A Dirt Cheap Net Net

Recent C-Suite Changes Could Results in Strategic Alternatives and a Winddown

One of the best reasons to invest in nano-caps is the higher chance of finding a net-net. Net-Nets are one of the best ways to put up incredible returns with low risk and have been historically back-tested.

For those new to the concept “net-net” here is the definition.

"Net net" in finance refers to a value investing strategy where an investor buys stocks of companies whose market capitalization is significantly less than their net current asset value (NCAV), essentially meaning the company is trading for less than the value of its liquid assets, indicating a potentially undervalued stock according to this metric; this approach was popularized by investor Benjamin Graham.

To calculate if a company is a net-net all you do is take the current assets and then subtract total liabilities.

Investors who follow the net-net strategy look for companies that are trading at a significant discount to their net current asset value per share, which is often 66% or less. The idea is that buying a stock at such a discount, the investor is effectively getting the company’s operating assets for free.

Net-nets have historically outperformed the broader market with a study conducted from 1970-1983, showing that investors could have earned an average return of 29.4% annually following this strategy.

A more recent analysis by James Montier found that net-nets generated average annual returns of 35% per year.

Finding a net-net is a value investors dream.

A stock that is so cheap that it is trading at more than a 60% discount to its net current asset value.

The problem with net-nets is that they are hard to find.

Back in the day they were easy to find.

But then cheap money caused an asset bubble and multiples went bananas.

Now finding net-nets is few and far in between.

But if you search hard enough, you might be able to find one.

And that is what I did this morning.

I found a net-net. The key stats are as follows:

Key Stats of this hidden net-net:

Share price of $1.09 and net current asset value per share of $2.62 or 140% upside.

Net current assets include: cash, marketable securities, accounts receivable and a massive inventory position.

Liabilities include a small amount of debt, a small amount of accounts payable and a bit of accrued expenses.

The company also owns significant property, plant and equipment including, land, office buildings, production faculties, and machinery and equipment. The owned assets in the property, plant and equipment could easily exceed the entire market cap.

In 2021 the company sold a single facility and associated inventory for more than double the current market cap of the company today.

The company continues to own assets on their balance sheet and associated inventory that could potentially be sold for a significant amount of proceeds that could exceed the entire valuation of the company.

The long-term CEO just stepped down as of December 31, 2024. The company has hired a search firm to find a new CEO. Change at the executive level could result in strategic alternatives, or an outright liquidation, as the company is subscale.

The company has significant NOLs and will not be a cash tax payer if they return to generating net income.

The company’s product that they sell is in a multi-year trough, but in early February 2025, competitors increased price, ushering optimism for 2025. Any optimistic news on the company’s end market could result in significant increases in EBITDA and cash flow.

Despite the significant value destruction seen in the equity value of this stock, the assets appear to be real, cash flow has been generated in the past, and a new CEO could result in significant change or an outright sale of the assets.

From my analysis it appears as if there is at least one last puff on this cigar.

Let’s dig in.

TOR Minerals International, Inc. $TORM produces and sells specialty mineral products in the United States, Europe, and Asia. The company offers alumina trihydrate and boehmite halogen-free flame retardant and smoke suppressant fillers for plastics, rubber, and specialty applications; and beige and gray colored titanium dioxide (TiO2) pigments for use in paints, coatings, plastics, paper, and various other products. It also provides white TiO2, a pigment to add whiteness and opacity to paints and coatings, plastics, and other materials; and engineered fillers for use in plastics, paints, coatings, catalysts, and industrial products.

