A $1.3 Million Company With $1.1 Million in Cash, a 76% Gross Margins, and Zero Debt

Buy a $1 Million Pile of Cash for $254k

The company I’m going to be talking about today is tiny. Their 1.7 million shares are currently selling for $0.75 which gives this business a teeny market cap of just $1.3 million. I don’t often come across companies this small but it wasn’t this company’s miniscule market cap that caught my eye. I almost never come across a company with so many pillars of value. Usually when something looks this good I find out half way through reading their financials why the company is priced so cheaply. This time however, the more I read, the more I liked what I was reading. I think this company might just be a perfect value investment candidate.

This company trades at $0.75 a share but has a NAV of $1.01 per share. This company has no long-term debt. They also have a $1.06 million cash pile. That’s almost the size of their market cap! Due to this low debt and large cash pile they have an astonishingly low $254k enterprise value. When all is said and done you can buy a $1.06 million pile of cash for just $254k!

When a business is trading this cheap it’s usually accompanied by a past full of net losses or at least shrinking margins, not here though. This company is growing its margins not just by lowering their cost of sales but also by lowering their general and administrative expenses, something I rarely see happen nowadays, especially in this post inflationary environment we’re in now. This company’s gross margins currently sit at 76.4% up from 73.6% last year and 71.1% in the company’s fiscal 2023. Any extra revenue this business is able to bring in should drop right down to their bottom line

After a new president and CEO joined the company they’ve finally managed to put some of their cash to work and have experienced a 627% increase in interest income over the past three years, further adding to the company’s profitability. This business makes real tangible products that benefit and actively helps to manufacture the world around us and have recently signed a contract with a huge international distributor that will put the company’s products in front of the eyes of countless businesses operating in the mold making and die casting industries around the world. This business also services a whole array of other industries including the automotive, aerospace, mining, petroleum, shipbuilding, welding, machine tooling, plastic molding, racing, engine building, and armament industries.

The products this company makes benefits manufacturers by saving them time and I mean extensively through processes that don’t require heat to be applied to metal and therefore doesn’t require an extensive cooling period. These products also help the metals they’re used on retain shape because they aren’t exposed to extreme heats which can warp parts. This technology scales too and can handle metals weighing just a few ounces all the way up to products that weigh one million pounds.

This is a small well run company with a new CEO/President and new ideas which could see the company looking at a large runway for growth in the coming years. You don’t often find this many catalysts in one place. The more I looked into this business the more I knew I had to write them up.

Located in Royal Oak, MI Bonal International, Inc. ($BONL) makes products and performs services that provide sub-harmonic vibratory stress relief to metal products during various stages of their manufacturing processes. The company sells its products both in the United States and internationally. In laymen’s terms, when companies manufacture metal products they usually induce a lot of stress upon the material which then needs to be worked back out of the metal. This happens all of the time when metals are welded, machined, casted, or forged. The most common way of providing stress relief to metal is by giving it a heat treatment.

How Sub-harmonic Vibratory Metal Stress Relief Works

Those products can often get heated up to 1,000 degrees Fahrenheit for up to 7 hours and then need to be cooled off before the metal can continue to be worked on. In some cases cooling off these stress relieved parts to room temperature can take 13 hours or more. BONL makes products that induce sub-harmonic frequencies into these parts. These frequencies rattle the part which in turn relieves the stress the part has built up during the manufacturing process. BONL can take that 20 hour heat up and cool off time needed to stress relieve parts via a heat treatment and reduce it to just an hour.

While we’ve had forms of vibration stress relief in metal manufacturing since WW2, those older methods are very inconsistent and not measurable. Sub-harmonic stress relief is on the other hand, measurable and consistent. You’re not just randomly shaking a product around. Instead you calculate the product’s harmonic frequency and then use one of BONL’s products to induce a frequency lower than the metal’s harmonic frequency (this is known as a sub-harmonic frequency). After inducing the frequency into the metal you then measure the metal's harmonic frequency again to see if it has changed. If there is a shift in the metal’s harmonic frequency, it means that stress relief has occurred. The effectiveness of BONL’s products have been independently tested and verified by the U.S. Army, the U.S. Navy, the Department of Energy, the University of California, and Lockheed Missiles and Aerospace.

