$6.5 Trillion Waiting For What?

A Look at Money Market Funds

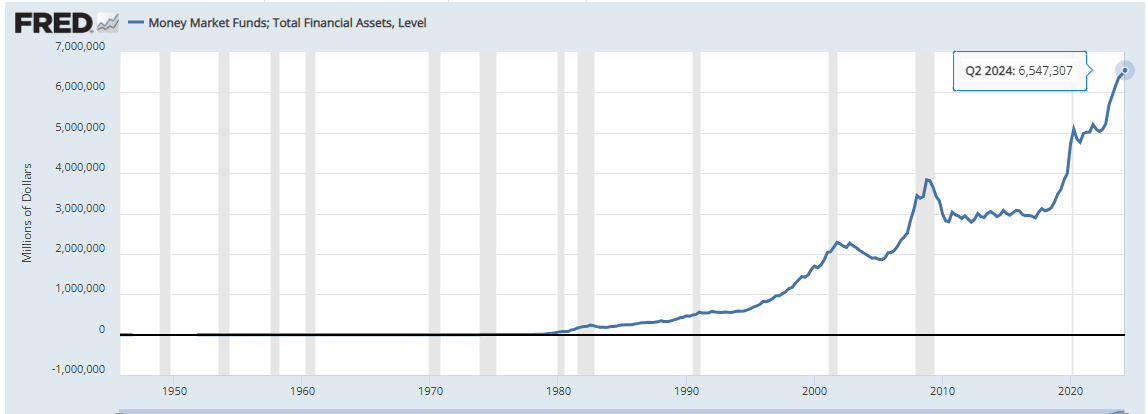

A common principal you’ll often hear in the investment community is that “you need to keep some money on the sidelines in case an opportunity arises.” How much money should be kept on the sidelines changes depending on how investors feel about the prospects of the future economy. When large institutional investors need to keep cash close by while they search for something to invest in they usually dump that cash into a money market fund. These funds invest in short term debt so their cash can collect interest while the investor looks for an investment. When investors can’t find an investment they think will provide an adequate return to justify the risk of the investment, these money market funds begin to balloon.

As of Q2 2024 we have $6.55 trillion sitting in these money market funds. That’s a 30.1% increase in cash dumped into these funds since the Federal Reserve announced it would hike interest rates in March of 2022. Between 2010 and 2018 money market funds usually held somewhere between $2.78 trillion and $3.3 trillion. As the Federal Reserve began hiking rates in 2018 and the market began experiencing what market reporters were calling a “taper tantrum”, these money market funds shot through the roof. As you can see from the money market funds graph from the St. Louis Federal Reserve, these funds shrank as people began pouring money into the market during COVID. Right after this however these money market funds shot up pretty steadily, especially since the Fed started raising rates again.

Waiting on Interest Rates

It seems pretty obvious from the data that a large portion of this money, probably somewhere close to the $1.5 trillion added since the Fed’s interest rate hikes, are just waiting for interest rates to come down before reinvesting this money again. When short term interest rates come down a portion of this money will have to look elsewhere in order to achieve the same or similar rates of return.

Fears of a Recession

There is a portion of this money that is probably sitting in these money market funds waiting for a recession, or at least for business valuations to come back down to more historical averages. P/E ratios have been unusually high for an unusually long time. For those with investment philosophies that take into consideration things like market timing, the risk of buying in at the top of a bubble versus the safety of earning a guaranteed 4.51% return on a three month U.S. Treasury note while you wait to score big on an economic slump can seem unappealing. Long before the Fed had even touched interest rates, investors were already hard at work trying to figure out whether inflation or the inevitable rate hikes to follow would steer the economy into a recession.