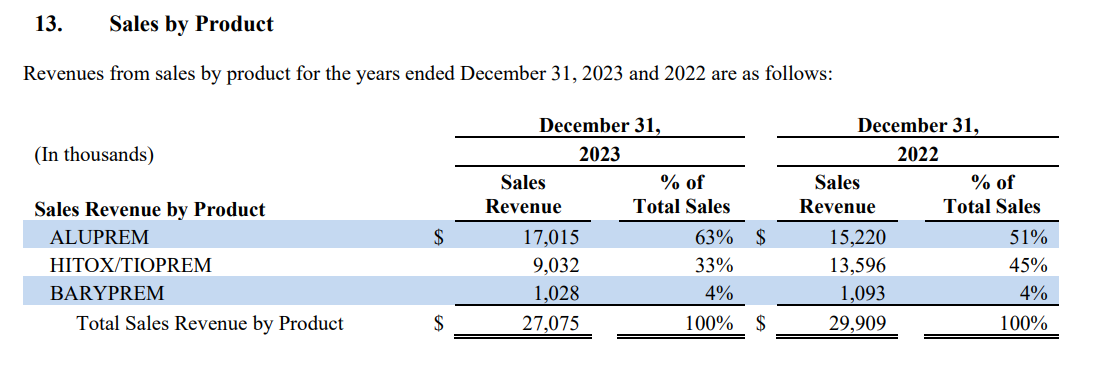

TOR Minerals breaks out product lines by the following:

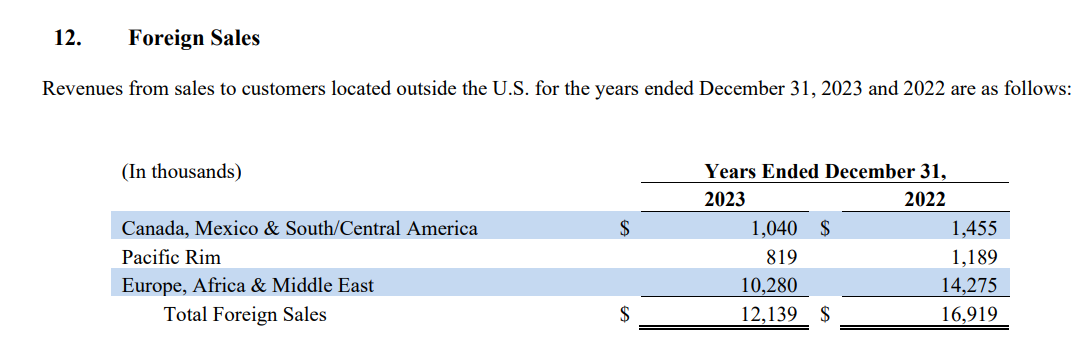

TOR Minerals Generates around 55% of their revenues in the United States and the remaining revenue generated in Europe, Africa, and the Middle East.

TOR Minerals has 3,542,000 shares outstanding and with a share price of $1.09 the market cap is a mere $3.8 million. The company also has $1.8mm of cash and marketable securities and $1.1 million of debt. The enterprise value is $3.2 million.

To be upfront, I am not an expert in the Ti02 market. If you wanted to get up to speed on this market I would suggest looking at Kronos Worldwide KRO 0.00%↑ , Tronox Holdings TROX 0.00%↑ and Venator Materials $VNTRF. From a high level reading, the Ti02 market is in a significant downturn, with each of these companies trading at multi-year lows and below book value. In fact, each of these three companies look like interesting investing prospects on their own basis.

What makes TOR Minerals interesting to me is the company’s net-net status.

Current assets are $13.2 million which include: $1.8mm of cash and marketable securities, $3 million of AR, $7.6 million of inventories, and $851k of other assets.

Total liabilities are only $4.0 million which include: $1.1 million of debt, $1.7 million of AP, $1.0 million of accrued expenses and $92k of other liabilities.

The net current asset value is $9.3 million and dividing the 3.5 million shares outstanding we get a net current asset value per share of $2.62.

This is over 140% upside from the current share price of only $1.09.

Based on the absolute cheap level of this security that is really all of the work that should be done. The market cap is extremely small and it is trading significantly under the net current asset value. Any other analysis is strictly not needed as this is a flip and not a buy and hold.

However, I think a few more things should be discussed.

