A Cheap Stock at 2.5x EBITDA and Growing 90%

Company trading at 2.5x EBITDA, revenues up 90% and under liquidation value

Sometimes when you are researching stocks you see opportunities that are such no brainers it only takes five minutes of research to know the stock is a buy.

That is like the idea I am writing about today.

Here is the pitch:

EV/EBITDA is 2.6x

Revenues in Q2 are up 88% and 55% in Q1.

The stock collapsed from a weak 2024 and will likely re-rate as Wall Street is asleep at the wheel.

Inventory is up substantially which suggests that there is strong demand for the company’s product and revenues will continue to grow.

Working capital will eventually get converted into cash which could be worth 35% of the enterprise value.

Owned land and buildings are worth more than the enterprise value giving us a substantial margin of safety.

This is an easy one.

The company is dirt cheap.

Revenues are growing substantially.

The owned land and buildings are worth the entire enterprise value.

And then you get a ton of working capital and equipment on top of that.

In addition the company is trading at 0.5x tangible book value.

Any value investor who looks at this name will know instantly that it is cheap, there is upside and if you are wrong on your assumptions, you probably won’t lose much money just given the absolute low valuation.

Let’s dig in.

REO Plastics, Inc. $REOP provides plastic injection molding and related manufacturing services in a single manufacturing location in Minnesota. There are 445,762 shares outstanding and with a share price of $32.50 the market cap is $14.5 million. The company has $2.4 million of cash, an additional $2.1 million of marketable securities and $3.9 million of debt. The enterprise value is $14.5 million.

What got me interested in the company was the sharp share price drop in 2024.

The stock has recovered slightly from the drop but I think the equity is still cheap with a huge margin of safety.

The company doesn’t provide much disclosure but in their 2024 annual report they do break down revenues by two key customers.

In 2023 Customer A generated $23.8 million of revenues for REO Plastics which represented 46% of consolidated revenues.

In 2023 Customer B generated $6.2 million of revenues for REO Plastics which represented 12% of consolidated revenues.

Then in 2024 things collapsed for these customers:

In 2024 Customer A generated $7.9 million of revenues for REO Plastics which was a drop of 66% from 2023.

In 2024 Customer B generated $4.5 million of revenues for REO Plastics which was a drop of 26% from 2023.

The company doesn’t explain the drop in revenues from what I can tell.

However, I suspect the company was gearing up for new business with both of these customers as they “retooled” their plastic machines.

My thesis for the “retooling” of the business is from the large increase in customer molds in process on the balance sheet.

For an example:

At the end of 2023 customer molds in process were $324k.

Q1 2024 customer molds in process were $1.4 million where they peaked.

Revenues collapsed in Q1 2024, down 51% as well.

Customer molds in process slowly creeped down every quarter from the highs in Q1 2024 and now sit at $672k.

The company doesn’t provide a breakdown of revenue by customer in their quarterly filings, but revenues are up substantially in 2024. Revenues in Q1 were up 55% and in Q2 they were up 88%.

I think these revenue numbers will continue as well as inventories are at all time highs of $13.8 million, along with accounts receivable at $7 million.

If revenues continue at the $13 million run-rate for the next two quarters, the company will generate $50 million of revenues. Gross profit is around 13% and at the current revenue level the company is generating 8% operating margins. Forward EBIT based on my estimates is $3.8 million and if we add back $1.8 million of D&A we get EBITDA of 5.6 million. With an enterprise value of $14.5 million, the company is trading at 2.60x EV/EBITDA.

As a sanity check, the company generated $6.2 million of EBITDA in 2022 with a revenue base of $52.6 million and in 2023 the company generated $3.9 million of EBITDA on a revenue base of $52 million.

Free cash flows are lumpy as the working capital cycle is volatile. In 2023 the company generated $7.8 million of cash from operations and spent $5 million on capex. The company also spent an additional $7.1 million of capex in 2022 as it appeared it was gearing up for expansion. Capex has recently come as the company has only spent $837k in 2024, and only $850k so far in the first six months of 2025.