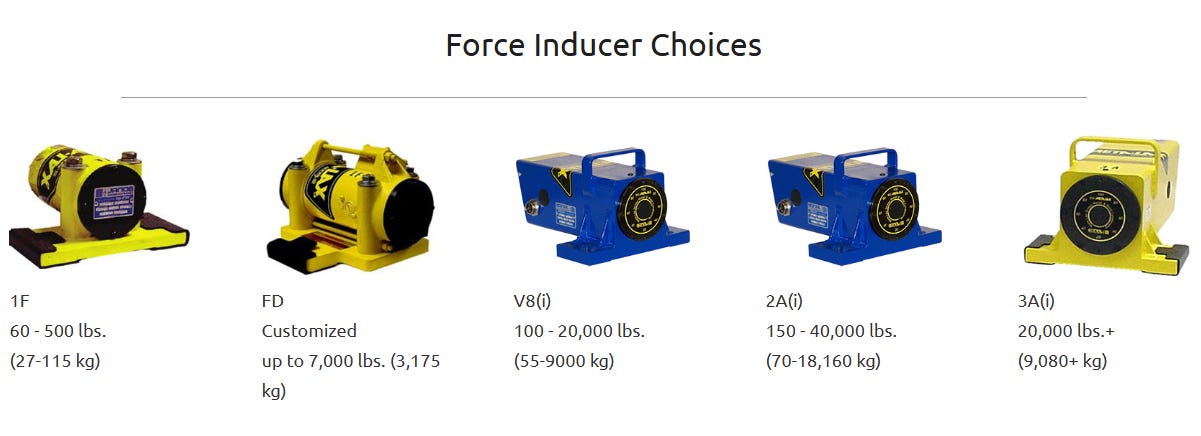

Bonal’s Products

BONL’s sub-harmonic stress relief products are sold in two parts, the console and the inducer that actually facilitates the vibrations. BONL doesn’t just sell these products it also provides metal stress relief services to several industries as well as provides consulting, training, and program design for its customers.

The Benefits Of Sub-harmonic Vibratory Metal Stress Relief Compared To Other Forms Of Stress Relief

The most obvious benefit a company would gain by adding BONL’s products to their production process would be the saved cycle time. The other benefit that isn’t as obvious is that products that use BONL’s sub-harmonic technology instead of heat treatments undergo way less warp. Using BONL’s sub-harmonic technology can help companies reduce scrap, save on material cost, or help them get jobs with tighter product specifications than they’d otherwise have been able to achieve with traditional heated stress relief. The other huge benefit that saves BONL’s customers money is that since BONL’s treatments aren’t heat intensive, companies don’t have to spend all of that money running large heat sources to treat their parts for almost an entire shift before having to let them cool off for another shift and a half before they can be handled again.

