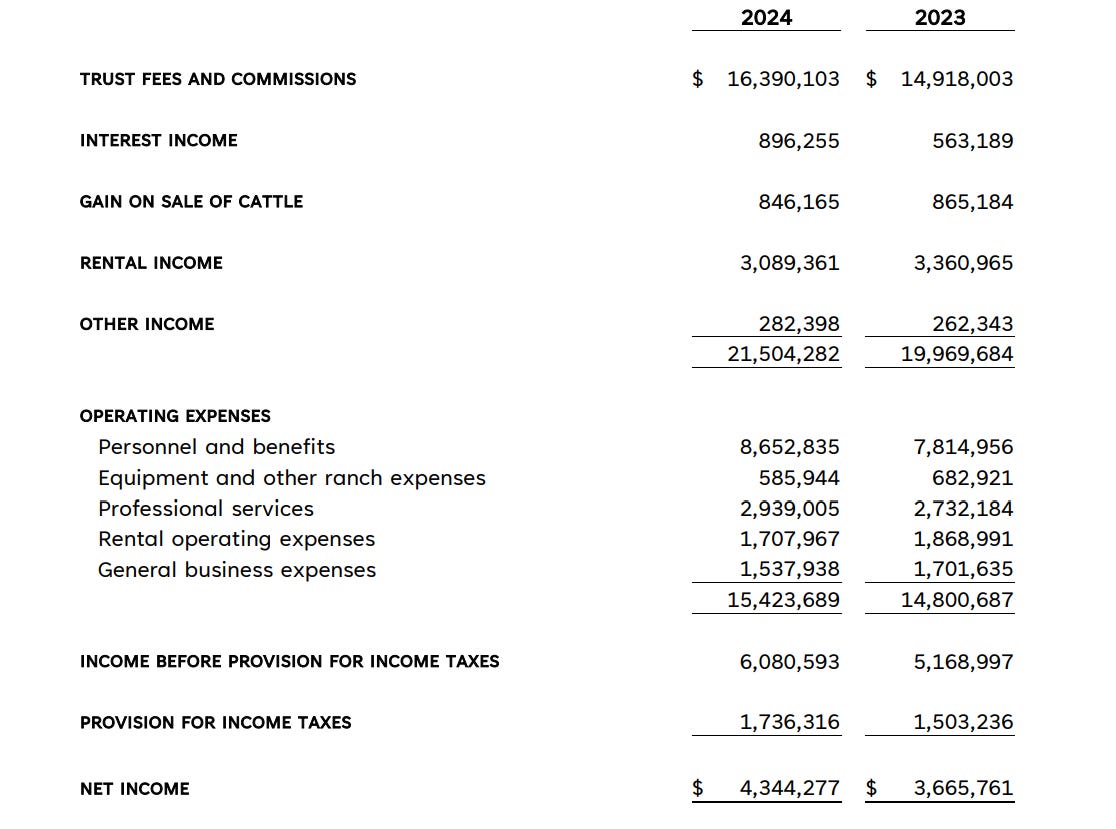

The only reporting I see Queen City Investments putting out are its annual reports but this past year it looks like the company did rather well.

Cattle prices are very high right now as the U.S. is experiencing its lowest herd numbers since the 1950’s. I expect the company's gain on sale of cattle figures to rise from this catalyst throughout 2025. Going back to 2019 in Queen City’s financials, cattle prices are the company’s only operational revenue source that has been volatile save for the small amount of income labeled other. Their income from their investment fees and their rental income have steadily risen YOY since 2019, the first year that the company’s annual reports show up on the OTCmarkets.com website. Steady long-term growth might not be a story that busts through the headlines but it’s what I like to see when I am looking for investment candidates.

A Hidden Asset Worth Queen City’s Market Cap

While I was trying desperately to dig up any information regarding Queen City’s properties I found something I rarely find, another author who had just recently wrote up QUCT.

wrote up an awesome piece on both Queen City Investments and on the Queen City adjacent company I mentioned earlier called the Farmers & Merchants Bank of Long Beach ($FMBL). These companies are ran by the same family (The Walker Family). Please if you get the chance, read Obscure Stock’s article on QUCT and FMBL, the article is here. If you like what you read please consider subscribing as the work done on both companies was quite remarkable. In this article Obscure Stock’s gives us some important insights into Queen City’s cattle operations.Queen City’s Cattle Operations

