A Cheap Steel Company With Some Major Upside

Olympic Steel, Inc. (NASDAQ: Zeus), Is Even Cheaper Than The United States Steel Corporation

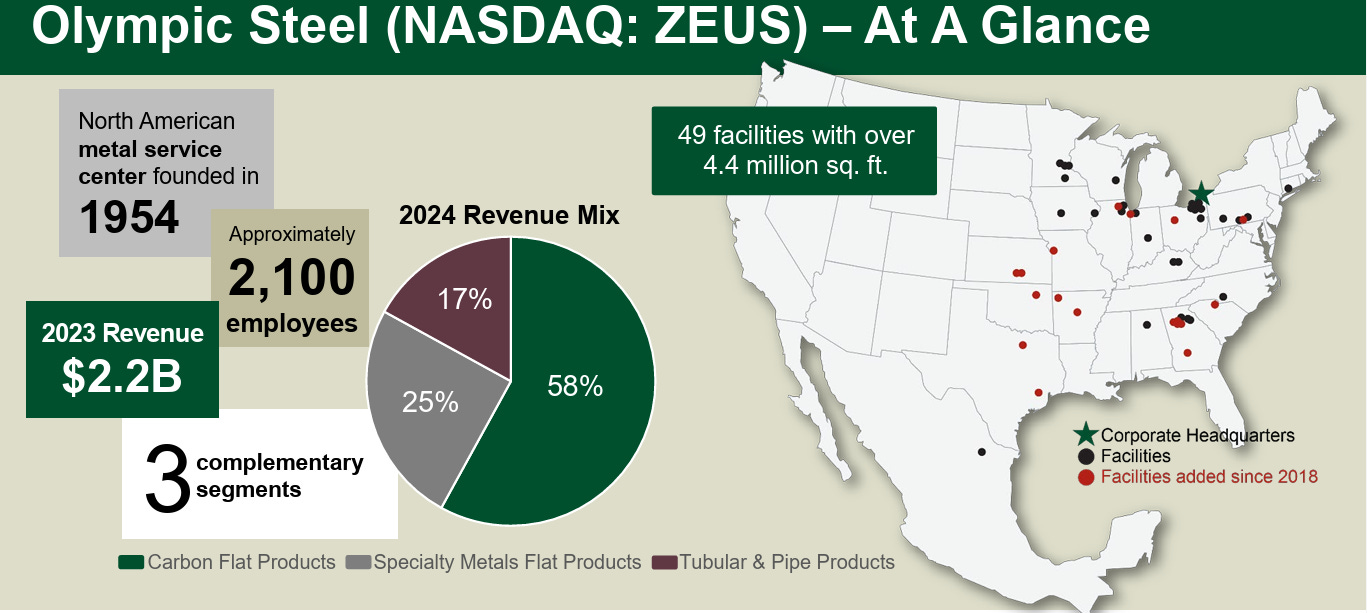

In a previous article I had posted right after Trump was sworn into office, I had written about multiple industries that might be beneficiaries under this new administration. One of those industries was the steel industry. I had mentioned Cleveland Cliffs Inc ( CLF 0.00%↑ ) and the US Steel Corp ( X 0.00%↑ ) specifically as possible investments that could see major tailwinds from a Trump administration. Today I’m going to talk about a company with a P/B ratio that’s even lower than the US Steel Corp that has been aggressively expanding their business towards less cyclical, higher margin products while actively devesting from their lower margin businesses. Steel prices have slumped and business from industrial manufacturing has been declining for a couple of years now. Due to the diligence of the management team behind Olympic Steel Inc ( ZEUS 0.00%↑ ) however, if steel demand simply levels out here, the company will likely grow its business simply because of their recent focused expansions to higher margin products. If steel demand picks back up, then I believe that ZEUS’s share price could explode.

The steel industry is highly cyclical and it appears that we are clearly at or near the bottom of a current cycle. Despite industry wide troubles resulting from falling steel prices, ZEUS has been able to not just maintain profitability but actively acquire new businesses like Metal-Fab and Central Tube and Bar while concurrently paying down their debt. These companies not only help fulfill ZEUS’s focused vision of expanding into higher margin endeavors but, these newly acquired businesses are pushing ZEUS into brand new geographical regions. This could help build important business relationships that may help ZEUS foster new revenue sources from their other product offerings in the future.

Here are what I believe to be, some key drivers to ZEUS’s future success.

Basically ZEUS is experiencing a slump in income due primarily to the falling price of steel. If the selling price of steel improves ZEUS should experience improved profits.

In FY2023 approximately 48% of ZEUS’s revenues came from industrial machinery and equipment manufacturers and their fabricators. If domestic industrial manufacturing was to do well with this new administration then ZEUS could profit handsomely.

FY2023 was the second year in a row that ZEUS experienced a hot-rolled carbon steel index pricing decline of more than 45%.