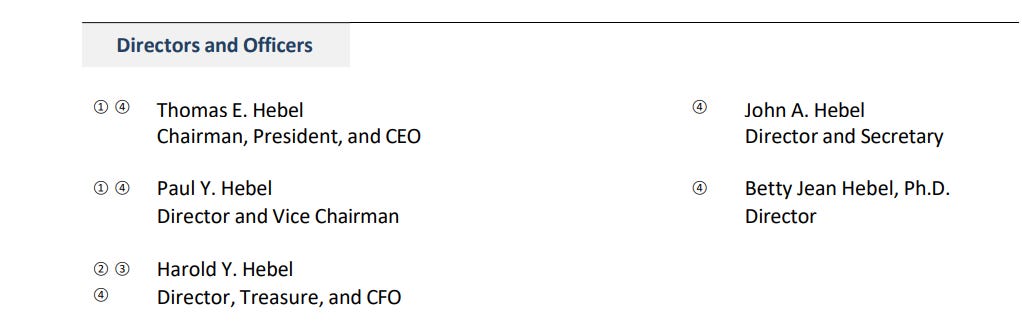

A Family Run Business

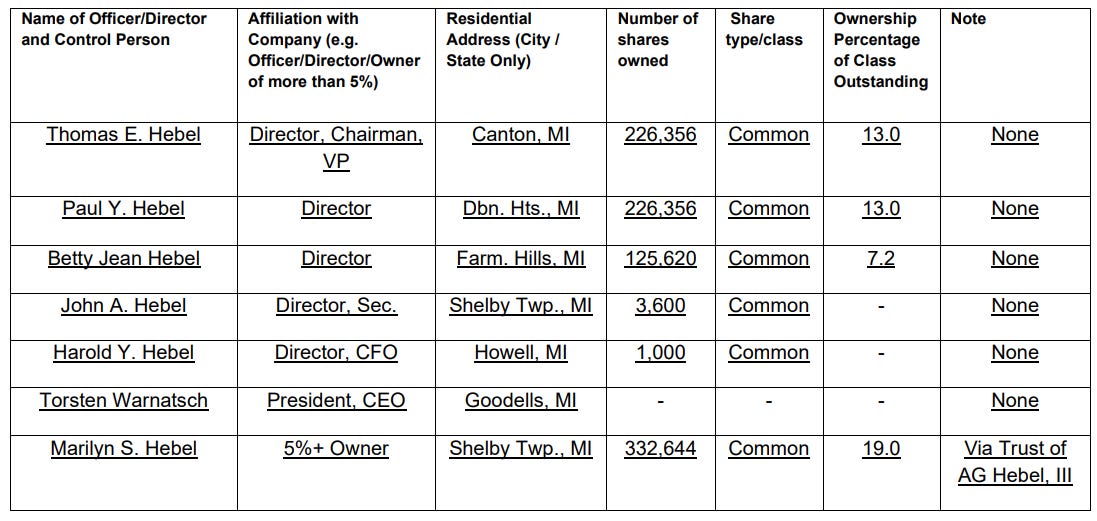

BONL is probably the closest knit family business I’ve ever seen during my time digging through all of these OTC stocks. Note all of the Hebels on this list, it’s literally everyone.

Thomas E. Hebel did retire though and the company has since hired Torsten Warnatsch as President and CEO. While the Hebel family has clearly done a very good job at building a valuable and debt free business, I’m hoping that Torsten can help BONL’s sub-harmonic vibrational metal stress relief technology become a more recognized option for metal stress relief not just in the U.S. but globally. It looks like Torsten is from Germany. From what I can tell from his Linkin page, Torsten appears to have moved to the Metro Detroit area to become the CEO and President of Bielomatik GmbH’s U.S. division. He worked at Bielomatik GmbH from 2015-2019 before working as President and CEO at Bucher USA INC until 2022 and then become President and CEO at BONL shortly after in June of 2023.

I’m hoping that a fresh set of eyes at a company with so much potential can help BONL really step up and capture some of that metal stress relief market share that’s out there waiting for them. Thomas Hebel had run that company for 50 years and a fresh set of eyes on BONL might lead to some positive catalysts that have been overlooked. While it’s hard to tell what the long-term prospects on BONL are, now that Thomas Hebel has stepped down as CEO and passed the torch to someone other than a Hebel, I wouldn’t be surprised if the company engaged in a sale at some point in the future. The company is cheap and their products and services would be attractive to a variety of companies involved in metal manufacturing. The Hebel family collectively owns 52.2% of the company’s outstanding stock so if the Hebel’s don’t want to sell they definitely don’t have to. It’s hard to say what the other family members want out of BONL now that Thomas has stepped down as President and CEO.

Is It Bonal’s Time To Shine?

According the BONL, “The market for Bonal's products, as determined by independent market studies, is more than $800 million in the U.S. and nearly $2 billion worldwide.” I’m assuming most of this potential market for BONL currently uses heat treatment because BONL only captured $1.7 million in revenues in their fiscal 2025. The company’s products offer a compelling alternative to heated metal stress relief that can save companies a ton of money during their production processes. Old habits die hard though and even with a new CEO/President shaking things up at the company BONL might have a hard time convincing established industrial manufacturing companies to change course. Tariffs might just end up being the catalyst that could start to change that.

For BONL Tariffs Could Be A Double Edged Sword

I think that if tariffs continue companies are going to have to rethink how they produce and manufacture metal products, not just in the United States but globally. BONL’s sub-harmonic vibratory metal stress relief products are easy to use and easy to quickly integrate into many industrial processes. While tariffs will surely pose a cost increase threat to just about everyone, there’s some companies that make products that almost seem destined to shine in an environment where cost control has to take precedent over everything else a company is doing in order to stay profitable.

On the other hand if the automotive industry collapses due to these tariffs it could have negative repercussions for BONL. They operate out of Royal Oak, Michigan just a 45 minute drive from my house. This area’s entire lifeblood is tied to the automotive industry and I’d wager that quite a bit of BONL’s revenues come from customers who also have close ties the auto industry and this could cut deep into BONL’s sales. I think that the upside to this is that the demand for metal stress relief carries itself across a wide variety of industries. With only $1.7 million in revenues in 2025, it’s quite conceivable that the company could double their revenues just from a few additional customers.

