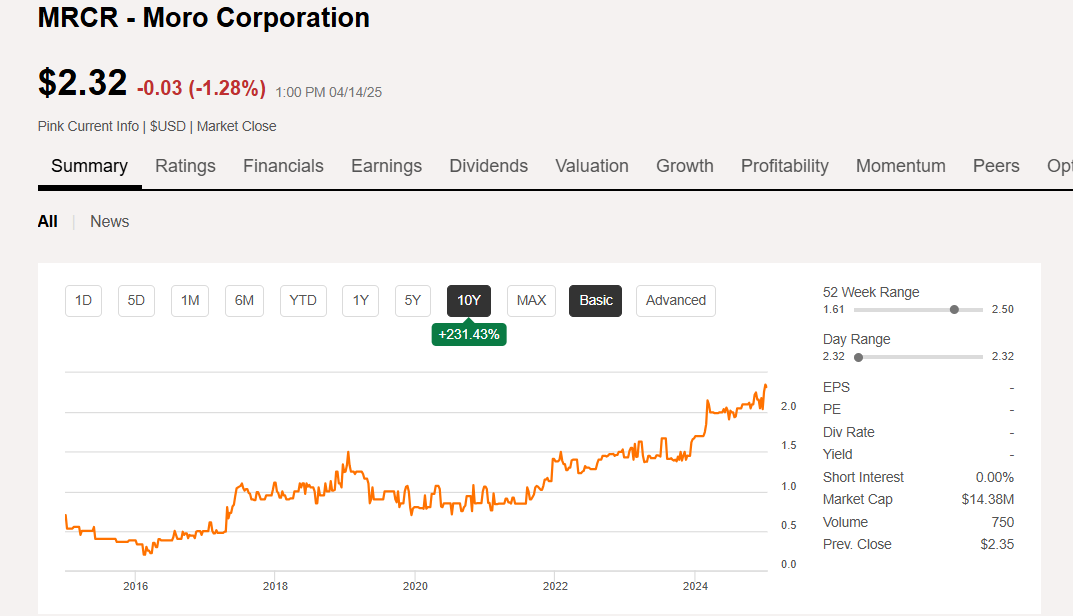

A $14.2 Million Market Cap Company With $8.1 Million in Cash Trading at a 32% Discount to NAV With a 116% Cash Flow Upside

A high NAV With An Undervalued Cash Flow

An investment acquaintance of mine had sent me a text earlier in the week throwing me a tip on a stock he’d found while looking through potential investment ideas for a fund that he works for. The ticker symbol he sent my way, along with the reason he sent it encompasses exactly why I like investing in Nano-Cap land. The message simply read “________ looks like a good stock, too small for us to buy but you’ll like it”, and like it I did.

This company is simple to understand and is undervalued from both a cashflow and a NAV standpoint. Another huge positive, considering all of this recent uncertainty around trade tariffs, is that this company is domestic. Although they do make large steel purchases, their suppliers are all domestic as well. If other manufacturers in their industry become unable to source steel from China, companies already sourcing their products domestically might gain some significant advantages that could help them weather a tariff storm should this recent global economic spat continue.