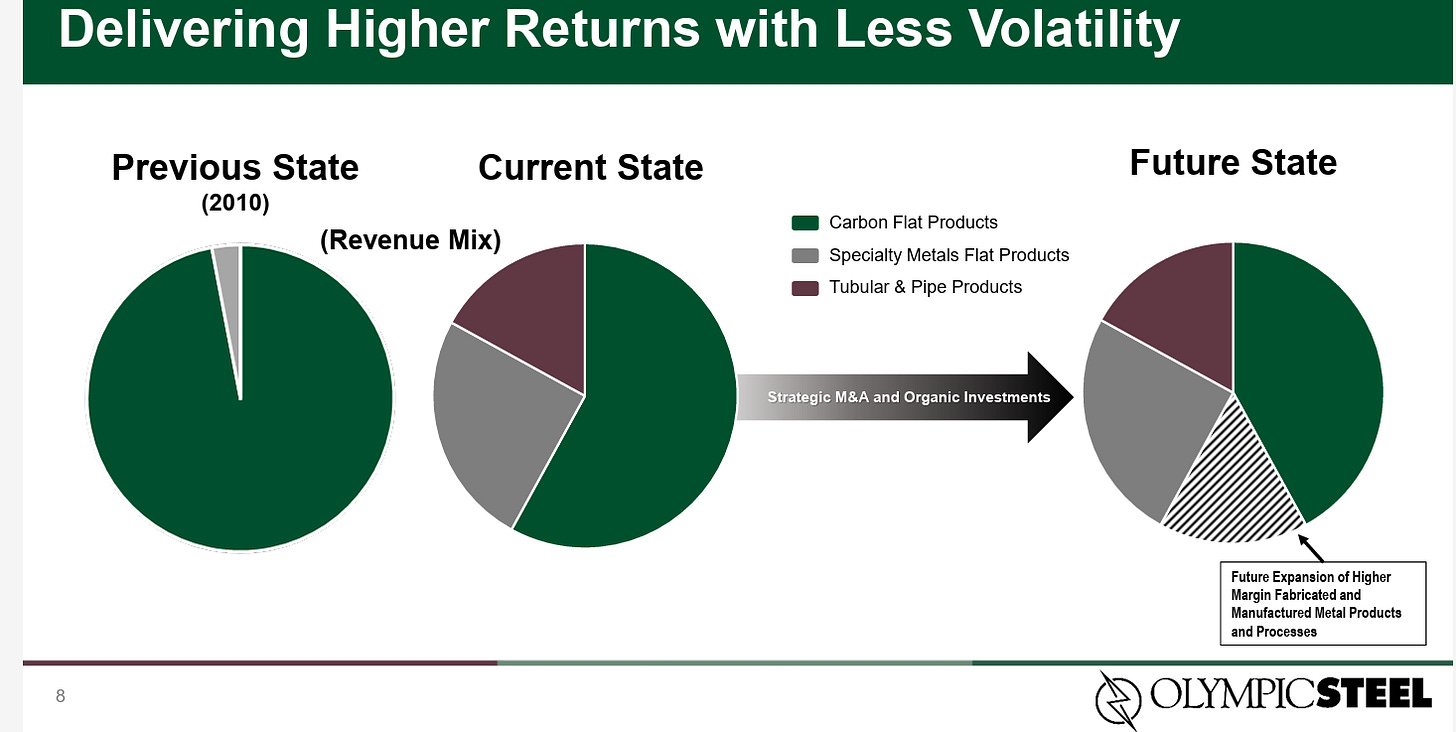

2024 would be ZEUS’s sixth year of operating under a business strategy aimed at building a more diversified company. The company used to offer mostly carbon flat products but in recent years has greatly expanded their line up of specialty metals flat products and tubular and pipe products.

Over the last five years ZEUS has made six acquisitions.

This strategy is intended to diversify ZEUS’s products into offering more countercyclical steel-intensive end products and invest in higher margin opportunities such as flat-rolled coated products and the expansion of their fabrication capabilities.

This should help ZEUS perform strongly under most economic conditions, including more challenging markets.

ZEUS has also strategically divested assets to further tighten their focus on higher-return, higher-value-added products.

In FY2023 ZEUS invested $170 million in the acquisitions of Metal-Fab and Central Tube & Bar. Both investments have produced strong EBITDA returns.

ZEUS has seen demand weakness from industrial machinery and equipment OEMs.

The company believes that there is some pent up demand from these sectors.

Even if demand fails to increase substantially, a stabilization in demand at current levels should lead to ZEUS’s revenue increasing as they have recently expanded their business so much.

One of the ways that ZEUS has been improving margins is by automating some of their facilities improving efficiency and throughput.

For news ways of improving efficiency ZEUS has ordered two new lasers and two new plasma cutting machines along with an automated material handling system to expand their fabrication capabilities in Chambersburg, Pennsylvania.

ZEUS has also ordered a new cut-to-length line for their Minneapolis coil facility, which will support their continued growth in cold-rolled and coated products to improve their efficiency.

ZEUS has also ordered a new cut-to-length line for their Schaumburg, Illinois facility, and a new high-speed specialty slitter for their Berlin Metals operation outside of Gary, Indiana.