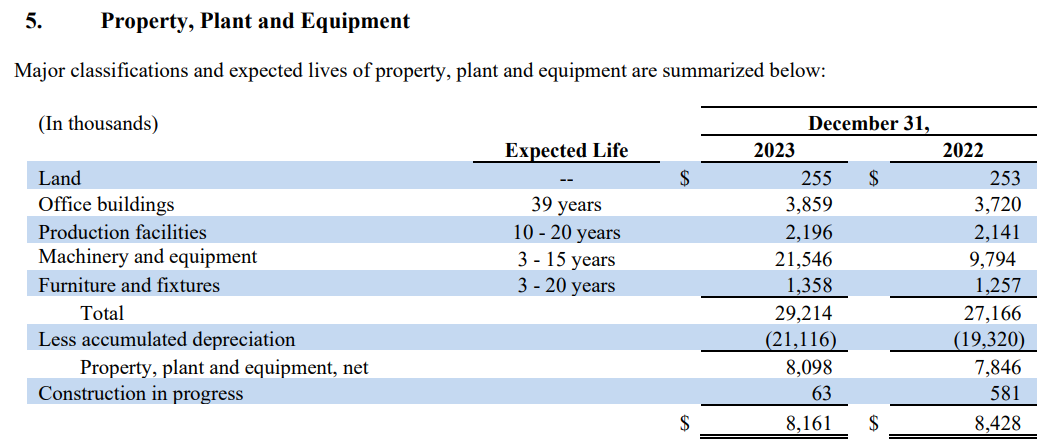

First, the company owns significant property, plant and equipment.

A lot of net-net guys tend to only focus on the current assets. I think that is fine, but understanding all of the assets a company owns can provide juice to the upside and an even bigger margin of safety.

TOR Minerals has $8.0 million of property and equipment on their balance sheet. This $8.0 million figure is a depreciated figure and doesn’t provide much context into what these assets are worth.

I tend to find it helpful to not look at net PP&E but rather look at gross PP&E as it tends to provide more color.

Note: the $9,794 million seen in the 2022 column is wrong. They had a typo and the figure should have been $19,794. You can see this per the 2022 annual report here.

The property, plant and equipment that TOR Minerals owns includes:

$255k of land

$3.8 million in an office building

$2.2 million of production facilities

$21.5 million of machinery and equipment

$1.3 million of furniture and fixtures.

I am not sure what any of this is worth because the annual reports do not provide much color. However, I would assume the land is probably worth more than $255k as that is held at historical cost and not depreciated. The office building is probably worth somewhere in the $3.0-4.0 million ballpark range. Production facilities are likely worth the gross PP&E. And the machinery and equipment is probably worth $2-3 million or so.

Put whatever value you want on these assets. The net PP&E value is $8.0 million and the book value of the company is $17.3 million. These assets have real value and the company is getting ZERO value of any of these assets.

Despite the company not getting any value for these assets, TOR Minerals sold a property in Corpus Christi, Texas for a total consideration of $5.6 million in 2021. When TOR Minerals sold the Corpus Christi assets they stated the following in the press release:

The purchase price for the included assets is $2,250,000 plus the inventory value of raw materials, intermediate and finished goods, and consumable materials.

This means the company sold the production facility in Corpus Christi for $2.25 million and then sold $3.35 million worth of inventories on top of the asset sale.