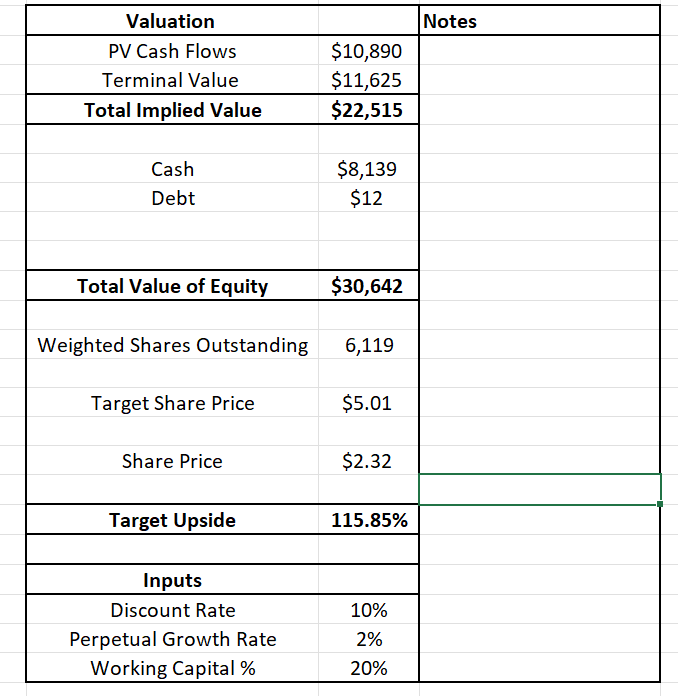

If tariff tensions ease, this company is looking like it’s set up to maintain a steady period of growth with healthy margins leaving a cashflow value upside potential of $5.00 per share, a 116% upside compared to the company’s current share price of $2.32. This 116% cash flow value upside potential comes paired with a NAV that’s 32% higher than the company’s market cap. Lastly, this company only has $12K in long-term debt. That sounds like a buy in my book.

The company I’m talking about is primarily involved in HVAC as well as producing rebar for buildings, bridges, and roads. This company manufactures a lot of their materials directly through their subsidiaries. The company I’m talking about is the Moro Corporation ($MRCR).

With 6.1 million shares outstanding and a share price of just $2.32, MRCR has a small market cap of roughly $14.2 million. The company also has a GAAP NAV of $3.06 per share, a 32% upside from the stock’s current trading price. Best of all, this company has only 12.5K in long-term debt and more than half of its market cap is in cash with $8.1 million sitting on its balance sheet.

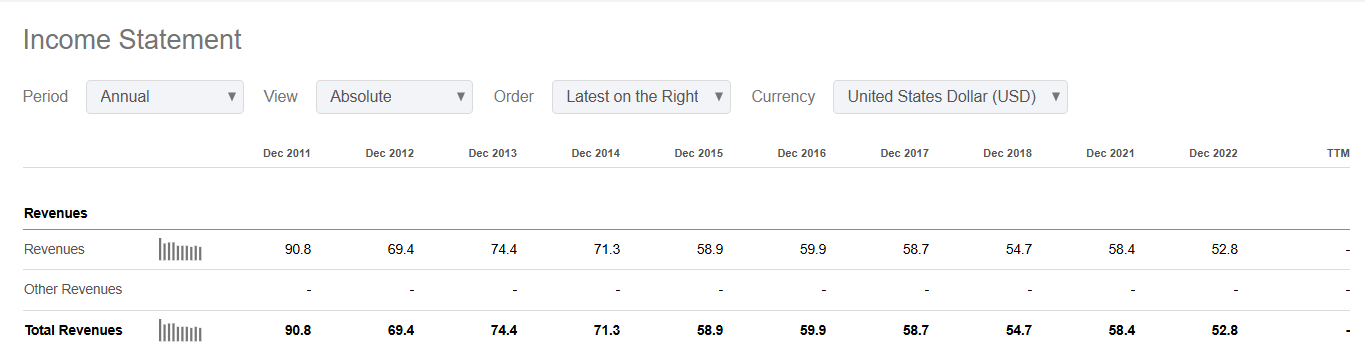

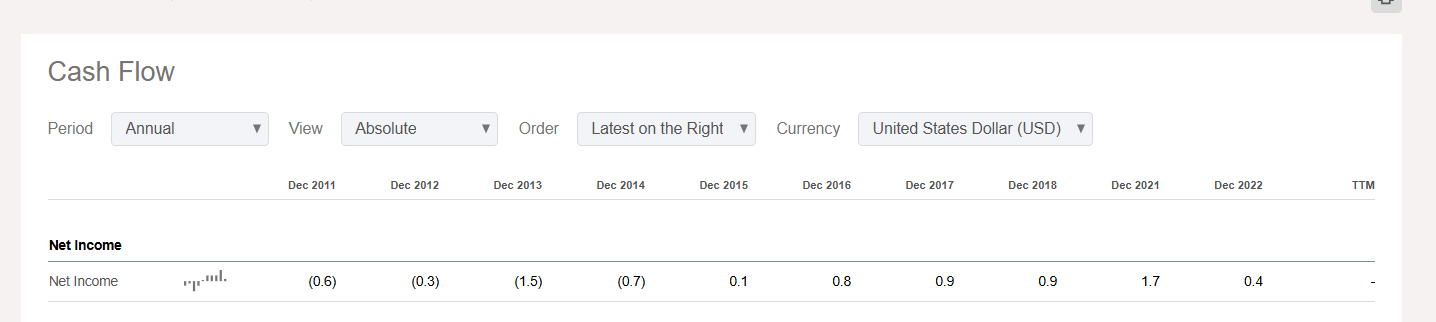

While MRCR used to make a considerable amount more in revenue, those operations were often unprofitable and so over the last dozen years the company has sold off its unprofitable business segments. This has led to consistent net income for the company since 2015. Besides a bad 2022, the company has been steadily growing their net income by lowering costs, in turn slowly increasing their margins.