Net Asset Value and Basic Business Model

At a net asset value of $48.79 per share I think ZEUS is poised to make the most of a comeback in the steel industry. The company is a processer, distributor, and stores metal products so that they can be used in a large variety of manufacturing and building applications. ZEUS segregates their value added steel processing into three segments: carbon flat products, specialty metals flat products, and tubular and pipe products. Just a few years ago the company produced mainly carbon flat products however, in the last five years ZEUS has made six acquisitions which have greatly expanded their product offerings.

This has also helped the company expand into new geographical regions across the United States.

Diversifying to Add Resilience

As ZEUS continues to expand into these higher margin businesses in new geographic regions, the company is also diversifying itself in order to be more resilient in the face of economic downturns and hardships. I think that ZEUS’s continued profitability throughout these past couple of years of slumping steel prices is a testament to management’s diligence. If economic conditions for value added steel processing simply stabilize, ZEUS’s new business diversifications into higher margin businesses should begin to shine through. If the steel industry starts to actively begin a modest recovery, then ZEUS should experience an enormous growth to their bottom line. If this were to happen the company’s share price could skyrocket.

DCF

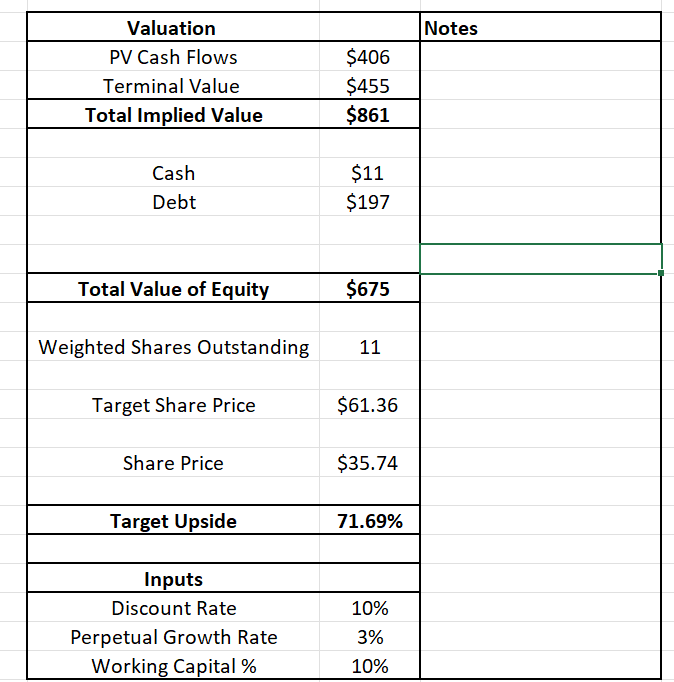

When I ran a discounted cash flow analysis on ZEUS with a 10% discount rate I got a target price of $61.39 per share. That’s a 72% upside from the current share price of $35.74. This assumes that ZEUS can grow their revenues at an average rate of 5.0% over the next decade with an average EBIT margin of 4.0%. I would consider this to be reasonably achievable considering how far these figures have fallen over the past couple of years.

Steel Prices and Tariffs

A drop in prices has been the main catalyst for the steel industry’s recent slump. As steel prices cheapened, ZEUS had to subsequently lower their prices hurting their performance. If the price of steel goes back up ZEUS should see their revenues begin to drastically increase. These new tariffs Trump has just announced could help raise steel prices. This should help ZEUS as they can charge more for their services. There is however a real risk of one of these trade disputes backfiring. If the price of steel becomes too great to pass along to their customers, ZEUS could fare poorly as large industries would have to slow down production to account for waning demand. Thus far Trump’s tariff policies have been short lived. I for one, am not about to pretend to know exactly what this administration is going to do next but, higher steel prices in most cases, should be a catalyst for a ZEUS recovery.

Conclusion

I may sell my position in MLP 0.00%↑ to shore up some funding to buy into ZEUS, I haven’t quit decided. I believe that ZEUS has much more upside in the short-term as compared with MLP. As you can see the stock price is pretty cyclical and I believe that the steel industry is likely at or near a bottom. Any positive industry wide news should lead to enhanced profitability and meaningful growth for ZEUS. Over this recent slump they’ve been busy acquiring other high asset low liability businesses while simultaneously lowering their debt burden.

ZEUS’s M&A activities have been very value centric while continuing to steer the company into higher margin steel processing ventures. I think that Richard Marabito (CEO), Richard Manson (CFO), and the rest of ZEUS’s management team are highly respectable and very thoughtful in their approach to operating within the steel industry. Their due diligence has I believe, put the company into a position to not just return to their former glory of past profits once the steel industry begins to pick back up but, to soar straight to new heights.

Disclosure: I do not own shares of Olympic Steel, Inc. ZEUS 0.00%↑ but I may buy shares following the publication of this newsletter. This is not investment advice. I am not an investment advisor. Do you own research.