A Century-Old Community Lender May Be Entering Its Next Big Upcycle

Debt Down, Margins Up: Signs of a Recovery at a Southern California Bank

This century-old Southern California community bank has weathered more than a few cycles and today it may be in the early innings of a recovery. After several years of elevated borrowing costs and falling net income, the bank has been aggressively cutting debt, slashing it from $1 billion in 2023 to just $300 million as of mid-2025. That discipline is starting to show. Net interest margins are improving, expenses are coming down, and profitability is trending higher. With a fortress balance sheet, deep community ties, and a long dividend history, this could be an opportunity to buy in before the market prices in a turnaround.

Subscribe Now and Get 25% Off Forever

Right now if you Subscribe to The Value Road you’ll get 25% off of your subscription. This is not a gimmick or a short-term coupon. If you subscribe now you’ll lock in that discounted rate for life. I’m doing this because I’ve crossed an important threshold and have written 100 articles on Substack and wanted to give something back to my supporters. Thank you guys so much. This is article 102 and I am looking forward to writing the next 100.

Farmers & Merchants Bank of Long Beach ($FMBL)

The Farmers & Merchants Bank of Long Beach ($FMBL) is a century-old, California state-chartered community bank founded in 1907 that serves customers from Long Beach through Orange County and up to Santa Barbara via 27 branches plus online services. This bank acts as a lender to individuals, small to medium sized businesses, and local commercial clients.

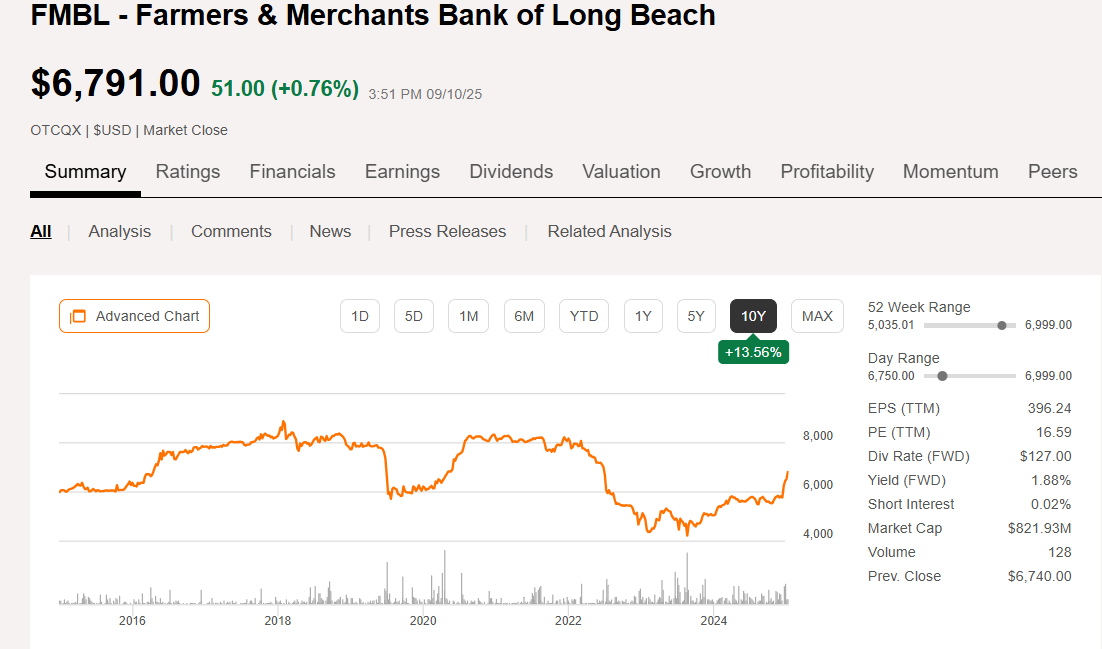

FMBL has an extremely low share count with only 122,126 shares currently outstanding. The company is currently trading at $6,791 per share giving them a market cap of $829.4 million.