Assuming the company generates around $5 million of cash from operations and spends $2 million on capex (around D&A), then free cash flow would be $3 million, a 21% free cash flow yield.

If I am wrong on my forecasts there is a substantial margin of safety.

There is zero net debt and the company has $14 million of inventories, $7 million of AR (offset by $6mm of AP), land and buildings on the balance sheet valued at $13.2 million, and $24.6 million of gross equipment.

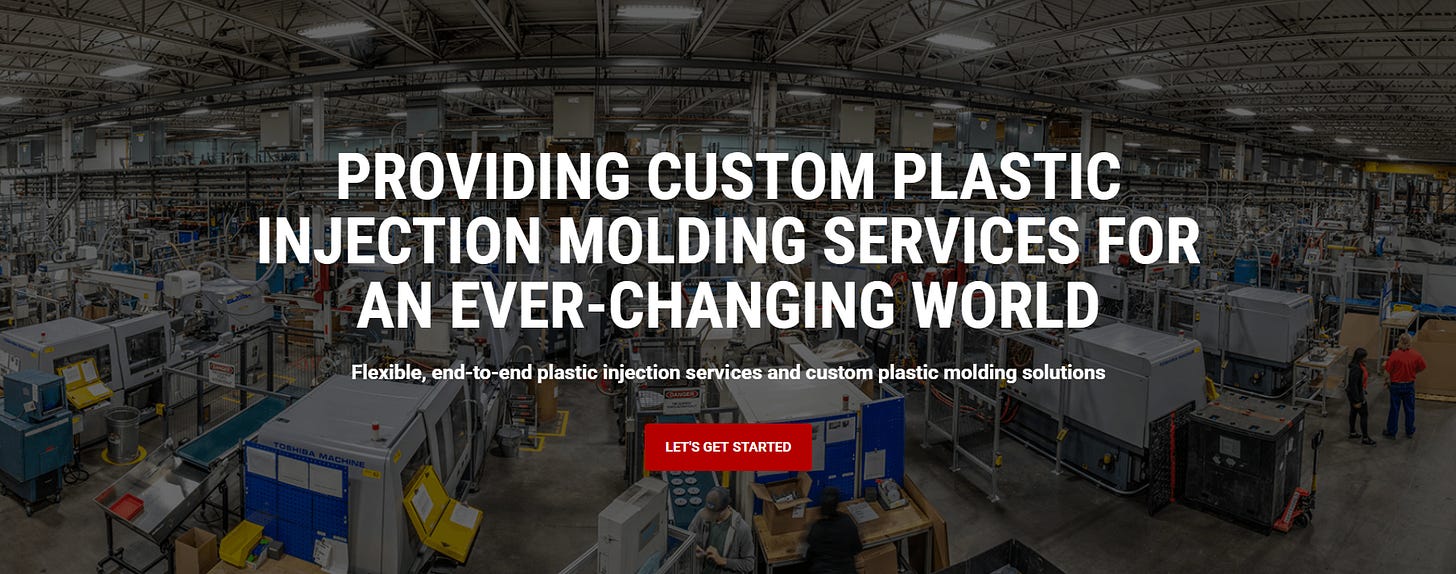

Here is a photo of the inside of their manufacturing facility:

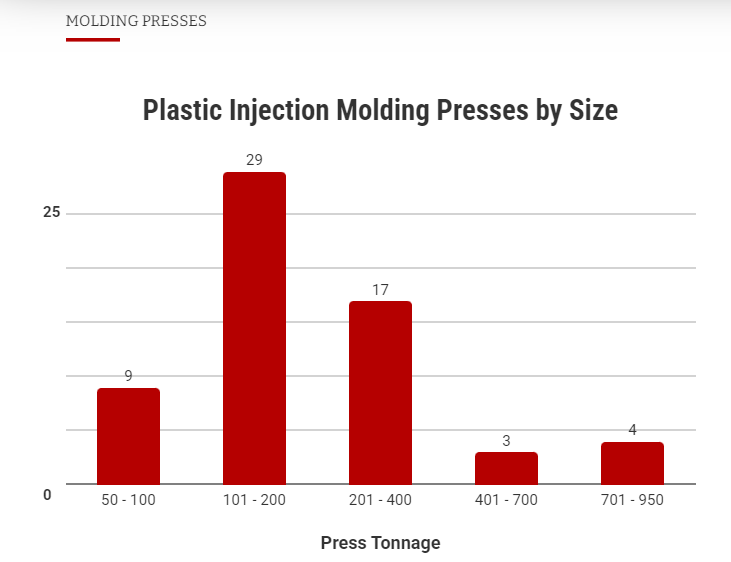

And here is the number of plastic injection molding presses the company owns:

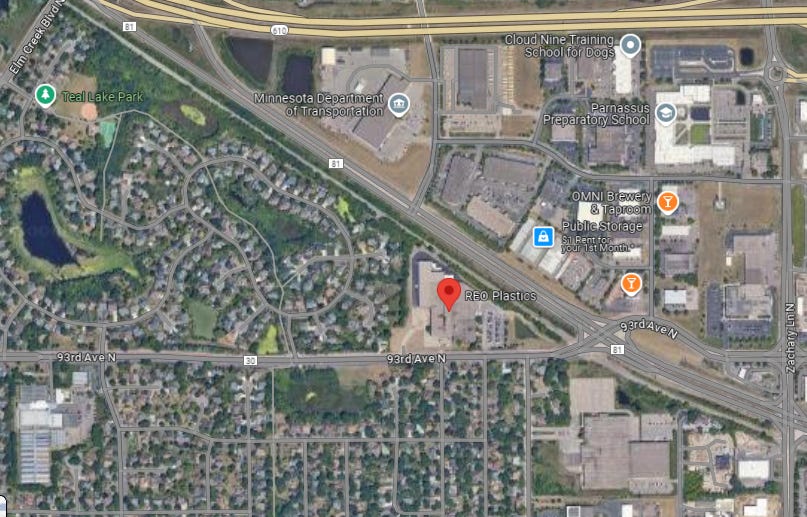

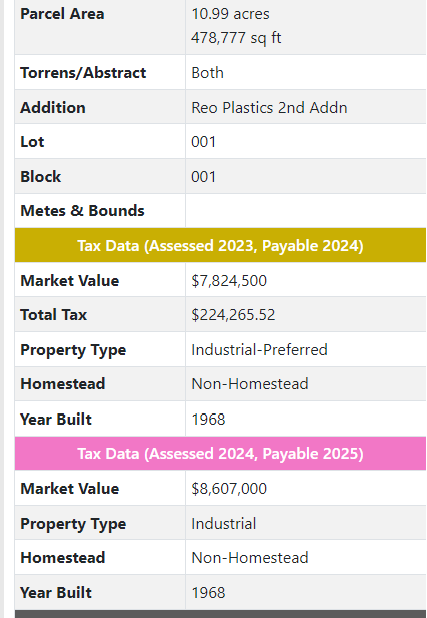

The company doesn’t disclose how many square feet they own but tax data says the facility is 478,777 square feet on 10.99 acres.

If you look on Google Maps it is also surrounded by housing development.

My best guess is the facility could be worth $20 million in a sale and leaseback, or $41 per square foot, for a nice industrial property. The property tax data says the property is worth $8.6 million, but property tax data is always substantially low.

There are risks with the name. Two customers make up over 50% of revenue. The CEO owns 80% of the stock so this is a fully controlled company. There isn’t much disclosure so it would be hard to figure out what is going on with the revenue swings. And it doesn’t look like a very good business that is extremely capital intensive.

However, the stock is just too cheap. Revenues are taking off, the stock is down, cash flows are going to flow back in, and Wall Street is asleep at the wheel. At the current price I don’t think you lose much if the business deteriorates. But if the business continues to accelerate like it has in the past two quarters, I think there is substantial upside.

Disclosure: I do not own REO Plastics, Inc. $REOP but I may purchase shares anytime after I publish this article. This is not investment advice. I am not an investment advisor. Do your own research.