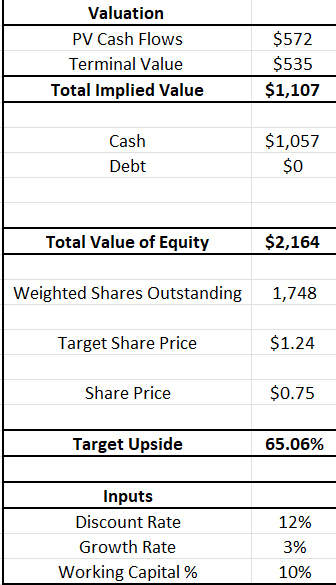

Discounted Cash Flow

I ran a DCF on BONL to get a sense of what the company’s future cashflows might look like through 2035. I set assumptions for the company’s revenue based on what their five year average has been which gives us an 6.1% growth rate. I then set BONL’s operating income margin at 7.3% which was their margin for 2025. I also gave BONL a 25% tax rate. The company’s D&A and Capex both came in at a low 0.6% of the company’s revenues. I then increased BONL’s working capital as a percentage of their revenues by 10% through 2035 just to account for any added expenses the company might run into in the future while expanding their business. Finally, I set the company’s perpetual growth rate at 3.0% after 2035, and then applied a 12.0% discount rate.

The DCF I ran ended up spitting out a $1.24 per share price target, a 65% upside from BONL’s current share price of $0.75. I actually think that this price target is conservative as BONL’s operating income margins should shoot through the roof if they can attract any new business because the company’s gross margins are really high (currently 76%) and have been rising while their G&A costs have been coming down.

I Have Actually Reached Out To BONL

I have actually reached out to BONL and have requested a phone call or an email exchange to ask them a couple of questions. I have also requested a tour of their Royal Oak facility. I will let my readers know exactly what management has told me when and if they respond as well as give a detailed description of the company’s facility and how it operates. I’m quite curious myself to see how much extra business the company expects to capture from their new international distribution deal with DME and how much capacity BONL has for their business to continue to expand.

BONL Highlights

It’s been a long time since I’ve seen this many catalysts converge around a single company. Just to highlight what BONL has going for it once again.

BONL trades at $0.75 a share but has a NAV of $1.01 a share.

BONL has a market cap of $1.3 million and a cash pile of $1.06 million.

BONL has no long-term debt.

BONL has an astonishingly low enterprise value of just $254k.

BONL has been growing their margins by lowering their cost of sales and their general and administrative expenses.

BONL had recently gotten a new CEO and the company’s fiscal 2025 was the first full year under Torsten Warnatsch’s leadership.

This is the first non family member added to management as far back as I can tell (probably ever).

Torsten has already done things like put the company’s cash to work in funds to produce interest income which has added to the company’s bottom line as well as sign an agreement with an international distributor.

This distribution agreement could grow the company’s future revenues substantially.

BONL’s sub-harmonic vibratory metal stress relief technology has huge market potential as these products offer an enormous amount of cost savings to its customers.

The company is positioned in Royal Oak which is part of Metro Detroit. This area is full of industrial shops working metal. If BONL’s new CEO can win over some business in the area BONL could see sufficient revenue increases as their current revenues only came in at $1.7 million in BONL’s fiscal 2025.

Wrapping It Up

All in all I think that BONL has a lot going for it. If the auto industry or the wider industrial manufacturing industry takes a hit from tariffs BONL could lose a lot of revenue. They could also gain customers from this too. The company’s metal stress relief methods have the potential to save a lot of factories a lot of money. It’s up to BONL’s new President and CEO Torsten Warnatsch to make that case to new customers.

I will probably be swooping in to buy up a decent position for my portfolio however, I am going to wait and see if I can get a response back from the company. Honestly this stock looks almost too good to be true and I’d really like to see the company’s main facility for myself. If any of my readers have any questions they’d like me to ask management, I’d be glad to do so on their behalf. Ask away in the comments section and I will relay them to management so long as I get the questions before I meet with BONL, provided they do respond to my request.

Disclosure: I do not own Bonal International, Inc. ($BONL) but may buy shares anytime following this article. This is not investment advice. Do your own research.

Excellent analysis. I think this is a good investment opportunity. There's just one big problem: I don't know if it's because of the company's size, my broker (IBKR) doesn't allow me to trade this company. If I can't trade it at IBKR, I'd be hard-pressed to find it anywhere else.