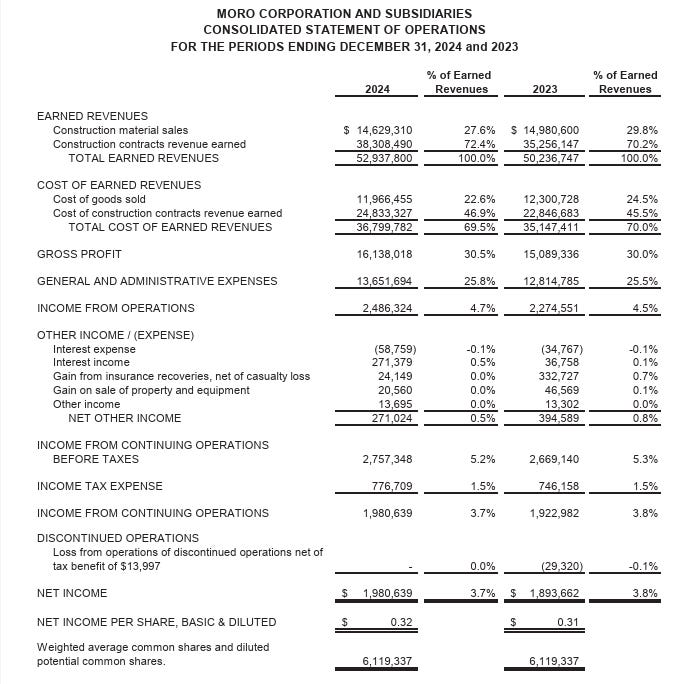

In MRCR’s fiscal 2023 and 2024 the company saw its net income climb to $1.89 million and then to $1.98 million.

MRCR’s Current Operations

MRCR used to be involved in a large array of construction related industries but has been slimming down the scope of its operations for a while now. The last subsidiary that MRCR closed was Titchener Iron Works in 2022. This company fabricated and installed custom stairs as well as steel and aluminum railings. The business was shut down and its assets sold off due to, like many of MRCR’s other shuttered businesses, its lack of profitability. Now however they’ve scaled back their operations substantially into two segments. Here’s the scoop.

Construction Contracting Division

This division provides heating, ventilating, and air conditioning (HVAC); plumbing and process piping; industrial electrical products (high voltage, fiber optics, building controls); contracting services as a subcontractor or as a prime contractor.

The Company sells, installs and services heating, ventilating and air conditioning (HVAC) systems to both residential and commercial customers in the Albany, Binghamton and Hudson Valley areas of New York.

The Company provides electrical contracting services for public and private sector customers in the Hudson Valley area of New York.

This Division purchases steel, steel pipe, HVAC and plumbing equipment, and electrical components from several domestic sources. The Company believes it has satisfactory relationships with its various vendors.

Construction Materials Division

This division fabricates reinforcing steel (also known as rebar) and distributes construction accessories. These products are primarily sold to concrete contractors who use the products as a component in the construction of roads, bridges, buildings, and other structures.

The products are sold primarily in New Jersey and southern New England.

Steel is generally purchased directly from one of several domestic steel mills while construction accessories are purchased from various manufacturers. The Company believes that it has satisfactory relationships with its various vendors. The company anticipates that it will have sufficient supplies and materials to conduct its operations in the ordinary course of business.