Money Market Funds and Recessions

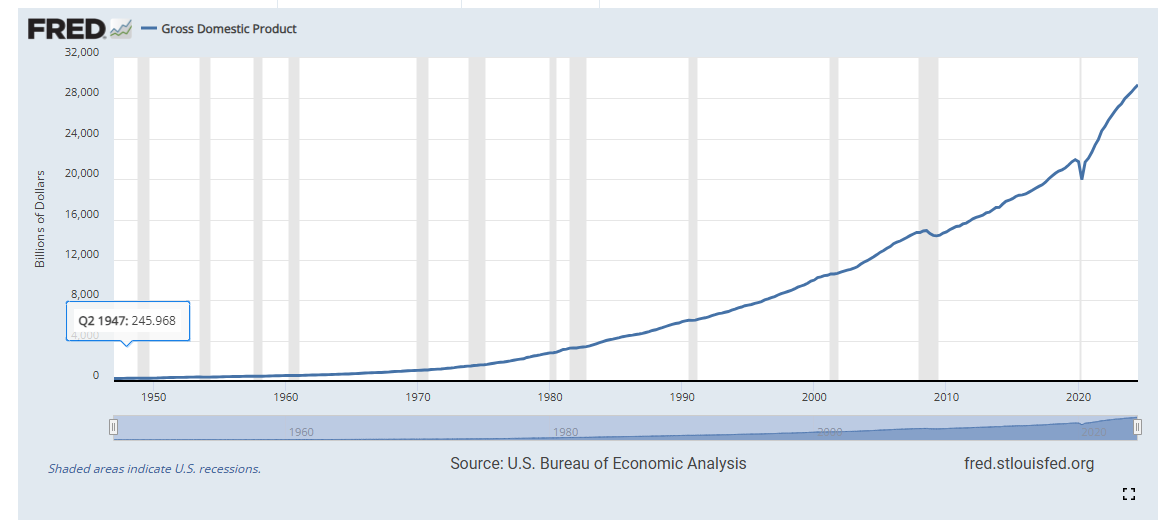

When looking at a graph of the US’s GDP, it becomes pretty evident more money flows into these money market funds before recessions happen. Cash usually flows into these accounts rapidly before and during the first portion of a recessionary cycle before being dispensed to purchase assets at bargain prices. Shortly after the 2008 recession all the way up until 2018 when the market starting throwing its “Taper Tantrum”, money market fund levels usually sat around 16% or 17% of US GDP. Right now we have money market fund levels sitting at 22% of US GDP. The last time they were that high, besides perhaps the very beginning of the COVID-19 pandemic when GDP absolutely tanked briefly, was right before the 2008 recession.

I am not a fortune teller and I can not predict what the market is going to do, that’s why I advocate the virtues of value investing so heavily. Buying into a stock with a small amount of debt compared to a very large amount of physical assets is in my opinion, one of the greatest guards against an economic downturn you can hope to get out of an investment. Companies well positioned to survive economic downturns can live another day and reap the benefits from the long-term growth of the overall economy.

If a recession were to happen banks will put the brakes on how many loans they are handing out, businesses with low amounts of debt in this environment have a large leg up against businesses that rely heavily on debt to fund operations. If a recession hits the holders of these money market funds will probably want to deploy this capital into value stocks. Investors often don’t pay attention to value metrics in a business until an economic downturn, then all of a sudden basic business valuation becomes rather important. If the Federal Reserve is able to a hit a soft landing some of this money would trickle back into the market as investors’ fears are calmed and they can more easily make decisions about their portfolio’s future.

Presidential Elections

When looking at the money market funds graph we can see another pattern emerge. It appears like money market funds usually see a surplus of money dumped into them during major and closely contested presidential elections. You can see this pattern emerge in 2008, 2016, and 2020. Money market funds will rise up before being dispersed shortly after an election as investors get time to process how they think their business environment will change due to the incoming administration.

Conclusion

All of these factors have combined into what appears to be a large cash pile up in money market funds. While there are a variety of reasons combined together to create this vast sum of money, at the end of the day I believe that all of this money is in these accounts for one major reason… Uncertainty. As discussed above, there are many reasons for investors to be uncertain right now. There are also many events right on our horizon that could possibly clear up some of this uncertainty. This nightmare of a US election is finally almost over. This should help disperse some of this cash. The Federal Reserve lowering interest rates should help disperse more of it.

When this cash does pour back into the markets I think it could be a driving force for widespread market gains. If one stays invested in small cap, low debt, and high asset stocks through this election and through this cycle of falling interest rates, you should be poised to experience some portfolio gains just on the sentiments of the wider economy. If the bears in the market are correct and we do end up in a recession, stocks with low debt and a surplus of assets to sell are the type of stocks, in my opinion, that you’d want to own to weather out such an event anyway.

Disclosure: This is not financial advice. Do your own research.