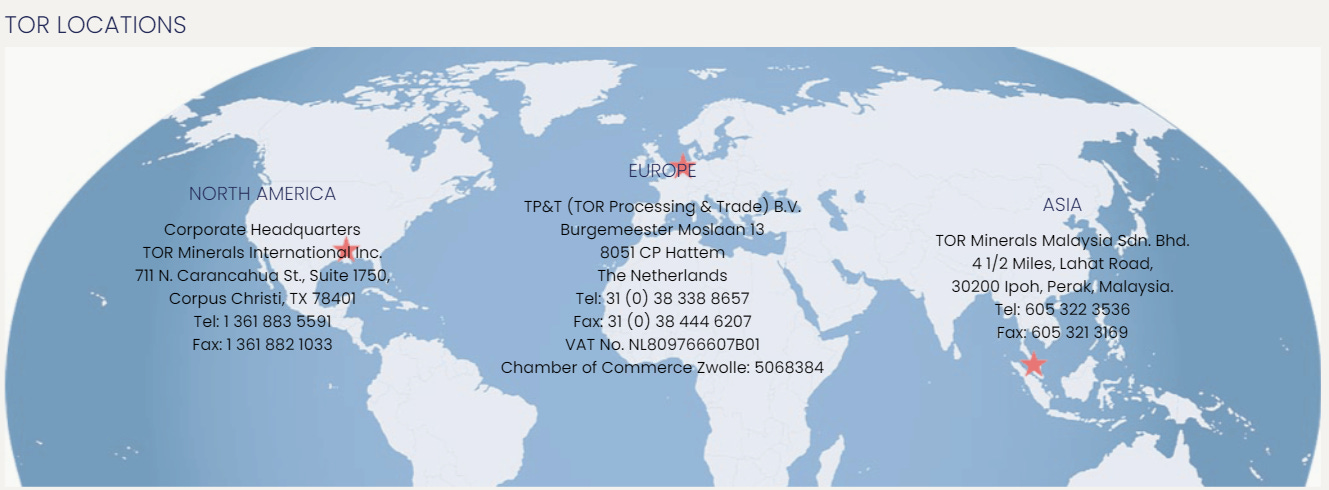

TOR Minerals operates out of three locations:

And they have $7.9 million of inventories on their balance sheet including:

$2.4 million of raw materials

$1.2 million of work in progress

$3.5 million of finished goods

$842k of supplies

What I am trying to say, the company has real assets including production facilities, offices and machinery and equipment and has $8 million of inventories on top of that. The company has sold assets in the past for almost double the current market cap, and I don’t see why they shouldn’t be able to liquidate the assets today for even more of a premium.

Finally, what makes this company even more interesting is the recent C-Suite change. On December 31, 2024, CEO James Roecker announced he was retiring. Mr. Roecker had served for five years as TOR Mineral’s CEO all of which saw the company experienced net losses. Chairman and Director Douglas Hartman has been named as the lead interim executive, while the company looks for a new CEO. Doug Hartman has been a Director of TORM since 2001 and has been Chairman of the Board since 2014.

Changes at the C-Suite level are something that I always pay close attention to. Especially if a company hasn’t been able to generate profits.

My best guess is that James Roecker was asked to step down given the recent large losses at the company. The interim CEO owned around 11.5% of the company back in 2018 (last proxy I could find) and has seen the value of his equity drop from $8.00 per share down to $1.09. In pure dollar terms Hartman’s value has dropped from $3.2 million down to $443k. My best guess is that Hartman and the board could announce a strategic alternative of the business anytime and sell the company. Results have stunk over the past decade and the company appears to be operating at a subscale level. Selling the company now would allow Hartman to exit with at least a few million and go onto other things.