Farmers & Merchants Bank of Long Beach’s Operations

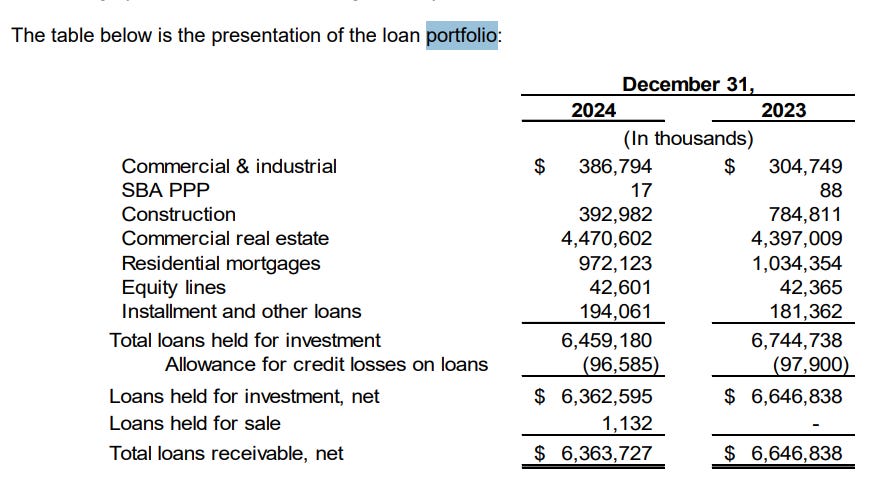

FMBL is a conservatively run, well-capitalized regional bank with a long dividend history and low loan stress. All of FMBL’s regulatory capital ratios are well in excess of regulatory requirements for a “well-capitalized” financial institution. They paid out their 533rd consecutive dividend declared this August and the company’s allowance for losses amounts to only 1.51% of their loan portfolio.

Other than their Commercial Real Estate loans weighing much more heavily on their portfolio, the bank’s loans are pretty well diversified by loan type with values that are much more closely aligned with one another. Regionally however, FMBL’s loan portfolio is concentrated specifically in Southern California.

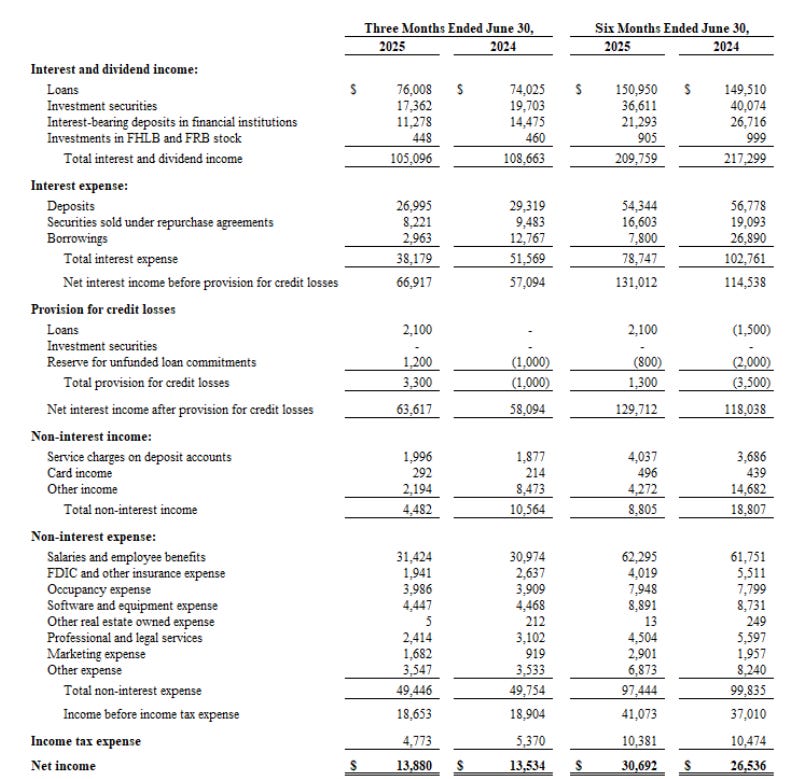

FMBL had substantially higher interest expenses for their bank deposits and borrowing as well as an increase in the company’s securities sold under repurchase agreements expenses during their FY 2024 as compared to 2023. This resulted in FMBL seeing a $25.1 million decrease in their net income in 2024, a 35% decrease from the previous year.

Thus far in 2025 FMBL is seeing a recovery in their banking operations. During the first six months of 2025 the bank has seen a $4.2 million increase in net income, a 15.7% increase YOY. This can largely be attributed to the bank seeing a large decrease in borrowing expenses.

FMBL has been hard at work lowering their outstanding borrowing figures. From the bank’s FY 2023 to their FY 2024 they cut their borrowings in half from $1 billion to $500 million.

Then from $500 million down to $300 million as of their last quarterly report.

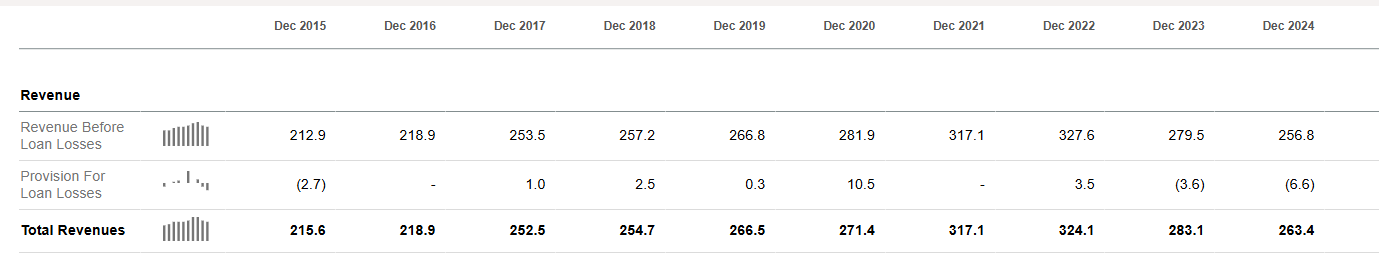

As you can see here FMBL’s total revenue figures have been on a bit of a roller coaster over the last decade.