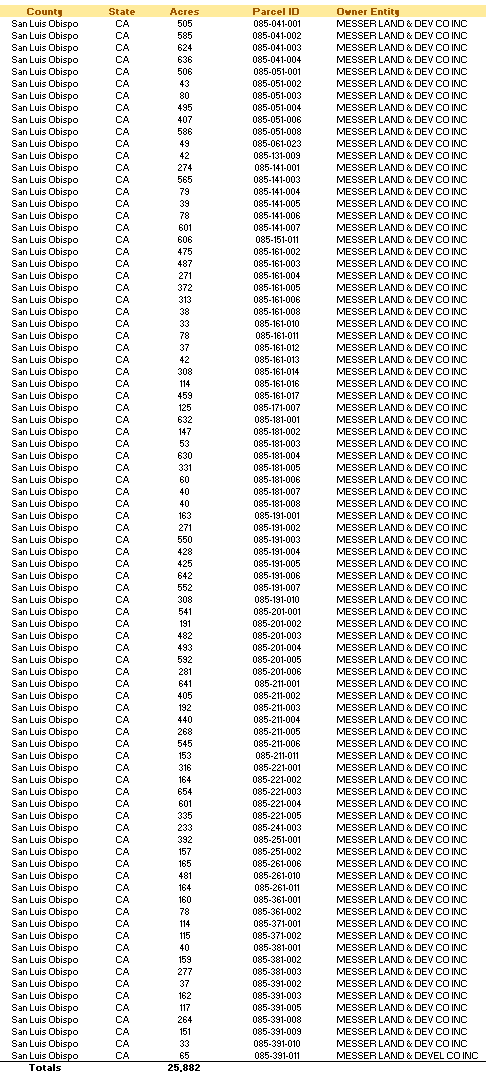

According to Obscure stocks, Queen City Investments owns a 26,000-acre contiguous cattle ranch in San Luis Obispo County that has approximately 1,000 head of beef on it. According to a shareholder who attended Queen City’s annual meeting, the Walker family is committed to selling the ranch.

Ranch properties in the area have recently sold for $1,400 and $7,500 an acre. If Queen City Investments can sell their ranch for just $3,500 an acre they’ll pull in $91 million from the sale, $6 million more than the company’s market cap. Even if the property sells for less than this QUCT is still going to walk away with a considerable amount of cash. A special dividend or stock re rating should be due when and if this sale was to take place. That being said this is California we’re talking about here and land sales can get bogged down. Queen City is almost certainly going to have to get some surveyors out to this property to get some title work done before a sale can go through. The property is split off into a ton of different parcels and I would imagine QUCT is going to want to condense this down to simplify the sales process.

There is a demand for ranch sales right outside of these highly dense cities in Southern California. Tech billionaires have been buying up these properties and turning them into their fancy tech compounds.

Putting It All Together

This is probably one of the simplest stocks I’ve covered. Queen City Investments, Inc. ($QUCT) operates three main segments. Their main segment handles investments for clients. The company has seen very stable growth in this segment since 2019 and this revenue currently makes up about 76% of Queen City’s annual income. The company’s rental income then makes up an additional 14% of the company’s annual income with the gain on the sale of cattle coming in at 3.9% of the company’s revenues. Interest income then makes up 4.2% but this is probably the company’s most widely varied income figure from year to year. Lastly, other income makes up just 1.3% of the company’s revenues.

This led to the company seeing a 7.7% increase in revenues and an 18.5% increase in net income YOY. Since 2019 the company has grown their revenues 38.5% and their net income by 89%. It might not be explosive growth but the company’s stock price perfectly aligns with this rise in net income, plus QUCT does pay a small dividend. This isn’t a sit on the edge of your seat type of investment but we’re here to make stable money not one up someone with a story about how you made money off of a risky bet.

A Bonus Value in QUCT’s Cattle Ranch

On top of this we get a bonus prospect of a land sale at some point in the future. This may take years though as Queen City’s cattle ranch property is broken up into a mess of parcels. This will probably result in some big delays to the property being sold off as this would be a bit of a headache for any company to straighten out but the red tape bureaucracy in California could further complete these efforts even more. In any case, Queen City Investments should see a substantial portion of its market cap realized via this sale. If this happens I imagine a special dividend or at the very least a stock rerating should be in Queen City’s future. Quct’s existing business model will have to hold investors over until this happens. With that said, Queen City Investments is a growing and profitable business which makes me a lot more comfortable than trying to wait for a land sale on a company burning through cash.

Conclusion

While the company’s financial disclosures are less enlightening than that of larger companies, I think that Queen City’s business is an easy enough one to understand. They aren’t reinventing the wheel they’re just grinding away at operating a couple of valuable businesses while maintaining a balance sheet free of debt and loaded with cash and investments. This is one of those businesses you can buy today and sleep well tonight knowing you own a part of a company that’s stable and growing who’s share price might just take off one day from these land sales prospects.

Disclosure: I do not own shares in Queen City Investments, Inc. (QUCT) but may buy shares anytime following this article. This is not investment advice. I am not a financial adviser. Do your own research.