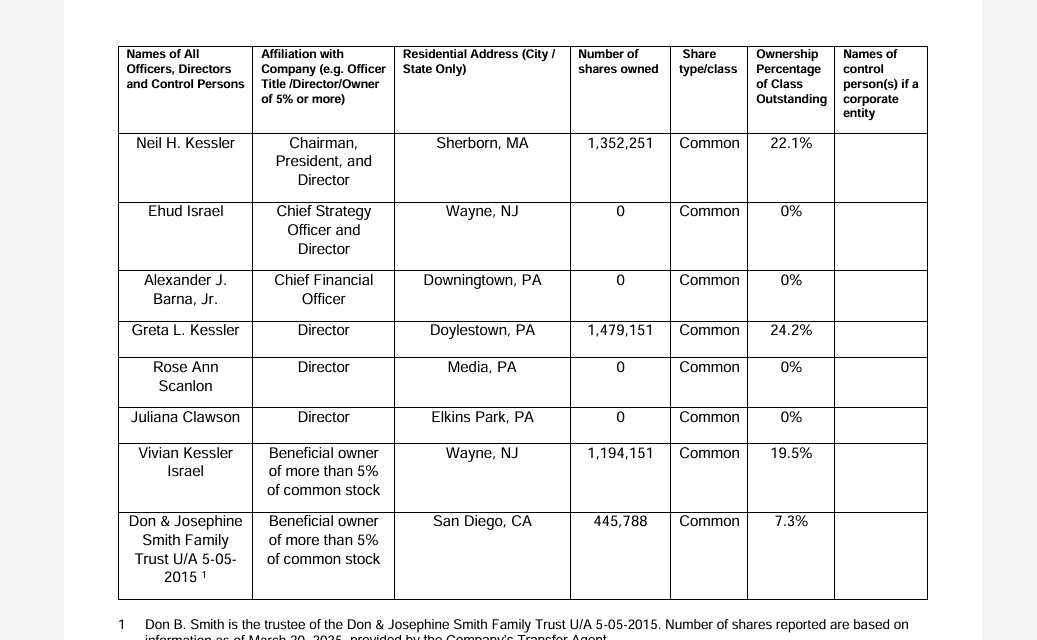

Management’s decision to shut down businesses when they become unprofitable says a lot about their dedication to constantly improve the company they run. Those in management that do own shares in MRCR own a considerable amount and stand to lose a lot of money if operations go south. I think that management’s diligence is reflected in the continued rise of the company’s share price since they’ve sold off what appears to be the last of their unprofitable businesses. Everyone that does own stock in the company also seems to be related, sharing the last name of Kessler.

Cash Flow Potential

While MRCR has seen it’s share price rise considerably over the past decade the market still has yet to price in the company’s cash flow potential now that they’ve reduced their operating costs and sold off their unprofitable business ventures. If MRCR was able to grow its revenues annually by an average of just 1.6% and were able to maintain their current EBIT margin of 4.7%, I believe that MRCR’s stock would be worth $5.00 a share, a 116% upside from their current share price of $2.32.

Conclusion

I think that MRCR is a buy. While there are other companies out there that have the cash flow potential to more than double their stock price, the goals that MRCR has to achieve in order to make this happen are entirely reasonable and likely easy to accomplish. What makes things even better is the company’s past commitments to clean up the their roster and get rid of the business ventures that kept cutting into their bottom line and just focusing on the select few operations that have a real potential to profit consistently.

A lot of the companies I come across have a lot potential if they sold off this or that segment of their operation and then used that cash to pay down their debts. This in turn would then set that company up for future profitability. In the case of MRCR however, they’ve already done that and can now maintain a closer focus on a smaller scope of operations. I don’t think the market has priced all of this in yet and I expect MRCR’s share price to continue to rise as investors see a consistent and steady increase in YOY income.

The bear case to be made against MRCR is largely based on tariffs and increased input costs for things like metals which the company needs to produce their Rebar and HVAC systems. Those dangers are real but there’s not many places you can park your money to escape this new economic reality. This company is profitable, has almost no debt, with a very undervalued cash flow potential. MRCR is just about as classic of a value investment play as it gets. Although MRCR make large steel purchases, their suppliers are all domestic. If other manufacturers in the industries where the company operates become unable to source their steel from China, companies like MRCR who are already sourcing their products domestically might gain some significant advantages against those who have to make new relationships with domestic steel companies.

Disclosure: I do not own shares of Moro Corporation ($MRCR) but I may purchase shares anytime after I publish this article. This is not investment advice. I am not an investment advisor. Do your own research.