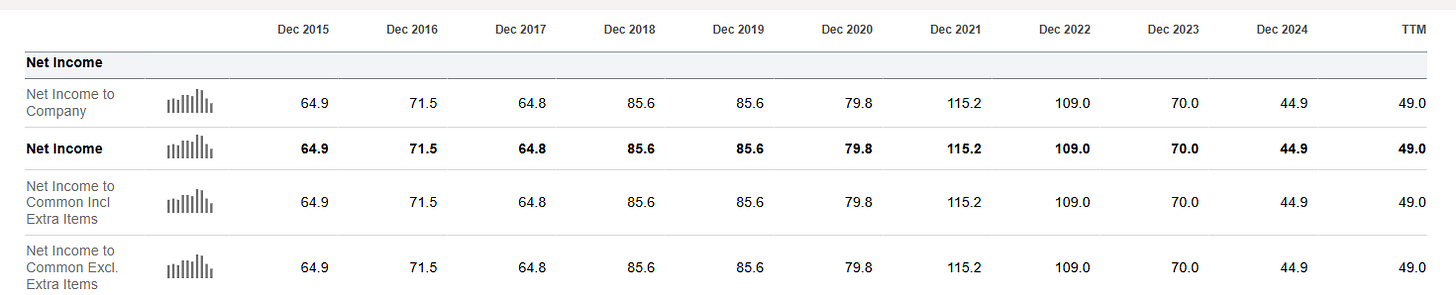

Their net income has too.

FMBL’s stock price has responded to this volatility largely in step with the company’s operating results with the bank’s last share price downturn beginning in 2022 and the stock falling from over $8,000 per share to around $4,500 per share at times.

As you can see from the bank’s share price history, FMBL’s share price follows the bank’s income streams and profitability pretty closely.

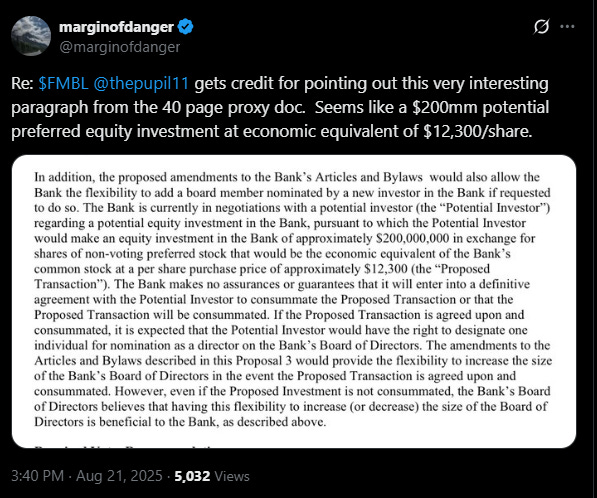

The Potential for a $200 Million Investment

FMBL may be on the receiving end of a $200 million investment from an unknown potential investor. I spend a lot of my time rummaging through the deepest corners of my X account and stumbled upon this.

FMBL would almost certainly have somewhere in mind for this to be invested in. Buying up a regional bank perhaps? Investing in property? Investing in other securities? A massive share buyback? The banks market cap is only $829 million. That much capital could be a game changer and alone could cause the stock to rerate.

Conclusion

Right now I believe we are looking at an opportunity to purchase some stock in FMBL while the company is still early in a recovery phase of an upward cycle. Their debt is coming down rapidly and their expenses are also lowering while their loans are finally growing again. The bank’s net interest margins improved to 2.42% in Q2 of 2025 from 1.92% a year ago and the company’s allowance for losses on their loans is only 1.51% of their loan portfolio. FMBL might also be looking down the barrel of a game changing $200 million investment. The bank could use that money to do all sorts of things and could be a huge positive catalyst for the bank’s share price.

So long as Southern California and the U.S. economy continues to remain prosperous FMBL should continue to see a comeback. FMBL has a conservative balance sheet with capital ratios well above the “well-capitalized” thresholds required federally. This bank is well over 100 years old and has deep roots in the very regional community that it serves. I could easily see this stock hitting $8,000 a share again if the company recovers their margins now that their debt is so reduced. If the economy was to see a downtown turn however all of this progress will likely be lost.

Disclosure: I do not own shares in the Farmers & Merchants Bank of Long Beach ($FMBL) but may buy shares anytime following this article. This is not investment advice. I am not a financial adviser. Do your own research.