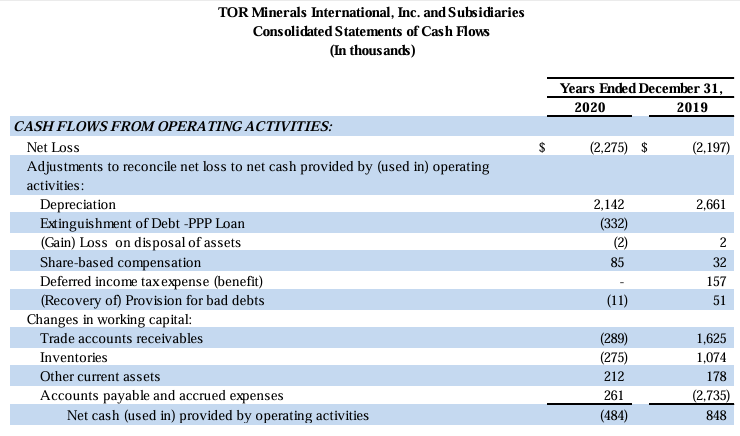

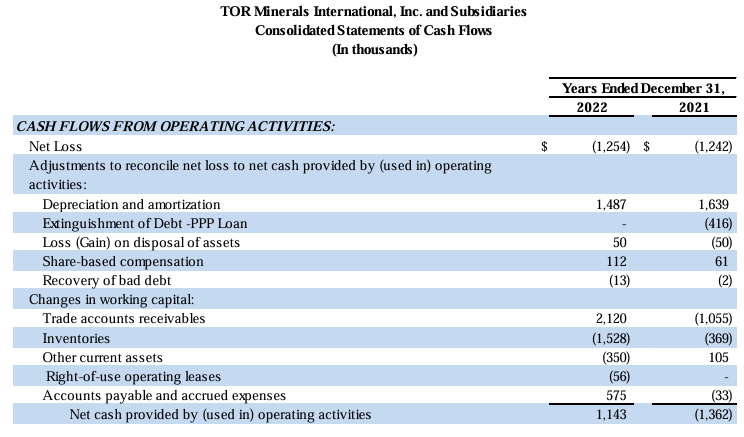

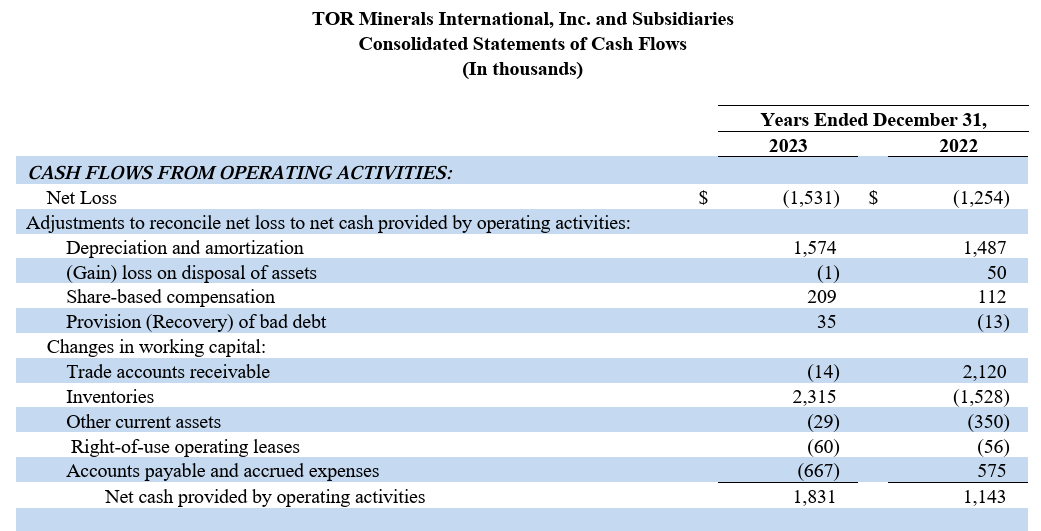

But what makes TOR Minerals interesting, and unlike most net-nets, is the company has historically generated free cash flow, despite net income being negative.

For the first nine months of 2024, cash from operations was negative $1.3 million. However, if you back out of the first six months, cash from operations was actually a positive $441k in the third quarter, offset by $320k of capex. In addition, gross margins were the highest they have been all year coming in at 7.1%, compared to 5.2% in Q2 and 2.3% in Q1. Finally, it appears as if things could be getting better for the Ti02 market per this recent headline:

New Year TIO2 price increase arrives as expected, titanium dioxide market is still optimistic after the holiday

After nine months of decline in the titanium dioxide market, at the beginning of the new year, the market lived up to expectations and ushered in the first round of price increases at the beginning of the year, and the price of titanium dioxide rebounded upward.

Conclusion

TOR Minerals is a cheap stock and is trading significantly below the net current asset value. In addition there are significant real estate assets including land, an office building, a production facility and machinery and equipment. The company has also sold off assets in the past and management appears to have a vested interest in the stock per old proxy statements. The retirement of the former CEO on December 31, 2024 is interesting and I think the company could announce strategic alternatives any day now. If strategic alternatives are not announced, I think there is potential for the Ti02 market to improve. Given the large margin of safety, I think TOR Minerals is a cheap stock and a safe bet.

Disclosure: I do not own shares of TOR Minerals International, Inc. ($TORM) but I may purchase shares anytime after I publish this article. This is not investment advice. I am not an investment advisor. Do your own research.